CVC Globals 2025 Review: Everything You Need to Know

Executive Summary

This cvc globals review shows major concerns about this online trading platform. Potential investors must think carefully before using it. CVC Globals has been marked by many sources as a possibly fake operation, with lots of bad customer feedback and worrying lack of rules watching over it.

The platform's overall score is very negative because of these basic problems with being open and protecting customers. While CVC Globals says it gives investment chances in forex trading, the lack of real regulatory papers and the pattern of bad customer experiences create serious warning signs. The platform seems to target traders who want high-risk investment opportunities.

However, this group should be extra careful given the problems we found. Based on available information and user feedback study, CVC Globals shows big problems across many operational areas, from customer service quality to platform reliability. The lack of clear regulatory following and the many negative user reports suggest that this platform may not meet the standards expected of real forex brokers in 2025.

Important Notice

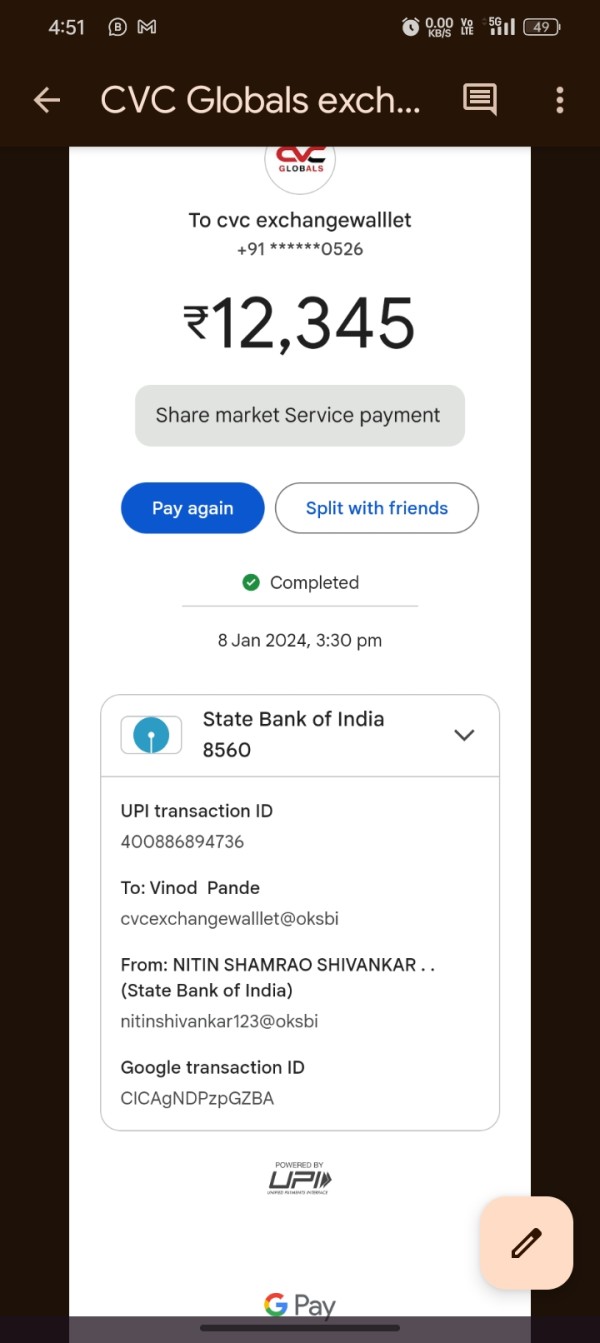

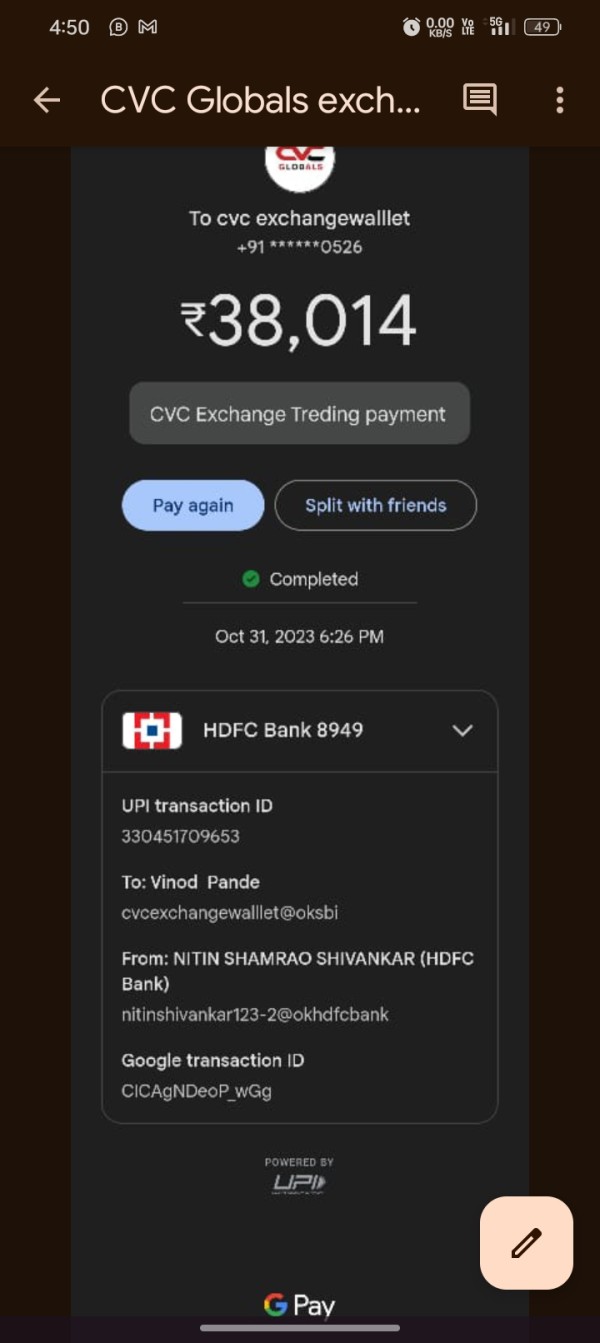

Due to the lack of real regulatory information for CVC Globals, cross-regional trading activities may put users at big legal and financial risks. The regulatory landscape changes a lot across different areas, and traders should know that operations done through unregulated platforms may lack standard investor protections.

This evaluation is based on available user feedback, market analysis, and publicly available information about the platform's operations. Given the limited openness of CVC Globals' business practices, future users should be extremely careful and do additional research before considering any engagement with this platform.

Rating Framework

Based on complete analysis of available information, CVC Globals gets the following ratings across six critical dimensions:

These ratings show the big concerns found across multiple operational areas, especially regarding regulatory following and customer satisfaction.

Broker Overview

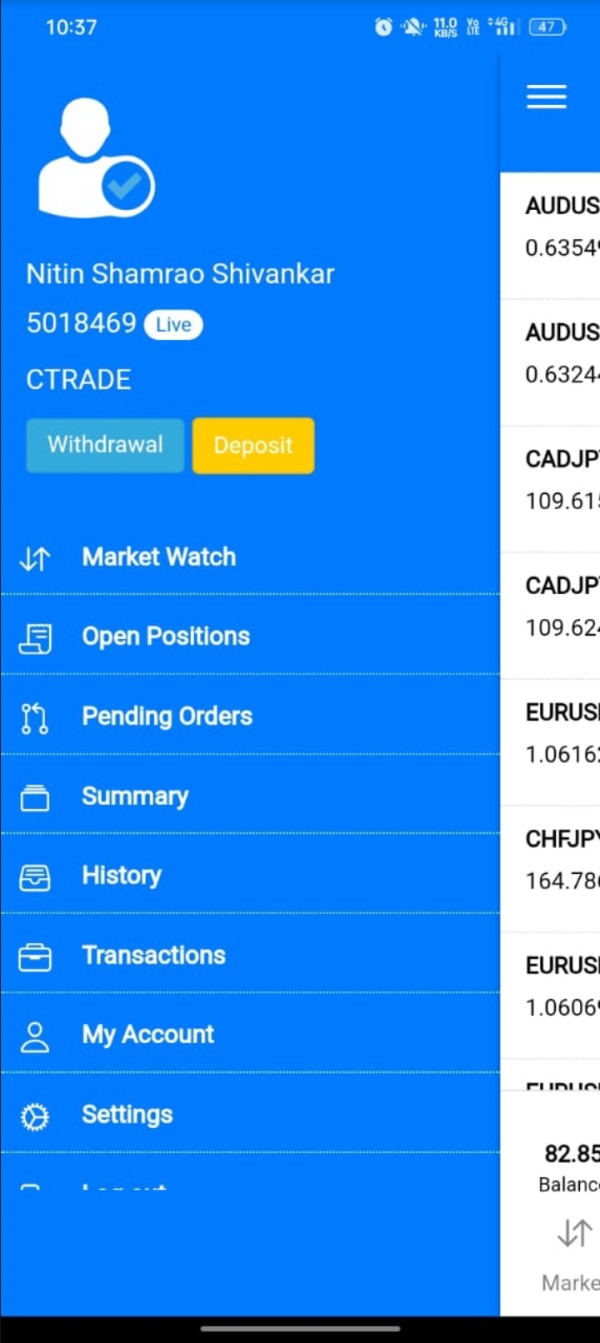

CVC Globals presents itself as an online trading platform operating in the forex market. However, detailed information about its founding date and corporate history remains notably missing from available sources. The platform claims to offer investment opportunities to retail traders, positioning itself within the competitive online forex brokerage space.

But the lack of clear corporate information raises immediate concerns about the platform's legitimacy and operational history. The company's business model appears to focus on attracting traders through promises of investment opportunities, though specific details about their operational framework, corporate structure, and management team are not easily available through standard industry channels. This lack of openness in basic business information is unusual for legitimate forex brokers, who typically provide complete corporate transparency.

According to available information, CVC Globals mainly focuses on forex trading services. However, complete details about their platform technology, asset offerings, and trading infrastructure remain unclear. The absence of clear regulatory oversight from recognized financial authorities represents a big concern for this cvc globals review, as legitimate brokers typically maintain transparent regulatory relationships with established financial authorities in their operational areas.

Regulatory Status: Available information does not identify any specific regulatory areas or oversight bodies governing CVC Globals' operations. This represents a critical concern for potential users seeking regulated trading environments.

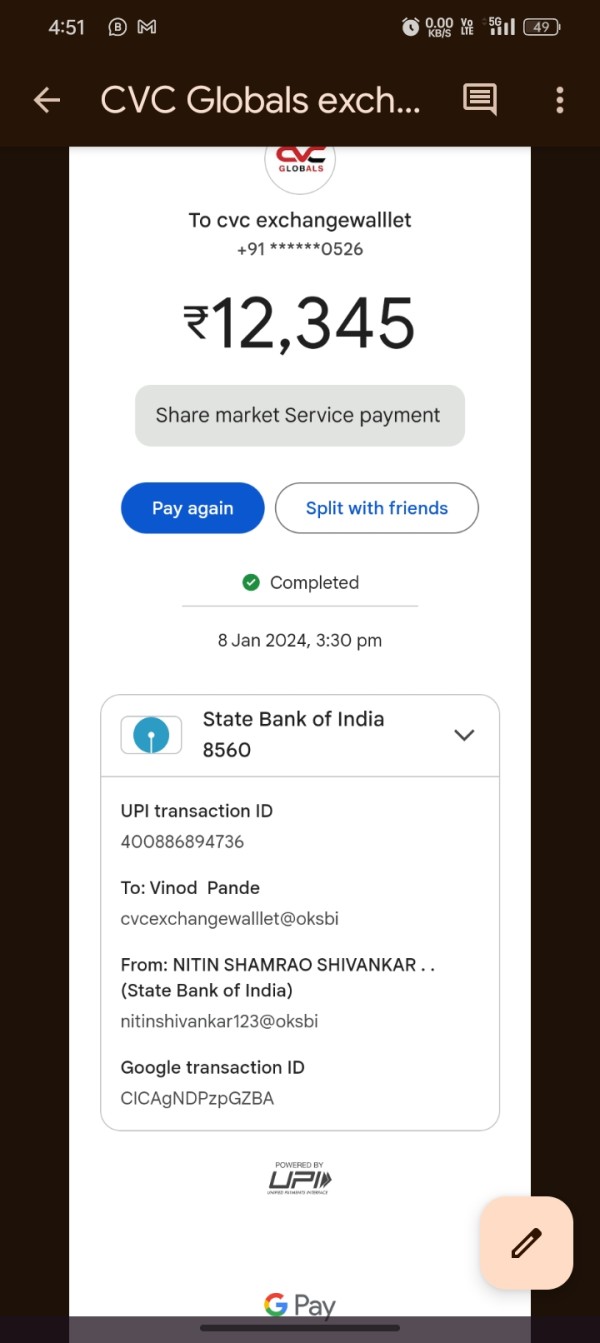

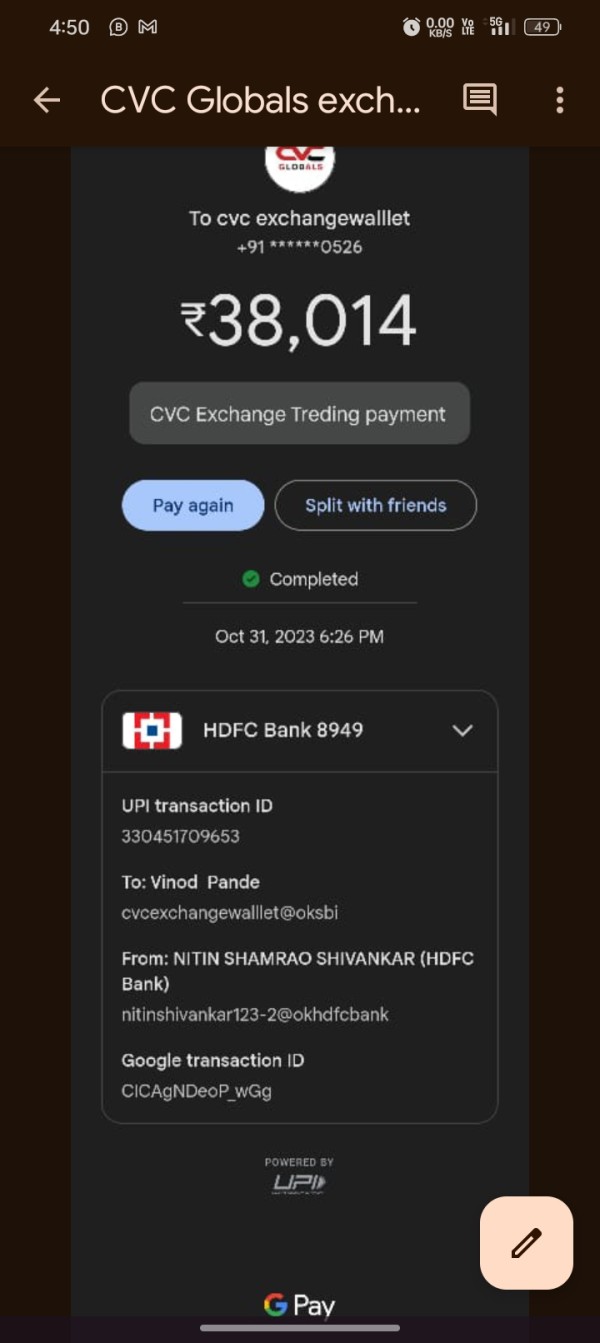

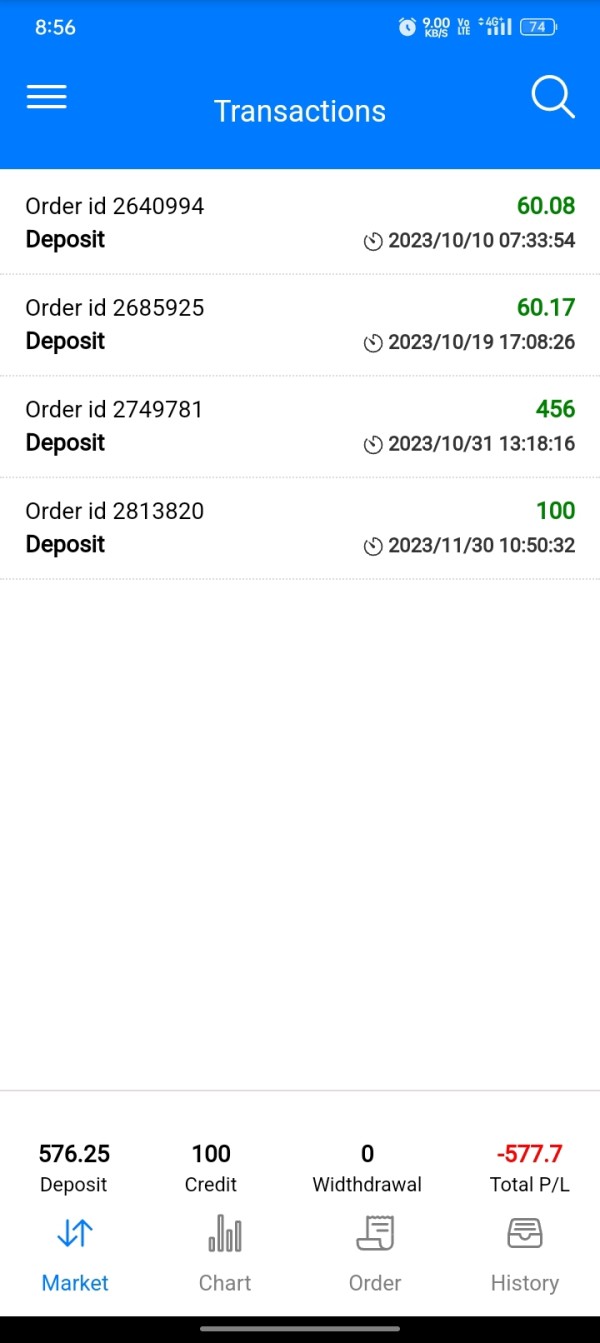

Deposit and Withdrawal Methods: Specific information regarding supported deposit and withdrawal methods is not detailed in available sources. This leaves potential users without clear understanding of fund management procedures.

Minimum Deposit Requirements: The platform's minimum deposit requirements are not specified in available documentation. This makes it difficult for potential traders to assess entry-level investment commitments.

Promotional Offers: Information regarding bonuses, promotional offers, or incentive programs is not detailed in available sources. However, this absence of promotional transparency may actually reflect positively given the platform's other concerns.

Tradeable Assets: While the platform appears to focus mainly on forex trading, complete information about specific currency pairs, asset classes, and trading instruments is not easily available through standard industry channels.

Cost Structure: Critical information regarding spreads, commissions, overnight fees, and other trading costs is not specified in available documentation. This makes cost comparison with legitimate brokers impossible.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available sources. This leaves traders without essential risk management information.

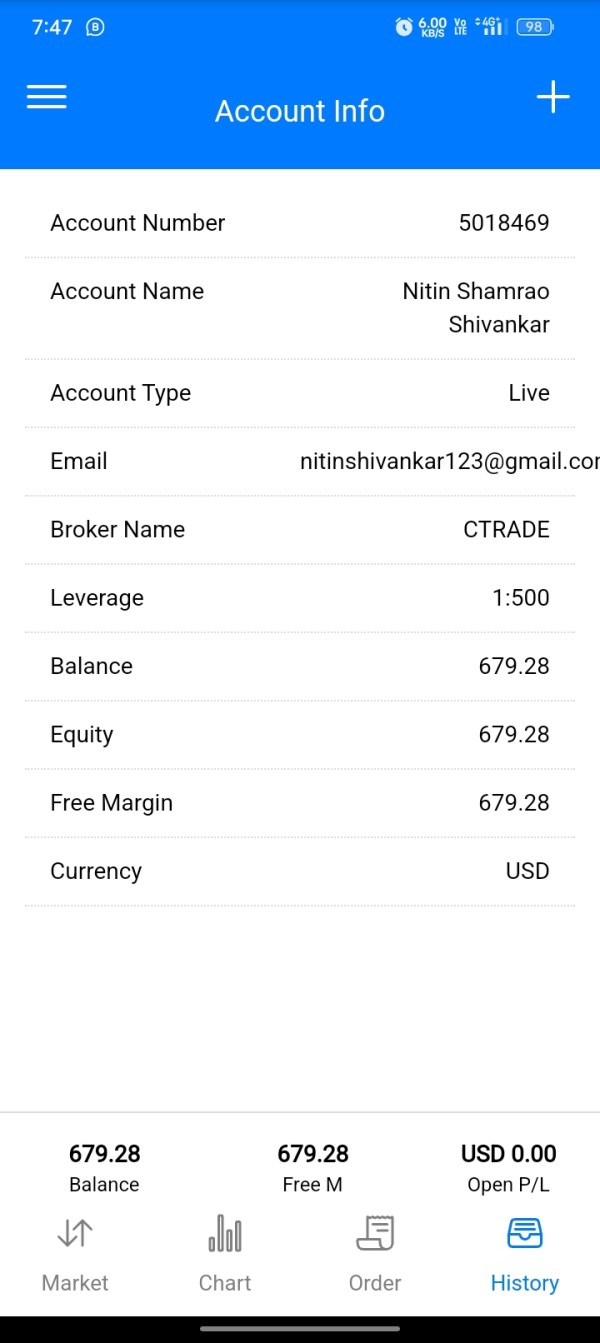

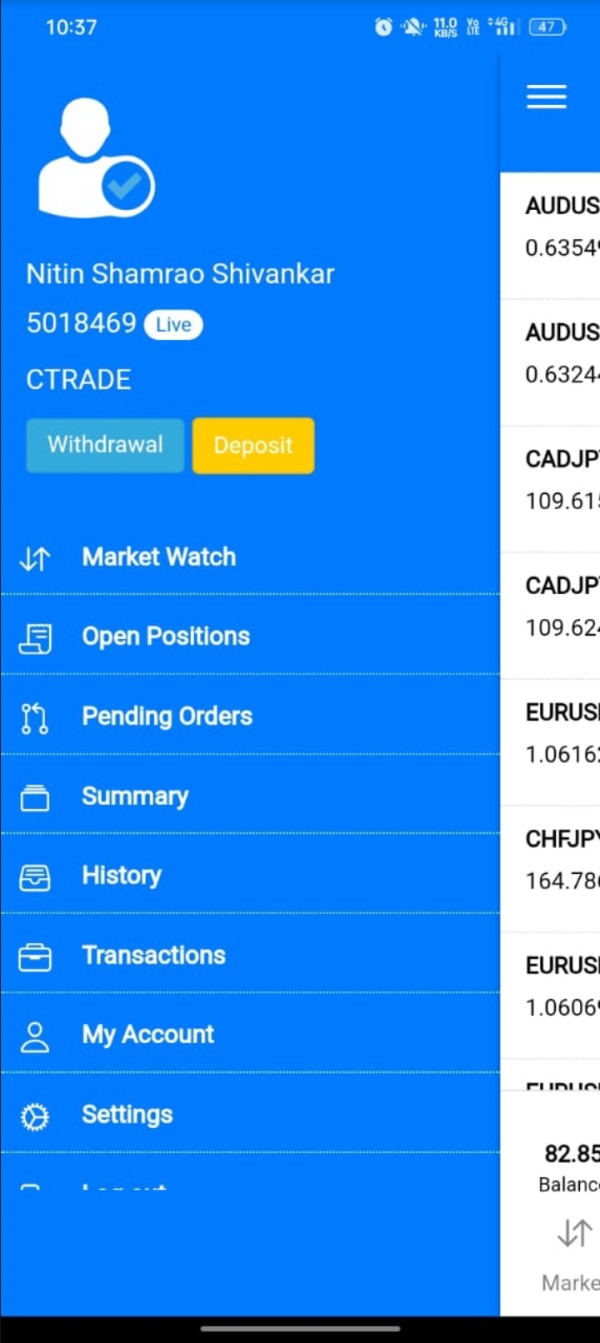

Platform Options: Information regarding trading platform technology, whether proprietary or third-party solutions like MetaTrader, is not specified in this cvc globals review based on available sources.

Geographic Restrictions: Specific information about regional availability and geographic restrictions is not detailed in available documentation.

Customer Support Languages: Available customer service languages and support options are not specified in accessible sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by CVC Globals get a poor rating mainly due to the lack of clear information about account types, features, and requirements. Legitimate forex brokers typically offer detailed specifications about different account tiers, minimum deposit requirements, and special features such as Islamic accounts for Muslim traders.

However, available sources do not provide complete details about CVC Globals' account structure. The absence of clear account opening procedures and verification requirements raises concerns about the platform's following of standard Know Your Customer and Anti-Money Laundering protocols. Established brokers maintain transparent account opening processes that follow international financial regulations, but CVC Globals appears to lack this basic transparency.

User feedback regarding account conditions is notably missing from available sources, which itself represents a concerning indicator. Legitimate brokers typically generate substantial user discussion about account features, benefits, and limitations.

The silence surrounding CVC Globals' account conditions suggests either very limited user engagement or potential issues with account functionality that discourage detailed user reviews. The platform's failure to provide clear information about account types, minimum deposits, and special features significantly impacts its credibility in this cvc globals review. Professional traders require detailed account specifications to make informed decisions about broker selection, and CVC Globals' lack of openness in this area represents a substantial weakness.

CVC Globals gets an extremely poor rating for tools and resources due to the complete absence of information about trading tools, analytical resources, and educational materials. Professional forex brokers typically provide complete suites of trading tools including technical analysis indicators, economic calendars, market research, and automated trading support.

The lack of identifiable research and analysis resources represents a big problem for serious traders who rely on market intelligence and analytical tools for informed decision-making. Established brokers invest heavily in providing market analysis, expert commentary, and research reports to support their clients' trading activities.

Educational resources appear to be entirely missing from CVC Globals' offering, which is particularly concerning given the importance of trader education in responsible forex brokerage. Legitimate brokers typically provide extensive educational materials including webinars, tutorials, market analysis training, and risk management guidance.

The absence of information about automated trading support, API access, or third-party tool integration further reduces the platform's appeal to sophisticated traders. Modern forex trading increasingly relies on automated systems and algorithmic trading, making platform compatibility with these tools essential for competitive brokerage services.

Customer Service and Support Analysis (Score: 2/10)

Customer service and support get a very poor rating based on widespread negative user feedback and the absence of clear support channel information. User reports consistently indicate poor service quality, though specific details about response times, support availability, and resolution effectiveness are not completely documented in available sources.

The lack of clear information about customer service channels, including phone support, email response times, and live chat availability, represents a big concern for potential users. Professional brokers typically provide multiple support channels with clearly stated availability hours and expected response times.

Multilingual support information is not available in accessible sources, which may limit the platform's accessibility to international users. Given the global nature of forex trading, complete language support is typically considered essential for legitimate international brokers.

The absence of positive customer service testimonials or detailed user experiences in available sources suggests systematic issues with support quality. Legitimate brokers typically generate positive customer feedback about support experiences, while the silence surrounding CVC Globals' customer service speaks volumes about potential service problems.

Trading Experience Analysis (Score: 4/10)

The trading experience provided by CVC Globals gets a below-average rating due to limited information about platform stability, execution quality, and overall trading environment. Available sources do not provide detailed user experiences regarding platform performance, order execution speed, or system reliability during peak trading hours.

Platform functionality and feature completeness cannot be properly assessed based on available information, which itself represents a concerning indicator. Professional traders require detailed information about platform capabilities, charting tools, order types, and execution methods to evaluate broker suitability.

Mobile trading experience information is notably missing from available sources, which is particularly concerning given the increasing importance of mobile trading in modern forex markets. Professional brokers typically provide complete mobile solutions with full platform functionality.

User feedback regarding trading experience is mainly negative where available, though specific details about execution problems, platform issues, or trading environment concerns are not completely documented. This cvc globals review notes that the absence of positive trading experience reports represents a big red flag for potential users.

Trust and Safety Analysis (Score: 1/10)

Trust and safety get the lowest possible rating due to basic concerns about regulatory following, fund security, and operational transparency. The absence of verifiable regulatory oversight from recognized financial authorities represents the most critical concern identified in this evaluation.

Fund security measures and client money protection protocols are not detailed in available sources, leaving users without assurance about the safety of their deposits. Legitimate brokers typically maintain separated client accounts, insurance protection, and transparent fund security measures.

Corporate transparency is severely lacking, with limited information available about company ownership, management structure, or operational history. Professional brokers typically provide complete corporate information including regulatory filings, management backgrounds, and operational transparency.

The platform has been specifically identified as potentially fraudulent by multiple sources, which represents an extreme red flag for potential users. Industry reputation and standing appear to be significantly compromised, with warnings about potential scam operations circulating within trading communities.

User Experience Analysis (Score: 2/10)

Overall user experience gets a very poor rating based on mainly negative feedback and the absence of positive user testimonials. Available user reports consistently indicate poor experiences across multiple operational areas, though complete user feedback analysis is limited by the scarcity of detailed reviews.

Interface design and platform usability cannot be properly assessed based on available information, though the absence of positive user comments about platform design suggests potential problems in user experience optimization. Registration and account verification processes are not clearly documented in available sources, which may contribute to user frustration and confusion.

Professional brokers typically provide clear, streamlined account opening procedures with transparent verification requirements. Fund management and deposit/withdrawal experiences are not well-documented in available sources, though the absence of positive feedback about fund operations represents a concerning indicator. The lack of detailed user reports about successful fund management suggests potential issues with deposit and withdrawal processes.

Conclusion

This complete cvc globals review reveals big concerns that strongly advise against engagement with this platform. CVC Globals shows critical problems across all evaluated dimensions, most notably in regulatory following and customer protection.

The absence of verifiable regulatory oversight, combined with widespread negative user feedback and lack of operational transparency, indicates substantial risks for potential users. The platform is particularly unsuitable for risk-averse investors or traders seeking regulated, transparent trading environments.

Professional traders requiring reliable customer service, complete trading tools, and secure fund management should consider alternative brokers with established regulatory credentials and positive user feedback. The primary disadvantages include complete lack of regulatory oversight, poor customer service quality, absence of trading tools and resources, and potential fraud concerns.

No significant advantages have been identified through this evaluation that would offset these substantial risks and problems.