Is EnclaveFX safe?

Business

License

Is EnclaveFX Safe or Scam?

Introduction

EnclaveFX is a relatively new player in the forex market, having been established in 2018. Positioned as a broker offering a wide range of trading instruments, including forex, CFDs, metals, and cryptocurrencies, EnclaveFX aims to attract traders with promises of high leverage and low fees. However, the increasing number of scams in the forex industry necessitates that traders exercise caution and conduct thorough evaluations of brokers before committing their funds. This article investigates whether EnclaveFX is a legitimate trading platform or if it poses a risk to potential investors. Our analysis is based on a review of regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and the safety of client funds. EnclaveFX operates without regulation from any recognized financial authority, which raises significant concerns regarding its credibility. Below is a summary of the regulatory information available:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that EnclaveFX does not adhere to any established financial laws or standards, leaving clients without the protection typically afforded by regulated brokers. This unregulated status is a major red flag, as it implies that clients have limited avenues for recourse in the event of disputes or financial mishaps. Furthermore, regulatory bodies like the UK's Financial Conduct Authority (FCA) have issued warnings against EnclaveFX, indicating that it operates illegally in certain jurisdictions. This lack of oversight not only jeopardizes client funds but also raises questions about the company's operational transparency and ethical practices.

Company Background Investigation

EnclaveFX is registered in the United Kingdom, specifically at 2nd Floor, College House, 17 King Edwards Road, Ruislip, London. Despite its UK registration, the company lacks the necessary authorization to provide financial services, as highlighted by the warnings from regulatory bodies. The ownership structure of EnclaveFX remains unclear, with little information available regarding its management team or their professional backgrounds. The lack of transparency concerning the company's leadership is concerning, as it often indicates a higher risk of fraudulent activities.

Moreover, the company's website does not provide sufficient information about its operational history or the qualifications of its team members. This opacity is a common trait among potentially fraudulent brokers, as it allows them to evade accountability and scrutiny. Without clear details about the management's experience and credentials, it is difficult for traders to trust EnclaveFX as a reliable trading partner.

Trading Conditions Analysis

EnclaveFX claims to offer competitive trading conditions, including various account types, high leverage of up to 1:500, and low spreads. However, the actual trading costs and fees associated with the platform are not clearly defined on its website. Below is a comparison of the core trading costs associated with EnclaveFX and the industry average:

| Fee Type | EnclaveFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 2.2 pips | From 1.0 pips |

| Commission Model | None | Variable |

| Overnight Interest Range | N/A | Varies |

While the promise of low spreads may seem appealing, the high starting point of 2.2 pips for major currency pairs is above the industry average, which could significantly impact trading profitability. Additionally, the absence of a transparent commission structure raises concerns about hidden fees or unfavorable trading conditions that may emerge later. Traders should be wary of brokers that do not clearly outline their fee structures, as this can lead to unexpected costs that erode profits.

Client Fund Safety

The safety of client funds is paramount when evaluating any broker. EnclaveFX does not provide clear information on its fund safety measures, such as whether client funds are segregated from the company's operational funds or if there are any investor protection schemes in place. The lack of such disclosures is alarming, as it suggests that client funds may be at risk in the event of the company's insolvency or fraudulent activities.

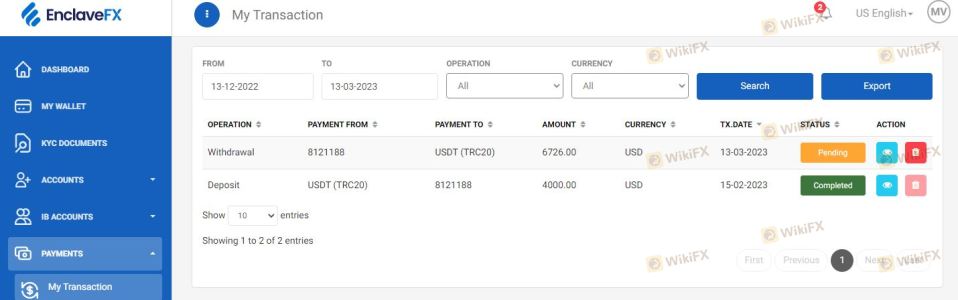

Historically, unregulated brokers like EnclaveFX have been associated with numerous cases of fund misappropriation and withdrawal issues. Clients often report difficulties in retrieving their funds, especially if the broker imposes unreasonable withdrawal conditions or delays. Given EnclaveFX's unregulated status, traders should be particularly cautious about depositing significant amounts of money, as there may be no legal recourse to recover lost funds.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of EnclaveFX reveal a mix of experiences, but many users report significant issues, particularly regarding withdrawal processes. Common complaints include delayed withdrawals, poor customer service response times, and difficulties in accessing trading accounts.

The following table summarizes the main types of complaints received about EnclaveFX:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Account Access Problems | High | Poor |

One notable case involved a trader who reported being unable to withdraw funds for several months, despite multiple requests. The broker's lack of communication and failure to address the issue led to significant frustration and financial loss for the trader. Such complaints are indicative of systemic problems within the broker's operational framework, raising further doubts about whether EnclaveFX is safe for traders.

Platform and Execution

The trading platform offered by EnclaveFX is based on MetaTrader 5 (MT5), a widely used trading software known for its robust features and user-friendly interface. However, user reviews indicate that the platform's performance may not meet expectations, with reports of execution delays and slippage during high volatility periods.

Additionally, there are concerns about the possibility of platform manipulation, where brokers may interfere with trade executions to benefit their positions. Such practices are more common among unregulated brokers, making it essential for traders to thoroughly evaluate the execution quality before committing to a platform like EnclaveFX.

Risk Assessment

Engaging with EnclaveFX carries several risks that potential traders should be aware of. Below is a risk assessment summarizing key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates without regulation, increasing the risk of fraud. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection measures. |

| Execution Risk | Medium | Reports of slippage and execution delays. |

| Customer Service Risk | High | Frequent complaints about withdrawal issues and poor support. |

To mitigate these risks, traders should consider using regulated brokers with clear fund protection policies and responsive customer service. Additionally, conducting thorough research and reading user reviews can help in making informed decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that EnclaveFX is not a safe trading option. Its unregulated status, combined with numerous complaints about withdrawal issues and poor customer service, raises significant concerns about the legitimacy of the broker. Traders should be particularly cautious, as engaging with unregulated brokers often leads to financial losses and difficulties in recovering funds.

For those considering trading in forex, it is advisable to seek out regulated brokers that offer clear and transparent trading conditions, robust customer support, and adequate fund protection measures. Some reputable alternatives include brokers regulated by the FCA, ASIC, or CySEC, which provide a safer trading environment. Always prioritize safety and due diligence when selecting a trading partner in the forex market.

Is EnclaveFX a scam, or is it legit?

The latest exposure and evaluation content of EnclaveFX brokers.

EnclaveFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EnclaveFX latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.