GSM 2025 Review: Everything You Need to Know

Executive Summary

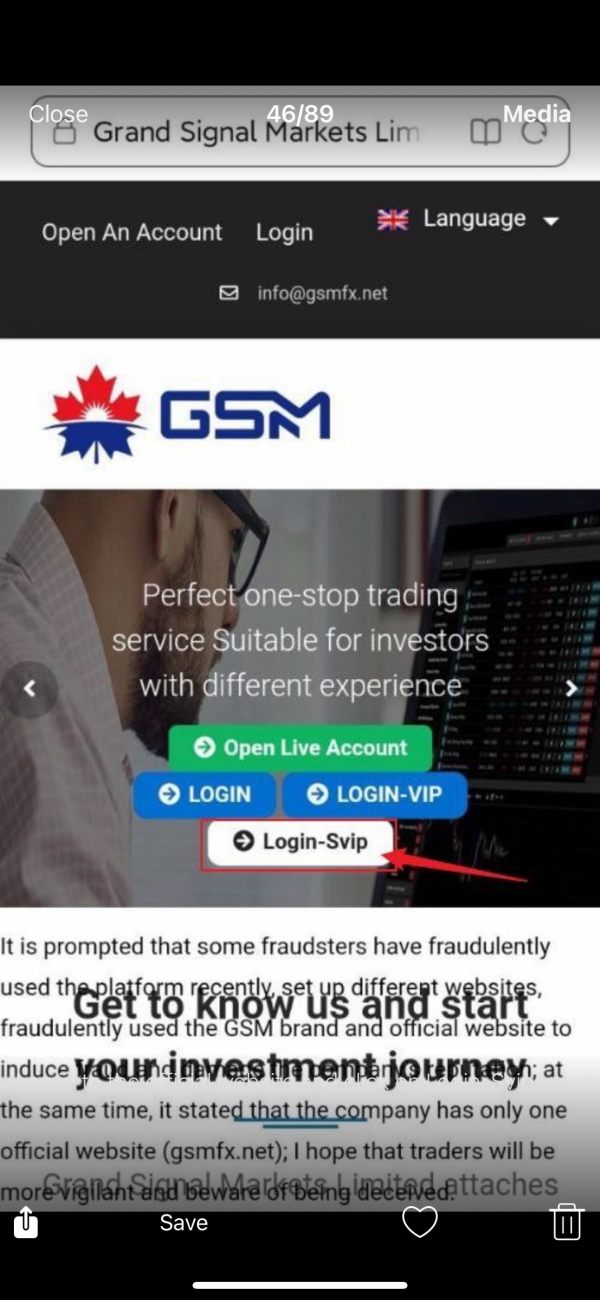

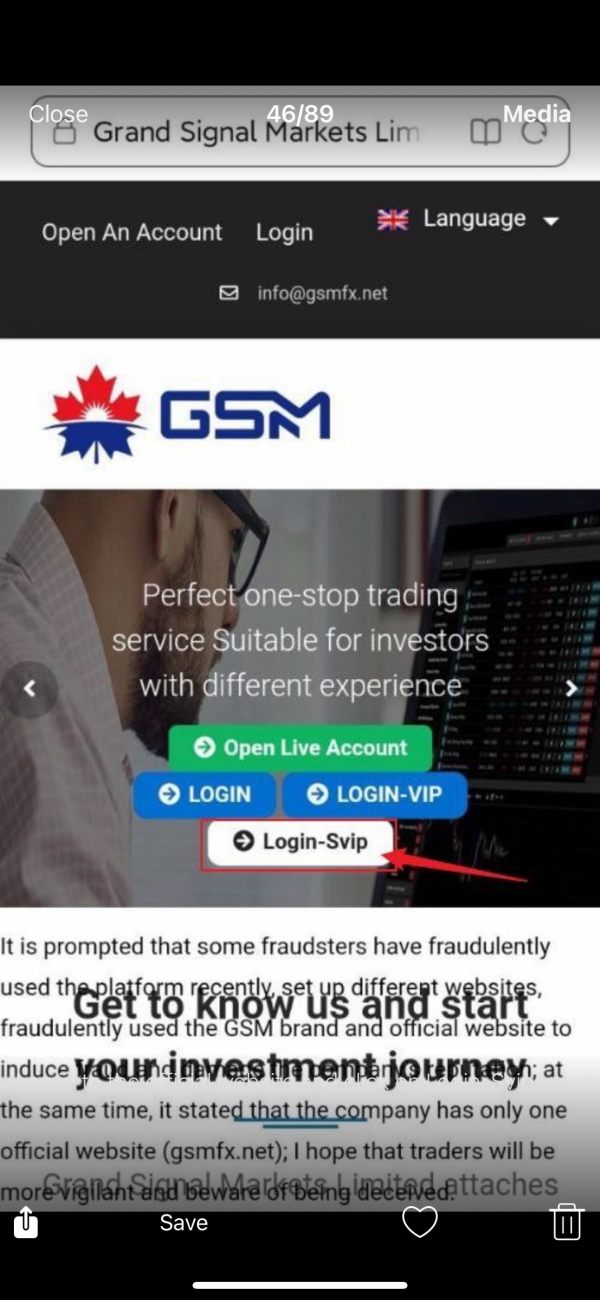

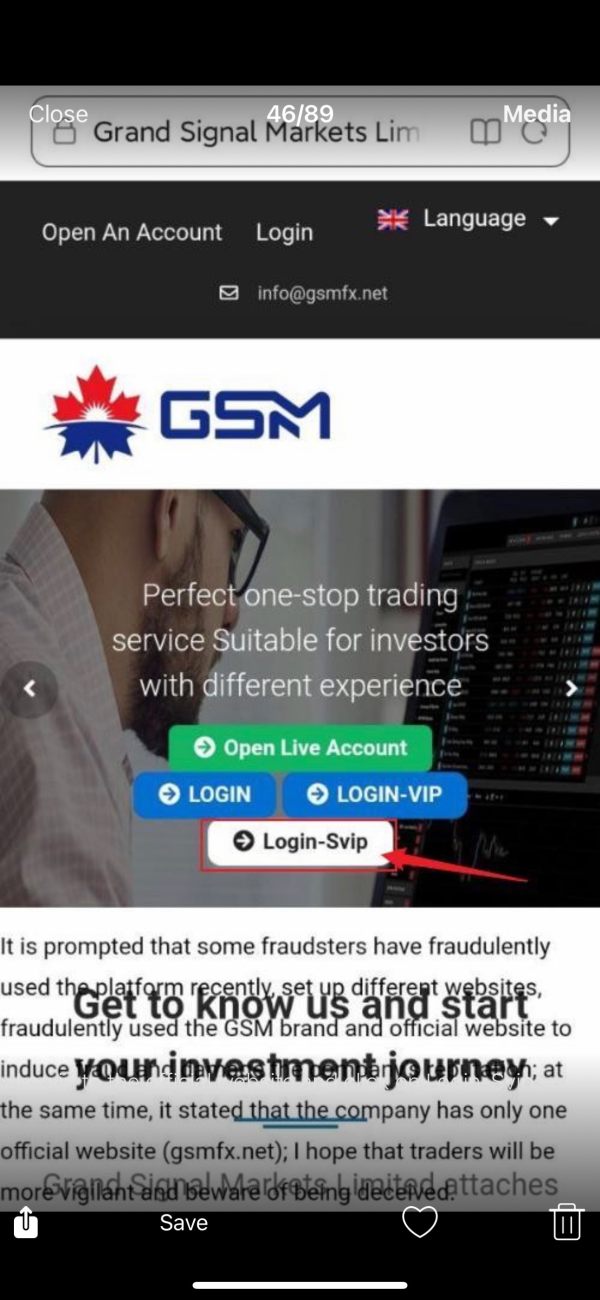

This gsm review examines GSM Investment Services. GSM is a financial services provider that appears to operate in multiple sectors including investment services and wholesale distribution. Based on available information, GSM presents itself as offering various financial products and services. However, specific details about their forex and trading operations remain limited in publicly accessible sources.

The company operates through multiple online platforms. It appears to have diversified business interests. However, traders considering GSM should exercise caution due to the lack of comprehensive regulatory information and detailed trading specifications in available documentation. The limited transparency regarding trading conditions, regulatory oversight, and client protection measures suggests that potential users should conduct thorough due diligence before engaging with this provider.

GSM may appeal to traders seeking alternative financial service providers. But the absence of clear regulatory frameworks and detailed trading specifications makes it challenging to provide a definitive assessment of their suitability for serious forex trading activities.

Important Notice

This review is based on publicly available information. It should not be considered as investment advice. Different regional entities may operate under varying regulatory requirements and legal frameworks. The information presented here reflects what is accessible through public sources and may not represent the complete scope of GSM's operations.

Traders should independently verify all information. They should ensure compliance with local regulations before engaging with any financial service provider. The limited availability of detailed information about GSM's trading operations necessitates careful consideration of the risks involved.

Rating Framework

Broker Overview

GSM Investment Services presents itself as a financial services company. The company has operations spanning multiple sectors. According to available information, the company maintains an online presence through various platforms and appears to offer investment-related services. However, the specific nature of their forex and trading operations remains unclear from publicly accessible sources.

The company's business model appears to encompass multiple financial service areas. Though detailed information about their primary focus on forex trading is not readily available. This lack of clarity regarding their core trading services raises questions about their positioning within the competitive forex brokerage landscape.

Without comprehensive information about GSM's establishment date, regulatory status, or specific trading platform offerings, it becomes challenging to assess their credibility and reliability as a forex service provider. The limited transparency in their operational framework suggests that potential clients should approach with considerable caution and seek additional verification of their credentials and services.

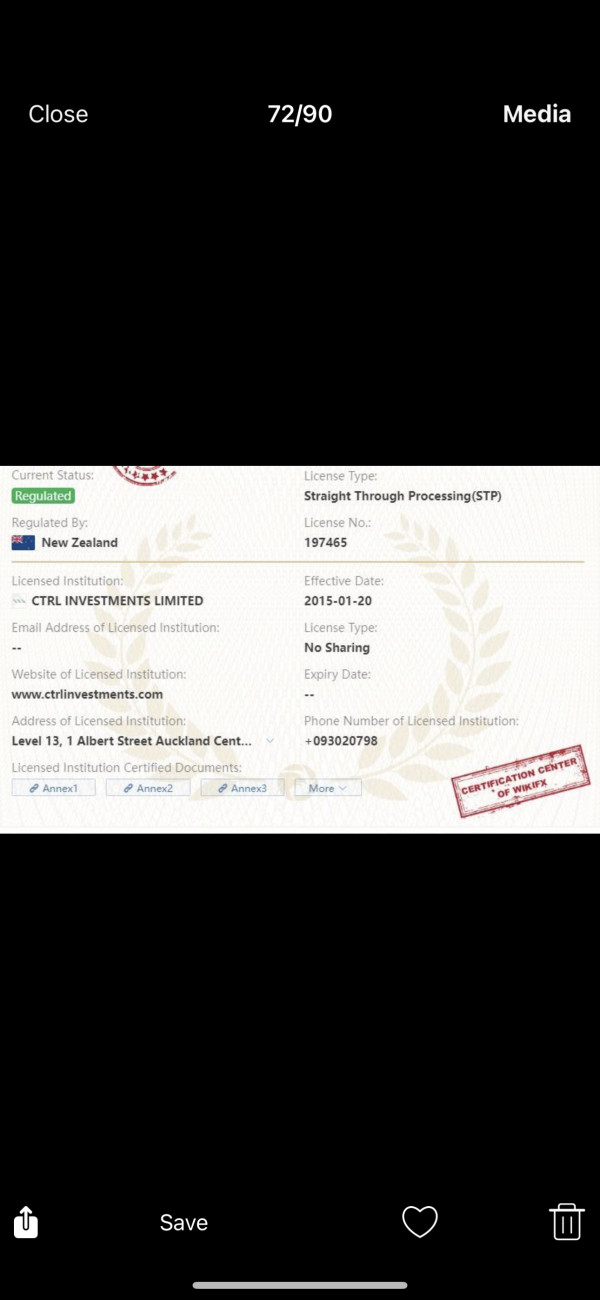

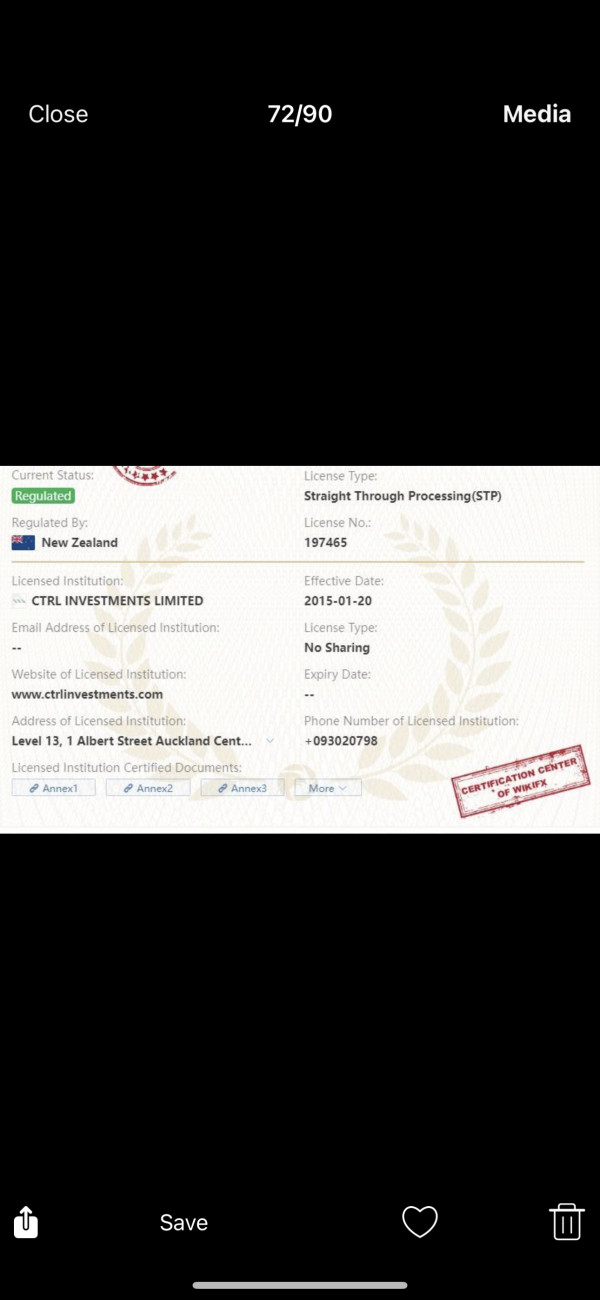

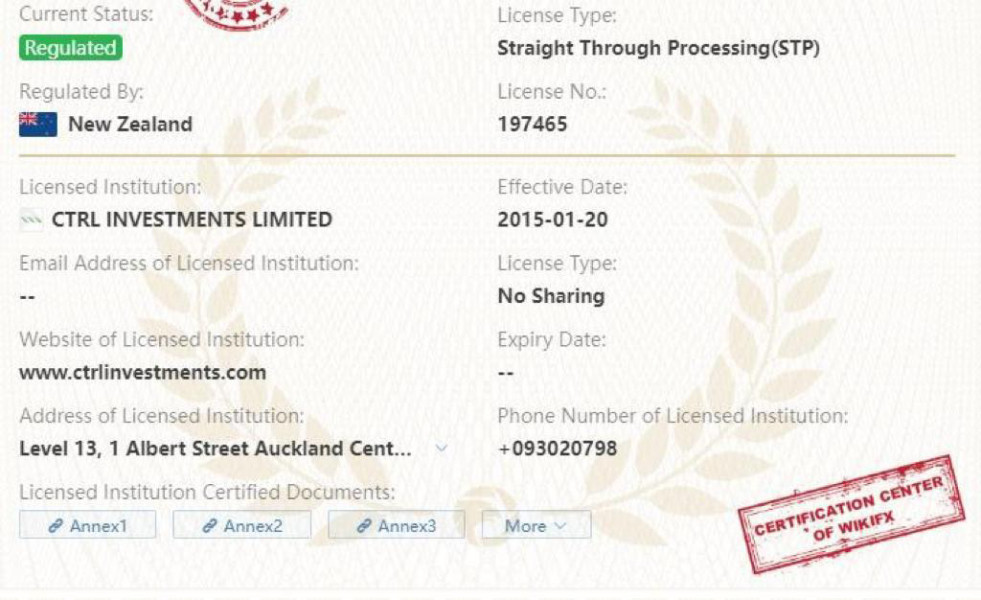

Regulatory Status: Specific regulatory information for GSM's trading operations is not clearly detailed in available sources. This raises significant concerns about client protection and operational oversight.

Deposit and Withdrawal Methods: Information regarding funding options and withdrawal processes is not specified in accessible documentation.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available materials.

Promotions and Bonuses: Details about promotional offers or bonus structures are not mentioned in current information sources.

Available Assets: The range of tradeable instruments and asset classes is not clearly specified in this gsm review based on available information.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not detailed in accessible sources.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation.

Platform Options: Details about trading platforms and their features are not clearly outlined in current information sources.

Geographic Restrictions: Information about regional limitations and service availability is not specified.

Customer Support Languages: Available support languages and communication options are not detailed in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The assessment of GSM's account conditions is significantly hampered by the lack of detailed information about their trading account structures. Without specific details about account types, minimum deposit requirements, or account features, it's impossible to evaluate the competitiveness of their offerings.

The absence of clear information about account opening procedures, verification requirements, and account management features raises concerns about the user experience and operational efficiency. Professional traders typically require detailed specifications about account conditions to make informed decisions. GSM's lack of transparency in this area is problematic.

Furthermore, the unavailability of information about special account features, such as Islamic accounts or professional trading accounts, suggests either limited product offerings or poor communication of available services. This gsm review finds the account conditions inadequate due to insufficient disclosure of essential details that traders need to evaluate suitability.

GSM's trading tools and resources cannot be adequately assessed due to the lack of detailed information about their platform capabilities and analytical offerings. The absence of clear descriptions of available trading tools, market analysis resources, and educational materials significantly impacts the evaluation.

Professional trading requires access to comprehensive analytical tools, real-time market data, and educational resources to support informed decision-making. The lack of information about these essential components suggests either limited offerings or inadequate communication of available resources.

Without details about research capabilities, technical analysis tools, or automated trading support, it's challenging to determine GSM's suitability for traders who rely on sophisticated analytical resources. The limited information available indicates a significant gap in the tools and resources that modern traders typically expect from a professional forex broker.

Customer Service and Support Analysis (3/10)

The evaluation of GSM's customer service capabilities is severely limited by the absence of detailed information about support channels, availability, and service quality. Without specific details about contact methods, response times, and support coverage, it's impossible to assess their customer service standards.

Professional forex brokers typically provide multiple communication channels, including live chat, phone support, and email assistance, with clearly defined availability hours and response time commitments. The lack of such information in GSM's publicly available materials raises concerns about their commitment to customer support.

Additionally, the absence of information about multilingual support, technical assistance capabilities, and problem resolution procedures suggests potential limitations in their customer service infrastructure. This lack of transparency regarding customer support represents a significant deficiency for a financial services provider.

Trading Experience Analysis (3/10)

Assessing GSM's trading experience is challenging due to the limited information available about their trading platforms, execution quality, and overall trading environment. Without specific details about platform stability, order execution speeds, and trading conditions, it's difficult to evaluate the actual trading experience they provide.

Key factors that influence trading experience, such as slippage rates, requote frequencies, and platform reliability, are not addressed in available information. Professional traders require detailed specifications about execution quality and platform performance to assess suitability for their trading strategies.

The absence of information about mobile trading capabilities, platform features, and trading tools significantly impacts the assessment of user experience. This gsm review finds the trading experience evaluation inconclusive due to insufficient information about critical trading infrastructure components.

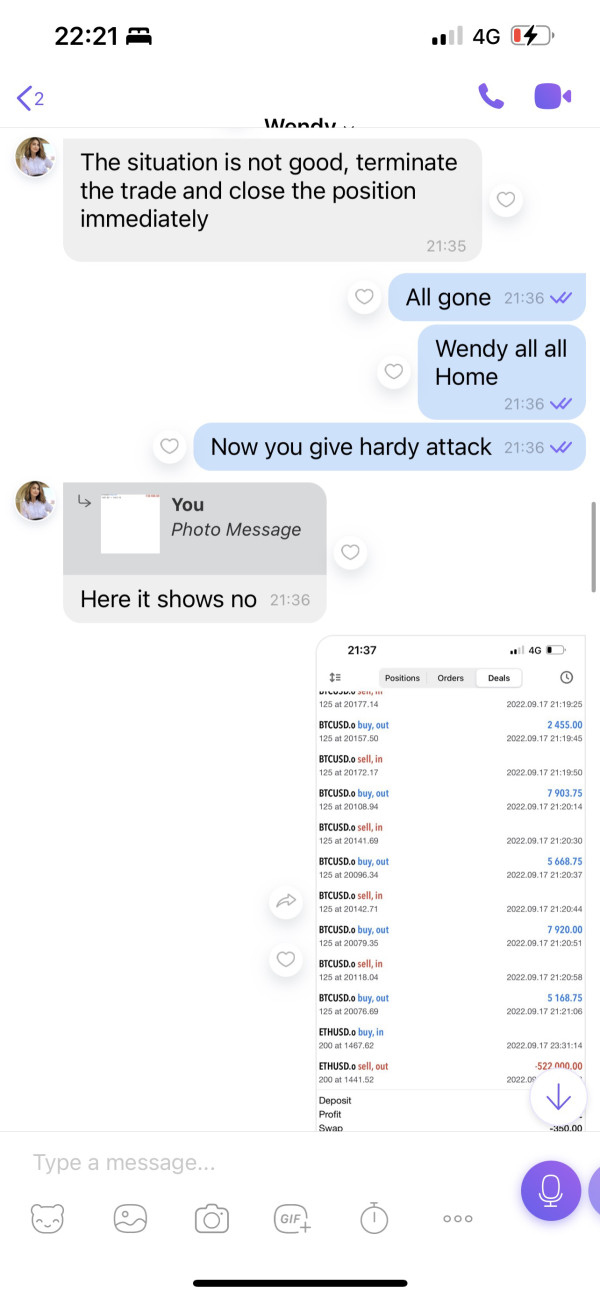

Trust and Reliability Analysis (2/10)

GSM's trust and reliability assessment reveals significant concerns due to the lack of clear regulatory information and transparency about their operations. The absence of detailed regulatory credentials, licensing information, and oversight mechanisms raises serious questions about client protection and operational legitimacy.

Financial services providers typically display prominent regulatory information, including license numbers, regulatory body affiliations, and compliance certifications. The lack of such information in GSM's available materials represents a major red flag for potential clients seeking regulated and trustworthy service providers.

Furthermore, the limited transparency about company background, operational history, and client fund protection measures contributes to concerns about reliability. Without clear evidence of regulatory oversight and client protection mechanisms, GSM's trustworthiness remains highly questionable.

User Experience Analysis (3/10)

The user experience evaluation for GSM is significantly limited by the lack of detailed information about their platform interfaces, account management systems, and overall client journey. Without specific details about registration processes, platform usability, and account management features, it's challenging to assess the user experience quality.

Modern forex brokers typically provide intuitive interfaces, streamlined account opening procedures, and comprehensive account management tools. The absence of detailed information about these aspects suggests either limited capabilities or inadequate communication of available features.

Additionally, the lack of user feedback, testimonials, or detailed platform descriptions makes it impossible to gauge actual user satisfaction levels. This limitation significantly impacts the ability to provide a comprehensive assessment of the user experience that GSM offers to its clients.

Conclusion

This gsm review reveals significant limitations in available information about GSM Investment Services as a forex broker. The lack of comprehensive details about regulatory status, trading conditions, and platform capabilities raises substantial concerns about their suitability for serious forex trading activities.

The absence of clear regulatory information, detailed trading specifications, and transparent operational frameworks suggests that potential clients should exercise extreme caution when considering GSM's services. Professional traders typically require comprehensive information about all aspects of a broker's operations before making informed decisions.

Based on the limited information available, GSM cannot be recommended for forex trading activities until more comprehensive details about their regulatory status, trading conditions, and operational capabilities become available through verified sources.