Cf Group 2025 Review: Everything You Need to Know

Executive Summary

This Cf Group review shows major concerns about this financial services provider's regulatory status and overall safety for traders. Based on available information, Cf Group offers clients access to various financial instruments and personalized solutions for managing investments and insurance obligations. However, the platform's activities are not controlled by leading financial regulators, which raises serious questions about the reliability and safety of working with this broker.

The company targets users seeking investment and insurance management services. Potential clients express considerable concerns about security and regulatory oversight. While Cf Group provides multiple financial instruments and tailored solutions, the absence of proper regulatory supervision creates substantial risks for traders. This Cf Group review highlights the critical importance of regulatory compliance in today's financial landscape.

The platform's lack of transparency regarding key operational details creates problems. Combined with user skepticism about safety measures, this positions it unfavorably compared to properly regulated alternatives in the competitive forex and CFD trading market.

Important Disclaimer

This review is based on publicly available information and user feedback collected from various sources. Traders should be aware that different regional entities may operate under varying legal frameworks and regulatory requirements. The evaluation presented here reflects the current available data and may not represent all aspects of Cf Group's operations across different jurisdictions.

Our assessment methodology incorporates user testimonials, regulatory database searches, and industry standard comparisons. Given the limited regulatory information available for this platform, potential users should exercise particular caution and conduct additional research before engaging with any services offered by Cf Group.

Rating Framework

Broker Overview

Cf Group operates as a financial services provider focusing on investment and insurance management solutions. The company positions itself as offering personalized approaches to help clients manage their financial obligations and investment portfolios. However, specific details about the company's establishment date and founding background are not detailed in available materials.

The platform's business model centers around providing access to various financial instruments. The exact nature of these offerings requires further clarification. Based on industry standards and the company's positioning, it likely operates in the forex and CFD trading space, though comprehensive details about asset categories and trading conditions remain limited.

This Cf Group review must emphasize that the platform operates without oversight from major financial regulatory authorities. This absence of regulatory control represents a significant concern for potential users, as regulatory supervision typically provides essential trader protections, dispute resolution mechanisms, and operational transparency requirements that safeguard client interests in the financial services industry.

Regulatory Status: The platform operates without control from leading financial regulatory authorities. This creates substantial concerns about trader protection and operational oversight.

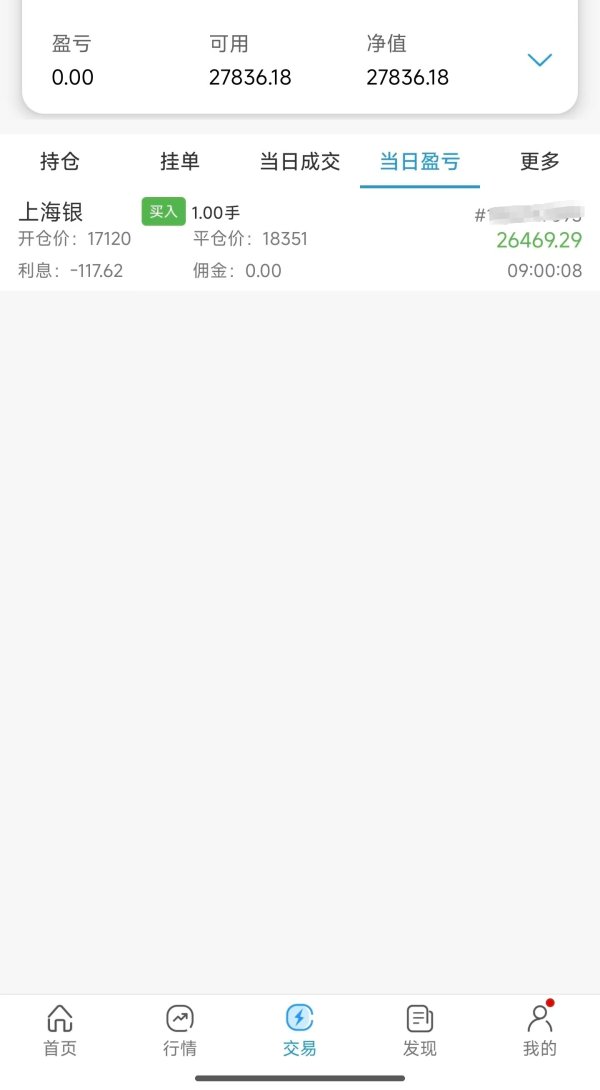

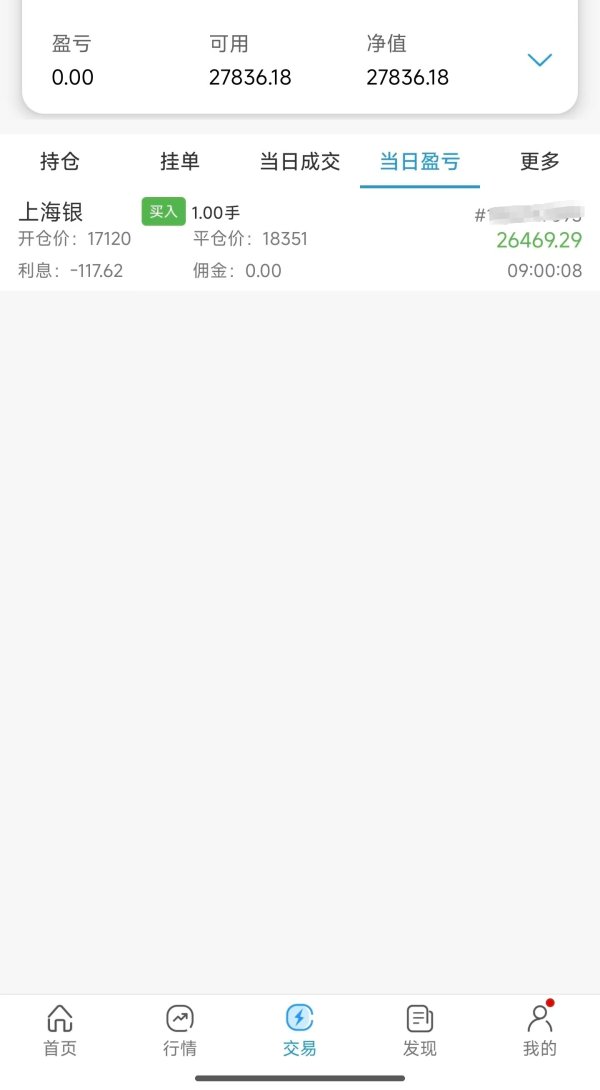

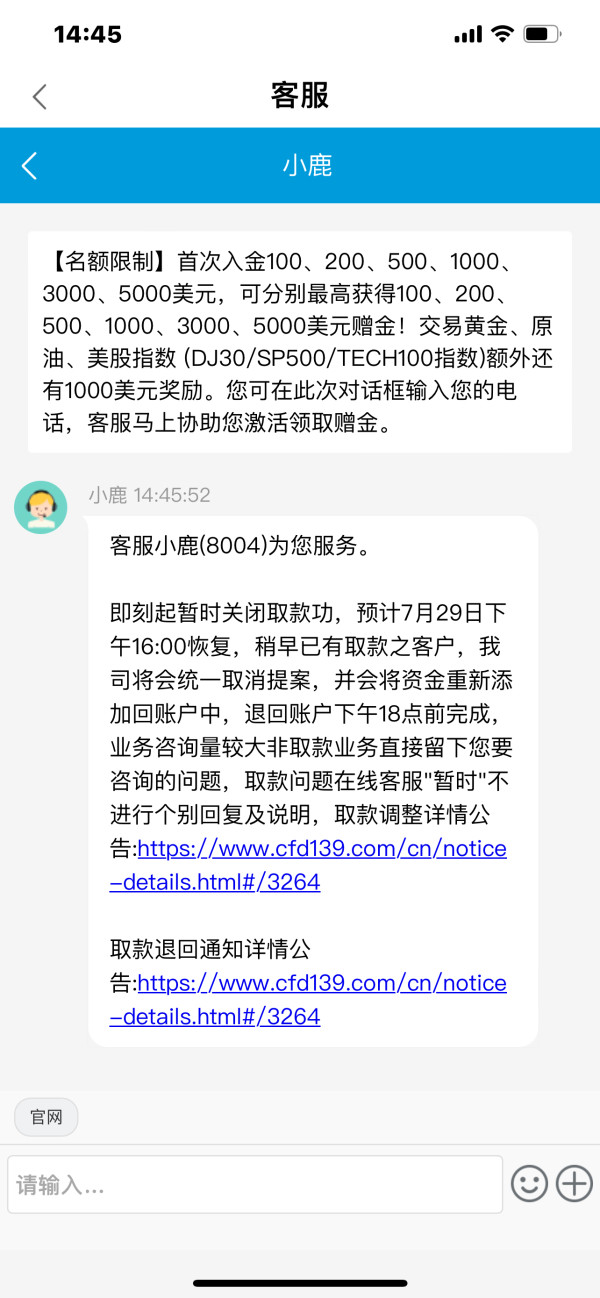

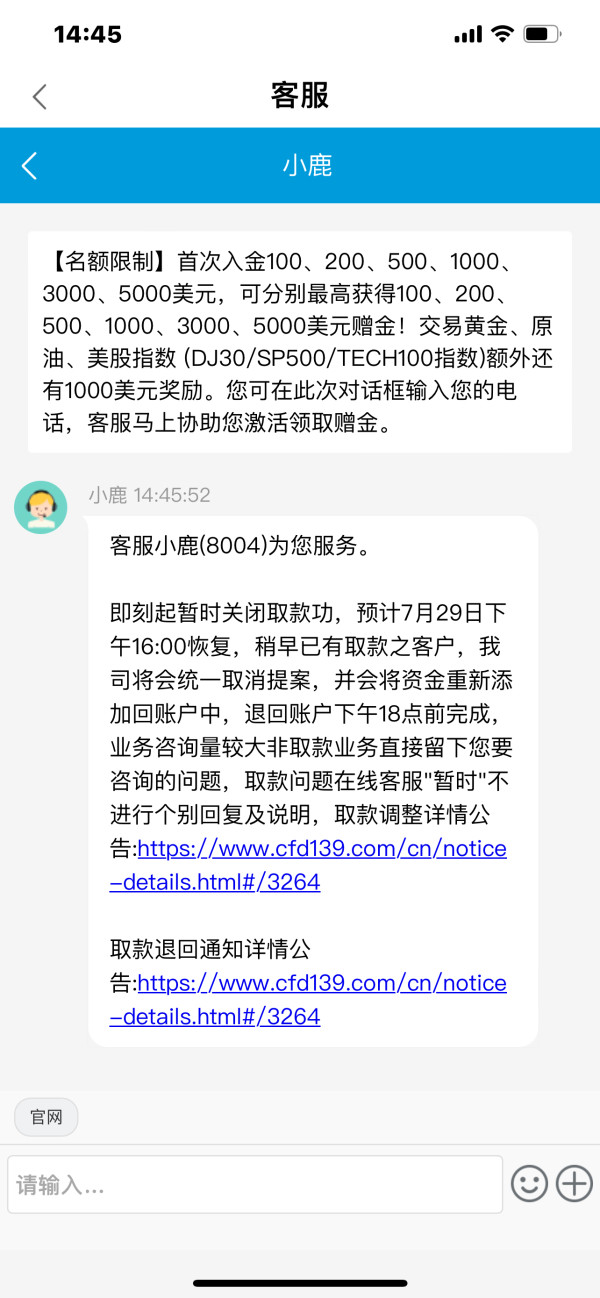

Deposit and Withdrawal Methods: Specific information about funding methods is not detailed in available materials, requiring direct inquiry with the platform.

Minimum Deposit Requirements: Minimum deposit information is not specified in available materials.

Bonuses and Promotions: Details about promotional offers are not detailed in available materials.

Tradeable Assets: Based on the company's positioning, the platform likely offers forex and CFD trading opportunities. Specific asset categories require confirmation.

Cost Structure: Information about spreads, commissions, and fee structures is not detailed in available materials.

Leverage Ratios: Leverage information is not specified in available materials.

Platform Options: Trading platform details are not specified in available materials.

Geographic Restrictions: Regional limitations are not detailed in available materials.

Customer Support Languages: Language support information is not specified in available materials.

This Cf Group review highlights the significant information gaps that potential users face when evaluating this platform. It emphasizes the importance of obtaining comprehensive details before making any trading decisions.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Cf Group's account conditions faces significant limitations due to insufficient publicly available information. Specific details about account types, their distinctive features, and associated benefits are not detailed in available materials. This lack of transparency makes it challenging for potential users to understand what options might be available to them.

Minimum deposit requirements, which typically serve as a key factor in broker selection, are not specified in available materials. Similarly, information about account opening procedures, verification requirements, and timeframes remains unclear. The absence of details about specialized account options, such as Islamic accounts for traders requiring Sharia-compliant services, further complicates the assessment process.

This Cf Group review cannot provide a meaningful evaluation of account conditions without access to comprehensive information about the platform's offerings. The lack of transparent account information represents a significant concern, as reputable brokers typically provide detailed specifications about their account structures, enabling informed decision-making by potential clients.

Potential users should directly contact the platform to obtain specific account condition details. The absence of readily available information may itself be indicative of the platform's approach to transparency and client communication.

Cf Group demonstrates some strength in its tools and resources offering, providing clients with access to multiple financial instruments and personalized solutions for investment and insurance management. This diversified approach suggests the platform recognizes the varied needs of different client types and attempts to address them through tailored service offerings.

The platform's emphasis on personalized solutions indicates a potentially sophisticated approach to client relationship management. Specific details about the nature and extent of these personalized services require further clarification. The availability of various financial instruments suggests breadth in trading opportunities, which could appeal to users seeking diversified investment options.

However, information about research and analysis resources, educational materials, and automated trading support is not detailed in available materials. These components typically form crucial elements of a comprehensive trading environment, helping users make informed decisions and develop their trading capabilities over time.

The limited available information prevents a complete assessment of the platform's analytical tools, market research capabilities, and educational resource quality. Modern traders typically expect access to technical analysis tools, fundamental analysis resources, and ongoing market commentary to support their trading activities.

Customer Service and Support Analysis

The assessment of Cf Group's customer service capabilities faces significant limitations due to the absence of detailed information about support structures and service quality. Available materials do not specify the customer service channels offered, such as live chat, email support, or telephone assistance, making it impossible to evaluate accessibility and convenience factors.

Response time expectations, service quality standards, and problem resolution procedures are not detailed in available materials. These factors typically play crucial roles in trader satisfaction and platform reliability, particularly during market volatility or technical difficulties when prompt support becomes essential.

Information about multilingual support capabilities, customer service hours, and regional support availability remains unspecified. For international traders, these factors often determine the practical viability of using a particular platform, especially when dealing with time-sensitive trading situations or urgent account issues.

The absence of user feedback specifically addressing customer service experiences further complicates the evaluation process. Without access to real user testimonials about support quality, response times, and problem resolution effectiveness, potential clients cannot gauge what level of service to expect from the platform.

Trading Experience Analysis

Evaluating Cf Group's trading experience requires assessment of platform stability, execution quality, and overall functionality. Specific information about these critical factors is not detailed in available materials. Platform reliability and execution speed typically determine trader satisfaction and success, making this information gap particularly concerning for potential users.

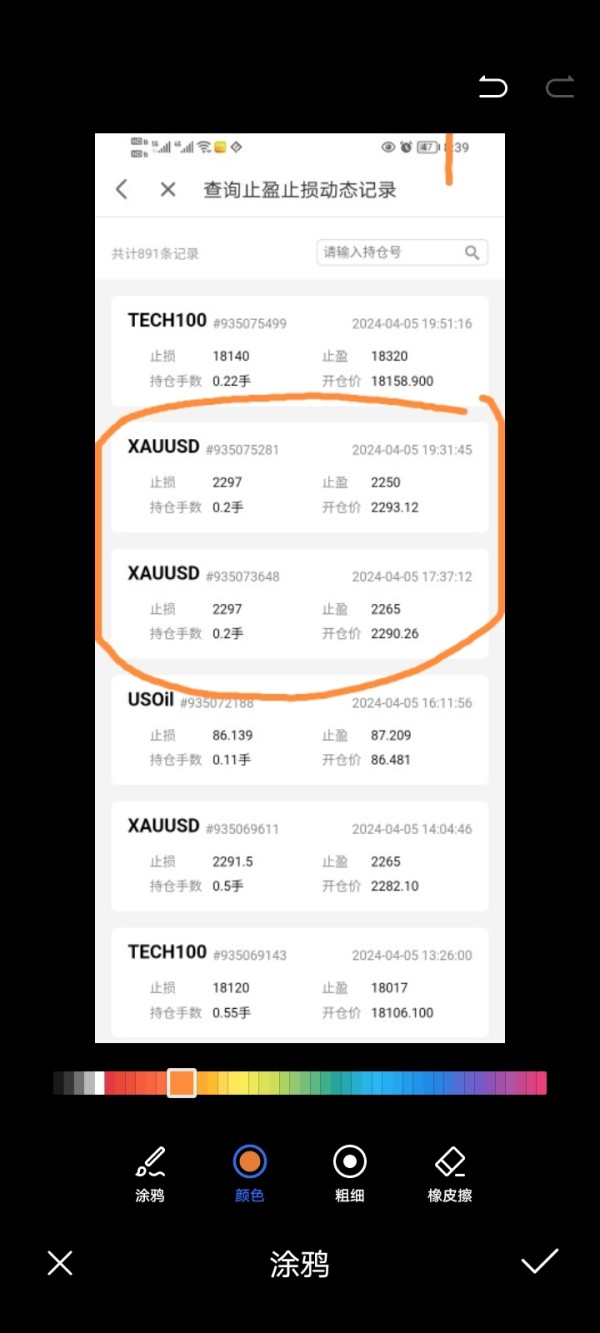

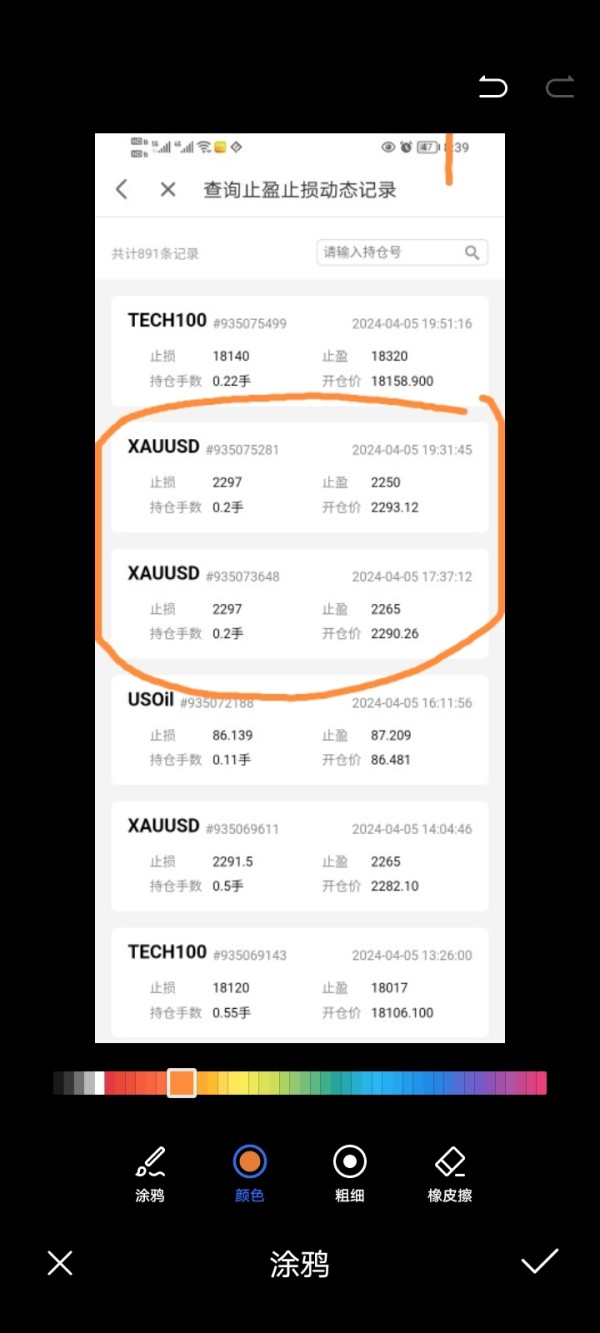

Order execution quality, including factors such as slippage, requotes, and execution speed during volatile market conditions, represents crucial considerations for serious traders. However, available materials do not provide insights into these technical performance aspects, preventing meaningful evaluation of the platform's trading environment quality.

Information about platform functionality, including charting capabilities, technical analysis tools, and order management features, is not specified in available materials. Modern traders typically require sophisticated analytical tools and flexible order management systems to implement their trading strategies effectively.

Mobile trading capabilities and cross-device synchronization, which have become essential features in today's trading environment, are not detailed in available materials. This Cf Group review cannot assess whether the platform meets contemporary expectations for mobile accessibility and multi-device trading support.

Trust and Safety Analysis

The trust and safety evaluation reveals the most significant concerns about Cf Group, primarily stemming from the absence of regulatory oversight by major financial authorities. According to available information, the platform's activities are not controlled by leading financial regulators, which fundamentally undermines trader protection and operational transparency.

Regulatory supervision typically provides essential safeguards including segregated client funds, dispute resolution mechanisms, compensation schemes, and operational oversight that protects traders from various risks. The absence of such regulatory control exposes users to potentially significant risks that regulated alternatives would typically mitigate through mandatory protective measures.

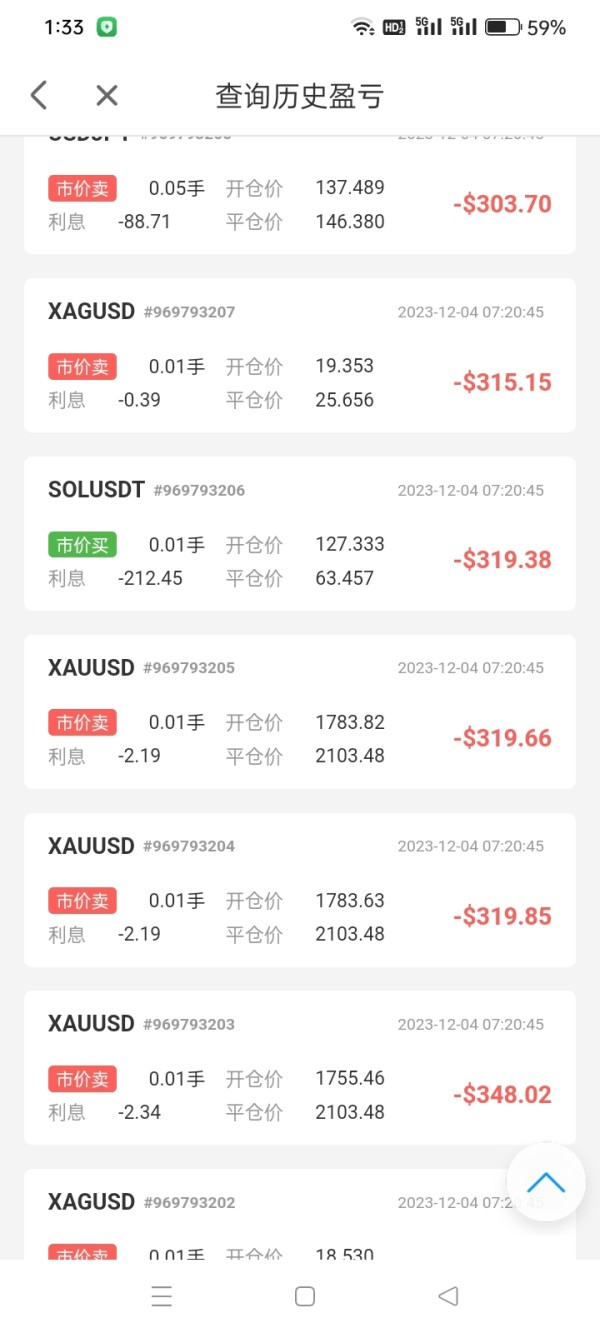

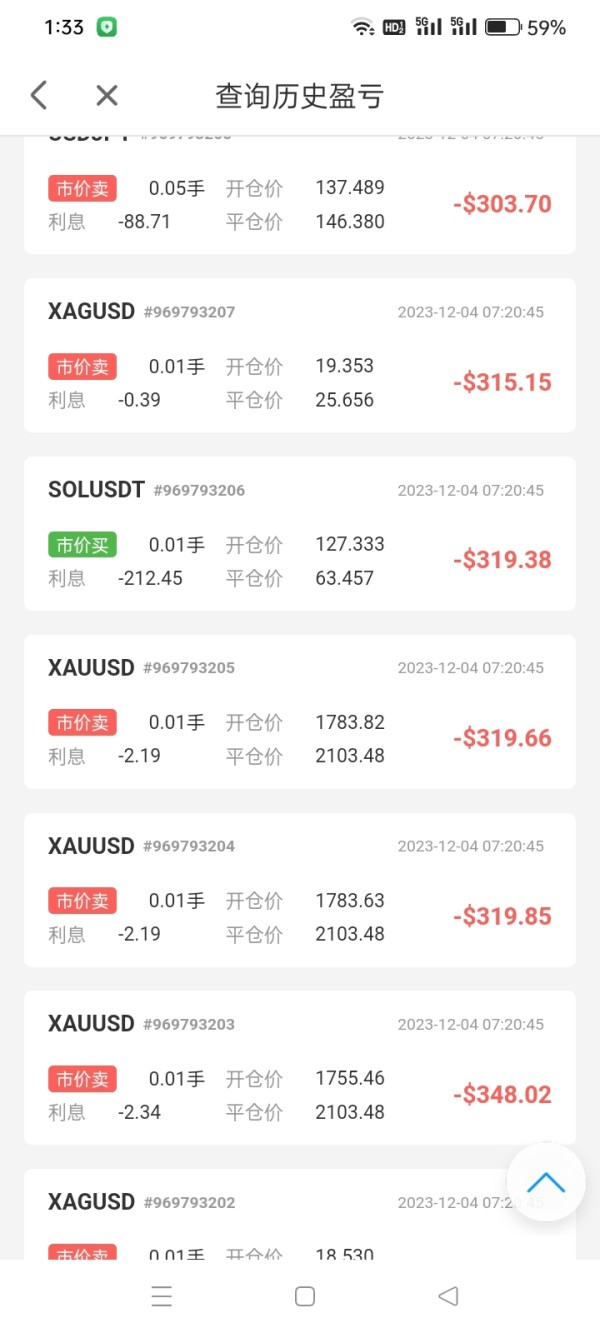

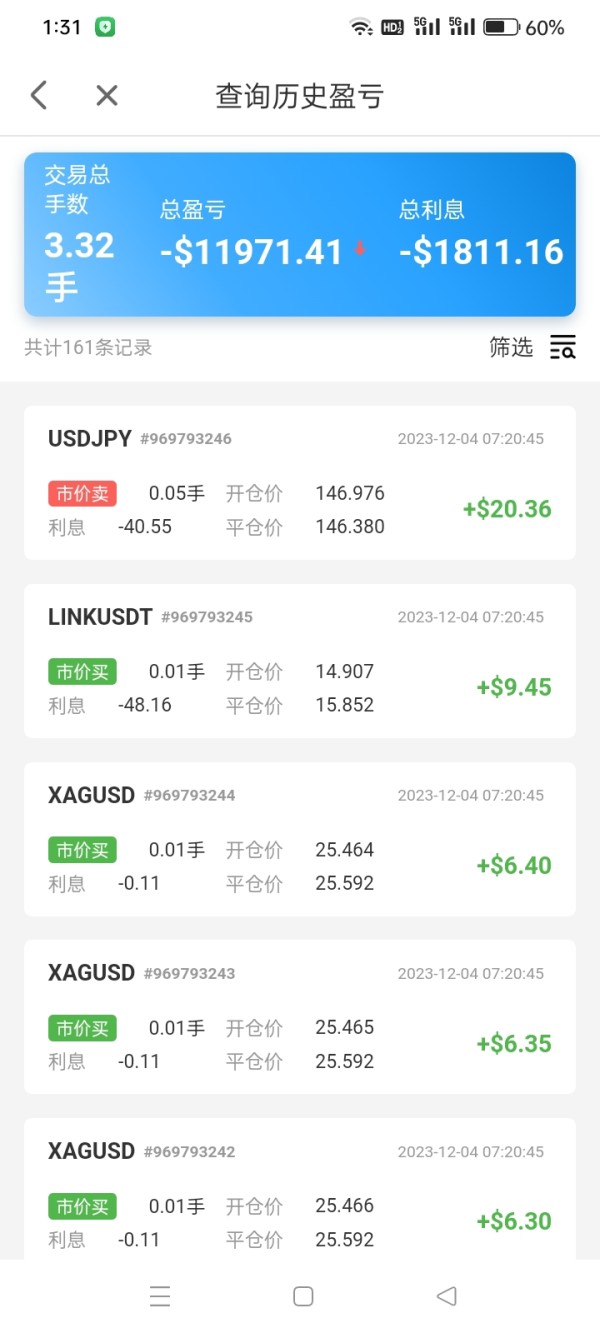

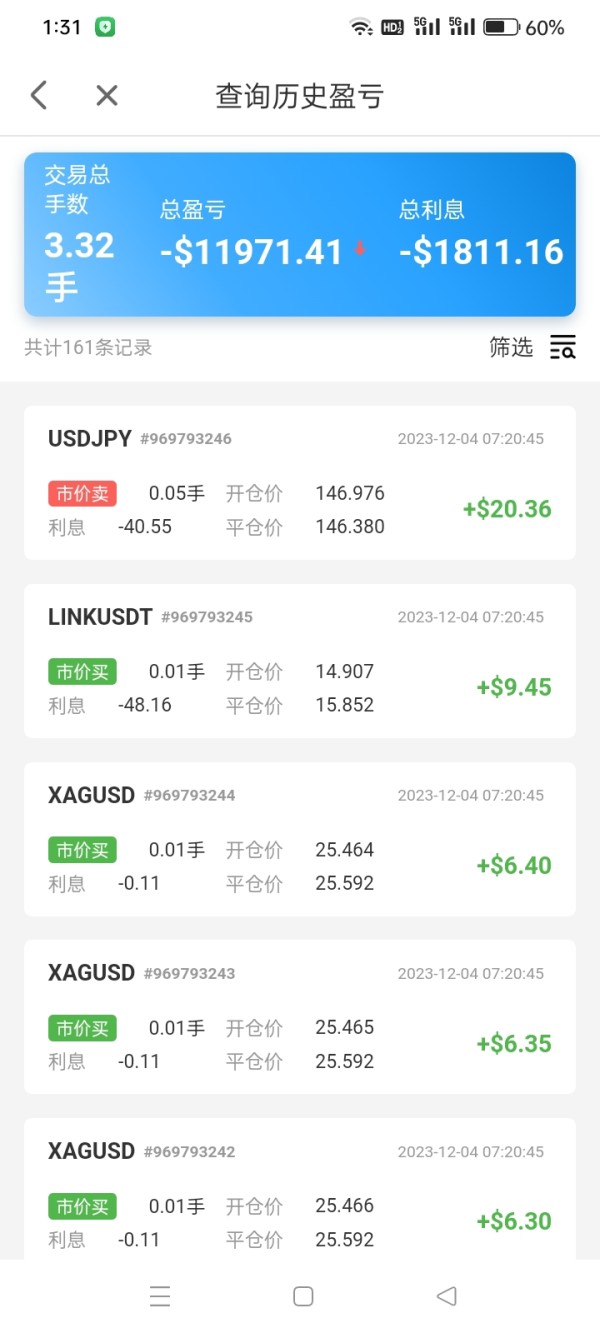

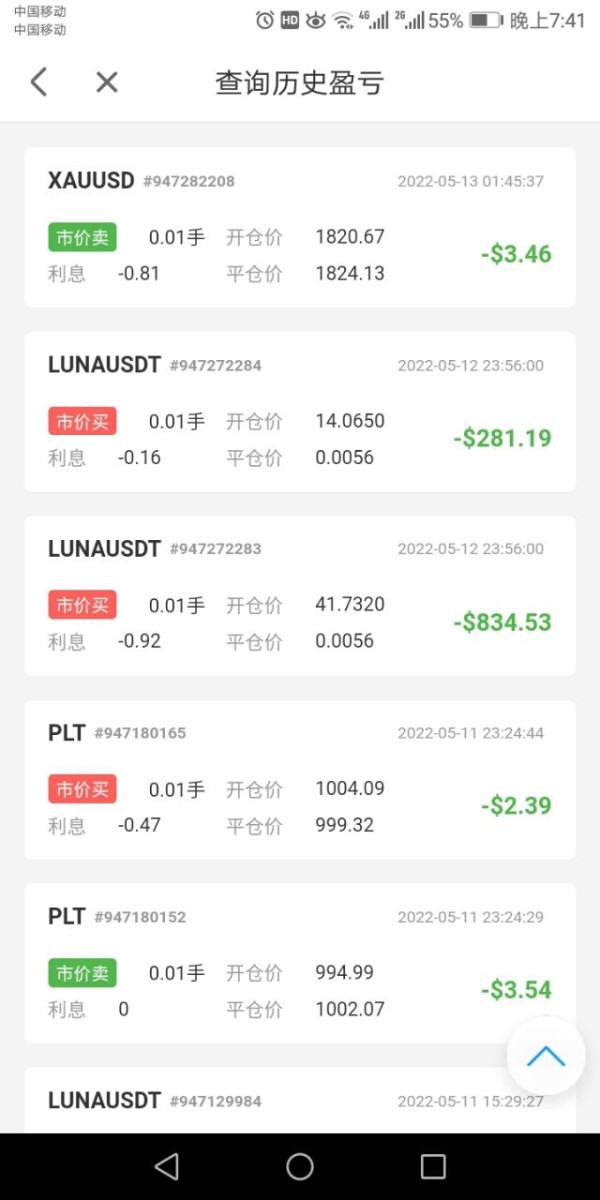

User feedback indicates skepticism about the platform's safety and reliability, with concerns specifically raised about the security of working with this platform. These user concerns, combined with the regulatory oversight absence, create a concerning pattern that potential clients should carefully consider before engaging with the platform.

The lack of information about fund segregation policies, insurance coverage, and operational transparency measures further compounds trust-related concerns. Reputable financial service providers typically maintain clear policies about client fund protection and operational procedures, making the absence of such information particularly noteworthy in this assessment.

User Experience Analysis

The user experience evaluation faces substantial limitations due to insufficient information about interface design, usability factors, and overall client satisfaction levels. Available materials do not provide insights into the platform's user interface quality, navigation ease, or overall design effectiveness, preventing comprehensive assessment of the user experience quality.

Registration and account verification procedures, which significantly impact initial user impressions and onboarding success, are not detailed in available materials. These processes typically set the tone for the entire client relationship and can indicate the platform's approach to user experience optimization and regulatory compliance.

Funding operations experience, including deposit and withdrawal procedures, processing times, and associated fees, remains unspecified in available materials. These operational aspects frequently determine user satisfaction and platform convenience, making their absence from available information particularly problematic for potential users.

The primary user feedback available focuses on safety and security concerns rather than general user experience factors. While this feedback provides valuable insights into user trust levels, it does not address broader user experience elements such as platform functionality, customer service quality, or overall satisfaction with the trading environment provided by Cf Group.

Conclusion

This comprehensive Cf Group review reveals significant concerns that potential users should carefully consider before engaging with this platform. The absence of regulatory oversight by major financial authorities represents the most substantial risk factor, as regulatory supervision typically provides essential trader protections and operational transparency requirements.

While the platform offers multiple financial instruments and personalized solutions, these potential benefits are overshadowed by fundamental safety and transparency concerns. The lack of detailed information about key operational aspects, combined with user skepticism about platform safety, creates a risk profile that may be unsuitable for most traders.

The platform might appeal to users specifically seeking investment and insurance management services who possess high risk tolerance levels. However, the combination of regulatory oversight absence and limited operational transparency makes Cf Group a challenging recommendation compared to properly regulated alternatives available in the competitive financial services marketplace.