Is BYDS safe?

Pros

Cons

Is Byds Safe or a Scam?

Introduction

Byds is an online forex broker that has gained attention in the trading community. Positioned as a platform for both novice and experienced traders, it claims to offer a range of financial instruments, competitive spreads, and user-friendly trading tools. However, the rise of fraudulent brokers in the forex market necessitates that traders exercise caution and conduct thorough evaluations before engaging with any trading platform. The importance of assessing the legitimacy of forex brokers cannot be overstated, as it directly impacts the safety and security of traders' investments.

This article aims to investigate whether Byds is a safe trading platform or a potential scam. We will evaluate its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk factors. Our analysis will be based on data gathered from various credible online sources, including reviews and regulatory information.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. A properly regulated broker is subject to oversight by financial authorities, which helps to ensure the safety of client funds and fair trading practices. In the case of Byds, it has been reported that the broker lacks valid regulatory oversight, raising significant concerns about its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation is a major red flag for potential traders. Without a regulatory framework, Byds is not required to adhere to the same standards of transparency and customer protection as regulated brokers. This lack of oversight can lead to issues such as withdrawal difficulties and potential fund misappropriation. Furthermore, the lack of verifiable information regarding Byds' operations and its management team only compounds these concerns, making it essential for traders to approach this broker with caution.

Company Background Investigation

A comprehensive understanding of a company's history, ownership structure, and management team is crucial in assessing its reliability. Byds appears to have limited publicly available information regarding its origins and development. This lack of transparency can create uncertainty among potential clients about who is behind the broker and what their intentions may be.

The management team's backgrounds are particularly important, as experienced and reputable leaders can indicate a broker's commitment to ethical practices. However, Byds does not provide sufficient information about its management team, further contributing to the perception that it may not be a trustworthy entity. Transparency in operations and clear communication from the broker are essential for building trust with clients, and Byds falls short in this regard.

Trading Conditions Analysis

Byds claims to offer competitive trading conditions, including tight spreads and various account types. However, the lack of transparency regarding its fee structure raises concerns. Traders should be wary of any hidden fees or irregularities that could affect their overall trading experience.

| Fee Type | Byds | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Variable |

| Overnight Interest Range | N/A | 0.5%-2% |

The absence of clear information about spreads, commissions, and overnight fees suggests that potential traders may encounter unexpected costs. This lack of clarity can significantly impact trading profitability and overall satisfaction with the broker. Therefore, prospective clients should carefully consider these factors when evaluating whether Byds is a suitable option for their trading needs.

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. Byds' security measures are a critical aspect of its overall reliability. Reports indicate that Byds lacks the necessary client fund protection mechanisms, such as segregated accounts and investor compensation schemes.

A reputable broker typically ensures that client funds are held in separate accounts, providing a layer of security in case of financial difficulties. Additionally, negative balance protection is essential to prevent clients from losing more than their initial investment. However, the absence of such measures with Byds raises serious concerns about the safety of traders' funds.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Reviews and testimonials from existing users can provide insights into the quality of service and potential issues that may arise. In the case of Byds, there have been numerous complaints regarding withdrawal difficulties and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Poor Customer Support | Medium | Inconsistent |

Common complaints include delayed withdrawals, unresponsive customer service, and issues with account verification. These patterns of dissatisfaction can indicate deeper systemic problems within the brokerage. Prospective clients should be cautious and consider these factors when determining whether to engage with Byds.

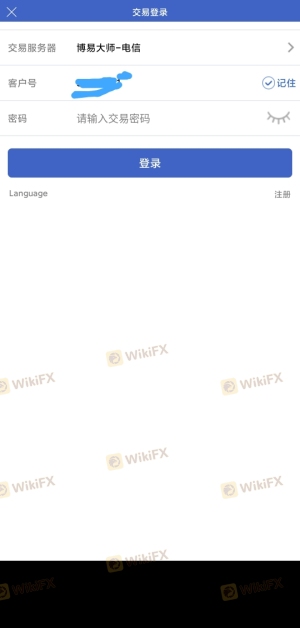

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Byds claims to offer a user-friendly interface and reliable trade execution. However, there are concerns about the platform's stability and execution quality. Reports of slippage and order rejections have been noted by users, which can significantly impact trading outcomes.

Traders expect their orders to be executed promptly and at the desired price. Any signs of manipulation or unfair practices can lead to a loss of trust in the broker. Therefore, it is essential for Byds to demonstrate a commitment to transparency and reliability in its trading execution processes.

Risk Assessment

Engaging with any broker carries inherent risks. For Byds, the combination of regulatory absence, unclear trading conditions, and negative customer feedback raises several red flags.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential fund misappropriation |

| Operational Risk | Medium | Issues with withdrawals and support |

Given these risks, it is advisable for traders to conduct thorough research and consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In summary, the evidence suggests that Byds may not be a safe trading platform for forex traders. The lack of regulation, transparency issues, and numerous customer complaints are significant indicators that potential clients should approach with caution.

For traders seeking reliable options, it may be beneficial to consider alternative brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. Platforms such as Forex.com, IG, or OANDA offer robust regulatory frameworks and positive user experiences, making them preferable choices for traders looking to safeguard their investments.

In conclusion, while the question of "Is Byds safe?" remains largely unanswered in the affirmative, it is crucial for traders to remain vigilant and prioritize their financial security by choosing well-regulated and reputable brokers.

Is BYDS a scam, or is it legit?

The latest exposure and evaluation content of BYDS brokers.

BYDS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BYDS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.