Is GTFX safe?

Business

License

Is GTFX Safe or a Scam?

Introduction

GTFX, a forex broker established in 2018, positions itself within the competitive landscape of the foreign exchange market, primarily targeting clients from Asia. As the forex market continues to attract traders worldwide, it becomes increasingly crucial for individuals to evaluate the credibility of brokers before committing their funds. The potential for scams in this sector is significant, as unregulated brokers may pose risks to traders' investments. This article aims to provide a comprehensive analysis of GTFX, examining its legitimacy, regulatory status, trading conditions, and overall safety for traders. Our investigation draws upon a variety of sources, including user reviews, regulatory information, and expert analyses to form a well-rounded assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and legitimacy. GTFX operates without any valid regulatory oversight, which raises significant concerns for potential clients. A lack of regulation often correlates with higher risks, as unregulated brokers are not held to the same standards as their licensed counterparts. Below is a summary of GTFX's regulatory information:

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that GTFX does not have to comply with the stringent requirements that licensed brokers must adhere to, such as maintaining segregated client accounts or offering negative balance protection. Furthermore, the lack of regulatory history raises questions about the broker's commitment to adhering to best practices, which is essential for ensuring client safety. Investors should be cautious when dealing with brokers like GTFX, as they may not have recourse in the event of disputes or issues arising from trading activities.

Company Background Investigation

GTFX was founded in 2018 and is based in China. However, the broker's ownership structure and management team remain somewhat opaque, as detailed information is scarce. The lack of transparency regarding the company's history and ownership can be a red flag for potential investors. A strong management team with relevant industry experience often contributes to a broker's credibility. Unfortunately, GTFX does not provide sufficient information about its management, making it challenging to assess their expertise and commitment to ethical trading practices.

Moreover, the company's transparency in terms of information disclosure is lacking. Traders typically benefit from brokers that provide clear and accessible information about their operations, fees, and policies. GTFX's limited disclosure practices may lead to uncertainty among clients regarding the broker's intentions and reliability. This lack of transparency further complicates the evaluation of whether GTFX is safe for trading.

Trading Conditions Analysis

GTFX's trading conditions are another essential aspect to consider when evaluating the broker's overall safety. An analysis of their fee structure reveals that GTFX charges spreads and commissions that may not be competitive compared to industry standards. Below is a summary of the core trading costs associated with GTFX:

| Fee Type | GTFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not specified) | 1-2 pips |

| Commission Model | Not specified | Varies (0-10 USD) |

| Overnight Interest Range | Not specified | Varies by broker |

The lack of clarity regarding spreads and commissions is concerning. Traders should be wary of brokers that do not provide detailed information about their trading costs, as hidden fees can significantly impact profitability. Furthermore, GTFX's fee structure appears less favorable when compared to established brokers, which may deter potential clients.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. GTFX's lack of regulation raises serious concerns about the security measures in place to protect traders' investments. Without regulatory oversight, GTFX is not required to maintain segregated accounts for client funds, which means that traders' money could be at risk in the event of the broker's insolvency. Additionally, there is no indication that GTFX offers negative balance protection, which is a crucial feature for safeguarding clients from losing more than their deposited amounts.

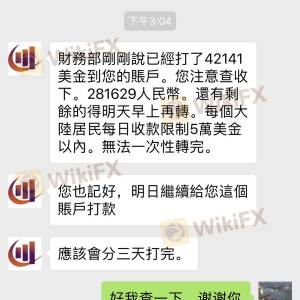

Historically, unregulated brokers have faced numerous complaints and issues related to fund safety, and GTFX is no exception. Reports of clients encountering difficulties with withdrawals and fund access have surfaced, further emphasizing the need for caution. Traders should be especially vigilant when dealing with brokers that lack a solid regulatory framework and proven track record of safeguarding client assets.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reliability of a forex broker. Reviews of GTFX reveal a mixed bag of experiences, with numerous complaints regarding withdrawal issues and unresponsive customer service. Below is a summary of the primary complaint types received by GTFX:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

| Misleading Information | High | Poor |

Specific case studies illustrate the challenges faced by clients. For instance, some users reported being unable to withdraw their funds, citing unresponsive customer service as a significant issue. These experiences are concerning and suggest that GTFX may not prioritize customer satisfaction or support.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. GTFX utilizes the MetaTrader 4 platform, which is known for its reliability and user-friendly interface. However, concerns have been raised about the quality of trade execution, including instances of slippage and order rejections. Traders have reported experiencing delays in order execution, which can be detrimental in fast-moving markets.

While the platform itself may be functional, the execution quality is a significant factor to consider when evaluating whether GTFX is safe for trading. The presence of slippage and rejected orders can lead to losses, especially for traders employing high-frequency or scalping strategies.

Risk Assessment

Engaging with GTFX comes with inherent risks that potential clients should carefully consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Financial Risk | High | Lack of fund segregation and negative balance protection. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Support Risk | High | Poor response times and unresolved complaints. |

To mitigate these risks, potential traders should conduct thorough due diligence before engaging with GTFX. It is advisable to start with a small investment and monitor the broker's performance closely. Additionally, exploring alternative brokers with robust regulatory frameworks and positive user experiences may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that GTFX presents several red flags that warrant caution. The lack of regulatory oversight, coupled with a history of client complaints and insufficient transparency, raises significant concerns about the broker's legitimacy. While GTFX may offer some attractive features, the risks associated with trading through an unregulated broker cannot be overlooked.

For traders seeking a more secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of safeguarding client funds. Brokers such as [insert reliable broker names] offer robust regulatory protections and positive user experiences, making them worthy alternatives to GTFX. Ultimately, it is crucial for traders to prioritize safety and due diligence when selecting a forex broker to ensure a secure trading experience.

Is GTFX a scam, or is it legit?

The latest exposure and evaluation content of GTFX brokers.

GTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GTFX latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.