Regarding the legitimacy of EASY TRADING ONLINE forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is EASY TRADING ONLINE safe?

Pros

Cons

Is EASY TRADING ONLINE markets regulated?

The regulatory license is the strongest proof.

ASIC Derivatives Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

AEFOREX

TOPONE Markets

Licensed Entity:

EASY TRADING ONLINE PTY LTD

Effective Date: Change Record

2010-06-29Email Address of Licensed Institution:

bradhowe@ozemail.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 608 L 6 97-99 BATHURST ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0407204611Licensed Institution Certified Documents:

Is Easy Trading Online A Scam?

Introduction

Easy Trading Online is a relatively new player in the forex market, offering a platform for trading various financial instruments, including currencies, commodities, and CFDs. As the online trading landscape continues to grow, traders must exercise caution when selecting a broker. The potential for scams and fraudulent activities in the forex market is significant, making it essential for investors to conduct thorough due diligence before committing their capital. This article investigates Easy Trading Online's legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors. The analysis is based on a review of multiple credible sources, including industry reports and user feedback.

Regulation and Legitimacy

Regulation is a crucial factor in determining a forex broker's legitimacy. Easy Trading Online claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulatory standards. This oversight is designed to protect traders by ensuring that brokers adhere to high operational and financial standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001304951 | Australia | Verified |

ASIC's regulatory framework requires brokers to maintain adequate capital reserves, segregate client funds, and provide transparent reporting, enhancing the trustworthiness of Easy Trading Online. However, the broker's regulatory history reveals some concerns. While it holds a license, there have been reports of customer complaints regarding withdrawal issues and account management, which can raise red flags about its operational practices.

Company Background Investigation

Easy Trading Online was established in Australia and operates under the name Easy Trading Online Pty Ltd. The company has positioned itself as a competitive option for forex traders, particularly those looking for high leverage and a diverse range of trading instruments. However, details about its ownership structure and management team are limited, which can impact transparency.

The absence of comprehensive information about the company's history and its founders raises questions about its credibility. A transparent company typically provides insights into its leadership and operational history, helping to build trust with potential clients. The lack of this information may lead to skepticism among traders regarding the broker's intentions and reliability.

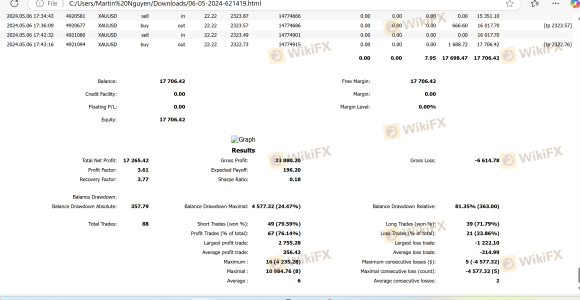

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is vital. Easy Trading Online offers a variety of trading accounts, including standard and ECN accounts, with competitive spreads and high leverage options. However, the overall fee structure requires careful examination to identify any hidden costs that may not be immediately apparent.

| Fee Type | Easy Trading Online | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | Varies by account | Varies widely |

| Overnight Interest Range | Competitive | Competitive |

While the advertised spreads appear attractive, traders should be cautious about the commission structure, especially for ECN accounts, which may involve additional fees. Transparency in fee disclosure is crucial, as unclear pricing can lead to unexpected costs that affect overall profitability.

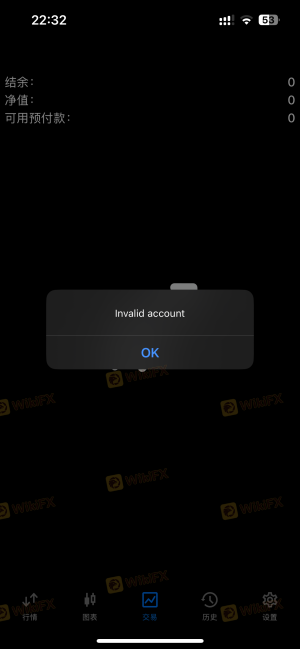

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Easy Trading Online claims to implement various security measures to protect client funds, including segregated accounts and adherence to ASIC regulations. These measures ensure that client funds are kept separate from the company's operational funds, minimizing the risk of loss in case of financial difficulties.

Additionally, the broker's policies on negative balance protection offer further reassurance to traders. However, historical complaints about fund withdrawals and account access raise concerns about the broker's commitment to safeguarding client assets. Such issues highlight the importance of evaluating a broker's track record in fund security.

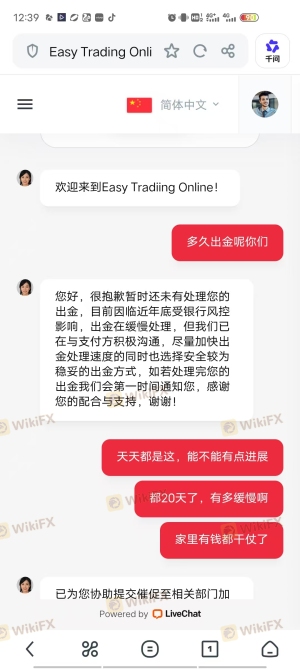

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's operational integrity. Easy Trading Online has received mixed reviews, with some users praising its trading platform and customer service, while others report serious issues, particularly regarding fund withdrawals and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Account Management | Medium | Inconsistent |

| Platform Stability | Low | Generally Positive |

For instance, several users have reported difficulties in withdrawing funds, citing delayed responses from customer support. These complaints are concerning, as they suggest potential operational inefficiencies that could affect traders' ability to access their capital.

Platform and Trade Execution

Easy Trading Online utilizes the MetaTrader 5 (MT5) platform, known for its advanced trading features and user-friendly interface. The platform's performance, stability, and execution quality are critical for traders, as they directly impact trading outcomes. Users have reported generally positive experiences with the platform, noting fast execution speeds and a reliable interface.

However, instances of slippage and order rejections have been reported, which can significantly affect trading strategies, especially for high-frequency traders. The absence of major platform manipulation signs is a positive aspect, but continuous monitoring of execution quality is essential for maintaining trader confidence.

Risk Assessment

While Easy Trading Online presents various attractive features, potential risks must be considered. Traders should be aware of the following risk factors:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Complaints about withdrawal issues. |

| Financial Stability | Medium | Limited transparency on ownership. |

| Customer Support | High | Slow response to critical issues. |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the platform and trading conditions before committing significant capital. Additionally, maintaining a diversified trading strategy can help manage exposure to potential losses.

Conclusion and Recommendations

In conclusion, while Easy Trading Online is regulated by ASIC, which adds a layer of credibility, there are several concerns that potential traders should consider. The lack of transparency regarding the company's ownership, mixed customer feedback, and reports of withdrawal issues warrant caution.

For traders seeking a reliable broker, it may be prudent to explore alternatives with more robust regulatory backgrounds and proven track records in customer satisfaction. Brokers such as IG Group or OANDA, known for their strong regulatory compliance and positive user experiences, may offer safer options for forex trading.

Is EASY TRADING ONLINE a scam, or is it legit?

The latest exposure and evaluation content of EASY TRADING ONLINE brokers.

EASY TRADING ONLINE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EASY TRADING ONLINE latest industry rating score is 5.80, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.80 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.