Is CTRL safe?

Pros

Cons

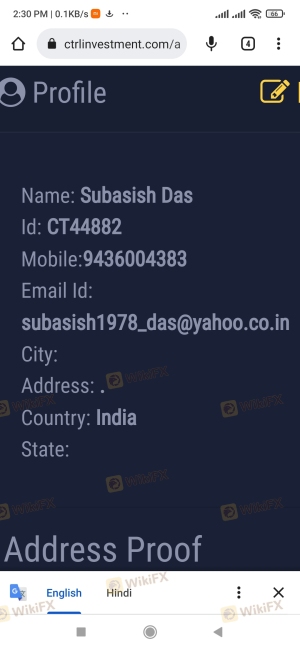

Is Ctrl Investments A Scam?

Introduction

Ctrl Investments is a broker operating in the forex market, primarily based in New Zealand and Australia. Established in 2010, the broker offers a range of trading services, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, traders must exercise caution when selecting a broker to ensure their investments are safe. The potential for scams and fraudulent activities in the industry necessitates a thorough evaluation of any broker before committing funds. This article will investigate Ctrl Investments, assessing its regulatory status, company background, trading conditions, and customer experiences to determine whether it is a safe trading option or a potential scam.

Regulation and Legitimacy

Regulation is a crucial aspect of any trading platform, as it provides a level of safety and accountability for traders. Ctrl Investments claims to be regulated by two authorities: the Financial Markets Authority (FMA) in New Zealand and the Australian Securities and Investments Commission (ASIC). However, the quality of regulation and the broker's compliance history are significant factors to consider.

Here is a summary of the regulatory information for Ctrl Investments:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FMA | 197465 | New Zealand | Verified |

| ASIC | 414198 | Australia | Verified |

While the presence of regulation from FMA and ASIC is a positive indicator, Ctrl Investments has faced scrutiny for breaching regulatory rules in the past. The FMA has previously censored the broker for compliance issues, raising concerns about its reliability. Despite holding licenses, the broker's history of regulatory violations necessitates caution, as it indicates a potential risk for traders.

Company Background Investigation

Ctrl Investments Limited, the parent company of Ctrl Investments, has been operational since 2010. The company is headquartered in Auckland, New Zealand, and has expanded its services to Australia. The ownership structure appears straightforward, but the management team's background and experience are essential to understanding the broker's credibility.

The management team at Ctrl Investments consists of professionals with varying degrees of experience in the financial services industry. However, detailed information about the team's qualifications and industry expertise is not readily available, which raises questions about the broker's transparency. Furthermore, the lack of comprehensive information on the company's website regarding its operational history and management can be concerning for potential traders.

Transparency is critical in establishing trust between a broker and its clients. Ctrl Investments does not provide sufficient information on its website regarding its operations, which may leave potential clients feeling uncertain about the broker's legitimacy. The absence of clear communication and detailed disclosures can hinder traders' confidence in the broker's practices.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is crucial. Ctrl Investments claims to offer competitive trading conditions; however, the details surrounding its fee structure are somewhat ambiguous. Traders should be aware of any hidden fees that could impact their profitability.

Here is a comparison of core trading costs at Ctrl Investments:

| Fee Type | Ctrl Investments | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.8 pips | 1.5 pips |

| Commission Model | None (claims) | Varies |

| Overnight Interest Range | Not disclosed | Varies |

While Ctrl Investments markets itself as a commission-free broker, the spreads on major currency pairs are slightly higher than the industry average. This discrepancy could indicate that while there are no explicit commissions, traders may end up paying more through wider spreads. Additionally, the lack of information regarding overnight interest rates raises concerns about potential hidden costs that could affect traders' bottom lines.

The broker's unclear fee structure and lack of transparency regarding costs necessitate caution. Traders should ensure they fully understand all potential charges before opening an account with Ctrl Investments.

Customer Funds Safety

The safety of customer funds is a primary concern for traders. Ctrl Investments claims to implement various measures to safeguard client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is essential to evaluate.

Ctrl Investments asserts that client funds are held in segregated accounts, which is a standard practice among regulated brokers. This practice helps ensure that client funds are protected in the event of the broker's insolvency. However, the absence of detailed information regarding investor protection schemes or negative balance protection raises concerns. Traders need to know that their investments are secure and that they will not incur losses beyond their initial deposits.

Historically, Ctrl Investments has faced allegations regarding fund safety, with some traders reporting difficulties in withdrawing their funds. Such issues can severely impact trader confidence and highlight potential risks associated with using the broker.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing a broker's reliability. Ctrl Investments has received mixed reviews from clients, with several complaints highlighting issues with fund withdrawals and customer service responsiveness.

Here are some common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| High Fees | Medium | Average |

Many users have reported feeling pressured to deposit funds and have expressed frustration over difficulties in withdrawing their capital. A few notable cases illustrate these concerns: one trader reported being unable to access funds after submitting multiple withdrawal requests, while another highlighted the lack of support from customer service when seeking assistance.

These complaints underscore the importance of assessing a broker's customer service and responsiveness, as these factors are critical to a positive trading experience. The recurring nature of these complaints raises red flags about the broker's reliability.

Platform and Execution

The trading platform offered by Ctrl Investments is another critical aspect to consider. The broker utilizes the widely recognized MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust features. However, the overall performance, stability, and execution quality of the platform are also essential.

Traders have reported mixed experiences with order execution quality, with some noting instances of slippage and delays in order processing. The absence of a proprietary platform may limit the broker's ability to offer advanced features that some traders desire. Additionally, concerns about potential platform manipulation have been raised, particularly in light of customer complaints regarding execution issues.

Risk Assessment

Using Ctrl Investments presents several risks that traders must be aware of. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | History of regulatory breaches |

| Fund Withdrawal Issues | High | Numerous complaints on withdrawal delays |

| Transparency | Medium | Lack of clear information on fees |

To mitigate these risks, traders should conduct thorough research before engaging with Ctrl Investments. It is advisable to start with a demo account to familiarize themselves with the platform and trading conditions before committing real funds.

Conclusion and Recommendations

In conclusion, while Ctrl Investments is regulated by FMA and ASIC, its history of regulatory breaches and numerous customer complaints raises significant concerns about its reliability. The broker's lack of transparency regarding fees and withdrawal policies, combined with mixed customer experiences, suggests that traders should exercise caution when considering this broker.

For those seeking a reliable trading experience, it may be prudent to explore alternative brokers with a proven track record of customer satisfaction and regulatory compliance. Consider brokers that are well-established and have positive reviews from users, such as those regulated by the FCA or CySEC.

Ultimately, while Ctrl Investments may not be an outright scam, the potential risks and concerns warrant careful consideration before proceeding with any investments.

Is CTRL a scam, or is it legit?

The latest exposure and evaluation content of CTRL brokers.

CTRL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CTRL latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.