Is Expert options247 safe?

Business

License

Is Expert Options247 A Scam?

Introduction

Expert Options247 is a relatively new player in the forex trading market, offering a platform for trading various financial instruments, including forex, commodities, and cryptocurrencies. As the online trading landscape becomes increasingly crowded, traders must exercise caution and conduct thorough evaluations of brokers before committing their funds. The potential for scams and fraudulent practices in the industry necessitates a careful assessment of a broker's legitimacy, regulatory compliance, and overall reputation.

This article aims to provide a comprehensive analysis of Expert Options247, utilizing various data sources and user reviews to explore its safety and reliability. We will examine the broker's regulatory status, company background, trading conditions, customer experience, and risk factors to determine whether Expert Options247 is a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. A well-regulated broker is typically subject to strict oversight, ensuring that it adheres to industry standards and provides adequate protection for clients' funds. Unfortunately, Expert Options247 operates without any significant regulatory oversight, which raises serious concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a valid regulatory license means that Expert Options247 does not adhere to the stringent requirements set by recognized financial authorities. This lack of oversight can expose traders to significant risks, as there are no guarantees regarding the safety of their investments. Furthermore, the broker's operations in regions with lax regulatory frameworks, such as offshore jurisdictions, can further complicate matters.

The quality of regulation is paramount in ensuring that brokers operate transparently and responsibly. In this case, Expert Options247's lack of regulatory compliance suggests that it may not prioritize client protection, making it essential for potential traders to approach with caution.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its credibility. Expert Options247 appears to have a limited history, having been established in recent years. There is minimal publicly available information regarding its ownership structure and management team, which can be a red flag for potential investors.

The absence of transparency regarding the company's background raises concerns about its operational integrity. A reputable broker typically discloses information about its founders, executive team, and corporate structure, allowing traders to evaluate the experience and qualifications of the individuals managing their investments. However, Expert Options247 lacks such disclosures, which may indicate a lack of accountability.

Moreover, the company's website does not provide sufficient information about its operational history or any awards or recognitions it may have received. This lack of transparency can lead to skepticism among potential traders, making it challenging to determine whether Expert Options247 is a trustworthy brokerage.

Trading Conditions Analysis

The trading conditions offered by a broker play a significant role in determining its attractiveness to traders. Expert Options247 claims to offer competitive trading fees and a user-friendly platform. However, without clear and transparent information about its fee structure, traders may find themselves facing unexpected costs.

| Fee Type | Expert Options247 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of detailed information on spreads, commissions, and overnight fees raises concerns about the broker's transparency. Traders should be wary of brokers that do not clearly outline their fee structures, as hidden costs can significantly impact profitability.

Moreover, it is essential to consider the potential for unusual or problematic fee policies. For instance, some brokers impose high withdrawal fees or inactivity charges that can erode traders' profits. Without clear information from Expert Options247, traders may unknowingly agree to unfavorable terms.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Expert Options247's lack of regulatory oversight raises serious questions about the security measures it has in place to protect clients' investments. A reputable broker typically employs robust security protocols, such as segregated accounts and investor protection schemes.

While Expert Options247 has not provided detailed information about its fund safety measures, the absence of regulatory oversight suggests that there may be inadequate protections in place. Traders should be cautious when dealing with brokers that do not prioritize fund safety, as this can lead to significant financial losses.

Additionally, there have been reports of disputes and complaints regarding fund withdrawals and account management, further exacerbating concerns about the broker's reliability. Traders should carefully consider these factors when evaluating whether Expert Options247 is a safe platform for their trading activities.

Customer Experience and Complaints

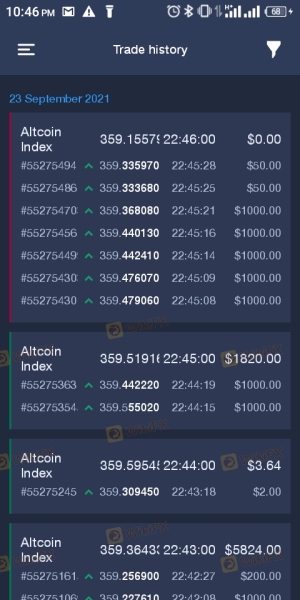

Customer feedback is a valuable resource for assessing the reliability of a broker. Unfortunately, Expert Options247 has received mixed reviews from users, with many expressing dissatisfaction with the platform's services. Common complaints include issues with fund withdrawals, poor customer support, and unclear fee structures.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Average |

| Fee Transparency | High | Poor |

The prevalence of withdrawal issues is particularly concerning, as it indicates potential problems with the broker's financial practices. Traders have reported difficulties in accessing their funds, leading to frustration and distrust. Additionally, the quality of customer support has been criticized, with users noting slow response times and inadequate assistance.

These complaints highlight the importance of thorough research before engaging with Expert Options247. While some traders may have had positive experiences, the overall sentiment suggests that the broker may not be meeting the expectations of its clients.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for traders. Expert Options247 claims to offer a user-friendly interface and efficient execution. However, without independent verification of these claims, it is difficult to assess the platform's true performance.

Traders have reported mixed experiences with order execution, with some noting instances of slippage and order rejections. Such issues can significantly impact trading outcomes, making it essential for traders to evaluate the platform's execution quality before committing their funds.

Additionally, any signs of potential platform manipulation should be taken seriously. Traders should be vigilant and monitor their trading activities closely to ensure that they are not subjected to unfair practices.

Risk Assessment

Using Expert Options247 presents various risks that traders should carefully consider. The lack of regulation, transparency issues, and negative customer feedback contribute to a higher risk profile for the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No significant regulatory oversight. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Customer Support Risk | Medium | Mixed reviews regarding responsiveness and quality. |

To mitigate these risks, traders should conduct thorough research and consider using smaller amounts when initially engaging with the broker. Additionally, they should stay informed about potential changes in the broker's operations or regulatory status.

Conclusion and Recommendations

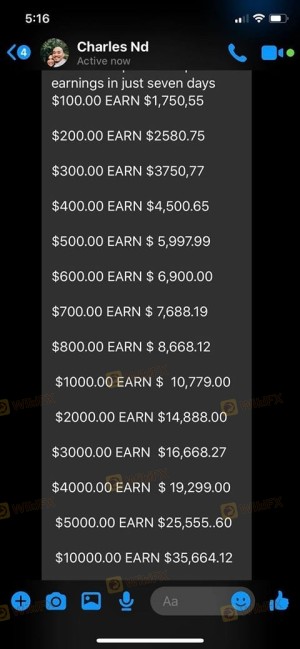

In conclusion, Expert Options247 raises several red flags that warrant caution among potential traders. The absence of regulatory oversight, coupled with negative customer feedback and transparency issues, suggests that the broker may not be a safe option for trading.

While some traders may find success with Expert Options247, the risks associated with using this platform outweigh the potential benefits. It is advisable for traders to seek alternative brokers that offer robust regulatory protections and transparent trading conditions.

For those looking for reliable alternatives, consider brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers typically offer better security for client funds and a more trustworthy trading environment. Always conduct thorough research and make informed decisions when choosing a trading platform.

Is Expert options247 a scam, or is it legit?

The latest exposure and evaluation content of Expert options247 brokers.

Expert options247 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Expert options247 latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.