Is Golden Tradex safe?

Business

License

Is Golden Tradex Safe or Scam?

Introduction

Golden Tradex is a relatively new player in the forex trading market, having been established in 2018. It positions itself as a broker offering a wide range of trading instruments, including forex pairs, commodities, and cryptocurrencies. As the online trading landscape continues to grow, traders must exercise caution when selecting a broker, as the risks associated with unregulated or poorly regulated firms can lead to significant financial losses. This article aims to investigate whether Golden Tradex is a safe trading option or if it harbors potential scam-like characteristics. Our assessment will draw from various sources, including regulatory information, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. In the case of Golden Tradex, it claims to be a trading name for Evest Group, which operates under multiple jurisdictions. However, a closer look reveals significant red flags regarding its regulatory claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | Not Applicable | Saint Vincent and the Grenadines | Unverified |

| National Futures Association (NFA) | 0523103 | USA | Not Registered |

| Australian Securities and Investments Commission (ASIC) | 62808630687 | Australia | Not Found |

Despite the claims of being regulated by reputable authorities, investigations show that Golden Tradex lacks valid licenses. The mention of the FSA is particularly concerning, as this body was dissolved in 2013, raising questions about the legitimacy of their claims. Furthermore, a search through the NFA and ASIC databases reveals no record of Golden Tradex or Evest Group, suggesting that they may not be authorized to handle client funds or provide trading services legally. This lack of regulatory oversight is a significant indicator that Golden Tradex may not be safe for traders.

Company Background Investigation

Golden Tradex operates under Evest Group, which has a controversial history. Initially known as FX Reino, the company appears to have rebranded in an attempt to distance itself from numerous negative reviews and allegations of fraud associated with its previous name. The transition to Golden Tradex raises concerns about the company's transparency and intentions.

The management team behind Golden Tradex is not well-documented, and there is limited information available regarding their professional backgrounds. This lack of transparency can be alarming for potential clients, as a credible broker should provide clear information about its leadership and their qualifications.

Moreover, the companys website lacks detailed disclosures about its ownership structure, which is often a red flag in the trading industry. Without a clear understanding of who is behind the broker, clients are left vulnerable to potential fraud or mismanagement. In summary, the company's obscure history and lack of transparency significantly contribute to the skepticism surrounding Golden Tradex's safety.

Trading Conditions Analysis

When assessing the trading conditions offered by a broker, one must consider the fee structure, spreads, and overall trading environment. Golden Tradex claims to provide competitive trading conditions, including leverage of up to 500:1 and a minimum deposit requirement of only $100. However, the specifics of their fee structure are less clear.

| Fee Type | Golden Tradex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable, starting from 0.08 pips | 1-2 pips |

| Commission Model | Not clearly defined | Typically $5-$10 per lot |

| Overnight Interest Range | Not disclosed | Varies by broker |

The lack of clarity regarding commissions and overnight interest rates raises concerns about hidden fees that could significantly affect a trader's profitability. Many brokers in the industry are transparent about their fee structures, which allows traders to make informed decisions. In contrast, Golden Tradex's ambiguous pricing could lead to unexpected costs, further questioning its reliability. Thus, traders should be cautious, as Golden Tradex may not provide a safe trading environment due to its unclear fees.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. Golden Tradex claims to implement several measures to protect client assets, including segregated accounts and negative balance protection. However, without regulatory oversight, the enforcement of these measures is questionable.

Traders should be aware that, in the absence of a credible regulatory framework, the broker may not be legally required to maintain these protections. Furthermore, there have been no reported incidents or transparency regarding the broker's handling of client funds, which raises concerns about their operational integrity. If a broker cannot guarantee the safety of your funds, it poses a significant risk to traders.

In conclusion, while Golden Tradex may claim to prioritize client fund safety, the lack of regulatory oversight and transparency makes it difficult to ascertain whether these claims are genuine. As such, traders should be wary of entrusting their funds to Golden Tradex, as the potential for loss remains high.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Golden Tradex reveal a mix of experiences, with many users expressing dissatisfaction with the platform. Common complaints include withdrawal issues, poor customer support, and difficulties in executing trades.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow or unresponsive |

| Poor Customer Support | Medium | Inconsistent replies |

| Account Closure Issues | High | No clear resolution |

Several users have reported being unable to withdraw their funds, citing various excuses from the broker. These types of complaints are serious and can indicate a potential scam. Additionally, the quality of customer support appears to be lacking, with many users describing long wait times and unhelpful responses.

One notable case involved a trader who attempted to withdraw their profits but faced multiple delays and unresponsive support. This situation highlights the risks associated with trading with Golden Tradex and raises further questions about its legitimacy. Given these complaints, it is clear that Golden Tradex may pose significant risks to potential traders.

Platform and Trade Execution

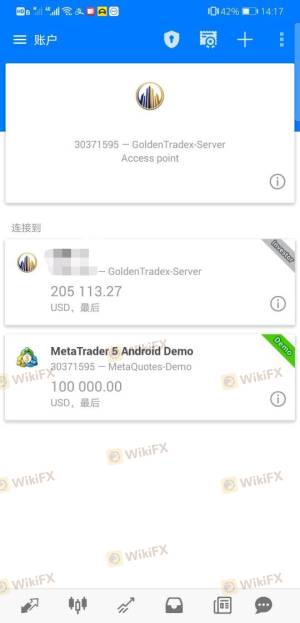

The trading platform's performance is another critical factor in assessing a broker's reliability. Golden Tradex offers access to popular trading platforms, including MetaTrader 5, but users have reported issues with execution quality. Concerns about slippage and rejected orders have been raised, which can severely impact trading outcomes.

The platform's stability and user experience are crucial for traders, as any disruptions can lead to missed opportunities or losses. Although some users have reported satisfactory experiences, the overall sentiment leans toward dissatisfaction, particularly regarding execution speed and reliability.

In summary, while Golden Tradex provides access to established trading platforms, the reported issues with trade execution and platform stability suggest that it may not be the safest option for traders. Therefore, Golden Tradex's safety as a trading platform remains questionable.

Risk Assessment

When considering whether to trade with Golden Tradex, it is essential to evaluate the overall risk involved. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid licenses found |

| Financial Risk | Medium | Unclear fee structure |

| Operational Risk | High | Complaints about fund withdrawals |

Given the high regulatory and operational risks associated with Golden Tradex, potential traders should approach with caution. It is advisable to conduct thorough research and consider alternative brokers with stronger regulatory backing and better customer feedback.

To mitigate risks, traders should only invest what they can afford to lose and consider starting with a demo account to test the platform before committing real funds.

Conclusion and Recommendations

In conclusion, the investigation into Golden Tradex raises significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, unclear fee structures, and negative customer feedback collectively point to a potentially unsafe trading environment.

Traders should be particularly cautious when considering Golden Tradex, as the risks associated with trading through this broker appear to outweigh any potential benefits. For those seeking reliable trading options, it is advisable to explore well-regulated brokers with transparent practices and positive customer experiences.

In summary, Golden Tradex may not be safe, and traders are encouraged to seek alternative, more reputable brokers to safeguard their investments and ensure a more secure trading experience.

Is Golden Tradex a scam, or is it legit?

The latest exposure and evaluation content of Golden Tradex brokers.

Golden Tradex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Golden Tradex latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.