Is GEGL safe?

Pros

Cons

Is Gegl Safe or a Scam?

Introduction

Gegl is a forex broker that has garnered attention in the trading community, primarily due to its offerings and the claims made about its trading platforms. As the forex market continues to grow, traders are increasingly cautious about choosing a broker, given the prevalence of scams and fraudulent activities. It is essential for traders to conduct thorough evaluations of forex brokers to ensure their safety and security. This article aims to investigate whether Gegl is a legitimate broker or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

A broker's regulatory status is a critical aspect of determining its legitimacy. Gegl operates without any significant regulatory oversight, which raises concerns about its trustworthiness. Regulatory bodies are crucial as they enforce standards that protect traders and ensure fair practices. Here is a summary of Gegl's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory license suggests that Gegl does not adhere to the stringent requirements imposed by recognized financial authorities. This lack of oversight can lead to potential risks for traders, as there are no guarantees regarding the safety of their funds or the integrity of the broker's operations. Moreover, the broker's high-risk profile is compounded by claims of suspicious regulatory licenses, which further casts doubt on its legitimacy.

Company Background Investigation

Gegl's company background is another area of concern. Established under the name Genesis Group, it claims to operate from Hong Kong. However, there is limited information available regarding its history, ownership structure, and corporate governance. The lack of transparency surrounding the management team and their qualifications raises further red flags. A reliable broker typically provides detailed information about its founders, executives, and their professional backgrounds, fostering trust among potential clients. Unfortunately, Gegl does not meet these transparency standards, making it difficult for traders to assess the broker's credibility.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for traders looking to maximize their potential returns. Gegl's fee structure appears to be inconsistent with industry norms, and several users have reported unusual charges. Heres a comparison of core trading costs:

| Fee Type | Gegl | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Range | High | Moderate |

The high spreads on major currency pairs indicate that traders may face increased costs when executing trades, which can significantly impact profitability. Additionally, the unclear commission structure raises questions about transparency and fairness in pricing. Traders should be wary of brokers that do not clearly disclose their fee structures, as this is often a tactic used by less reputable firms.

Client Fund Safety

A broker's commitment to client fund safety is paramount. Gegl's lack of regulatory oversight raises concerns about its security measures for safeguarding clients' funds. There is no information available on whether Gegl employs segregated accounts, investor protection schemes, or negative balance protection policies. Such measures are essential for ensuring that clients' funds are safe from misappropriation or loss. Moreover, historical complaints about withdrawal issues and blocked accounts further exacerbate concerns regarding the safety of funds with Gegl.

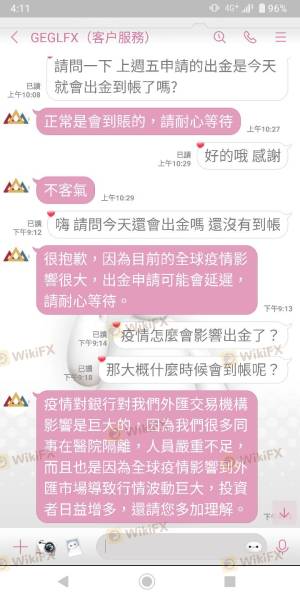

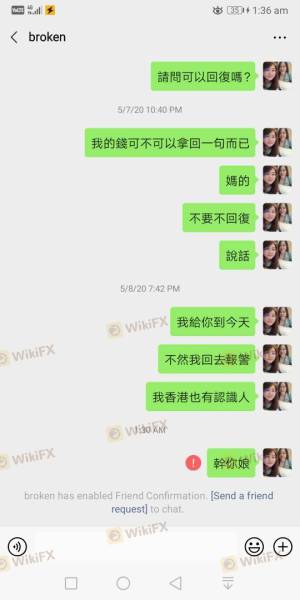

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Gegl indicate a pattern of dissatisfaction among users, particularly regarding withdrawal processes. Many traders have reported difficulties in accessing their funds, with claims that the broker provides excuses to delay or deny withdrawals. Heres a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| High Spreads | Medium | Vague |

| Lack of Transparency | High | Ignored |

The severity of withdrawal issues is particularly alarming, as it suggests that Gegl may not prioritize the financial well-being of its clients. The company's lack of responsiveness to complaints further highlights the potential risks associated with trading through this broker.

Platform and Execution

The trading platform offered by Gegl is built on MetaTrader 4/5, which is known for its robust features and user-friendly interface. However, the performance and stability of the platform have been questioned by users. Issues such as slippage, order rejections, and execution delays can severely impact trading outcomes. Traders should be cautious of any signs of platform manipulation, as this could indicate unethical practices by the broker.

Risk Assessment

Using Gegl as a trading platform comes with inherent risks. The absence of regulatory oversight, high trading costs, and negative customer feedback contribute to an overall high-risk profile. Heres a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No significant regulatory oversight |

| Financial Risk | High | High spreads and unclear fees |

| Operational Risk | Medium | Customer complaints regarding withdrawals |

To mitigate these risks, traders should consider using a regulated broker with transparent fee structures and a solid reputation for customer service.

Conclusion and Recommendations

In conclusion, the evidence suggests that Gegl is not a safe trading option. The lack of regulation, high trading costs, and numerous customer complaints indicate a potential scam or, at the very least, a broker that traders should approach with caution. It is advisable for traders to seek alternative brokers that are regulated by reputable financial authorities and offer transparent trading conditions. Some recommended alternatives include brokers that are well-regarded in the industry and have proven track records of reliability and customer satisfaction. Always prioritize safety and due diligence when selecting a forex broker to protect your investments.

Is GEGL a scam, or is it legit?

The latest exposure and evaluation content of GEGL brokers.

GEGL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GEGL latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.