Is HuiYing safe?

Business

License

Is Huiying Safe or Scam?

Introduction

Huiying is a forex brokerage that has emerged on the trading scene, positioning itself as a platform for traders looking to navigate the complexities of the foreign exchange market. As the forex market is known for its high volatility and potential for both profit and loss, it is crucial for traders to thoroughly evaluate the credibility and safety of their chosen brokerage. This article aims to provide an objective assessment of whether Huiying is a safe trading option or a potential scam. Our investigation is based on a comprehensive analysis of various sources, including regulatory information, customer feedback, and financial practices, to build a well-rounded perspective.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its safety. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards. In the case of Huiying, a thorough examination reveals a concerning lack of regulation, which raises significant red flags for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation means that Huiying operates without the oversight that could protect traders in the event of disputes or financial mishaps. Regulatory bodies are essential as they enforce rules that safeguard client funds and ensure fair trading practices. Without such oversight, traders may face higher risks, including potential fraud or mismanagement of funds. Historical compliance issues are also absent from Huiying's track record, but the lack of regulatory backing itself is a significant concern that cannot be overlooked. Thus, when asking, "Is Huiying safe?" the answer leans towards caution due to its unregulated status.

Company Background Investigation

Huiying's company history and ownership structure provide further insight into its legitimacy. Established recently, there is limited information available regarding its operational history and the experience of its management team. The ownership structure remains opaque, which raises questions about accountability and transparency within the organization.

The management team's background is crucial, as experienced leaders with a solid track record can significantly influence a company's reliability. However, in the case of Huiying, there appears to be a lack of publicly available information detailing the professional backgrounds and qualifications of its executives. This lack of transparency can be indicative of potential issues within the company, as reputable brokers typically provide clear information about their leadership.

Furthermore, the level of information disclosure is minimal, which can be a warning sign for potential investors. A trustworthy brokerage should be open about its operations, including its financial health and business practices. Thus, when considering whether "Is Huiying safe?" the lack of transparency and clarity in its company background raises additional concerns.

Trading Conditions Analysis

Understanding the trading conditions offered by Huiying is essential for evaluating its safety. The overall fee structure and trading conditions can significantly impact a trader's profitability and experience. Huiying claims to offer competitive trading conditions; however, the specifics of its fee structure warrant scrutiny.

| Fee Type | Huiying | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While the exact figures are not readily available, traders should be cautious of any unusual or hidden fees that could erode their profits. A common tactic among less reputable brokers is to impose excessive fees or unfavorable trading conditions that are not clearly communicated upfront. Therefore, it is crucial for traders to diligently review the fee structure before committing to any trades. Consequently, the question "Is Huiying safe?" becomes more pressing in light of potential hidden costs that could affect a trader's bottom line.

Client Funds Safety

The safety of client funds is paramount when evaluating any brokerage. Huiying's measures for safeguarding client funds, such as fund segregation and investor protection policies, are critical aspects that need thorough investigation. Unfortunately, specific details regarding Huiying's security measures are not readily available, which raises concerns about the safety of traders' investments.

In reputable brokerages, client funds are typically held in segregated accounts, ensuring that they are protected even if the brokerage faces financial difficulties. Additionally, investor protection schemes provide further assurance that traders can recover their funds in case of insolvency. However, without clear information on Huiying's practices regarding fund safety, traders may be left vulnerable.

Moreover, any historical incidents involving fund security or disputes with clients can serve as crucial indicators of a brokerage's reliability. In this case, the lack of transparency surrounding Huiying's fund safety measures further complicates the assessment of whether "Is Huiying safe?" and suggests a need for caution.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a brokerage. An analysis of user experiences with Huiying reveals a mixed bag of reviews, with several complaints surfacing regarding the company's responsiveness and overall service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Fair |

Common complaints include difficulties with fund withdrawals and slow customer support responses, which can be significant issues for traders who need timely assistance. When a brokerage fails to address these concerns effectively, it can lead to frustration and a loss of trust among its clients. Moreover, the severity of these complaints indicates that there may be systemic issues within the company, further questioning its reliability.

Examples of typical cases highlight the struggles some users faced while attempting to withdraw their funds, leading to speculation about Huiying's operational practices. Such issues not only paint a concerning picture of the company's customer service but also contribute to the ongoing question of "Is Huiying safe?" as these experiences can directly impact a trader's financial security.

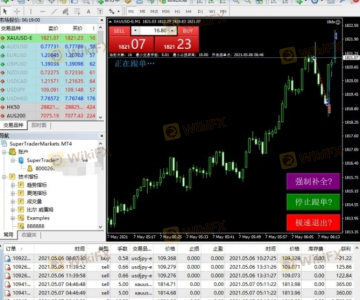

Platform and Execution

The performance and reliability of a brokerage's trading platform are critical factors that influence the overall trading experience. Huiying's platform must be evaluated for its stability, execution quality, and user experience. Unfortunately, there is limited information available about the specific features and performance metrics of Huiying's trading platform.

Order execution quality is another essential aspect to consider. Traders need assurance that their orders will be executed promptly and at the expected prices. Instances of slippage or order rejections can significantly hinder trading performance, particularly in a fast-paced market like forex. Additionally, any signs of platform manipulation, such as artificially widening spreads or delaying order execution, can be detrimental to a trader's success and raise further concerns regarding Huiying's integrity.

Therefore, when contemplating "Is Huiying safe?" the lack of detailed information about its platform performance and execution quality adds another layer of uncertainty for potential traders.

Risk Assessment

Evaluating the overall risk associated with trading through Huiying is essential for potential investors. The absence of regulatory oversight, coupled with the company's unclear operational practices, presents a range of risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight raises significant concerns. |

| Financial Risk | Medium | Lack of transparency regarding financial practices. |

| Customer Service Risk | High | Numerous complaints about withdrawal and support issues. |

Given these factors, potential traders should approach Huiying with caution. Recommendations for risk mitigation include conducting thorough research, seeking alternative brokers with better regulatory standing, and ensuring that any investments made are within a manageable risk level. The question "Is Huiying safe?" is particularly relevant in light of these risks, and traders should consider their risk tolerance before proceeding.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Huiying presents several red flags that warrant caution. The lack of regulatory oversight, coupled with transparency issues and numerous customer complaints, raises significant concerns regarding the safety of trading with this broker. Therefore, potential traders should carefully consider these factors before making any commitments.

For traders seeking a reliable and safe trading environment, it is advisable to explore alternative brokers with established regulatory frameworks and positive customer feedback. Recommendations may include brokers that are well-regulated and have a solid reputation for customer service and fund safety. Ultimately, the question "Is Huiying safe?" leans towards negative, and traders should prioritize their financial security when choosing a brokerage.

Is HuiYing a scam, or is it legit?

The latest exposure and evaluation content of HuiYing brokers.

HuiYing Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HuiYing latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.