Is horbaxglobal.com safe?

Business

License

Is Horbaxglobal.com Safe or a Scam?

Introduction

In the dynamic world of forex trading, HorbaX Global has emerged as a contender, offering a range of trading services that span across various asset classes, including cryptocurrencies and forex. As the trading landscape becomes increasingly populated, traders must exercise caution and conduct thorough evaluations of brokers before committing their funds. The importance of assessing the legitimacy of a broker cannot be overstated, as the forex market is rife with both opportunities and potential pitfalls. This article aims to provide a comprehensive analysis of HorbaX Global, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of multiple online sources, including user reviews, regulatory databases, and expert analyses, ensuring a well-rounded perspective on whether HorbaX Global is indeed safe or a potential scam.

Regulatory and Legitimacy

The regulatory status of a forex broker is critical in determining its legitimacy and safety for traders. HorbaX Global claims to operate under regulations from the UK, but there are significant concerns regarding its actual compliance and oversight. Regulatory bodies are essential for protecting traders' interests, ensuring that brokers adhere to strict guidelines that mitigate fraud and malpractice. Below is a summary of the regulatory information related to HorbaX Global:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of a valid regulatory license raises red flags about the broker's operational legitimacy. In the forex industry, brokers are expected to register with recognized regulatory authorities such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia. The lack of such registration for HorbaX Global indicates a higher risk level for potential investors, as there is no oversight to ensure fair practices or protect client funds. Given this information, traders should approach HorbaX Global with caution and consider the implications of trading with an unregulated entity.

Company Background Investigation

Understanding the background of HorbaX Global is crucial for assessing its trustworthiness. The company is relatively new, having been registered only a few months ago, which often correlates with a higher risk of being a scam. Newer brokers can sometimes operate without a solid reputation, making it difficult for traders to gauge their reliability. The ownership structure of HorbaX Global is also somewhat opaque, as there is limited information available regarding its founders or management team. Transparency is a key factor in establishing trust, and the lack of clear information on who runs the company can be concerning.

The management team's background is another area of scrutiny. A reputable broker typically has a team with extensive experience in finance and trading. However, HorbaX Global does not provide detailed profiles or qualifications of its management, which diminishes its credibility. Furthermore, the company's website lacks comprehensive information about its operations, which is often a tactic used by fraudulent brokers to obscure their true intentions. Consequently, potential clients should remain vigilant and conduct further research before engaging with HorbaX Global.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is critical. HorbaX Global has a diverse fee structure, but there are concerns about the transparency and competitiveness of its pricing. It is essential to have a clear view of the costs associated with trading, as high fees can erode profits. Below is a comparison of core trading costs associated with HorbaX Global:

| Fee Type | HorbaX Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific figures for spreads and commissions raises concerns about the broker's pricing model. Traders should be wary of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs and reduced profitability. Additionally, if HorbaX Global imposes unusually high fees or hidden charges, it could signal a lack of integrity and transparency.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. HorbaX Global claims to implement various measures to protect client funds, but the lack of regulatory oversight raises questions about the effectiveness of these measures. Key aspects to consider include the segregation of client funds, investor protection schemes, and negative balance protection policies.

Traders should ensure that their funds are held in segregated accounts, which means that client money is kept separate from the broker's operational funds. This practice is essential for safeguarding client assets in the event of the broker facing financial difficulties. Additionally, investor protection schemes provide a safety net for traders, ensuring that they can recover a portion of their funds if the broker fails. Unfortunately, HorbaX Global has not provided clear information regarding these safety measures, which further complicates the assessment of its trustworthiness.

Customer Experience and Complaints

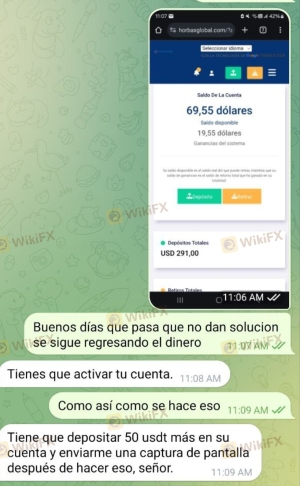

User feedback is an invaluable resource for assessing the credibility of any broker. Reviews of HorbaX Global reveal a mixed bag of experiences, with several complaints highlighting issues related to withdrawals and customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Average |

| Lack of Transparency | High | Poor |

Many users have expressed frustration over delayed withdrawals, which is a significant concern in the trading community. A broker that fails to process withdrawals in a timely manner may be perceived as untrustworthy. Additionally, the quality of customer service is crucial for resolving issues promptly; however, HorbaX Global has received criticism for its slow and unhelpful responses.

One notable case involved a trader who reported waiting weeks to withdraw funds, only to receive vague responses from customer service. Such experiences can be indicative of deeper issues within the broker's operations and should not be taken lightly.

Platform and Execution

The trading platform's performance is another critical factor for traders. HorbaX Global claims to offer a user-friendly trading environment, but there are concerns about the execution quality and potential manipulation. Traders rely on swift and accurate order execution, and any signs of slippage or high rejection rates can lead to significant losses.

Users have reported instances of slippage during high volatility periods, which can be detrimental to trading strategies. Additionally, if a broker engages in practices that favor the house over the trader, it could indicate a lack of integrity. Therefore, it is essential to assess the platform's reliability and the broker's commitment to fair trading practices.

Risk Assessment

The overall risk associated with trading through HorbaX Global is considerable, given the regulatory concerns, lack of transparency, and negative user feedback. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Security | High | Lack of clear safety measures |

| Customer Service | Medium | Poor response to complaints |

| Trading Conditions | High | Unclear fees and high withdrawal issues |

To mitigate these risks, potential traders should conduct thorough due diligence, consider using smaller amounts for initial trades, and explore alternative brokers with better reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that HorbaX Global raises several red flags that warrant caution. The lack of regulatory oversight, transparency issues, and negative user experiences indicate that it may not be a safe choice for traders. While some traders may still find success, the risks involved are significant.

For those considering trading with HorbaX Global, it is advisable to proceed with extreme caution and be aware of the potential for issues related to withdrawals and customer service. For traders seeking safer alternatives, brokers with established regulatory frameworks, transparent fee structures, and positive user feedback should be prioritized. Ultimately, ensuring the safety of your investments should be the top priority in the forex trading landscape.

Is horbaxglobal.com a scam, or is it legit?

The latest exposure and evaluation content of horbaxglobal.com brokers.

horbaxglobal.com Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

horbaxglobal.com latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.