Regarding the legitimacy of CF Group forex brokers, it provides VFSC and WikiBit, .

Is CF Group safe?

Business

License

Is CF Group markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

CF Group Limited

Effective Date:

2021-05-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CF Group A Scam?

Introduction

CF Group is a forex and CFD brokerage that positions itself as a provider of trading services to retail and institutional clients. Operating primarily in the online trading space, CF Group claims to offer a range of financial products and services aimed at enhancing trading opportunities for its users. However, the forex market is rife with potential pitfalls, and traders must exercise caution when evaluating brokers. The importance of due diligence cannot be overstated, as unregulated or poorly regulated brokers can expose traders to significant risks, including the loss of funds.

In this article, we will thoroughly investigate CF Group's legitimacy and safety. We will analyze its regulatory status, company background, trading conditions, client fund security, customer experience, platform performance, and associated risks. Our investigation is based on a comprehensive review of available online resources, user feedback, and regulatory information, aiming to provide a balanced and informative assessment of whether CF Group is safe to trade with or if it leans towards being a scam.

Regulation and Legitimacy

CF Group's regulatory status is a critical factor in determining its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established standards and practices. Unfortunately, CF Group has been flagged for lacking adequate regulation. Below is a summary of the regulatory information associated with CF Group:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001273790 | Australia | Revoked |

| VFSC | 41693 | Vanuatu | Revoked |

| FSPR | 507506 | New Zealand | Suspicious Clone |

CF Group claims to be regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Markets Authority (FMA) in New Zealand; however, these claims are misleading. The FCA has confirmed that CF Group is not registered, and the FMA has issued warnings against the broker, advising potential clients to exercise extreme caution. The absence of legitimate regulation raises red flags about the broker's credibility and operational integrity, leading many to question whether CF Group is safe for trading.

Company Background Investigation

CF Group was established in 2019 and claims to be headquartered in London. The company operates two subsidiaries: CF Global UK Limited and CF Group Limited in New Zealand. Despite its claims of regulatory compliance, the company has a murky ownership structure and limited transparency regarding its management team.

A thorough investigation reveals that CF Group has faced scrutiny for its lack of clear information about its operations and ownership. Transparency is crucial in the financial services sector, and the absence of publicly available information about key executives and their qualifications raises concerns about the broker's reliability. Additionally, the company's claims of accolades and awards are unsubstantiated, further diminishing its credibility. The lack of transparency and accountability suggests that CF Group is not safe for traders looking for a trustworthy brokerage.

Trading Conditions Analysis

CF Group offers a variety of trading options, including forex pairs and CFDs on commodities, indices, and cryptocurrencies. However, the overall fee structure and trading conditions warrant scrutiny. While the broker advertises competitive spreads and low minimum deposit requirements, there are concerns regarding hidden fees and unfavorable trading conditions.

Heres a comparative overview of the core trading costs associated with CF Group versus industry averages:

| Fee Type | CF Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not disclosed) | 1.0 - 2.0 pips |

| Commission Model | Not specified | $5 - $10 per lot |

| Overnight Interest Range | Not disclosed | Varies (usually 2-5%) |

The lack of transparency regarding spreads and commissions raises concerns about potential hidden costs that could impact trading profitability. Moreover, traders have reported issues with withdrawal processes and unexpected fees, which further complicates the trading experience. Given these factors, it is imperative to question whether CF Group is safe for traders who seek a reliable and cost-effective trading environment.

Client Fund Security

When evaluating a broker's safety, the security of client funds is paramount. CF Group claims to implement measures for fund protection, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable, especially in light of the broker's lack of regulation.

The absence of a robust regulatory framework means that CF Group is not held to the same standards as regulated brokers, which typically have stringent requirements for fund protection. Additionally, there have been reports of difficulties in withdrawing funds, which raises concerns about the broker's financial practices and stability. Historical issues related to fund security further underscore the importance of asking whether CF Group is safe for traders looking to protect their investments.

Customer Experience and Complaints

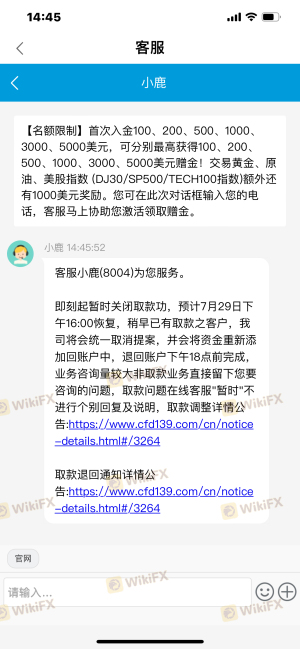

User feedback and experiences play a crucial role in assessing a broker's reliability. A review of customer experiences with CF Group reveals a pattern of complaints related to withdrawal issues, account freezes, and poor customer service. Many users have reported being unable to access their funds or experiencing significant delays in processing withdrawals.

Heres a breakdown of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or no response |

| Account Freezes | High | No clear communication |

| Poor Customer Support | Medium | Inconsistent responses |

For instance, one user reported that their account was frozen without explanation, leading to a frustrating experience when attempting to retrieve their funds. Another user highlighted the lack of responsiveness from customer service when seeking assistance. Such complaints indicate a troubling trend that raises questions about whether CF Group is safe for prospective traders.

Platform and Execution

The trading platform provided by CF Group is another critical aspect to consider. Users have reported mixed experiences regarding platform stability, execution quality, and overall user experience. Issues such as slippage and order rejections have been noted, which can significantly impact trading outcomes.

The absence of a demo account for prospective traders to test the platform adds to the concerns surrounding CF Group. Without the ability to assess the platform's performance before committing funds, traders may find themselves at a disadvantage. Furthermore, the potential for platform manipulation raises additional questions about the broker's integrity. Consequently, traders must carefully consider whether CF Group is safe for executing their trading strategies.

Risk Assessment

Engaging with a broker like CF Group involves inherent risks that traders must acknowledge. The combination of regulatory issues, customer complaints, and platform performance creates a precarious trading environment. Below is a risk assessment summarizing the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises concerns about accountability. |

| Financial Risk | High | Reports of withdrawal issues suggest potential financial instability. |

| Operational Risk | Medium | Platform performance issues could affect trade execution. |

| Customer Service Risk | High | Poor response to complaints indicates a lack of support. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with established regulatory frameworks and positive user experiences. It is essential to weigh the potential benefits against the risks associated with trading through CF Group, as the overall assessment leans toward a negative conclusion regarding whether CF Group is safe.

Conclusion and Recommendations

In conclusion, the investigation into CF Group reveals significant concerns regarding its legitimacy and safety as a trading platform. The lack of proper regulation, combined with numerous user complaints and questionable business practices, strongly suggests that CF Group is not safe for traders.

For those considering trading in the forex market, it is advisable to seek out well-regulated brokers with transparent operations and a solid reputation. Alternatives such as brokers regulated by the FCA or ASIC should be prioritized to ensure a safer trading environment. Ultimately, traders must exercise caution and conduct thorough due diligence to protect their investments and avoid potential scams in the forex market.

Is CF Group a scam, or is it legit?

The latest exposure and evaluation content of CF Group brokers.

CF Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CF Group latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.