Regarding the legitimacy of intermagnum forex brokers, it provides FSA and WikiBit, .

Is intermagnum safe?

Pros

Cons

Is intermagnum markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Magnum International Markets Ltd

Effective Date:

--Email Address of Licensed Institution:

faiz@intermagnum.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.intermagnum.comExpiration Time:

--Address of Licensed Institution:

1st Floor, Vairam Building, Zone 6, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4379909Licensed Institution Certified Documents:

Is Intermagnum A Scam?

Introduction

In the rapidly evolving landscape of forex trading, Intermagnum has emerged as a notable player, offering a platform for trading various financial instruments, including currencies, commodities, and cryptocurrencies. As traders increasingly seek opportunities in the global market, the importance of selecting a trustworthy broker cannot be overstated. The potential for fraud and mismanagement in the financial industry necessitates a thorough evaluation of trading platforms to ensure safety and reliability. This article aims to provide an in-depth analysis of Intermagnum, assessing its legitimacy and safety based on regulatory compliance, company background, trading conditions, customer experiences, and risk factors. Our investigation relies on a combination of user reviews, regulatory information, and market analyses to form a comprehensive view of whether Intermagnum is safe or potentially a scam.

Regulation and Legitimacy

Understanding the regulatory status of a trading platform is crucial, as it often serves as a key indicator of its legitimacy and operational standards. Intermagnum claims to be regulated by the Seychelles Financial Services Authority (FSA), which oversees its operations and ensures compliance with financial regulations. The significance of regulation lies in the protection it offers to traders, as regulated brokers are required to adhere to strict operational standards, including the segregation of client funds and transparent reporting practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 132 | Seychelles | Verified |

While the Seychelles FSA provides a regulatory framework, it is considered an offshore regulator, which may not offer the same level of investor protection as more established regulatory bodies like the FCA or ASIC. The offshore status raises questions about the robustness of investor safeguards and the overall quality of regulation. Historical compliance records indicate that while Intermagnum has maintained its licensing, the oversight may not be as stringent as that of higher-tier regulators. Therefore, while Intermagnum operates under a legitimate license, potential traders should remain cautious and conduct thorough due diligence before engaging with the platform.

Company Background Investigation

Intermagnum is owned and operated by Magnum International Markets Ltd., a company that has been in operation since 2021. The ownership structure and management team play a significant role in determining the reliability of a trading platform. The leadership team consists of professionals with backgrounds in finance and technology, which is essential for navigating the complexities of the trading environment. However, the relatively short history of the company raises concerns about its long-term stability and commitment to investor protection.

Transparency is a critical factor in evaluating a broker's legitimacy. Intermagnum provides basic information about its operations, but the level of detail regarding its management and financial standing could be improved. The lack of comprehensive disclosure may lead to suspicions among potential users about the company's operational integrity. Overall, while Intermagnum appears to have a solid foundation, the limited information available may warrant caution from traders seeking a well-established broker.

Trading Conditions Analysis

A thorough examination of trading conditions is essential for assessing the overall cost of trading with a platform. Intermagnum offers a variety of trading accounts, each with different minimum deposit requirements and associated fees. The fee structure includes spreads, commissions, and overnight interest rates that can significantly impact trading profitability.

| Fee Type | Intermagnum | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | 1.5% - 5% | 1% - 2% |

Intermagnum's spreads appear to be higher than the industry average, which may deter cost-sensitive traders. Additionally, the platform imposes various fees, including overnight interest and inactivity fees, which can accumulate and affect overall trading costs. These additional charges raise questions about the platform's transparency and fairness in its pricing model. While competitive pricing is essential for attracting traders, the presence of unusual fees may indicate potential pitfalls for users.

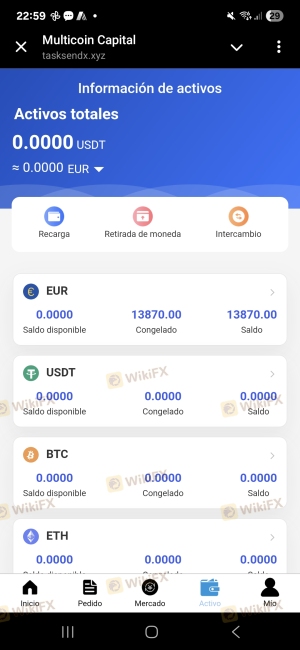

Customer Fund Security

Ensuring the safety of customer funds is paramount for any trading platform. Intermagnum claims to prioritize fund security through various measures, including the segregation of client funds and the use of advanced encryption technologies. By keeping client funds in separate accounts, the platform aims to protect traders' investments in case of insolvency or operational issues.

However, the effectiveness of these measures is contingent upon the regulatory environment in which the broker operates. As previously mentioned, being regulated by an offshore authority like the Seychelles FSA may not provide the same level of protection as more stringent regulators. Furthermore, there have been no reported incidents of fund mismanagement, which is a positive sign. Nonetheless, potential traders should remain vigilant and consider the inherent risks associated with trading with a broker that operates under less rigorous regulatory scrutiny.

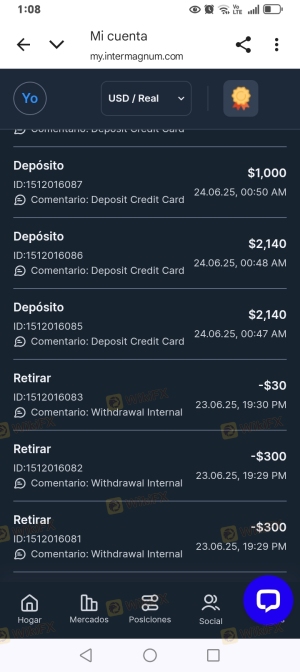

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a trading platform. Reviews of Intermagnum indicate a mixed bag of experiences among users. While some traders praise the platform for its user-friendly interface and responsive customer service, others report issues related to withdrawal delays and unresponsive support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Customer Support Issues | Medium | Generally Responsive |

Common complaints include slow processing times for withdrawals, which can be frustrating for traders needing quick access to their funds. Additionally, some users have expressed dissatisfaction with the quality of customer support, citing long wait times for responses. These complaints highlight potential areas of improvement for Intermagnum, suggesting that while the platform may be legitimate, there are operational challenges that could impact user satisfaction.

Platform and Trade Execution

The performance of a trading platform is critical for ensuring a smooth trading experience. Intermagnum offers a proprietary trading platform designed for both desktop and mobile use. User feedback indicates that the platform is generally stable and easy to navigate, with a range of tools available for technical analysis and trade execution.

However, some users have reported issues with order execution quality, including slippage and rejected orders during high volatility periods. These issues could indicate potential problems with the platform's liquidity and execution capabilities, raising concerns about whether Intermagnum is safe for high-frequency trading strategies.

Risk Assessment

When evaluating the risks associated with trading on Intermagnum, several factors must be considered. The relatively high spreads, potential withdrawal delays, and the offshore regulatory environment contribute to an overall risk profile that may be categorized as moderate to high.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may lack robust investor protections. |

| Operational Risk | High | Reports of withdrawal delays and customer service issues. |

| Market Risk | High | Trading in volatile markets can lead to significant losses. |

To mitigate these risks, traders should ensure they have a clear understanding of the platform's fee structure, maintain a diversified portfolio, and utilize risk management tools such as stop-loss orders.

Conclusion and Recommendations

In conclusion, while Intermagnum presents itself as a legitimate trading platform with various features and tools, several factors warrant caution. The offshore regulatory status may limit investor protection, and the presence of higher-than-average fees could impact trading profitability. Additionally, customer feedback indicates operational challenges that could affect user experience.

For traders considering whether Intermagnum is safe, it is crucial to weigh the potential benefits against the risks. Novice traders may want to explore alternative platforms with stronger regulatory oversight and proven track records. For those willing to proceed with Intermagnum, it is advisable to start with a small investment and utilize the demo account feature to familiarize themselves with the platform before committing larger sums.

Ultimately, thorough research and due diligence are essential for making informed trading decisions. If you're looking for alternative options, consider platforms that are regulated by tier-1 authorities, offer transparent fee structures, and have a strong reputation for customer service and fund security.

Is intermagnum a scam, or is it legit?

The latest exposure and evaluation content of intermagnum brokers.

intermagnum Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

intermagnum latest industry rating score is 3.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.