Is Phoenix Wealth safe?

Pros

Cons

Is Phoenix Wealth Safe or a Scam?

Introduction

Phoenix Wealth is a forex broker that has garnered attention in the trading community for its various offerings and potential investment opportunities. However, as with any financial service provider, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with both legitimate brokers and scams, making it essential for traders to discern the difference. In this article, we will investigate whether Phoenix Wealth is a safe trading option or if it raises red flags that suggest it may be a scam. Our assessment will be based on a comprehensive review of regulatory compliance, company background, trading conditions, customer safety measures, and user experiences.

Regulation and Legitimacy

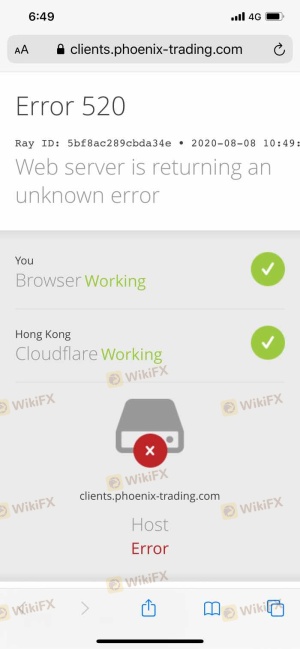

One of the primary factors in determining the safety of a forex broker is its regulatory status. Regulation serves as a protective mechanism for traders, ensuring that brokers adhere to specific standards and practices that safeguard client funds and maintain market integrity. In the case of Phoenix Wealth, our investigation reveals that the broker operates without any valid regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Phoenix Wealth is not subject to the scrutiny and requirements imposed by financial authorities. This lack of oversight can lead to various risks, including the potential for fraud, mismanagement of funds, and unethical trading practices. Furthermore, the absence of a regulatory body means that traders have limited recourse in the event of disputes or issues with the broker. Overall, the lack of regulation is a significant indicator that IS Phoenix Wealth safe for traders.

Company Background Investigation

Examining the history and ownership of a broker can provide valuable insights into its operations and trustworthiness. Phoenix Wealth appears to have a relatively obscure background, with limited information available about its establishment and development. The company claims to have been active in the forex market for several years, but the lack of transparency regarding its ownership structure and management team is concerning.

The management team‘s qualifications and experience play a vital role in a broker’s reliability. However, there is little public information available about the individuals behind Phoenix Wealth, which further complicates the assessment of its credibility. A transparent broker typically provides detailed bios of its leadership team, including their professional backgrounds and qualifications. The lack of such disclosures raises questions about the level of expertise and integrity present within the organization.

In summary, the opaque nature of Phoenix Wealth's company background contributes to the growing skepticism regarding its safety. As such, traders should be cautious and consider the implications of engaging with a broker that lacks transparency.

Trading Conditions Analysis

Understanding a broker's trading conditions is crucial for evaluating its overall value proposition and potential risks. Phoenix Wealth advertises various trading instruments and competitive spreads, but the absence of detailed information about its fee structure raises concerns.

| Fee Type | Phoenix Wealth | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Model | Not Available | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The lack of clarity regarding spreads, commissions, and overnight fees can lead to unexpected costs for traders. In a competitive market, legitimate brokers typically provide comprehensive details about their fee structures to help clients make informed decisions. The absence of such information from Phoenix Wealth may indicate a less favorable trading environment, potentially making it more challenging for traders to realize profits.

Moreover, the lack of transparency regarding trading conditions could also suggest that Phoenix Wealth may employ hidden fees or unfavorable trading practices. As a result, traders should approach this broker with caution and consider the potential impact on their trading outcomes.

Customer Fund Safety

When dealing with a forex broker, the safety of customer funds is paramount. Traders need to ensure that their deposits are protected through effective security measures. In the case of Phoenix Wealth, there is a concerning lack of information regarding its policies on fund segregation, investor protection, and negative balance protection.

A reputable broker typically segregates client funds from its operational funds, ensuring that clients' money is protected even in the event of financial difficulties. Additionally, many regulated brokers offer investor protection schemes that provide compensation in case of insolvency. However, given that Phoenix Wealth operates without regulation, there is no assurance that such protective measures are in place.

Furthermore, the absence of documented policies on negative balance protection raises additional concerns. Negative balance protection ensures that traders cannot lose more money than they have deposited, providing an essential safety net. Without this protection, traders could face significant financial losses, especially during volatile market conditions.

In conclusion, the lack of information regarding customer fund safety measures at Phoenix Wealth is a significant red flag. Traders should be wary of investing with a broker that does not prioritize the security of their funds.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability and service quality. In the case of Phoenix Wealth, reports from users indicate a mix of experiences, with several complaints surfacing regarding withdrawal issues and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support Quality | Medium | Inconsistent |

One common complaint revolves around withdrawal delays, with some traders reporting that they faced significant challenges when attempting to access their funds. Such issues can indicate underlying operational problems within the broker and may suggest a lack of commitment to customer service.

Additionally, the quality of customer support is crucial for resolving issues and providing assistance to traders. Reports of inconsistent and slow responses from Phoenix Wealth's support team further exacerbate concerns about the broker's reliability.

In light of these complaints, it is clear that potential traders should be cautious when considering Phoenix Wealth as their broker, as the customer experience may not meet their expectations.

Platform and Execution

The trading platform and execution quality are critical factors that can significantly impact a trader's experience. Phoenix Wealth utilizes a trading platform that claims to offer advanced features and stable performance. However, without independent reviews and user feedback, it is challenging to assess the platform's reliability.

Traders have reported mixed experiences concerning order execution quality, with some noting instances of slippage and order rejections. Such issues can be detrimental, especially for scalpers and day traders who rely on precise execution to capitalize on market movements.

Moreover, the potential for platform manipulation raises concerns about the broker's integrity. Traders should be vigilant and consider whether the platform they are using is truly in their best interest.

Risk Assessment

Using Phoenix Wealth as a broker comes with inherent risks, primarily due to its lack of regulation and transparency. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Transparency Risk | High | Lack of information about fees and company background. |

| Fund Safety Risk | High | Unclear safety measures for client funds. |

| Customer Support Risk | Medium | Reports of poor customer service and withdrawal issues. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with established regulatory frameworks and transparent practices.

Conclusion and Recommendations

In conclusion, the investigation into Phoenix Wealth reveals significant concerns regarding its safety and legitimacy. The absence of regulation, lack of transparency, and troubling customer experiences suggest that traders should exercise extreme caution when considering this broker.

While Phoenix Wealth may present appealing trading opportunities, the risks associated with it outweigh potential benefits. For those seeking reliable trading options, it is advisable to explore brokers that are regulated by reputable authorities and provide transparent information about their services.

In summary, IS Phoenix Wealth safe? The evidence suggests that it is not a trustworthy option for traders, and potential clients should be wary of engaging with this broker. Instead, consider reputable alternatives that prioritize client safety and regulatory compliance.

Is Phoenix Wealth a scam, or is it legit?

The latest exposure and evaluation content of Phoenix Wealth brokers.

Phoenix Wealth Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Phoenix Wealth latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.