Is GSM safe?

Pros

Cons

Is GSM Safe or Scam?

Introduction

GSM, also known as Grand Signal Markets, positions itself as a forex broker catering to a diverse clientele seeking to trade in various financial instruments. In the rapidly evolving forex market, where opportunities abound, it is imperative for traders to exercise caution and thoroughly evaluate their brokers. This is particularly true for GSM, as a plethora of mixed reviews and regulatory concerns have emerged. In this article, we will investigate whether GSM is a scam or a legitimate trading platform. Our analysis is based on a comprehensive review of online sources, including regulatory information, customer feedback, and operational practices.

Regulatory and Legitimacy

The regulatory status of a forex broker is crucial for ensuring the safety of traders' funds and maintaining fair trading practices. GSM claims to be registered in the United Kingdom; however, it lacks proper regulation from any recognized financial authority.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation raises significant red flags regarding GSM's legitimacy. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK enforce strict guidelines to protect traders. Without oversight from a reputable authority, traders' funds may be at risk, and the broker's operational practices remain unmonitored. Furthermore, historical compliance issues and the broker's classification as a "suspicious clone" by various watchdogs suggest that GSM may not adhere to industry standards.

Company Background Investigation

GSM was founded in 2019 and is purportedly headquartered in the UK. However, the details surrounding its ownership and operational history remain opaque. The lack of transparency in the company's structure raises concerns about its credibility and reliability.

The management team behind GSM has not been publicly disclosed, which further complicates the assessment of the broker's trustworthiness. A transparent company typically provides information about its founders and key personnel, along with their professional backgrounds. In GSM's case, the absence of such information can lead to skepticism regarding their intentions and operational integrity.

Moreover, GSM has faced numerous complaints from users who have reported difficulties in withdrawing funds, leading to speculation about the company's practices. The lack of accessible information about the broker's history and ownership structure contributes to the perception that GSM may not be a safe option for traders.

Trading Conditions Analysis

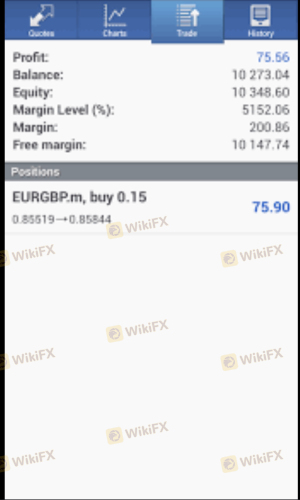

When evaluating a forex broker, understanding the trading conditions and fee structures is vital. GSM advertises competitive trading conditions, including leverage up to 1:200 and spreads starting from 0.0 pips. However, the overall cost structure may not be as favorable as it appears.

| Fee Type | GSM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips (average) | 0.6 - 1.0 pips |

| Commission Model | $0 | $0 - $10 |

| Overnight Interest Range | Varies | Varies |

While GSM's spreads may seem appealing, they are often accompanied by hidden fees or unfavorable trading conditions. Users have reported unexpected costs during withdrawals and unclear policies regarding commissions, which can significantly impact overall profitability. These factors should prompt traders to exercise caution and thoroughly investigate GSM's fee structure before committing funds.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. GSM's lack of regulation raises significant questions about the safety measures it has in place. Unregulated brokers often do not implement robust security protocols, leaving clients vulnerable to potential fraud or mismanagement of funds.

GSM does not provide clear information regarding the segregation of client funds, which is a critical practice that protects traders' assets in the event of a broker's insolvency. Additionally, there are no indications of investor protection schemes or negative balance protection policies, further heightening the risks associated with trading on this platform.

Historically, GSM has faced accusations of fund mismanagement and has been implicated in several complaints regarding withdrawal issues. These incidents suggest that the broker may not prioritize the safety of its clients' investments, raising concerns about whether GSM is safe for traders.

Customer Experience and Complaints

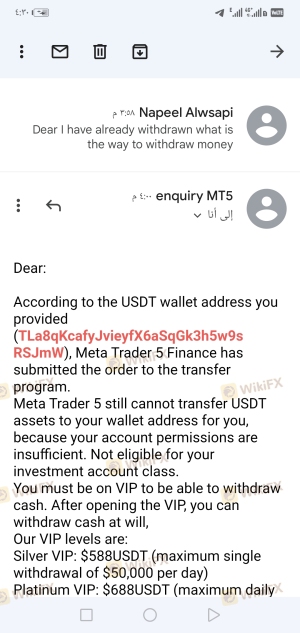

Customer feedback plays a crucial role in assessing the reliability of a forex broker. A review of online forums and social media reveals a pattern of complaints against GSM, primarily related to withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Misleading Information | High | Poor |

Many users have reported that their withdrawal requests were either denied or significantly delayed, leading to frustration and financial losses. Furthermore, the company's response to these complaints has been largely inadequate, with many users stating that their inquiries went unanswered or were met with vague explanations.

For instance, one trader reported that after initially seeing gains, their account was blocked once they attempted to withdraw funds. Such experiences contribute to the perception that GSM may engage in practices that are not in the best interest of its clients, casting doubt on whether GSM is safe.

Platform and Execution

The trading platform offered by GSM is another critical factor in evaluating its credibility. Traders often rely on platform stability and execution quality to ensure a seamless trading experience. However, users have reported issues with order execution, including slippage and rejections.

The absence of a robust trading platform can hinder a trader's ability to capitalize on market opportunities. Furthermore, the lack of transparency regarding the platform's performance metrics raises concerns about potential manipulation or unfair practices.

Risk Assessment

Engaging with GSM carries inherent risks, primarily due to its unregulated status and negative user feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from any regulatory body. |

| Financial Risk | High | Potential loss of funds due to lack of security measures. |

| Operational Risk | Medium | Issues with platform stability and execution. |

| Customer Service Risk | High | Poor response to client complaints and inquiries. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with GSM. This includes exploring alternative brokers with established regulatory frameworks and positive user feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that GSM raises significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, coupled with numerous complaints about withdrawal issues and poor customer service, indicates that traders should approach this broker with caution.

For those considering forex trading, it is advisable to explore alternative brokers that are regulated by reputable authorities and have a proven track record of reliability. Brokers such as IG, XM, and Forex.com offer robust regulatory oversight and positive user experiences, making them safer options for traders.

Ultimately, the question remains: Is GSM safe? Based on the current information, the answer leans towards caution, and potential traders should be aware of the risks involved before proceeding with GSM.

Is GSM a scam, or is it legit?

The latest exposure and evaluation content of GSM brokers.

GSM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GSM latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.