Regarding the legitimacy of KINNELL forex brokers, it provides CYSEC and WikiBit, .

Is KINNELL safe?

Business

License

Is KINNELL markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

Clone FirmLicense Type:

Forex Execution License (STP)

Licensed Entity:

Argus Stockbrokers Ltd

Effective Date:

2003-05-12Email Address of Licensed Institution:

argus@argus.com.cySharing Status:

No SharingWebsite of Licensed Institution:

http://www.argus.com.cy/, www.argusglobaltrader.comExpiration Time:

--Address of Licensed Institution:

25 Demostheni Severi Avenue, Metropolis Tower, 1st & 2nd floor, CY-1080 NicosiaPhone Number of Licensed Institution:

35722717000Licensed Institution Certified Documents:

Is Kinnell Safe or Scam?

Introduction

Kinnell is a forex broker that has garnered attention in the trading community for its offerings and market positioning. As the forex market continues to attract traders globally, it becomes increasingly vital for individuals to evaluate the safety and legitimacy of brokers before committing their funds. The potential for scams and fraudulent activities in the trading sector necessitates thorough research and analysis. This article aims to provide a comprehensive evaluation of Kinnell, exploring its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The assessment is based on a review of multiple sources, including regulatory information, user feedback, and industry reports, to ensure an unbiased perspective on whether Kinnell is safe or a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety. Kinnell operates under varying regulatory conditions, which can significantly impact its credibility. In the forex trading industry, regulation serves to protect traders by ensuring that brokers adhere to strict operational standards and maintain transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Not specified | Cyprus | Unverified |

| National Futures Association (NFA) | Not applicable | United States | Unauthorized |

The table above summarizes the core regulatory information regarding Kinnell. It is essential to note that Kinnell has been flagged as operating under a "clone firm" designation, indicating that it may be imitating a legitimate broker without proper authorization. This raises serious concerns about its legitimacy. The lack of verification from reputable regulatory bodies such as CySEC and NFA suggests that Kinnell may not be operating within a secure and regulated environment. Furthermore, the presence of high-risk warnings associated with Kinnell indicates that traders should exercise caution. Overall, the regulatory landscape for Kinnell points toward potential red flags, leading to the question: Is Kinnell safe?

Company Background Investigation

Kinnell's company history and ownership structure provide additional context to evaluate its legitimacy. Founded in Cyprus, Kinnell has evolved within a competitive marketplace. However, the lack of transparency regarding its ownership and management team raises concerns. Reliable brokers typically provide information about their founders and executives, showcasing their expertise and experience in the financial sector.

The management team at Kinnell has not been prominently featured in reputable publications, which may suggest limited experience in the forex industry. This lack of visibility could contribute to a perception of opacity, making it challenging for potential traders to assess the broker's reliability. Furthermore, the absence of clear information regarding the company's operational history could deter traders from engaging with Kinnell. Transparency in business practices is crucial for building trust, and Kinnell's limited disclosure may lead some to question whether it is safe or a scam.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is paramount. Kinnell's overall fee structure and trading model can significantly impact traders' profitability. A detailed examination of the broker's fees reveals potential areas of concern.

| Fee Type | Kinnell | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High (exact figures not disclosed) | Low (typically 1.0 - 2.0 pips) |

| Commission Structure | Not clearly defined | Varies (generally 0 - 10 USD per lot) |

| Overnight Interest Range | Not specified | Varies (typically 1 - 3%) |

The table above highlights Kinnell's trading costs compared to industry averages. The absence of specific figures regarding spreads and commissions raises questions about the broker's transparency. High spreads can significantly erode trading profits, particularly for active traders who rely on tight margins. Additionally, unclear commission structures may lead to unexpected costs, further complicating the trading experience. Traders should be wary of brokers that do not clearly outline their fee structures, as this could indicate a lack of transparency or potential hidden fees. Therefore, one must consider: Is Kinnell safe in terms of trading conditions?

Customer Funds Security

The safety of customer funds is a critical aspect of evaluating any forex broker. Kinnell's measures for protecting client funds can directly impact a trader's decision to engage with the platform. It is essential to assess whether Kinnell employs adequate security protocols, such as segregated accounts and investor protection schemes.

Kinnell has not provided explicit details regarding its fund protection policies. The lack of information surrounding fund segregation and negative balance protection raises concerns about the safety of clients' investments. In the forex market, where volatility is common, having a robust safety net is crucial for traders. If a broker does not safeguard client funds effectively, it could lead to significant financial losses during adverse market conditions.

Additionally, any historical issues related to fund security or client complaints can further illuminate Kinnell's reliability. Reports of fund mismanagement or withdrawal issues would be significant red flags. As such, traders must ask: Is Kinnell safe when it comes to customer funds?

Customer Experience and Complaints

Understanding customer experiences can provide valuable insights into a broker's reliability. Analyzing user feedback for Kinnell reveals a mixed bag of experiences. While some users report satisfactory interactions, others highlight significant issues.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response time |

| Poor Customer Support | Medium | Limited availability |

| Unclear Fee Structures | High | No clear communication |

The table above summarizes common complaints associated with Kinnell. Withdrawal delays and poor customer support are two prevalent issues that can severely impact a trader's experience. A broker's responsiveness to complaints is crucial for maintaining trust, and Kinnell's slow response times indicate a potential lack of commitment to customer service. In some cases, traders reported feeling frustrated due to the lack of clarity regarding fees, which can lead to misunderstandings and dissatisfaction.

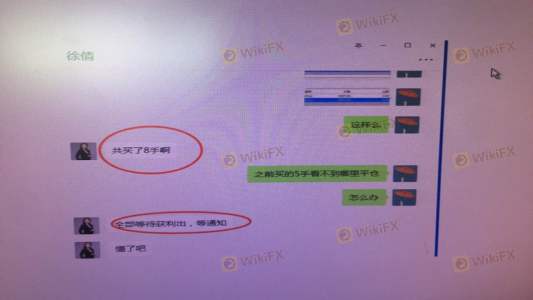

Typical cases of user complaints include instances where traders faced significant delays in withdrawing their funds, leading to concerns about the broker's financial stability. Such experiences can create a perception of distrust, prompting traders to question: Is Kinnell safe in terms of customer experience?

Platform and Trade Execution

The performance and reliability of a trading platform are essential for a successful trading experience. Kinnell's platform stability, order execution quality, and user experience must be critically assessed. Traders rely on efficient execution to capitalize on market opportunities, and any signs of manipulation or slippage can erode trust.

Feedback regarding Kinnell's platform suggests that users have encountered issues with order execution, including slippage and occasional rejections of orders. These problems can significantly affect trading outcomes, especially in fast-moving markets. A high rejection rate or consistent slippage could indicate underlying issues with the broker's infrastructure or trading practices. Traders must consider whether Kinnell's platform is designed to support their trading needs effectively.

Given these factors, the question remains: Is Kinnell safe when it comes to platform and trade execution?

Risk Assessment

Engaging with any forex broker carries inherent risks, and Kinnell is no exception. A comprehensive risk assessment can help traders understand the potential dangers associated with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Financial Stability | Medium | Limited transparency on financial practices |

| Customer Support | High | Poor response times and service issues |

The table above summarizes key risk areas related to Kinnell. The high regulatory risk is particularly concerning, as it suggests that traders may not have adequate protections in place. Additionally, the lack of transparency regarding Kinnell's financial stability raises further concerns. Traders must be proactive in mitigating these risks by conducting thorough research and considering alternative options.

Conclusion and Recommendations

In conclusion, the evidence surrounding Kinnell suggests that potential traders should exercise caution. The lack of robust regulatory oversight, combined with customer complaints and transparency issues, raises significant doubts about the broker's safety. While some users may have had positive experiences, the overall risk profile and indicators of potential fraud cannot be overlooked.

For those considering trading with Kinnell, it may be prudent to explore alternative brokers that offer stronger regulatory protection and a more transparent operating environment. Reliable options include brokers regulated by top-tier authorities such as the FCA or ASIC, which can provide a safer trading experience. Ultimately, the critical question remains: Is Kinnell safe? Based on the available evidence, it is advisable to approach this broker with caution and explore other options to safeguard your investments.

Is KINNELL a scam, or is it legit?

The latest exposure and evaluation content of KINNELL brokers.

KINNELL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KINNELL latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.