Is GSI Markets safe?

Pros

Cons

Is GSI Markets Safe or a Scam?

Introduction

GSI Markets positions itself as a global broker specializing in forex and CFD trading, appealing to a wide range of traders with promises of competitive trading conditions and advanced trading technology. However, the foreign exchange market is fraught with risks, making it imperative for traders to exercise caution when evaluating brokers. A broker's regulatory status, transparency, and customer feedback are critical factors that can significantly influence a trader's experience and safety. This article investigates the safety of GSI Markets by analyzing its regulatory framework, company background, trading conditions, and customer experiences, aiming to provide a comprehensive assessment of whether GSI Markets is indeed safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant indicators of its legitimacy and safety. GSI Markets claims to operate under the jurisdiction of the Marshall Islands, but it lacks regulation from any recognized financial authority. This absence of oversight raises serious concerns regarding the safety of traders' funds and the overall reliability of the broker. Below is a summary of GSI Markets' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Unverified |

The lack of regulation implies that GSI Markets does not adhere to the stringent standards imposed by top-tier regulators, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). These authorities enforce strict capital requirements, ensure client fund segregation, and offer compensation schemes to protect investors. GSI Markets has received warnings from multiple regulators, including the FCA and Spain's CNMV, highlighting its unauthorized activities. Such warnings are crucial red flags for potential investors, indicating that GSI Markets may not be safe for trading.

Company Background Investigation

GSI Markets is operated by Media Force Limited, a company registered in the Marshall Islands. The company's history is relatively obscure, with limited information available regarding its establishment and operational practices. The management team behind GSI Markets lacks publicly available profiles, which raises questions about their expertise and commitment to transparency. A reputable broker typically provides detailed information about its management and ownership structure, allowing potential clients to assess their credibility.

Furthermore, GSI Markets does not appear to have a strong online presence or community engagement, which is often a sign of a trustworthy broker. The opacity surrounding its operations and the absence of verifiable information contribute to the perception that GSI Markets may not be a safe trading option. In light of these factors, it is crucial for traders to remain vigilant and consider the implications of engaging with a broker that lacks transparency and established credibility.

Trading Conditions Analysis

When evaluating a broker's safety, understanding its trading conditions is essential. GSI Markets claims to offer competitive trading fees, but the absence of regulatory oversight raises concerns about the potential for hidden fees or unfavorable trading conditions. Below is a comparison of GSI Markets' core trading costs against industry averages:

| Fee Type | GSI Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies (not disclosed) | 1.5 pips |

| Commission Model | None (zero commissions claimed) | $4 per lot |

| Overnight Interest Range | Varies (not disclosed) | 2-3% per annum |

The lack of transparent information regarding spreads and commissions is alarming. Many reputable brokers provide clear and accessible details about their fees, allowing traders to make informed decisions. The absence of such information from GSI Markets suggests a potential risk of unexpected costs, which could adversely affect trading profitability. Additionally, the broker's claim of zero commissions may not be as advantageous as it appears if it compensates for this by widening spreads, a common practice among unregulated brokers.

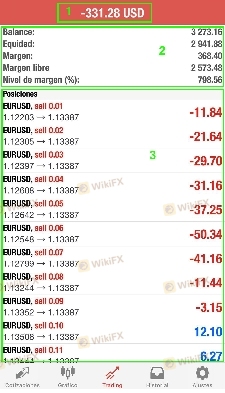

Client Fund Safety

The safety of clients' funds is paramount when assessing a broker's reliability. GSI Markets has not provided any clear information regarding its fund safety measures, such as whether client funds are kept in segregated accounts or if it offers negative balance protection. The absence of these safety nets poses a significant risk for traders, especially given the broker's lack of regulation. Without regulatory oversight, there are no guarantees that client funds are protected or that the broker operates in a financially sound manner.

Moreover, historical complaints and reports indicate that GSI Markets has faced issues related to fund withdrawals, with numerous traders claiming difficulties in accessing their funds. Such accounts of financial disputes further underscore the risks associated with trading with GSI Markets, raising concerns about the broker's commitment to safeguarding client investments. In light of these factors, it is evident that GSI Markets does not exhibit the necessary precautions to ensure the security of client funds, making it a less safe choice for traders.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews and testimonials regarding GSI Markets reveal a pattern of dissatisfaction among clients, particularly concerning withdrawal issues and customer support. Many traders have reported delays in processing withdrawals, while others have expressed frustration over the lack of responsive customer service. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

| Misleading Information | High | Poor |

Several traders have shared their experiences of being unable to withdraw funds, which raises significant concerns about the broker's operational integrity. One user reported being unable to access their funds for over a month, while another claimed they were misled about the trading conditions. Such complaints point to a troubling trend that suggests GSI Markets may not prioritize customer satisfaction or transparency.

Platform and Trade Execution

The trading platform offered by a broker plays a crucial role in the overall trading experience. GSI Markets provides access to the widely used MetaTrader 4 platform, which is known for its robust features and user-friendly interface. However, the quality of trade execution, including slippage and order rejection rates, is equally important. Reports from users indicate varying experiences with execution quality, with some traders claiming instances of slippage during volatile market conditions. Additionally, any signs of platform manipulation could further undermine trust in the broker.

Risk Assessment

Using GSI Markets presents several risks that potential traders should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight raises concerns about fund safety. |

| Financial Risk | High | Reports of withdrawal issues and lack of transparency indicate potential financial instability. |

| Operational Risk | Medium | Customer service complaints suggest operational inefficiencies. |

To mitigate these risks, traders should conduct thorough research before engaging with GSI Markets. It is advisable to consider alternative brokers that are regulated by reputable authorities, ensuring a safer trading environment.

Conclusion and Recommendations

In conclusion, the investigation into GSI Markets raises significant concerns about its safety and legitimacy. The absence of regulation, combined with reports of withdrawal issues and customer dissatisfaction, suggests that GSI Markets may not be a safe broker for trading. Traders are strongly advised to exercise caution and consider alternative options that offer regulatory oversight and transparent trading conditions. For those seeking reliable trading partners, brokers regulated by the FCA, ASIC, or similar authorities are recommended, as they provide a greater level of security and investor protection.

In summary, while GSI Markets may present itself as a viable trading option, the evidence suggests that it is not safe, and traders should remain vigilant and informed to protect their investments.

Is GSI Markets a scam, or is it legit?

The latest exposure and evaluation content of GSI Markets brokers.

GSI Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GSI Markets latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.