Is EQUINOX safe?

Pros

Cons

Is Equinox Safe or Scam?

Introduction

Equinox Markets, established in 2020, positions itself as a player in the forex trading landscape, offering a wide range of trading instruments and platforms. However, the influx of online brokers and the varying degrees of regulatory oversight necessitate that traders exercise caution when selecting a broker. A thorough evaluation of a brokers legitimacy is crucial, as many traders have fallen victim to scams that exploit their trust. This article aims to provide a comprehensive analysis of Equinox Markets, examining its regulatory status, company background, trading conditions, customer safety, and user experiences. The evaluation draws on various sources, including regulatory databases, user reviews, and expert analyses, to present a balanced view of whether Equinox is safe or potentially a scam.

Regulatory and Legality

The regulatory environment is a key factor in determining the safety of a forex broker. Brokers are typically required to be licensed by recognized financial authorities to ensure they adhere to strict operational standards designed to protect traders. In the case of Equinox Markets, the broker claims to operate under the auspices of several regulatory bodies, including the National Futures Association (NFA) in the United States and the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, upon investigation, it becomes clear that these claims lack substantiation.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| NFA | 0547126 | USA | Not Valid |

| SVG FSA | 26854 BC 2022 | Saint Vincent | Not Regulated |

The NFA does not recognize Equinox as a member, and the SVG FSA has explicitly stated that entities engaging in forex trading are not licensed from this jurisdiction. The absence of valid regulation raises significant concerns regarding the safety of funds deposited with Equinox. The lack of oversight means that traders are not afforded the protections typically associated with regulated brokers, such as negative balance protection and segregated client accounts. Therefore, it is essential for potential clients to consider these regulatory gaps when assessing whether Equinox is safe for trading.

Company Background Investigation

Equinox Markets was founded relatively recently, in 2020, and purports to have a sophisticated operational structure. However, details surrounding its ownership and management team are scant. The company claims to be based in the United Kingdom, but also lists addresses in Saint Vincent and the Grenadines, leading to ambiguity regarding its true operational base. This lack of transparency is concerning, as reputable brokers typically provide clear information about their ownership structure and regulatory compliance.

The management teams background is also critical in assessing the broker's credibility. A strong team with extensive experience in financial markets can enhance a broker's reliability. However, Equinox does not provide detailed profiles of its management team, which raises questions about their qualifications and expertise in the forex industry. Furthermore, the broker's transparency in terms of financial disclosures and operational practices is limited, making it difficult for potential clients to gauge the firm's legitimacy. This opacity contributes to the skepticism surrounding whether Equinox is safe for trading.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are a vital aspect to consider. Equinox Markets presents various account types, each with different minimum deposit requirements and trading conditions. The minimum deposit for the Mercury account is set at $1,000, which is relatively high compared to industry standards. Additionally, the broker offers leverage up to 1:500, which, while attractive, can significantly increase trading risk, especially for inexperienced traders.

| Fee Type | Equinox Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 2.5 pips | 1.5 pips |

| Commission Structure | None stated | Varies widely |

| Overnight Interest Rate | Varies | Typically lower |

The spread on major currency pairs starts from 2.5 pips, which is above the industry average of 1.5 pips. This discrepancy raises concerns about the overall cost of trading with Equinox, as higher spreads can erode potential profits. Furthermore, the lack of clarity regarding commission structures and potential hidden fees could lead to unexpected costs for traders. These factors contribute to the assessment that Equinox is safe may be more of a gamble than a secure trading experience.

Customer Fund Security

The safety of customer funds is paramount in the forex trading environment. Equinox Markets claims to implement various measures to protect client funds, such as segregated accounts and investor protection policies. However, the reality is that the broker operates without valid regulation, which severely undermines these claims. Without oversight from a recognized regulatory body, there is no guarantee that client funds are held securely or that they would be protected in the event of insolvency.

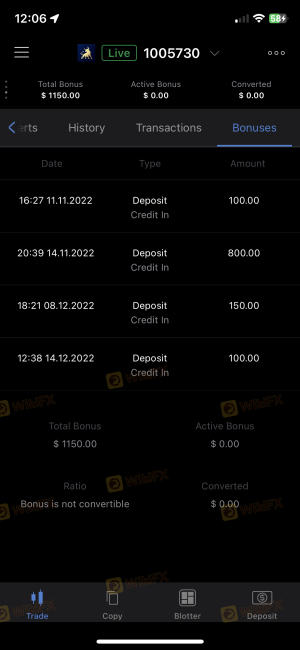

Moreover, historical issues surrounding fund security with unregulated brokers are well-documented. Many traders have reported difficulties in withdrawing their funds, often facing delays or outright refusals. While Equinox claims to offer a seamless withdrawal process, the lack of regulatory backing raises red flags regarding the actual safety of funds. Given these considerations, it is prudent for traders to question whether Equinox is safe for their investments.

Customer Experience and Complaints

User feedback is an essential component of evaluating a broker's reliability. An analysis of customer reviews for Equinox Markets reveals a mixed bag of experiences. While some users report satisfactory service and trading conditions, a significant number of complaints highlight issues with withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor response |

| Customer Support Delays | Medium | Inconsistent |

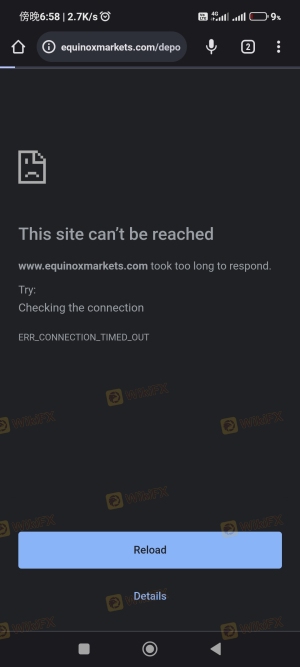

Common complaints include difficulties in withdrawing funds, with reports of users being unable to access their accounts or facing excessive delays. Additionally, the quality of customer support seems to be a recurring issue, with many users citing long response times and inadequate assistance. For example, one user reported being unable to log in to the withdrawal page, leading to significant frustration. Such patterns of complaints suggest that Equinox is safe may not hold true for many traders based on their experiences.

Platform and Trade Execution

The trading platform offered by a broker significantly impacts the trading experience. Equinox Markets claims to provide access to advanced trading platforms, including cTrader and MetaTrader 4. However, the actual performance and reliability of these platforms are critical to consider. Users have reported varying levels of execution quality, with some experiencing slippage and others noting delays in order processing.

The potential for platform manipulation is another concern, particularly with unregulated brokers. If a broker has the ability to control execution speeds or manipulate prices, it can lead to unfavorable trading conditions for clients. Traders should be cautious and assess whether Equinox is safe, especially considering the reported issues with trade execution quality.

Risk Assessment

Using Equinox Markets presents several risks that potential traders should carefully evaluate. The primary risks include the lack of regulation, high leverage offerings, and the potential for withdrawal issues. Each of these factors contributes to a heightened risk profile for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Financial Risk | Medium | High leverage can amplify losses. |

| Operational Risk | High | Reports of withdrawal issues. |

To mitigate these risks, traders should consider starting with smaller investments, utilizing risk management strategies, and thoroughly researching alternative, regulated brokers. It is vital to remain vigilant and informed to ensure a safer trading experience.

Conclusion and Recommendations

In conclusion, the analysis of Equinox Markets reveals several concerning factors that suggest it may not be a safe option for traders. The lack of valid regulation, coupled with reports of withdrawal issues and customer complaints, raises significant red flags. While the broker offers a variety of trading instruments and platforms, the risks associated with trading with an unregulated entity cannot be overlooked.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers regulated by top-tier authorities, such as the FCA or ASIC, provide a higher level of protection and transparency, ensuring that traders can engage in the forex market with greater confidence. Ultimately, while Equinox is safe may be a question worth exploring, the evidence suggests that caution is warranted.

Is EQUINOX a scam, or is it legit?

The latest exposure and evaluation content of EQUINOX brokers.

EQUINOX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EQUINOX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.