HYCM Review 2025: Everything You Need to Know

Executive Summary

HYCM (Henyep Capital Markets) is a well-known forex trading broker with over 40 years of experience. The company has built a strong reputation as a trustworthy platform for traders who want regulated and reliable trading services. This hycm review looks at what the broker offers, including access to more than 300 trading instruments across forex and CFD markets. The broker supports these services with the popular MetaTrader 4 and MetaTrader 5 platforms.

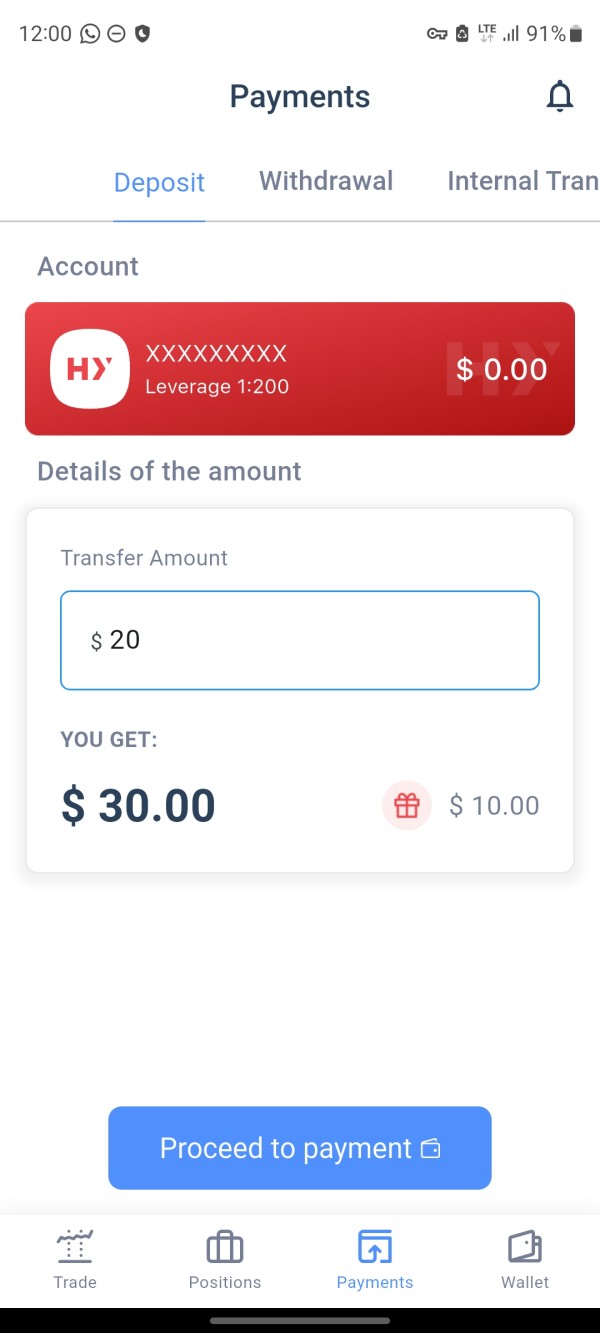

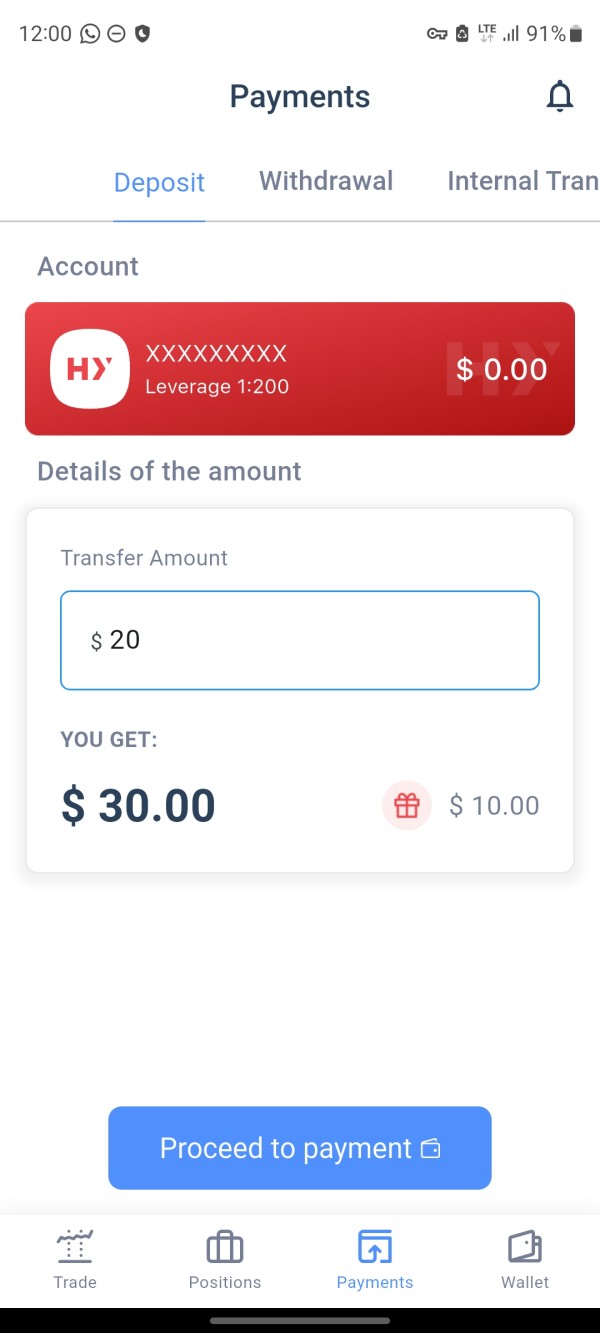

The broker stands out because it operates under multiple regulatory authorities. These include the Financial Conduct Authority (FCA) in the UK, Dubai Financial Services Authority (DFSA), and Saint Vincent and the Grenadines (SVG) regulatory bodies, which are all respected financial authorities. HYCM only requires a minimum deposit of $20, making it accessible to many different types of traders. This low requirement helps both beginners who are just starting in forex trading and experienced professionals who want advanced trading tools and market access.

HYCM shows its commitment to customer satisfaction through strong customer support and positive user reviews on various platforms. The broker has been in the market for a long time, follows regulations carefully, and provides a complete trading environment. These factors make it a good option for traders who are looking at different brokerages in 2025.

Important Disclaimers

Traders need to know that HYCM works through different legal entities in various countries. Each entity follows different regulatory rules and offers different trading conditions. The regulatory status, available trading instruments, and account features you get may be different depending on where you live and which HYCM entity serves your area.

This review uses publicly available information, official company statements, and user feedback from various sources. We try to be accurate, but trading conditions, fees, and services can change over time. We have not tested all the trading conditions mentioned in this analysis ourselves. Potential clients should check current information directly with HYCM and think about their individual trading needs before making decisions.

Rating Framework

Broker Overview

HYCM is one of the most established names in the forex brokerage industry. The company has been trading for over four decades. Founded as Henyep Capital Markets, the company built its reputation by providing steady access to global financial markets while following regulations in multiple countries.

The broker's business model focuses on offering forex and CFD trading services to retail and institutional clients. HYCM supports this with a commitment to transparent operations and customer-focused service. The company's long experience in financial markets has helped it understand what traders need across different experience levels and trading styles.

HYCM's approach combines traditional forex brokerage services with modern technology solutions. This creates an environment where both new and experienced traders can access the tools and resources they need for their trading strategies. The broker operates mainly through MetaTrader 4 and MetaTrader 5 platforms, giving traders access to over 300 trading instruments.

These instruments include major and minor currency pairs, commodities, indices, and other CFD products. The broker's regulatory framework includes oversight from the Financial Conduct Authority (FCA) in the United Kingdom, the Dubai Financial Services Authority (DFSA), and Saint Vincent and the Grenadines financial regulators. This offers clients multiple layers of regulatory protection depending on their location and which HYCM entity they trade with.

Regulatory Coverage: HYCM works with multiple financial authorities, including the respected Financial Conduct Authority (FCA) in the United Kingdom. This gives the broker's operations significant credibility. The Dubai Financial Services Authority (DFSA) and Saint Vincent and the Grenadines regulatory framework provide additional oversight, creating a multi-country approach to compliance and client protection.

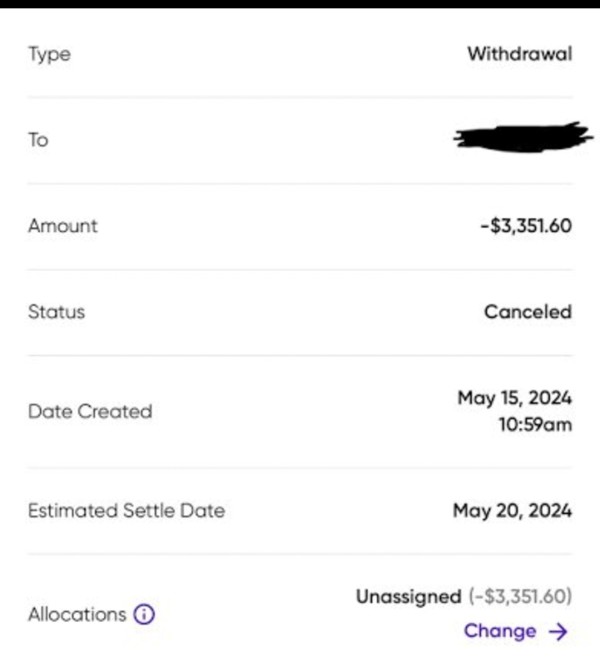

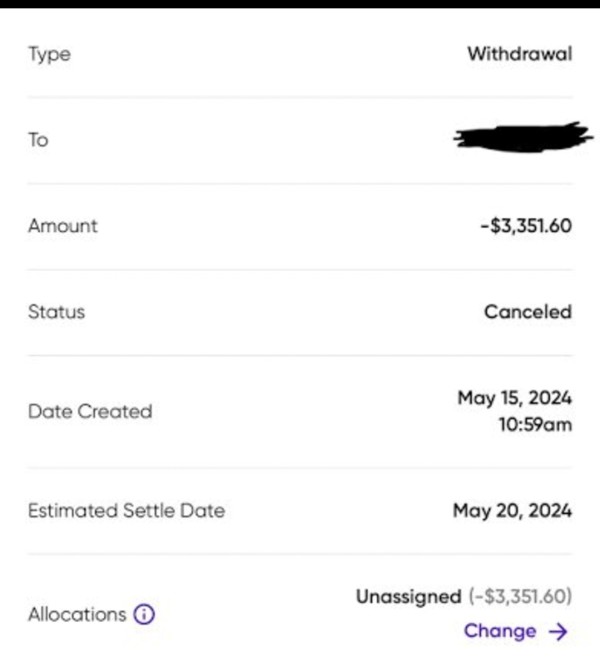

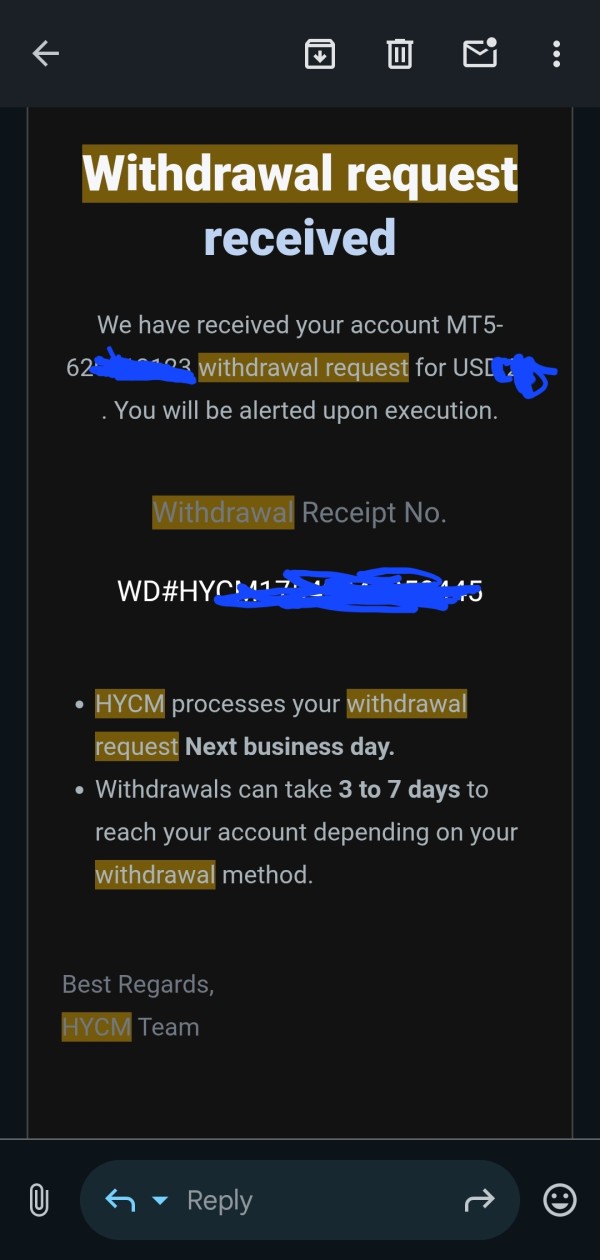

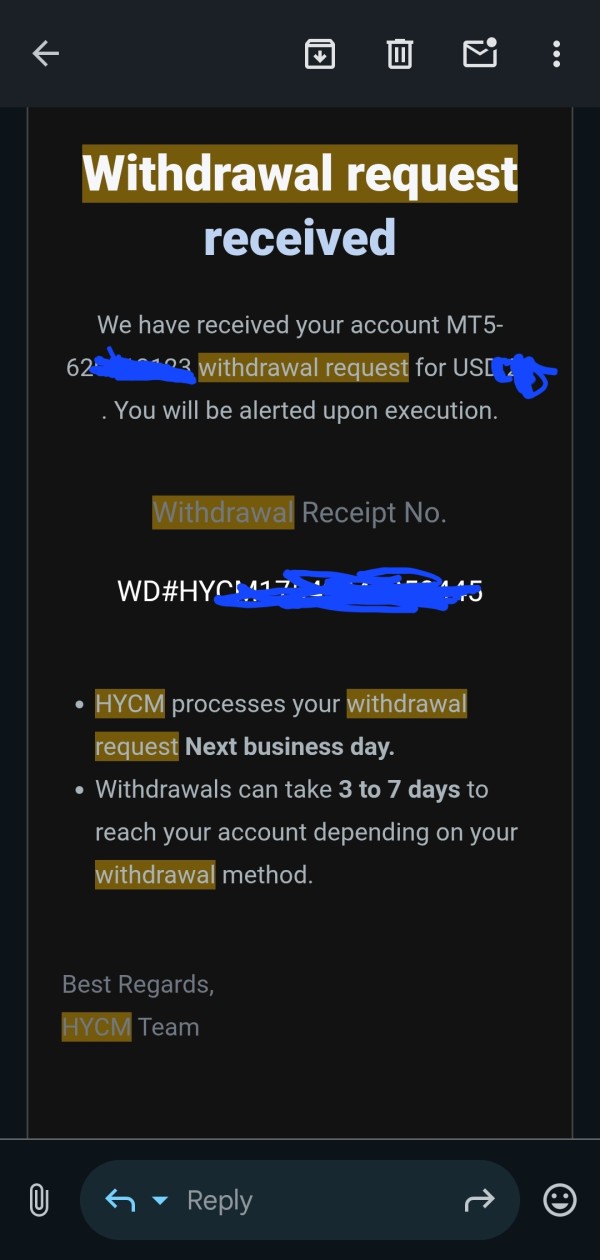

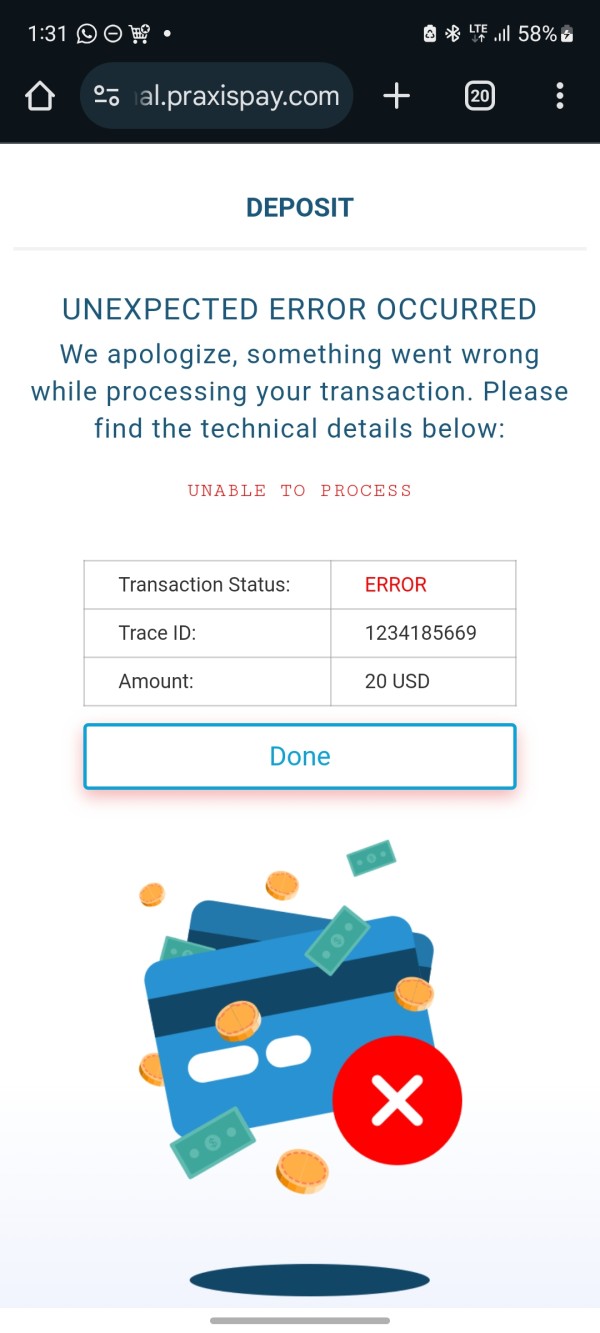

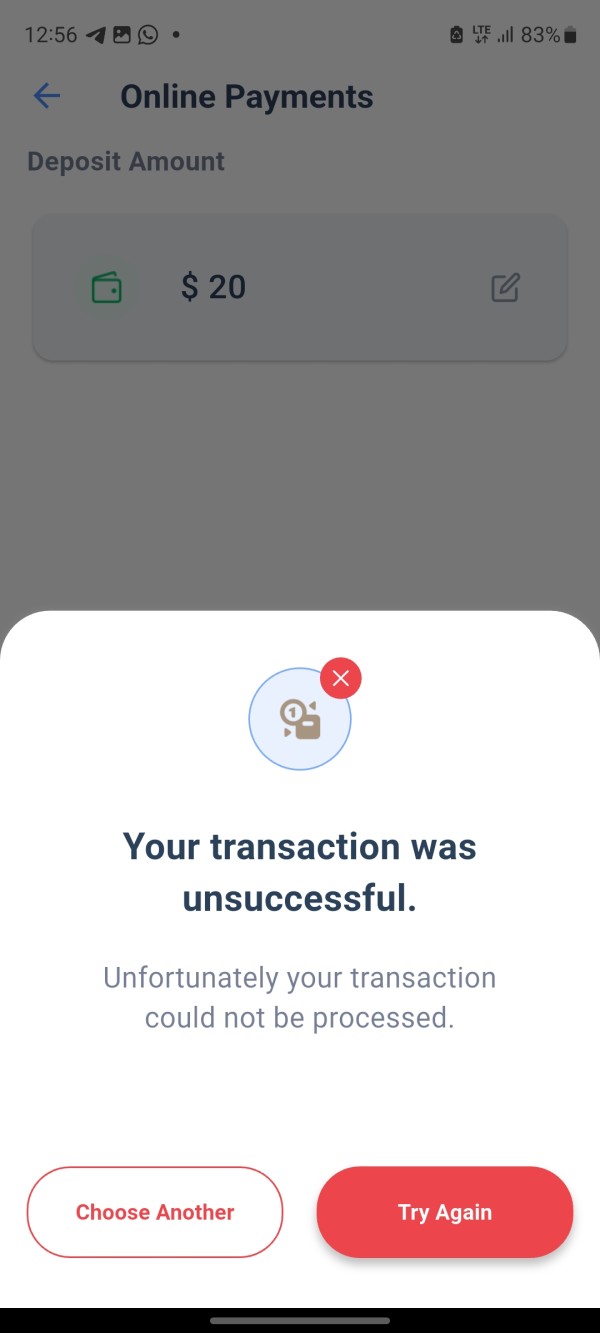

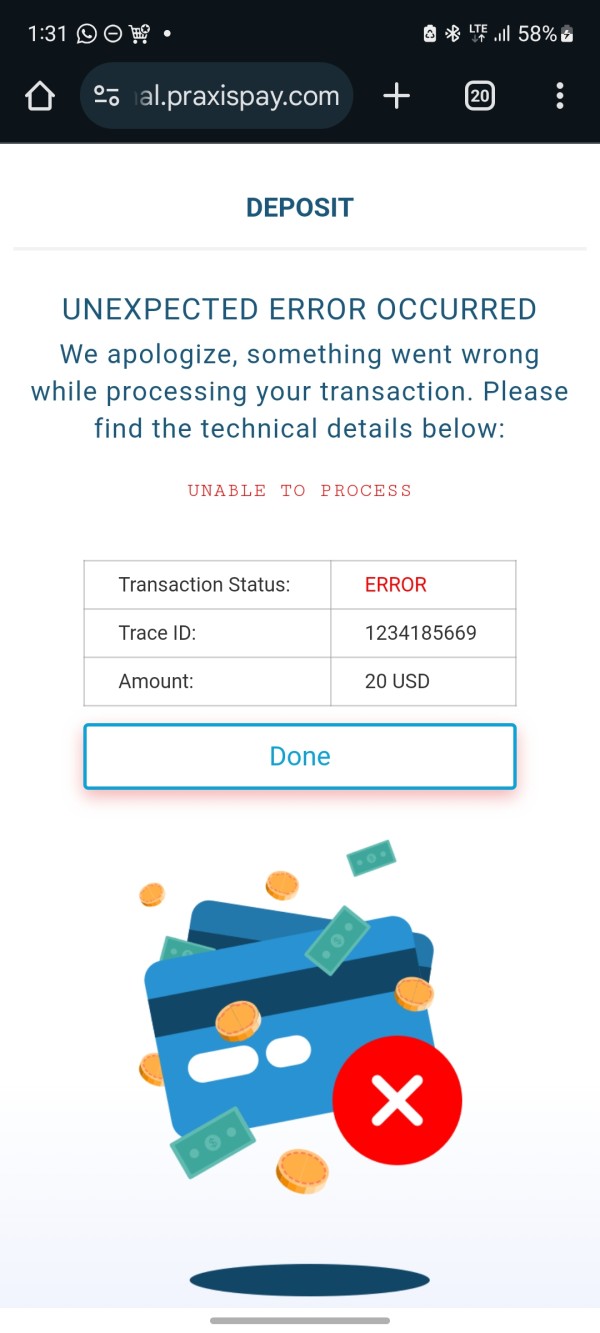

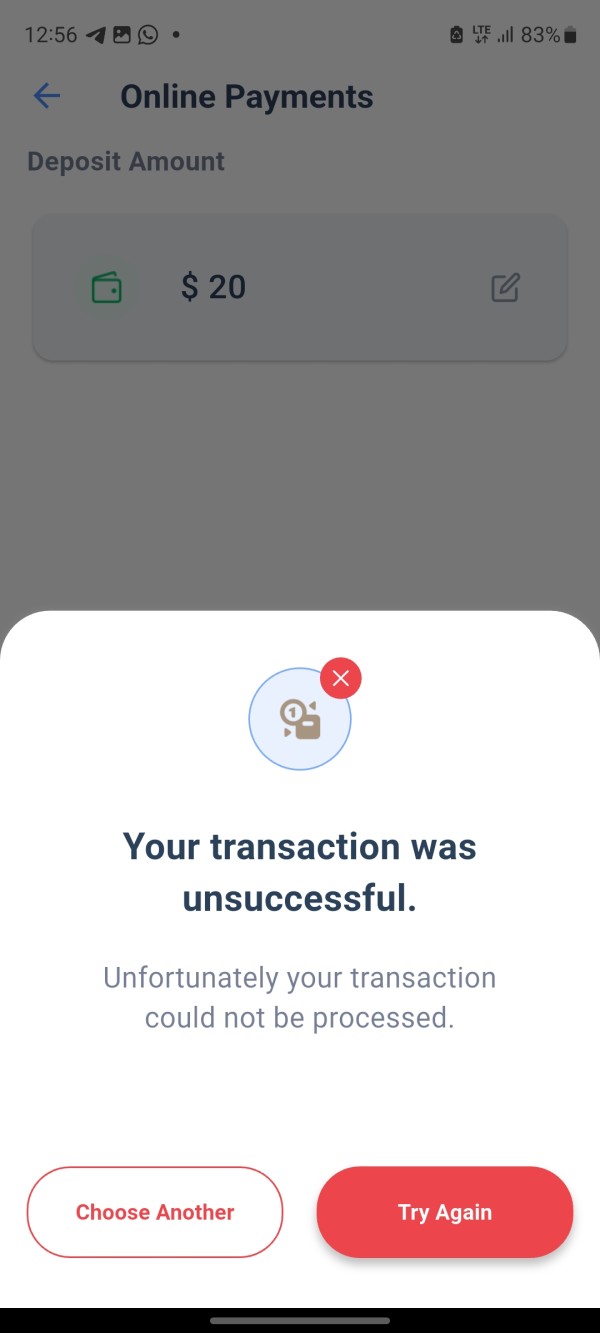

Deposit and Withdrawal Methods: The available materials did not include specific information about deposit and withdrawal methods. Potential clients need to check current payment options directly with the broker.

Minimum Deposit Requirements: HYCM sets its minimum deposit at $20, making it very accessible for beginning traders. This allows new traders to start with limited capital while learning how markets work.

Promotional Offers: Available information sources did not specify details about current bonus programs or promotional offers.

Available Trading Assets: The broker gives access to more than 300 trading instruments. This covers a wide range of financial markets including foreign exchange pairs and contracts for difference (CFDs) across various asset classes.

Cost Structure: Available materials did not include specific information about spreads, commissions, and other trading costs. This would require direct verification with the broker.

Leverage Ratios: Available sources did not provide detailed leverage information. This may vary based on regulatory jurisdiction and account type.

Platform Options: HYCM supports both MetaTrader 4 and MetaTrader 5 trading platforms. This gives traders access to industry-standard trading environments with comprehensive analytical tools and automated trading capabilities.

Geographic Restrictions: Available materials did not include specific information about geographic limitations or restricted jurisdictions.

Customer Service Languages: Available information sources did not specify details about supported languages for customer service.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

HYCM's account structure clearly focuses on accessibility, especially with its $20 minimum deposit requirement. This low entry threshold puts the broker in a good position for beginning traders who want to explore forex markets without large initial investments. The accessibility factor is a significant advantage in today's competitive brokerage market, where many brokers require much higher minimum deposits that can discourage newcomers to forex trading.

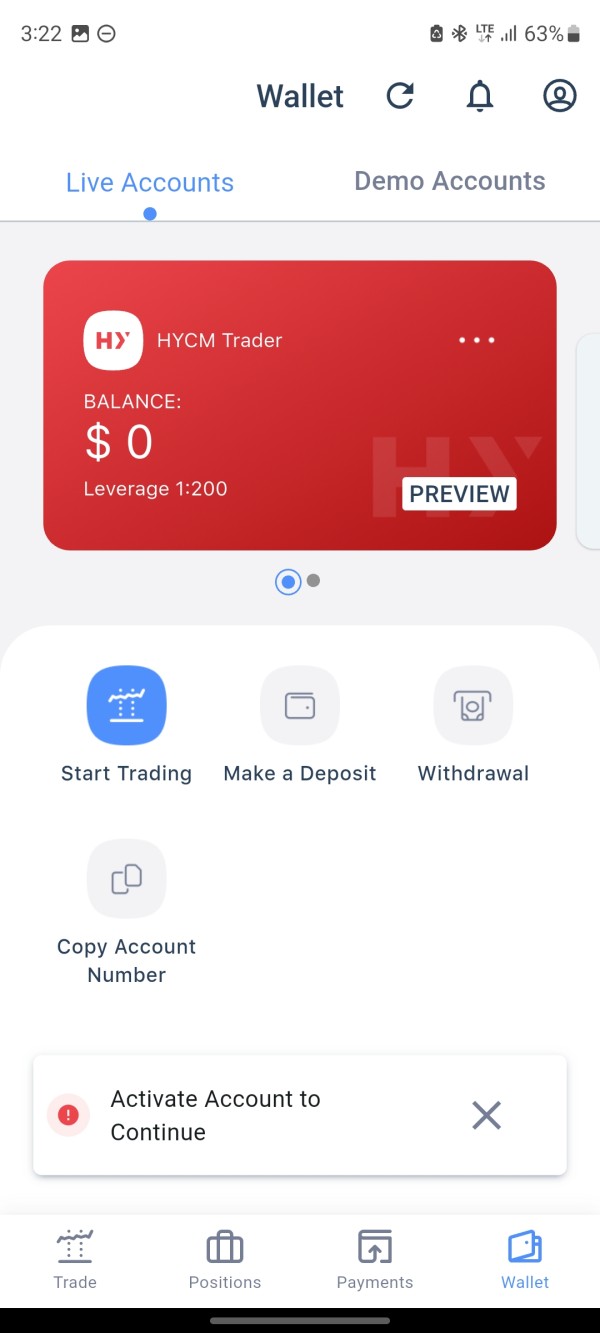

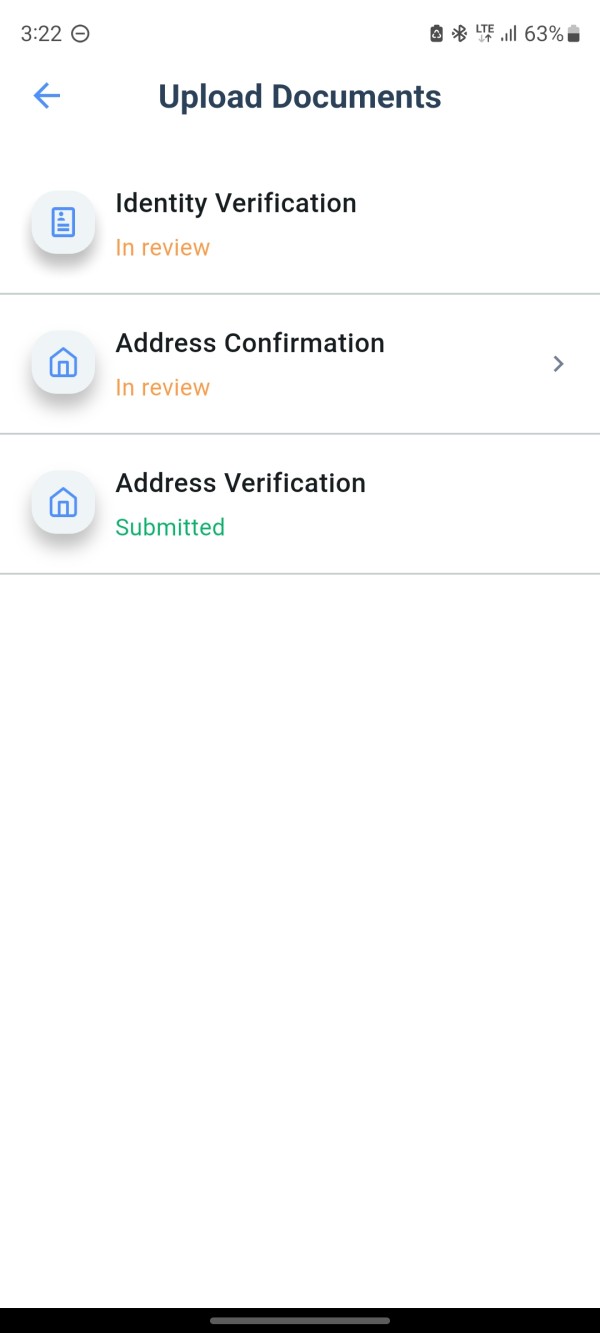

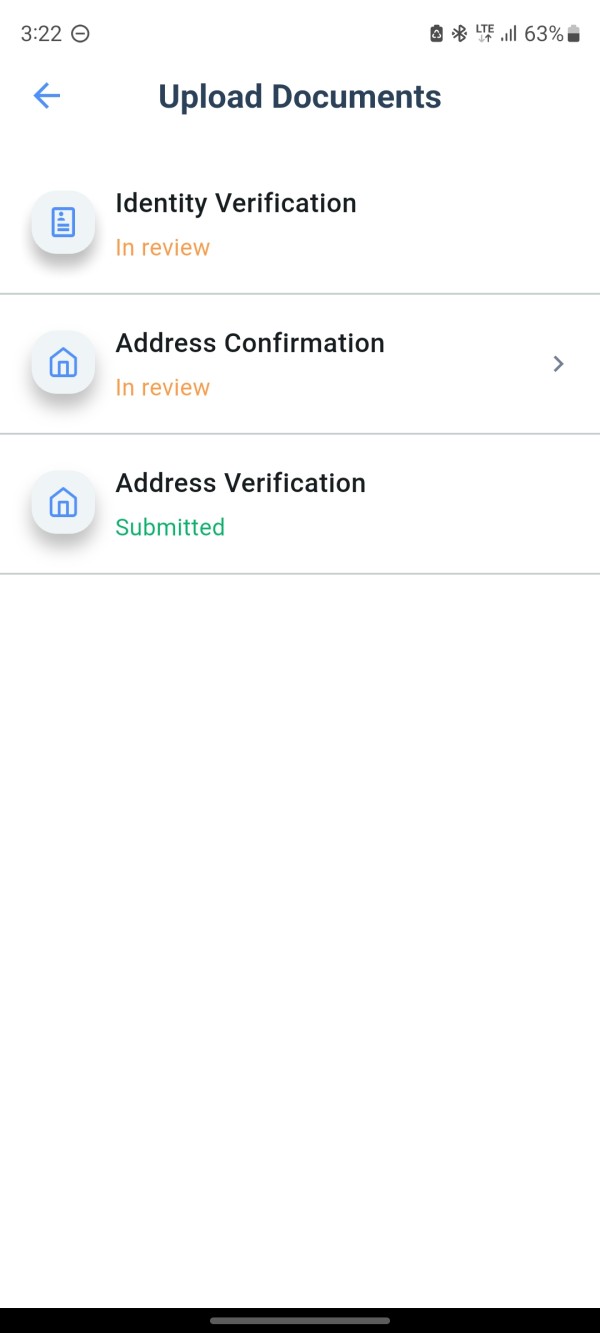

However, this hycm review must note that available materials did not include specific information about different account types, their features, and any benefits based on deposit levels. The account opening process, verification requirements, and any special account features such as Islamic accounts for Sharia-compliant trading were not well documented in accessible sources.

The lack of detailed account tier information means potential clients would benefit from talking directly with HYCM representatives to understand all available account options. Despite this information gap, the low minimum deposit requirement shows HYCM's commitment to market accessibility. This aligns well with serving diverse trader groups from beginners to more experienced market participants.

HYCM's offering of over 300 trading instruments represents a large asset selection that covers the essential markets most forex and CFD traders want to access. This extensive instrument range suggests the broker has invested in building comprehensive market access across major currency pairs, commodities, indices, and other CFD products. These form the foundation of most trading strategies.

The availability of both MetaTrader 4 and MetaTrader 5 platforms gives traders access to industry-leading trading technology. This includes advanced charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors. These platforms represent the gold standard in retail forex trading technology and show HYCM's commitment to providing professional-grade trading infrastructure.

However, available sources did not extensively detail specific information about proprietary research resources, market analysis, educational materials, and trader development programs. The absence of clear information about educational resources, webinars, market commentary, or analytical tools beyond the standard MetaTrader offerings represents a significant information gap. Potential clients would need to investigate this directly with the broker.

Customer Service and Support Analysis (8/10)

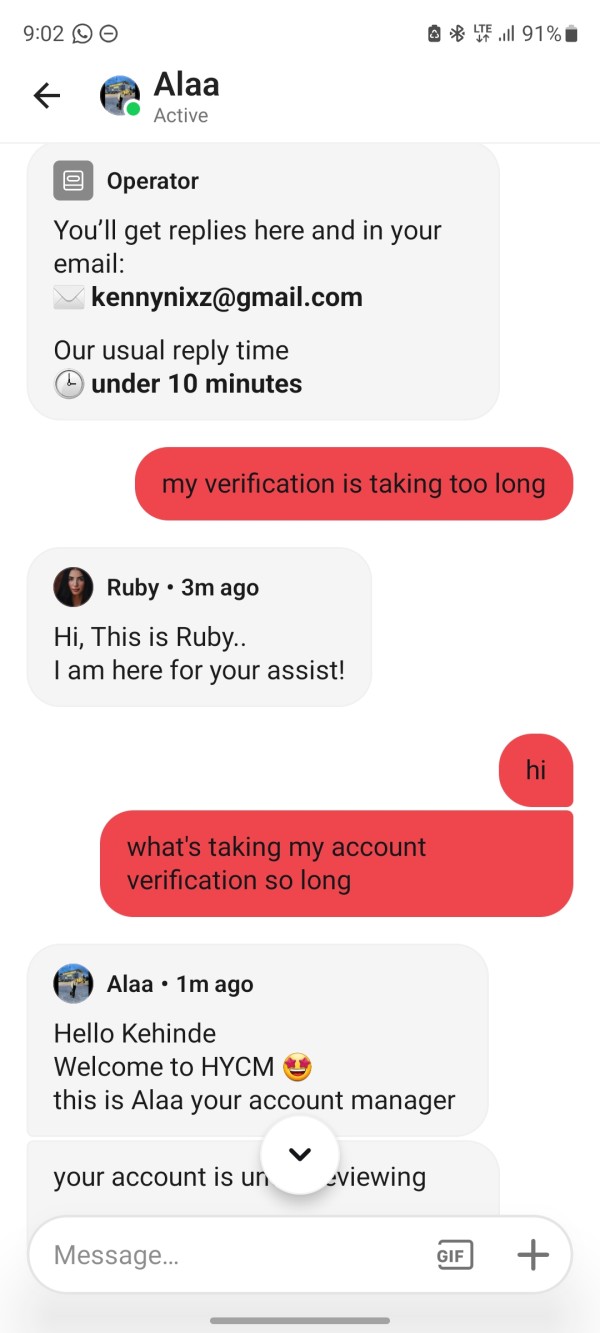

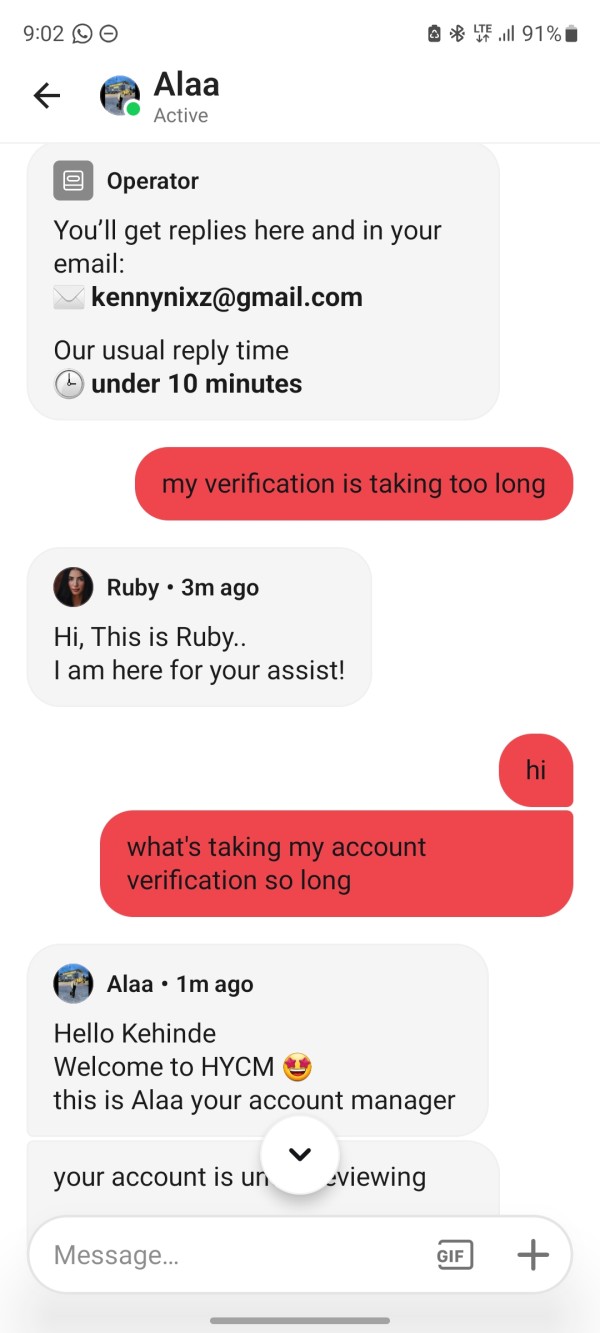

Available information shows that HYCM has built a reputation for providing quality customer support. User feedback suggests positive experiences with the broker's service team. This positive sentiment is an important factor in broker selection, as reliable customer support can significantly impact the overall trading experience. This is especially true during technical issues or account-related questions.

The broker's four decades of industry experience likely contributes to its understanding of common customer needs and effective support protocols. Long-established brokers typically develop comprehensive support frameworks that address the various challenges traders encounter. These range from technical platform issues to account management questions.

However, available materials did not extensively document specific details about available support channels, response times, multilingual support capabilities, and service hours. The absence of detailed information about support accessibility, including whether 24/5 or 24/7 support is available during market hours, represents an area where potential clients would benefit from direct verification with HYCM representatives.

Trading Experience Analysis (7/10)

HYCM's provision of MetaTrader 4 and MetaTrader 5 platforms ensures traders have access to robust, professional-grade trading environments. These platforms offer comprehensive functionality for market analysis, order management, and automated trading strategies. These platforms are widely regarded as industry standards and provide the technical foundation necessary for effective forex and CFD trading across various trading styles and strategies.

The broker's extensive instrument selection of over 300 trading products suggests traders can access diverse markets through a single account. This potentially simplifies portfolio management and reduces the need for multiple broker relationships. This comprehensive market access represents a significant advantage for traders seeking to diversify their trading activities across different asset classes.

This hycm review notes that available sources did not detail specific information about order execution quality, typical spreads, slippage rates, and platform performance metrics. Additionally, information about mobile trading capabilities, platform customization options, and any proprietary trading tools beyond standard MetaTrader functionality was not extensively documented. These represent areas where potential clients would need to conduct direct evaluation.

Trust and Safety Analysis (9/10)

HYCM's regulatory framework represents one of its strongest features, with oversight from multiple respected financial authorities including the Financial Conduct Authority (FCA) in the United Kingdom. FCA regulation is widely regarded as among the most strict in the global forex industry, providing significant credibility to HYCM's operations. It offers substantial client protections including segregated funds and compensation scheme coverage.

The broker's additional regulatory relationships with the Dubai Financial Services Authority (DFSA) and Saint Vincent and the Grenadines authorities create a multi-country compliance framework. This demonstrates commitment to regulatory adherence across different markets. This diversified regulatory approach can provide clients with multiple layers of protection depending on their geographic location and the specific HYCM entity they trade with.

Available information shows no significant fraud allegations or major regulatory actions against HYCM. This suggests the broker has maintained a clean operational record throughout its four-decade history. The combination of established regulatory oversight, longevity in the market, and absence of major negative incidents creates a strong foundation for client trust and confidence in the broker's operations.

User Experience Analysis (7/10)

HYCM's positioning as suitable for traders ranging from beginners to experienced professionals suggests the broker has developed systems and processes that accommodate diverse user needs and experience levels. The low $20 minimum deposit requirement particularly supports accessibility for newcomers to forex trading. Meanwhile, the comprehensive instrument selection and professional trading platforms can satisfy more advanced trading requirements.

User feedback available in public sources generally shows positive experiences with HYCM's services. However, available materials did not extensively document specific details about user interface design, account management processes, and overall platform usability. The broker's long-standing presence in the market suggests it has developed user experience protocols refined through decades of client interaction.

However, detailed information about the registration and verification process, fund management procedures, common user concerns, and specific user satisfaction metrics was not comprehensively available in accessible sources. Potential clients would benefit from direct evaluation of the broker's user experience elements. These include account opening procedures, platform navigation, and customer service accessibility.

Conclusion

HYCM emerges from this analysis as a well-established, regulated forex broker that offers significant value for traders seeking reliable market access through professional trading platforms. The broker's four-decade history, comprehensive regulatory framework including FCA oversight, and positive user feedback create a foundation of trust and credibility. This distinguishes it in the competitive brokerage landscape.

The broker appears particularly well-suited for beginning traders due to its accessible $20 minimum deposit requirement. At the same time, it offers the professional tools and extensive market access that can satisfy more experienced traders' requirements. HYCM's combination of MetaTrader platform access and over 300 trading instruments provides a comprehensive trading environment for diverse market strategies.

While this hycm review identifies some information gaps regarding specific trading conditions, detailed fee structures, and comprehensive service offerings, the broker's regulatory standing and market reputation suggest it merits consideration from traders evaluating their brokerage options. Potential clients are encouraged to conduct direct due diligence with HYCM representatives to verify current trading conditions. They should also ensure the broker's services align with their specific trading needs and objectives.