Is CBMH safe?

Pros

Cons

Is Cbmh Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, traders are continuously seeking reliable brokers to facilitate their trading activities. One such broker that has garnered attention is Cbmh, a platform that claims to provide various trading services. However, given the high stakes involved in forex trading, it is crucial for traders to exercise caution and thoroughly evaluate the credibility of any broker they consider engaging with. This article aims to investigate the legitimacy of Cbmh, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The findings are based on a comprehensive analysis of multiple sources, including user reviews, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory environment in which a broker operates is paramount in determining its legitimacy and trustworthiness. Cbmh operates as an unregulated broker, which raises significant concerns regarding investor protection. Without oversight from a recognized financial authority, clients have limited recourse in the event of disputes or misconduct. The following table summarizes the core regulatory information regarding Cbmh:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of valid regulatory oversight is a major red flag for potential investors. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US enforce stringent standards to protect traders. The lack of such oversight for Cbmh means that there are no guarantees regarding the safety of client funds or the transparency of trading practices. Historical compliance records are also absent, which further diminishes the broker's credibility. It is essential for traders to recognize that engaging with unregulated brokers like Cbmh exposes them to heightened risks, including potential fraud and loss of funds.

Company Background Investigation

Understanding the background of a broker is crucial in assessing its reliability. Cbmh Company Limited was incorporated on October 21, 2020, in the United Kingdom, with a registration number of 12964514. However, the company status is currently listed as dissolved as of April 12, 2022. This dissolution raises questions about the broker's operational integrity and longevity. The ownership structure and management team details are sparse, which is concerning as transparency is a critical factor in establishing trust in a financial institution.

The lack of a clear and accessible company history, along with the dissolution status, suggests that Cbmh may not have the stability or commitment necessary to serve its clients effectively. Furthermore, the absence of information regarding the qualifications and expertise of the management team leaves potential investors in the dark about who is handling their funds. This lack of transparency is indicative of a company that may not prioritize the interests of its clients, further contributing to the perception that Cbmh is not safe.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Cbmh claims to provide a range of trading instruments, including forex, CFDs, binary options, stocks, and cryptocurrencies. However, the overall fee structure and potential hidden costs warrant closer scrutiny. Below is a comparison of core trading costs associated with Cbmh:

| Cost Type | Cbmh | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (1.5 pips) | 1.0 – 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Low to Moderate |

The spreads offered by Cbmh are relatively high compared to industry standards, which can significantly impact trading profitability. Additionally, the absence of a clear commission structure raises concerns about potential hidden fees that may be levied on traders. Such discrepancies in trading conditions could lead to unexpected costs, making it difficult for traders to accurately assess their potential returns.

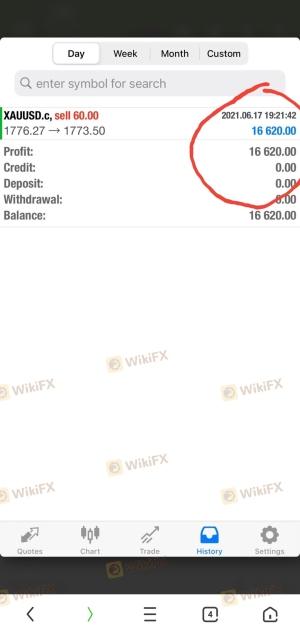

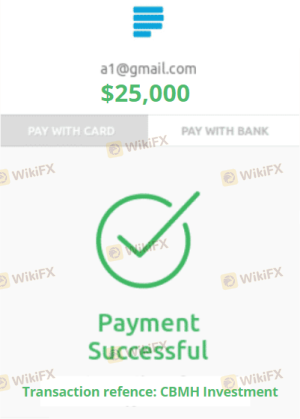

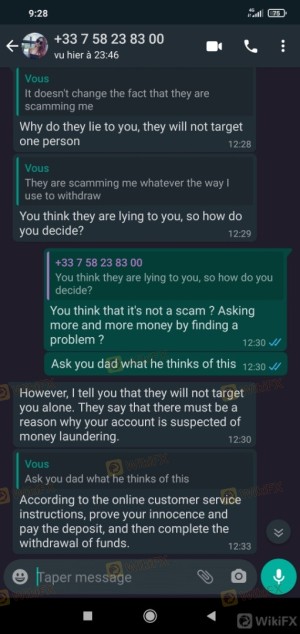

Moreover, traders have reported issues related to withdrawal processes, with many users claiming they faced excessive delays or were asked to pay additional fees before accessing their funds. This pattern of behavior is highly concerning and suggests that Cbmh may not be safe for traders looking to manage their investments effectively.

Client Fund Security

The security of client funds is a critical aspect of any brokerage's credibility. Cbmh has been scrutinized for its lack of robust security measures. The absence of regulatory oversight means that there are no mandated requirements for fund segregation or investor protection schemes, which are typically enforced by regulated brokers. Without these safeguards, clients' funds are at risk of being mismanaged or lost entirely.

Furthermore, there have been allegations of past incidents involving difficulties in withdrawing funds, which raises questions about the broker's integrity and operational practices. A broker that does not prioritize the safety of client funds or provides vague policies regarding fund protection is likely to be viewed as untrustworthy. Therefore, it is imperative for potential clients to consider these factors seriously when assessing whether Cbmh is a scam.

Customer Experience and Complaints

Customer feedback is an invaluable resource for evaluating a broker's reliability. Numerous reviews and reports from users indicate a troubling trend of complaints regarding Cbmh. Common issues include unresponsive customer service, withdrawal difficulties, and pressure to deposit additional funds. Below is a summary of the main types of complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Poor |

| Misleading Information | High | Nonexistent |

Several users have shared experiences of being unable to withdraw their funds, often after being asked to pay additional fees or taxes. These practices are characteristic of fraudulent schemes, further solidifying the notion that Cbmh is not safe for traders. One notable case involved a user who was encouraged to invest larger sums under the pretense of earning substantial returns, only to later face significant hurdles when attempting to access their capital.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Cbmh utilizes the popular MetaTrader 4 platform, which is known for its user-friendly interface and advanced trading tools. However, reports of execution issues, including slippage and order rejections, have surfaced among users. These problems can severely impact trading outcomes and raise concerns about the broker's operational integrity.

Additionally, there are indications that the platform may exhibit signs of manipulation, with users reporting discrepancies in pricing and execution times. Such practices are highly unethical and can lead to significant financial losses for traders. Given these factors, it is essential for potential clients to approach Cbmh with caution, as the platform's reliability remains in question.

Risk Assessment

Engaging with Cbmh carries a multitude of risks that traders must consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Financial Risk | High | High spreads and potential withdrawal issues. |

| Operational Risk | Medium | Issues with platform execution and customer service. |

| Security Risk | High | Lack of fund protection and segregation measures. |

To mitigate these risks, potential traders are advised to conduct thorough research and consider alternative, regulated brokers that provide greater security and transparency. Engaging with a broker that is overseen by a reputable regulatory authority can significantly reduce the likelihood of encountering fraudulent practices.

Conclusion and Recommendations

In conclusion, the investigation into Cbmh reveals several alarming indicators that suggest it may not be a safe option for forex trading. The lack of regulatory oversight, combined with a history of customer complaints and questionable trading conditions, raises significant red flags. Traders should exercise extreme caution and consider the potential risks associated with engaging with Cbmh.

For those seeking reliable trading partners, it is advisable to explore alternatives that are regulated and have a proven track record of transparency and customer satisfaction. Brokers such as FXPro, IC Markets, and Exness are examples of reputable firms that prioritize client safety and regulatory compliance. Ultimately, ensuring the safety of your investments should be the top priority when navigating the forex market.

Is CBMH a scam, or is it legit?

The latest exposure and evaluation content of CBMH brokers.

CBMH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CBMH latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.