Dana 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive dana review examines a broker that has gained attention in the financial services sector. Specific trading-related information remains limited in publicly available sources, which creates challenges for thorough evaluation. Based on available data, Dana appears to maintain a moderate profile in the industry with mixed employee satisfaction ratings that suggest standard operational performance. The company shows particular strength in its engineering department, where 96% of team members provide positive evaluations. This suggests robust technical capabilities that could translate into reliable trading infrastructure for client services.

However, this dana review must note significant gaps in publicly available information regarding core trading services, regulatory compliance, and client-facing operations. The overall assessment remains neutral due to insufficient data on critical aspects such as trading conditions, platform offerings, and regulatory oversight that potential clients need to evaluate. While employee satisfaction indicators suggest internal operational stability, potential clients should exercise caution and seek additional verification of trading credentials and regulatory status before engaging with this broker. This recommendation stems from the limited transparency in publicly available documentation about essential trading services.

Important Notice

This dana review is based on publicly available information and employee feedback data. Due to limited disclosure of specific trading operations and regulatory details, readers should conduct independent verification of all trading conditions, regulatory status, and service offerings before making any financial commitments to ensure their investment safety. The information presented reflects the current state of available data and may not represent the complete operational picture of the broker's services. Comprehensive due diligence remains essential for potential clients considering this broker for their trading activities.

Cross-regional regulatory differences may apply, though specific jurisdictional information was not available in source materials. Prospective clients should verify applicable regulations in their respective jurisdictions and confirm the broker's authorization to provide services in their region to ensure compliance with local financial laws.

Rating Framework

Broker Overview

Dana operates within the financial services sector. Comprehensive details about its establishment date, founding background, and specific business model remain unclear from available public sources, which limits thorough evaluation of the company's history and development. The limited information suggests the company maintains operations with a focus on technical excellence, as evidenced by high satisfaction rates within its engineering department. This technical strength could indicate a foundation suitable for developing robust trading infrastructure, though specific confirmation of trading services requires further verification from potential clients.

The company's operational structure appears to emphasize internal team satisfaction and technical capabilities. With 63% overall positive employee evaluations and notably higher satisfaction in technical departments, Dana demonstrates competency in maintaining skilled technical teams that could support quality service delivery. However, this dana review must emphasize that these internal metrics do not necessarily translate directly to client service quality or trading performance, as specific client-facing service information remains limited in available documentation. The gap between internal operations and client experience requires independent verification.

Available data suggests the organization maintains standard corporate governance practices. Specific details about trading platform types, asset class offerings, and regulatory oversight remain unspecified in source materials, creating evaluation challenges for potential clients. The absence of detailed regulatory information represents a significant consideration for potential clients evaluating the broker's compliance status and operational authorization.

Regulatory Status: Specific regulatory information was not detailed in available source materials. Prospective clients should independently verify regulatory compliance and authorization status to ensure legal protection.

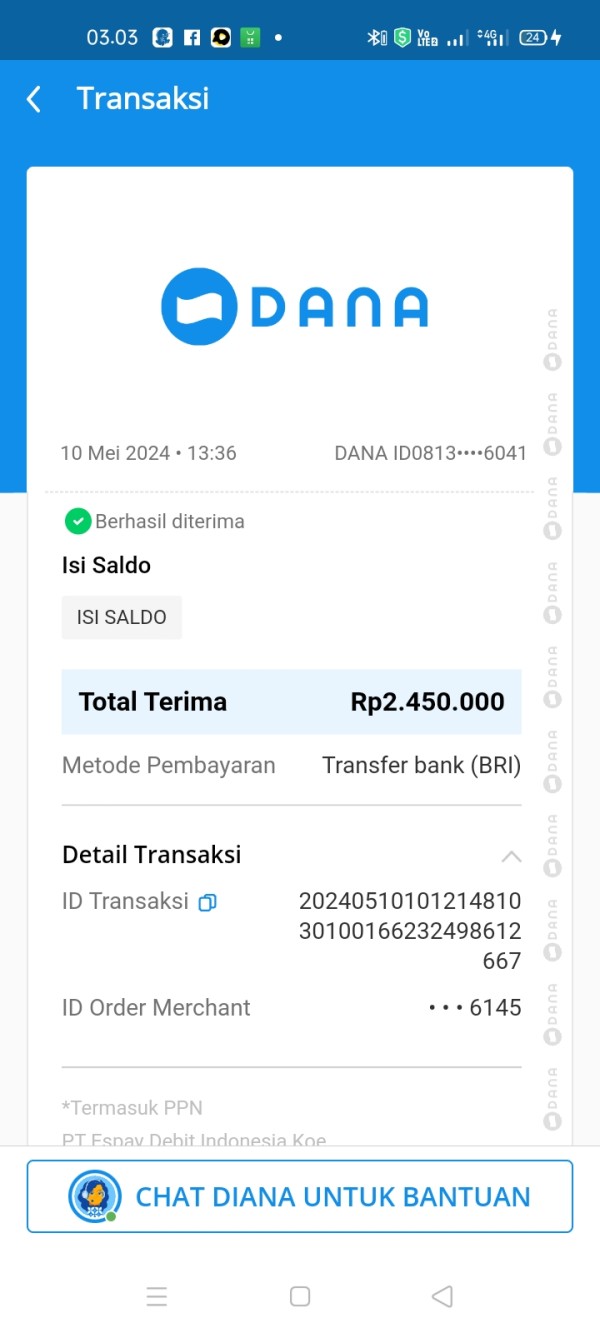

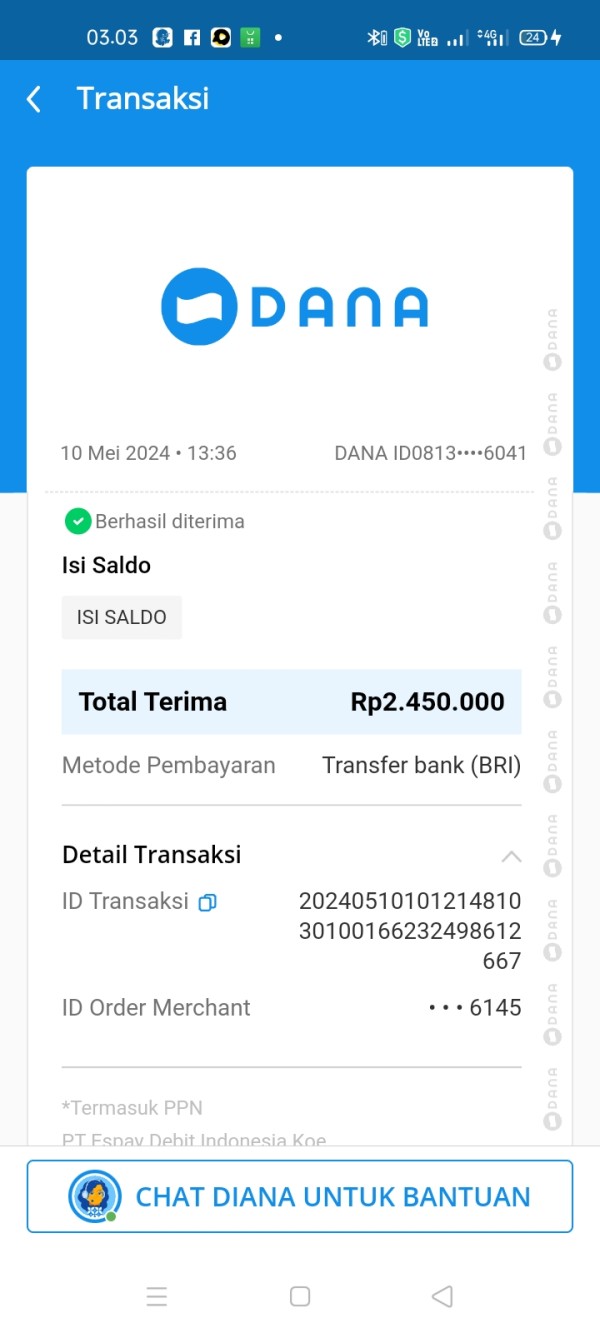

Deposit and Withdrawal Methods: Information regarding payment processing methods, supported currencies, and transaction procedures was not specified in available documentation. Clients should inquire directly about available funding options.

Minimum Deposit Requirements: Specific minimum deposit amounts and account funding requirements were not disclosed in source materials. This information requires direct verification from the broker.

Promotional Offers: Details about welcome bonuses, promotional campaigns, or client incentive programs were not available in reviewed sources. Potential clients should inquire about current promotional offerings.

Tradeable Assets: Information about available trading instruments, asset classes, and market access was not specified in available documentation. Asset availability requires direct confirmation from the broker.

Cost Structure: Specific details about spreads, commissions, overnight fees, and other trading costs were not disclosed in source materials reviewed for this dana review. Cost information is essential for trading decisions and requires direct inquiry.

Leverage Options: Maximum leverage ratios and margin requirements were not detailed in available information. Leverage terms significantly impact trading strategies and require verification.

Platform Selection: Specific trading platforms, software options, and technological infrastructure details were not available in source documentation. Platform capabilities require direct evaluation from potential clients.

Geographic Restrictions: Information about service availability by region and jurisdictional limitations was not specified. Regional service availability requires direct confirmation.

Customer Support Languages: Details about multilingual support options were not available in reviewed materials. Language support capabilities require direct inquiry from international clients.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Dana's account conditions faces significant limitations due to insufficient publicly available information about account types, minimum deposit requirements, and account-specific features. This dana review cannot provide detailed analysis of account tier structures, special account offerings such as Islamic accounts, or professional account categories due to this information gap that prevents comprehensive assessment. The absence of transparent account information creates challenges for potential clients seeking to understand their options and requirements.

Without specific data on account opening procedures, verification requirements, or account maintenance conditions, potential clients cannot adequately assess whether Dana's account structure aligns with their trading needs and financial circumstances. The absence of information about account funding methods, withdrawal procedures, and associated fees represents a critical knowledge gap that impacts the overall evaluation of the broker's suitability. These details are essential for making informed decisions about broker selection and account management.

Industry standards typically expect transparent disclosure of account conditions, minimum balance requirements, and associated terms. The lack of readily available information in these areas suggests either limited public disclosure practices or potential gaps in client-facing service documentation that could indicate communication challenges. Prospective clients should directly contact the broker to obtain comprehensive account condition details before proceeding with account opening procedures.

Assessment of Dana's trading tools and resources remains challenging due to limited available information about platform capabilities, analytical resources, and educational offerings. The high satisfaction rates within the engineering department suggest potential technical competency that could support robust trading infrastructure, though specific tool descriptions were not available in source materials for verification. This creates uncertainty about the actual quality and availability of trading tools for client use.

Professional trading environments typically provide comprehensive charting tools, technical indicators, economic calendars, and market analysis resources. However, this review cannot confirm the availability or quality of such tools within Dana's offerings due to insufficient documentation that limits thorough evaluation. The absence of detailed information about automated trading support, API access, or third-party integration capabilities represents another significant evaluation limitation for advanced traders.

Educational resources, research materials, and market analysis tools form crucial components of comprehensive broker offerings. Without specific information about Dana's educational programs, webinar schedules, or analytical research quality, potential clients cannot assess the value-added services that support trading decision-making and skill development. The technical strength suggested by employee satisfaction data could indicate capability for developing quality tools, though confirmation requires direct verification from potential clients.

Customer Service and Support Analysis

Evaluation of Dana's customer service capabilities remains limited due to insufficient information about support channels, response times, and service quality metrics. Standard industry practices include multiple contact methods such as live chat, telephone support, email assistance, and comprehensive FAQ resources, though specific availability of these services at Dana was not confirmed in available sources for this assessment. This creates uncertainty about the accessibility and quality of customer support services.

Response time expectations, service availability hours, and multilingual support capabilities represent critical factors for international clients, particularly in forex markets that operate across global time zones. The absence of specific information about 24/7 support availability, regional service teams, or escalation procedures limits the assessment of Dana's customer service infrastructure and its ability to serve diverse client needs. International clients require reliable support across different time zones and languages.

Quality customer support typically includes knowledgeable representatives capable of addressing technical issues, account inquiries, and trading-related questions. While internal employee satisfaction data suggests operational competency, this does not necessarily correlate with client-facing service quality that directly impacts user experience. Direct evaluation of customer service responsiveness, problem resolution effectiveness, and overall client satisfaction requires additional verification through direct contact or independent client feedback sources.

Trading Experience Analysis

Assessment of Dana's trading experience requires evaluation of platform stability, execution quality, and overall trading environment, though specific information in these areas was not available in source materials. This dana review cannot provide detailed analysis of order execution speeds, slippage rates, or platform reliability due to insufficient technical performance data that would enable comprehensive evaluation. These factors are crucial for determining trading quality and client satisfaction.

Professional trading environments demand stable platforms with minimal downtime, fast execution speeds, and comprehensive functionality across desktop and mobile applications. The high technical team satisfaction could suggest capability for maintaining quality trading infrastructure, though specific performance metrics and client experience data require independent verification to confirm actual service delivery. Technical capability does not always translate to superior client experience without proper implementation.

Trading experience evaluation typically includes analysis of platform interface design, order management capabilities, risk management tools, and mobile trading functionality. Without specific information about Dana's platform offerings, user interface quality, or mobile application capabilities, potential clients cannot adequately assess whether the trading environment meets their operational requirements and performance expectations that are essential for successful trading. Direct platform testing becomes necessary for proper evaluation.

Trust and Reliability Analysis

Trust and reliability assessment faces significant limitations due to insufficient information about regulatory oversight, compliance practices, and industry reputation. Regulatory authorization represents a fundamental requirement for broker operations, though specific regulatory status and oversight details were not available in reviewed source materials for verification. This creates substantial uncertainty about the broker's legal standing and client protection measures.

Client fund protection measures, segregated account practices, and deposit insurance coverage typically form core components of broker reliability. The absence of specific information about these protective measures represents a critical evaluation gap that potential clients must address through direct inquiry and independent verification of regulatory compliance status to ensure their financial safety. Fund protection is essential for client security and peace of mind.

Industry reputation, third-party evaluations, and historical performance records contribute to overall trust assessment. Without access to detailed regulatory filings, industry awards, or independent audit results, this review cannot provide comprehensive reliability evaluation that clients need for informed decision-making. The mixed employee satisfaction ratings suggest standard operational challenges but do not necessarily indicate client-facing reliability issues that would affect service quality.

User Experience Analysis

User experience evaluation remains limited due to insufficient information about client interface design, account management procedures, and overall client satisfaction metrics. Modern broker platforms typically emphasize intuitive navigation, streamlined account opening procedures, and efficient fund management processes, though specific details about Dana's user experience were not available in source materials for assessment. This limits the ability to evaluate the practical aspects of using the broker's services.

Registration and verification procedures significantly impact initial client experience, particularly regarding documentation requirements, approval timeframes, and account activation processes. Without specific information about these procedures, potential clients cannot assess the convenience and efficiency of beginning their relationship with Dana, which affects the overall client onboarding experience. Smooth onboarding processes are essential for positive first impressions and client retention.

Overall user satisfaction typically reflects the cumulative experience across platform usability, customer service quality, and operational reliability. The absence of specific client feedback, user interface screenshots, or usability testing results limits comprehensive user experience assessment that would help potential clients understand what to expect. Potential clients should consider requesting demo access or trial periods to directly evaluate the user experience before committing to account opening.

Conclusion

This dana review reveals a broker with limited publicly available information about core trading services, regulatory status, and client-facing operations. While internal employee satisfaction data suggests operational competency, particularly in technical areas, the absence of detailed trading conditions, platform specifications, and regulatory compliance information represents significant evaluation limitations that prevent comprehensive assessment. The lack of transparency in key areas creates challenges for potential clients seeking to make informed decisions about broker selection.

The neutral overall assessment reflects the need for additional verification and direct inquiry to obtain comprehensive service details. Potential clients should exercise appropriate due diligence, including independent verification of regulatory status, trading conditions, and service availability before proceeding with account opening procedures to ensure their investment safety and regulatory compliance. Professional traders and institutions may find the suggested technical competency encouraging, though confirmation of actual service delivery requires direct evaluation through demo accounts or direct contact with the broker.