Is CVC GLOBALS safe?

Business

License

Is CVC Globals Safe or Scam?

Introduction

CVC Globals positions itself as an online broker offering a range of trading services in the forex, commodities, and cryptocurrency markets. With the growing popularity of online trading platforms, it's crucial for traders to carefully evaluate the legitimacy and safety of brokers like CVC Globals. Many traders have fallen victim to scams in the past, making it imperative to conduct thorough due diligence before investing. This article aims to provide an objective analysis of CVC Globals, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. Our evaluation will draw from various sources, including user reviews and regulatory databases, to present a comprehensive overview of whether CVC Globals is safe or potentially a scam.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. A regulated broker must adhere to strict guidelines to ensure the protection of its clients. Unfortunately, CVC Globals operates without valid regulatory oversight, which raises significant red flags. The absence of regulation means that there are no external bodies monitoring their activities, leaving clients vulnerable to potential fraud or unfair trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory framework is concerning, as it indicates that CVC Globals does not have to comply with any established standards for financial conduct. This absence of oversight can lead to a lack of accountability, making it difficult for clients to seek recourse in case of disputes or issues with withdrawals. In the forex trading industry, regulatory compliance is crucial for ensuring the safety of traders' funds and maintaining trust in the broker's operations. Without regulation, clients are left with limited options for recourse if they encounter problems.

Company Background Investigation

CVC Globals claims to have been operating for approximately two to five years, but the details surrounding its ownership structure and management team remain unclear. The company's website does not provide adequate information about its founders or key personnel, which is a significant transparency issue. A reliable broker should disclose information about its management team, including their professional backgrounds and experience in the financial industry.

Moreover, the company's registered address in Jakarta, Indonesia, does not inspire confidence, especially given the country's reputation for financial fraud. The lack of transparency regarding ownership and management raises concerns about the broker's legitimacy and reliability. Traders should be wary of engaging with a broker that does not provide clear and verifiable information about its operations and personnel.

Trading Conditions Analysis

When assessing whether CVC Globals is safe, it's essential to consider its trading conditions, including fees, spreads, and commissions. The broker claims to offer competitive trading conditions, but the lack of transparency regarding its fee structure makes it challenging to evaluate its offerings accurately.

| Fee Type | CVC Globals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The absence of clear information about commissions and spreads can be a warning sign for potential traders. Furthermore, the presence of unusual fee policies, such as high withdrawal fees or hidden charges, can indicate that the broker may not be acting in the best interest of its clients. Traders should always seek brokers with transparent fee structures and no hidden costs to ensure they are not taken advantage of.

Customer Funds Security

The safety of customer funds is a critical aspect when determining whether CVC Globals is safe. A reputable broker should implement robust measures to protect client funds, including segregated accounts and investor protection schemes. However, CVC Globals has not provided sufficient information regarding its security protocols.

The absence of fund segregation means that client funds may be mixed with the broker's operational funds, increasing the risk of loss in case of financial difficulties. Additionally, without a regulatory framework, there is no guarantee that clients will receive compensation in case of insolvency or fraud. The lack of transparency surrounding these safety measures is a significant concern for potential investors.

Customer Experience and Complaints

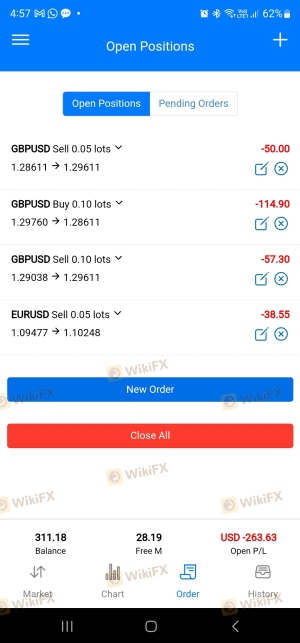

Customer feedback is a valuable resource for assessing the reliability of a broker. Unfortunately, reviews and complaints regarding CVC Globals paint a troubling picture. Many users have reported issues with fund withdrawals, claiming that the broker delays or denies their requests. This pattern of complaints is alarming and suggests that CVC Globals may not be acting in good faith.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No response |

| Lack of Transparency | Medium | Minimal response |

| Unusual Fees | Medium | No clarification |

Typical complaints include users stating that they were unable to withdraw their profits or that the broker required additional deposits to access their funds. Such practices are common among fraudulent brokers and indicate a lack of integrity. In one case, a user reported losing a substantial amount of money due to unfulfilled withdrawal requests, which further solidifies the notion that CVC Globals may not be safe for trading.

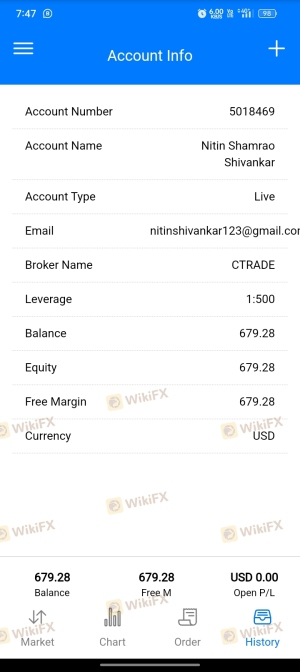

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Users have reported mixed reviews regarding the stability and functionality of CVC Globals' trading platform. Issues such as slippage, order rejections, and slow execution times can significantly impact a trader's profitability.

Moreover, any signs of platform manipulation, such as sudden price changes or irregular trading conditions, should raise concerns for potential investors. A reliable broker should provide a seamless trading experience without unexpected disruptions, allowing traders to execute their strategies effectively.

Risk Assessment

Engaging with CVC Globals presents several risks that traders should consider. The lack of regulation, transparency, and negative customer feedback collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, potential for fraud. |

| Financial Risk | High | Unclear fee structure, potential for hidden costs. |

| Withdrawal Risk | High | Numerous complaints about inability to withdraw funds. |

| Transparency Risk | High | Lack of information about ownership and management. |

To mitigate these risks, traders are advised to conduct thorough research and consider using regulated brokers with a proven track record of reliability and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that CVC Globals may not be a safe option for traders. The absence of regulation, coupled with numerous complaints regarding fund withdrawals and transparency issues, raises significant concerns about the broker's legitimacy. Traders should exercise caution and consider alternative options when looking to invest in the forex market.

For those seeking reliable trading platforms, it is advisable to explore well-regulated brokers with transparent operations and positive customer feedback. Some reputable alternatives include brokers regulated by the FCA or ASIC, which provide a higher level of security and accountability for traders. Ultimately, thorough research and careful consideration are essential for safeguarding investments in the forex market.

Is CVC GLOBALS a scam, or is it legit?

The latest exposure and evaluation content of CVC GLOBALS brokers.

CVC GLOBALS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CVC GLOBALS latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.