GSI Markets 2025 Review: Everything You Need to Know

Summary

GSI Markets presents itself as an online forex broker. The company has been operating since 2003 and claims to be headquartered in London, UK. This gsi markets review reveals a concerning pattern of user complaints and potential red flags that investors should carefully consider.

The platform offers trading through MetaTrader 4 and Sirix platforms. It provides access to over 50 forex currency pairs, indices, CFDs, and commodities.

However, multiple independent reviews and user testimonials raise serious questions about the legitimacy of GSI Markets. According to Scam Brokers Reviews, published in July 2023, the platform has been flagged for potential fraudulent activities and withdrawal difficulties. User feedback on various review platforms indicates problems with fund withdrawals and questionable business practices.

While GSI Markets advertises a comprehensive trading environment with multiple asset classes and professional trading platforms, the lack of clear regulatory information and numerous negative user experiences suggest that potential investors should exercise extreme caution. This review aims to provide a balanced assessment based on available information. Prospective traders are advised to conduct thorough due diligence before considering this broker.

Important Notice

Regional Entity Differences: GSI Markets' regulatory status remains unclear across different jurisdictions. The company claims UK headquarters but lacks transparent information about regulatory oversight from major financial authorities such as the FCA, CySEC, or other recognized regulators. Investors should be aware that trading conditions, legal protections, and regulatory safeguards may vary significantly depending on their location.

Review Methodology: This assessment is based on publicly available information, user feedback from multiple review platforms, and industry reports. Due to limited transparency from GSI Markets regarding their operations, some information gaps exist. This review aims to present an objective analysis while highlighting areas where information is incomplete or concerning.

Rating Framework

Broker Overview

GSI Markets positions itself as an established online forex broker. The company has origins dating back to 2003. The company claims to operate from London, UK, focusing on providing retail and institutional clients access to foreign exchange markets and other financial instruments.

According to their marketing materials, GSI Markets aims to deliver professional trading services through advanced technology platforms and comprehensive market access. The broker's business model centers on offering online trading services across multiple asset classes. GSI Markets advertises itself as a technology-driven platform that connects traders to global financial markets through sophisticated trading infrastructure.

However, the lack of transparent information about the company's actual operations, management team, and regulatory compliance raises significant concerns about their legitimacy. GSI Markets offers trading through two primary platforms: MetaTrader 4 and Sirix. The platform provides access to over 50 forex currency pairs, various indices, CFDs, and commodity instruments.

Despite these offerings, this gsi markets review must note that the absence of clear regulatory oversight from recognized financial authorities represents a major red flag for potential investors considering this broker.

Regulatory Status: Information about GSI Markets' regulatory compliance remains notably absent from available sources. The company does not clearly display authorization from major financial regulators such as the Financial Conduct Authority, Cyprus Securities and Exchange Commission, or other recognized regulatory bodies.

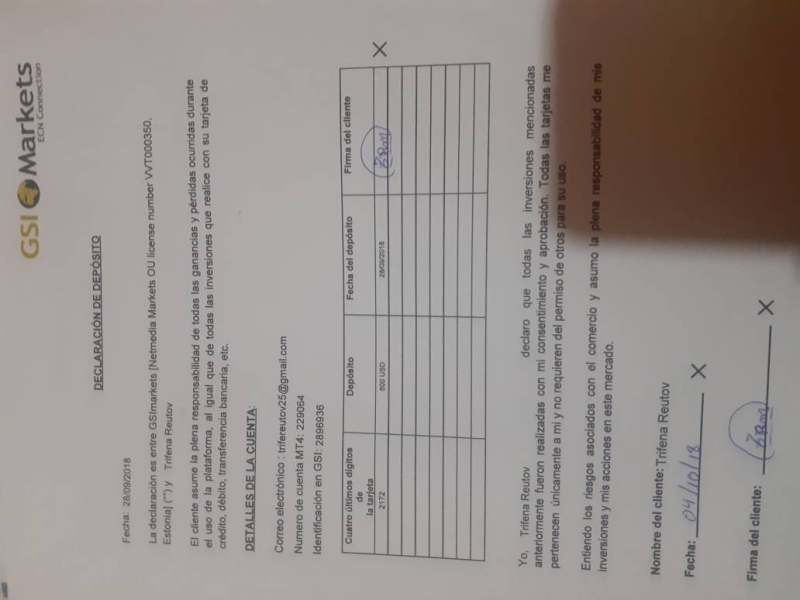

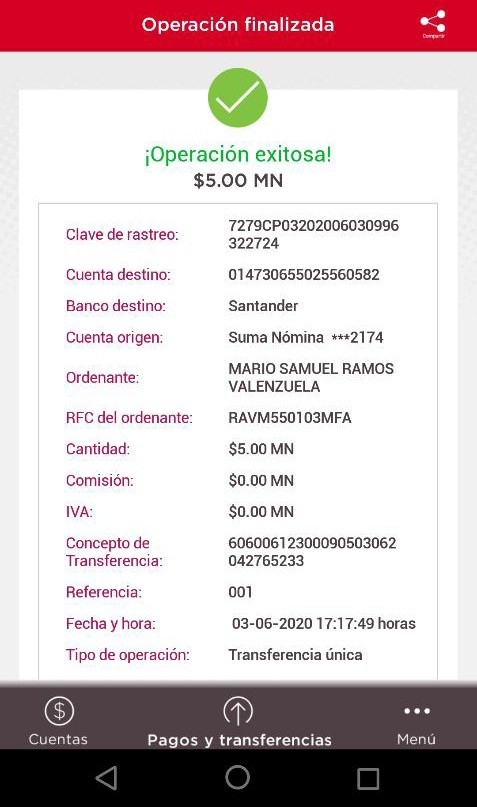

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available public sources. User complaints suggest difficulties with withdrawal processes.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with GSI Markets is not specified in available documentation.

Bonuses and Promotions: Information about promotional offers or bonus programs is not available in current public sources.

Tradeable Assets: GSI Markets advertises access to over 50 forex currency pairs, stock indices, CFDs, and commodity instruments. This provides traders with a diverse range of market exposure opportunities.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not transparently provided in available sources. This represents another concern for potential clients.

Leverage Ratios: Specific leverage offerings are not detailed in publicly available information about GSI Markets.

Platform Options: The broker offers MetaTrader 4 and Sirix trading platforms. Both of these are recognized industry-standard platforms.

Geographic Restrictions: Information about regional trading restrictions or prohibited countries is not available in current sources.

Customer Support Languages: Details about multilingual support options are not specified in available documentation.

This gsi markets review highlights the concerning lack of transparency regarding essential trading conditions and regulatory compliance.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of GSI Markets' account conditions is significantly hampered by the lack of transparent information available from the broker. Unlike reputable forex brokers who clearly outline their account types, minimum deposit requirements, and specific features for different client categories, GSI Markets fails to provide comprehensive details about their account offerings.

Industry-standard practice requires brokers to clearly specify account tiers, such as standard, premium, or VIP accounts, along with their respective benefits and requirements. However, available sources do not reveal GSI Markets' account structure or the specific conditions associated with different account types. This lack of transparency is particularly concerning when compared to regulated brokers who must comply with disclosure requirements.

The absence of information about Islamic accounts, demo account availability, or special features for professional traders further compounds concerns about GSI Markets' legitimacy. Reputable brokers typically provide detailed account comparison charts and clear explanations of account benefits, which are notably missing from GSI Markets' available documentation.

Without access to verified information about minimum deposits, account currencies, or maintenance requirements, potential clients cannot make informed decisions about whether GSI Markets meets their trading needs. This gsi markets review must emphasize that the lack of account transparency represents a significant red flag for prospective investors.

GSI Markets offers trading through two established platforms: MetaTrader 4 and Sirix. MetaTrader 4 remains one of the most widely used trading platforms in the forex industry, known for its robust charting capabilities, technical indicators, and automated trading support through Expert Advisors. The inclusion of MT4 suggests that GSI Markets can provide traders with familiar and functional trading tools.

The Sirix platform represents a web-based trading solution that offers social trading features and portfolio management tools. This platform choice indicates an attempt to cater to different trader preferences, from traditional retail traders who prefer MT4 to those interested in copy trading and social trading features available through Sirix.

However, the evaluation of tools and resources extends beyond platform availability. Reputable brokers typically provide comprehensive market research, daily analysis, economic calendars, and educational resources to support trader decision-making. Available information about GSI Markets does not reveal the extent or quality of such supplementary resources.

The absence of detailed information about research capabilities, market analysis, or educational materials suggests that GSI Markets may not provide the comprehensive support that serious traders require. Additionally, without clear information about platform stability, execution speed, or technical support for these platforms, traders cannot adequately assess the quality of the trading environment.

Customer Service and Support Analysis

Evaluating GSI Markets' customer service quality proves challenging due to the limited available information about their support infrastructure. Professional forex brokers typically provide multiple communication channels, including live chat, phone support, email assistance, and comprehensive FAQ sections. However, specific details about GSI Markets' customer service capabilities are not readily available in public sources.

The quality of customer support often serves as a crucial differentiator in the forex industry, particularly when traders encounter technical issues, account problems, or need assistance with platform functionality. Reputable brokers maintain detailed contact information, specify support hours, and provide multilingual assistance to serve their international client base.

User feedback available in various review sources suggests potential issues with GSI Markets' responsiveness to client concerns, particularly regarding withdrawal requests and account-related problems. The lack of transparent contact information and clear support procedures raises concerns about the broker's commitment to customer service excellence.

Without verified information about response times, support quality, or the availability of dedicated account managers, potential clients cannot assess whether GSI Markets provides adequate customer support. The absence of clear communication channels and support documentation represents another area where GSI Markets falls short of industry standards.

Trading Experience Analysis

The trading experience evaluation for GSI Markets faces significant limitations due to insufficient user feedback and platform performance data. While the broker offers access to established platforms like MetaTrader 4 and Sirix, the actual quality of trade execution, platform stability, and overall trading environment remains unclear from available sources.

Professional trading environments require reliable order execution, minimal slippage, competitive spreads, and stable platform performance during high-volatility market conditions. However, detailed information about GSI Markets' execution quality, server reliability, or trading conditions during major market events is not available in current public sources.

The diversity of tradeable assets, including over 50 forex pairs, indices, CFDs, and commodities, suggests potential for varied trading strategies. However, without specific information about spreads, execution speeds, or liquidity provision, traders cannot adequately assess whether GSI Markets provides competitive trading conditions.

Mobile trading capabilities, which are essential for modern forex trading, are not detailed in available information about GSI Markets. The absence of comprehensive information about platform features, trading tools, and execution quality makes it impossible to provide a thorough assessment of the trading experience.

This gsi markets review must note that the lack of detailed trading condition information, combined with user complaints about platform reliability, raises concerns about the overall trading experience quality.

Trust Score Analysis

The trust evaluation of GSI Markets reveals several concerning factors that significantly impact the broker's credibility. According to Scam Brokers Reviews, GSI Markets has been flagged as a potentially fraudulent operation, with specific warnings about the platform's legitimacy published in July 2023.

The absence of clear regulatory authorization from recognized financial authorities represents a fundamental trust issue. Legitimate forex brokers typically display their regulatory licenses prominently and provide verification numbers that can be checked with regulatory bodies. GSI Markets lacks this transparent regulatory documentation.

User testimonials and reviews from multiple sources indicate problems with fund withdrawals, which represents one of the most serious red flags in forex broker evaluation. Withdrawal difficulties often signal deeper operational or financial problems that can put client funds at risk.

The company's claimed establishment date of 2003 and London headquarters cannot be independently verified through available regulatory databases or company registries. This lack of verifiable corporate information further undermines trust in the platform's legitimacy.

Industry reputation plays a crucial role in broker evaluation, and the negative coverage from review sites and user complaints significantly impacts GSI Markets' trustworthiness. The combination of regulatory uncertainty, user complaints, and scam allegations creates a highly concerning trust profile.

User Experience Analysis

User experience evaluation for GSI Markets reveals a troubling pattern of negative feedback and operational concerns. Available user testimonials and review site coverage indicate significant problems with the overall client experience, particularly regarding fund management and customer service responsiveness.

The most frequently reported user concern involves withdrawal difficulties, with multiple sources indicating that clients have experienced problems accessing their funds. This represents a fundamental failure in user experience, as reliable fund access is a basic requirement for any legitimate trading platform.

Interface design and platform usability information is limited in available sources, though the use of established platforms like MetaTrader 4 suggests that basic trading functionality should be familiar to experienced traders. However, the overall user experience extends beyond platform interface to include account management, customer support, and operational reliability.

Registration and account verification processes are not detailed in available documentation, making it difficult to assess the onboarding experience for new clients. Professional brokers typically provide clear information about account opening requirements and verification procedures.

The target user profile for GSI Markets appears to be traders with some forex experience, given the platform offerings and asset diversity. However, the negative user feedback suggests that even experienced traders have encountered significant problems with this broker, indicating fundamental operational issues that affect user satisfaction across different experience levels.

Conclusion

This comprehensive gsi markets review reveals significant concerns about the broker's legitimacy and operational reliability. While GSI Markets advertises access to established trading platforms and multiple asset classes, the lack of regulatory transparency, negative user feedback, and scam allegations create a highly problematic profile for potential investors.

The broker may appeal to traders seeking diverse asset exposure through familiar platforms like MetaTrader 4, but the numerous red flags significantly outweigh any potential benefits. The absence of clear regulatory oversight, combined with user reports of withdrawal difficulties and operational problems, suggests that GSI Markets does not meet the standards expected of legitimate forex brokers.

Prospective traders are strongly advised to consider regulated alternatives with transparent operations, verified regulatory compliance, and positive user track records. The forex industry offers numerous reputable brokers with comprehensive regulatory oversight and proven operational reliability, making GSI Markets an unnecessarily risky choice for serious traders.