Regarding the legitimacy of fandford forex brokers, it provides ASIC, CYSEC, FCA and WikiBit, (also has a graphic survey regarding security).

Is fandford safe?

Business

License

Is fandford markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

EIGHTCAP PTY LTD

Effective Date: Change Record

2011-04-29Email Address of Licensed Institution:

compliance@eightcap.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

EIGHTCAP PTY LTD 'RIALTO SOUTH TOWER' L 35 525 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

0383734800Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

Forextime Ltd

Effective Date:

2012-12-13Email Address of Licensed Institution:

compliance@forextime.comSharing Status:

No SharingWebsite of Licensed Institution:

www.forextime.com/euExpiration Time:

--Address of Licensed Institution:

35, Lamprou Konstantara Street, FXTM Tower, Kato Polemidia, CY-4156 LimassolPhone Number of Licensed Institution:

+357 25 558 777Licensed Institution Certified Documents:

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

Clone FirmLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

Global Market Index Limited

Effective Date:

2015-11-23Email Address of Licensed Institution:

info@gmimarkets.co.uk, compliance@gmimarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.gmimarkets.co.ukExpiration Time:

--Address of Licensed Institution:

We Work 1 Fore Street Avenue London City Of London EC2Y 9DT UNITED KINGDOMPhone Number of Licensed Institution:

+4402038905100Licensed Institution Certified Documents:

Is Fandford Safe or a Scam?

Introduction

Fandford is a forex broker that has garnered attention within the trading community for its various offerings in the foreign exchange market. As the forex landscape becomes increasingly crowded, traders are often faced with the challenge of discerning which brokers are trustworthy and which may pose risks to their investments. Given the potential for scams in this domain, it is crucial for traders to conduct thorough evaluations of any broker they consider working with. This article aims to provide an objective analysis of Fandford, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a review of multiple sources, including regulatory databases, customer feedback, and expert analyses, ensuring a comprehensive evaluation framework.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining whether a broker like Fandford is safe for trading. Regulation helps ensure that brokers adhere to specific standards and practices that protect investors. Fandford claims to operate under licenses from various regulatory authorities; however, details on its actual regulatory status are murky.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | Not provided | Australia | Unverified |

| FCA | Not provided | United Kingdom | Unverified |

| CySEC | Not provided | Cyprus | Unverified |

The absence of a clear regulatory framework raises significant concerns. Brokers regulated by top-tier authorities such as the FCA or ASIC are generally considered safer due to stringent compliance requirements. However, Fandfords lack of clear licensing information suggests that it may not be operating under the necessary regulatory oversight, which is a red flag for potential investors.

Company Background Investigation

Fandford's history and ownership structure are essential components of its credibility. While information on the companys founding and development is limited, it is crucial to analyze the backgrounds of its management team. A lack of transparency regarding the ownership and management can be indicative of potential risks.

The management team‘s backgrounds vary, with some members having experience in the financial sector, while others appear to lack significant credentials. The company’s transparency regarding its operations and decision-making processes is also questionable, as potential investors have reported difficulty in accessing detailed information about the brokers activities and regulatory compliance.

Trading Conditions Analysis

Understanding the trading conditions offered by Fandford is vital for evaluating whether it is safe for traders. The broker claims to provide competitive trading fees, but the actual costs may vary significantly.

| Fee Type | Fandford | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Not disclosed | $5 - $10 per lot |

| Overnight Interest Range | Variable | 0.5% - 1.5% |

Fandford's fee structure appears to lack clarity, particularly regarding commissions and spreads. Traders have reported unexpected charges that deviate from the advertised rates, raising concerns about the brokers transparency and fairness. This lack of clarity can lead to unexpected costs that may significantly impact trading profitability.

Client Fund Safety

The safety of client funds is another crucial aspect when assessing whether Fandford is safe. A reputable broker should implement stringent measures to protect client deposits, including segregating client funds from the companys operational funds and offering investor protection schemes.

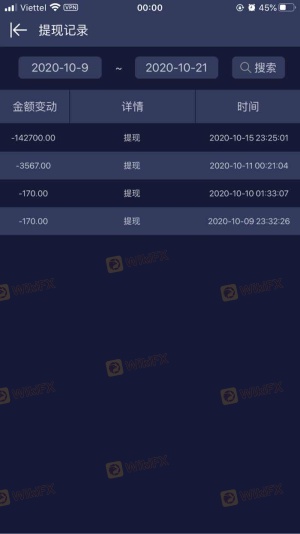

Fandford's policies on fund protection are not clearly outlined, leading to skepticism regarding the safety of client investments. Reports of issues related to fund withdrawals and the inability to access funds have emerged, further complicating the assessment of whether Fandford is a safe trading environment. Without robust security measures, traders may find themselves at risk of losing their investments.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the actual experiences of traders using Fandford. Reviews and testimonials indicate a mixed bag of experiences, with some users reporting satisfactory trading conditions, while others have raised serious concerns.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Unexpected Fees | Medium | Unclear explanations |

| Poor Customer Support | High | Limited availability |

Common complaints include difficulties in withdrawing funds and a lack of responsive customer service. These issues can significantly affect a trader's experience and raise alarms about the broker's reliability. A notable case involved a trader who reported being unable to withdraw funds after multiple attempts, citing poor communication from the support team.

Platform and Trade Execution

The performance of Fandford‘s trading platform is crucial in determining whether it is safe for traders. A reliable platform should offer stability, fast execution times, and minimal slippage. However, user reviews suggest that Fandford’s platform may not meet these standards.

Traders have reported instances of high slippage and execution delays, which can adversely affect trading outcomes. Additionally, there are concerns about potential platform manipulation, where traders may experience sudden changes in pricing that favor the broker. Such practices can undermine the integrity of the trading environment and indicate a lack of ethical standards.

Risk Assessment

Overall, the risks associated with trading through Fandford require careful consideration.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulation |

| Fund Safety Risk | High | Reports of withdrawal issues |

| Trading Conditions Risk | Medium | Unclear fee structures |

The absence of regulatory oversight, coupled with reports of fund safety issues and unclear trading conditions, places Fandford in a high-risk category. Traders should approach this broker with caution and consider implementing risk management strategies to mitigate potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fandford may not be a safe choice for traders. The lack of clear regulatory status, combined with reports of fund safety issues and customer complaints, raises significant concerns about the broker's reliability. Traders looking for a safe trading environment should exercise caution and consider alternative options that offer robust regulatory oversight and transparent trading conditions.

For those still interested in forex trading, it is advisable to explore brokers with strong regulatory credentials, such as those regulated by the FCA or ASIC. These brokers typically provide a safer trading experience and more reliable customer support, ensuring that traders can focus on their trading strategies without undue concern about the safety of their funds.

Is fandford a scam, or is it legit?

The latest exposure and evaluation content of fandford brokers.

fandford Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

fandford latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.