Is Hlifx safe?

Business

License

Is hlifx A Scam?

Introduction

Hlifx is a forex broker that has positioned itself within the competitive landscape of online trading, catering to traders looking for access to various financial instruments. Given the proliferation of online trading platforms, it is essential for traders to exercise caution and thoroughly evaluate any broker before committing their funds. The forex market is rife with opportunities, but it also harbors risks, including potential scams and unreliable platforms. This article aims to provide an objective analysis of hlifx, examining its regulatory status, company background, trading conditions, and customer experiences to determine whether it is a safe choice for traders or a potential scam.

To conduct this investigation, we utilized a comprehensive approach that includes analyzing regulatory information, company history, customer feedback, and trading conditions. Our evaluation framework focuses on key aspects such as regulatory compliance, financial security, customer service, and overall reputation in the trading community.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. In the case of hlifx, the broker's regulatory history raises significant concerns.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 225973 | Australia | Revoked |

| NFA | 0479264 | United States | Unauthorized |

| FMA | 146605 | New Zealand | Revoked |

Hlifx was once regulated by the Australian Securities and Investments Commission (ASIC), but this license has been revoked. Similarly, the licenses from the National Futures Association (NFA) and the Financial Markets Authority (FMA) have also been revoked or deemed unauthorized. This lack of regulation is alarming, as it indicates that hlifx is not subject to the oversight that is typically expected from reputable brokers. The revocation of these licenses raises red flags about the broker's compliance with industry standards and its commitment to protecting traders' interests.

Company Background Investigation

Hlifx's history and ownership structure provide further insight into its credibility. Established in 2014, hlifx has operated in a highly competitive environment. However, the broker's operational history is marred by the revocation of its licenses, which casts doubt on its reliability. The management team behind hlifx is not well-documented, and there is limited information available about their professional backgrounds and expertise in the financial sector. This lack of transparency can be concerning for potential clients, as a knowledgeable and experienced management team is crucial for the effective operation of a trading platform.

Moreover, the absence of clear information regarding the company's ownership structure raises additional questions about its accountability and transparency. In a market where trust is paramount, the inability to ascertain the key players behind hlifx is a significant drawback.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Hlifx presents a range of trading fees; however, the lack of clarity around their fee structure is problematic. Traders need to be aware of all potential costs before engaging with a broker.

| Fee Type | hlifx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1-2 pips |

| Commission Model | Unclear | Varies |

| Overnight Interest Range | Unspecified | Varies |

Hlifx has not clearly defined its spreads or commission structures, which can lead to unexpected costs for traders. In a competitive market, brokers typically provide detailed information about their trading costs to attract clients. The absence of such transparency at hlifx raises concerns about its commitment to fair trading practices. Additionally, any unusual or hidden fees could significantly impact a trader's profitability.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Hlifx's practices regarding fund security are crucial in evaluating whether it is a safe broker or a potential scam. The broker's website does not provide detailed information about its measures for safeguarding client funds, such as whether they maintain segregated accounts or offer negative balance protection.

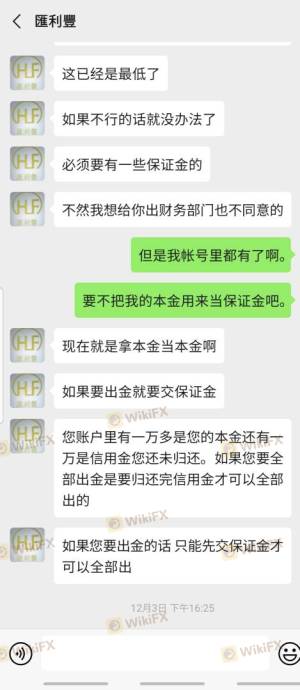

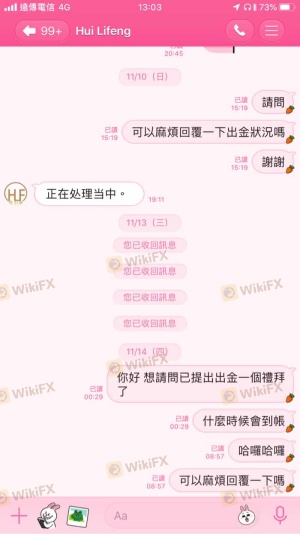

In the event of financial instability or insolvency, the absence of investor protection measures could leave traders vulnerable. Furthermore, past reports of issues regarding fund withdrawals from hlifx add to the concerns about the broker's reliability in handling client funds. The lack of transparency in this area is a significant warning sign for potential investors.

Customer Experience and Complaints

Customer feedback is invaluable in assessing a broker's reputation. An analysis of reviews and complaints about hlifx reveals a pattern of negative experiences among users. Common complaints include difficulties with fund withdrawals, inadequate customer support, and concerns about the platform's reliability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Quality | Medium | Poor |

| Platform Reliability | High | Unclear |

Several users have reported being unable to withdraw their funds, leading to frustrations and allegations of scam-like practices. The company's slow response to these issues further exacerbates the situation, raising questions about its commitment to customer satisfaction.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a seamless trading experience. Hlifx offers a web-based trading platform; however, there is limited information available regarding its stability and user experience. Traders have expressed concerns about order execution quality, including instances of slippage and rejected orders.

The absence of detailed performance metrics or user testimonials about the platform's reliability is worrisome. In a market where speed and accuracy are vital, any signs of potential manipulation or execution issues could deter traders from using hlifx.

Risk Assessment

Engaging with hlifx presents various risks that traders should carefully consider. The lack of regulatory oversight, coupled with negative customer feedback and unclear trading conditions, contributes to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Revoked licenses indicate risk |

| Fund Security | High | Lack of transparency in fund handling |

| Customer Service | Medium | Poor response to complaints |

To mitigate these risks, traders should conduct thorough due diligence before engaging with hlifx. It is advisable to consider alternative brokers with established reputations and transparent practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that hlifx poses significant risks for traders. The revocation of its regulatory licenses, coupled with negative customer experiences and a lack of transparency, raises serious concerns about the broker's legitimacy. While hlifx may offer certain trading opportunities, the potential for scams and unreliable practices cannot be overlooked.

For traders seeking a safer alternative, it is recommended to explore brokers with strong regulatory oversight, positive customer feedback, and transparent trading conditions. Brokers such as [insert recommended brokers] can provide a more secure trading environment and a better overall experience. Always prioritize safety and due diligence when selecting a forex broker to protect your investments.

In summary, is hlifx safe? The overwhelming evidence points to significant concerns, making it advisable for traders to approach with caution or seek alternatives.

Is Hlifx a scam, or is it legit?

The latest exposure and evaluation content of Hlifx brokers.

Hlifx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hlifx latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.