Is BV Trading safe?

Business

License

Is BV Trading Safe or Scam?

Introduction

BV Trading is an online brokerage that operates in the forex market, offering a range of trading services in currencies, commodities, indices, and cryptocurrencies. As the financial landscape continues to evolve, the proliferation of online trading platforms has raised concerns about the legitimacy and safety of many brokers. For traders, especially those new to the market, it is crucial to conduct thorough evaluations of forex brokers to avoid potential scams and ensure the safety of their investments. This article aims to assess whether BV Trading is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, and customer experiences. The investigation is based on a comprehensive review of available data from reputable sources and user feedback.

Regulation and Legitimacy

When evaluating a forex broker, the regulatory framework is a critical factor that determines its legitimacy and operational integrity. BV Trading currently operates without any recognized financial regulatory oversight, which raises significant concerns regarding its trustworthiness. The absence of regulation means that BV Trading is not subject to the stringent requirements imposed by regulatory authorities, which are designed to protect traders and ensure fair trading practices. Below is a summary of the regulatory information for BV Trading:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of a regulatory license is a major red flag for potential clients. Regulated brokers are required to adhere to strict operational standards, including maintaining segregated client accounts, conducting regular audits, and ensuring transparency in their operations. In contrast, unregulated brokers like BV Trading can operate with minimal oversight, increasing the risk of fraudulent activities and financial mismanagement. Traders are advised to exercise extreme caution when dealing with unregulated entities, as there is a higher likelihood of encountering scams or unfair treatment.

Company Background Investigation

BV Trading's operational history is another essential aspect to consider when assessing its safety. The company claims to have been in operation for approximately 5 to 10 years, with its registered location in Switzerland. However, specific details regarding its founding, ownership structure, and management team remain unclear. The lack of transparency in these areas raises concerns about the credibility of the broker.

A thorough examination of the management team's qualifications and experience is crucial in determining the broker's reliability. Unfortunately, information regarding the key personnel at BV Trading is sparse, which further complicates the evaluation of the company's integrity. Without a clear understanding of the management's professional background, it becomes challenging to ascertain whether the broker operates with the necessary expertise and ethical standards.

Additionally, the company's website has been reported as down, which is another troubling indicator of its operational stability. Brokers that prioritize transparency typically provide comprehensive information about their services, management, and corporate history. In the case of BV Trading, the lack of available information suggests a potential lack of commitment to fostering trust with its clients.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's overall experience and profitability. BV Trading provides various account types, including starter, advanced, and pro elite accounts, with a minimum deposit requirement starting at $100. The leverage offered by the broker is notably high, reaching up to 1:500, which can amplify both potential profits and losses.

However, the overall cost structure is not clearly defined, leading to potential confusion among traders. Below is a comparative table of the core trading costs associated with BV Trading:

| Cost Type | BV Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 1.0 pip | Typically 0.5 - 1.5 pips |

| Commission Model | Not specified | Varies widely |

| Overnight Interest Range | Not disclosed | Typically available |

The lack of clarity regarding commissions and overnight interest rates is concerning. Many traders have reported unexpected fees or unfavorable trading conditions when dealing with unregulated brokers, which can lead to financial losses. It is essential for traders to fully understand the cost structure before committing to any broker, especially one with questionable regulatory oversight.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. BV Trading's lack of regulation raises significant concerns regarding its fund protection measures. Regulated brokers are required to implement strict protocols for safeguarding client funds, including the segregation of client accounts and participation in compensation schemes. In contrast, BV Trading's unregulated status means that it may not have such safeguards in place.

Furthermore, there is limited information available regarding BV Trading's policies on negative balance protection and investor compensation. Traders should be aware that engaging with unregulated brokers can expose them to substantial risks, including the potential loss of their invested capital. Historical data on BV Trading does not indicate any major fund security issues, but the absence of a regulatory framework means that clients have limited recourse in the event of disputes or financial mismanagement.

Customer Experience and Complaints

Understanding customer experiences and feedback is crucial in evaluating the reliability of any broker. BV Trading has received mixed reviews from users, with some praising its trading platform and range of instruments, while others have expressed concerns about customer support and withdrawal processes. Common complaints include difficulties in withdrawing funds, lack of responsiveness from customer service, and unclear trading conditions. Below is a summary of the primary complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Limited response |

| Customer Support Quality | Medium | Slow and unhelpful |

| Transparency in Fees | High | No clear communication |

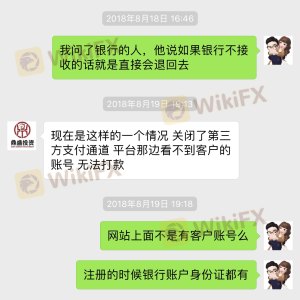

Two notable cases involve clients reporting significant delays in fund withdrawals, leading to frustration and distrust. In one instance, a trader claimed to have waited over a month for a withdrawal request to be processed, only to receive vague responses from customer support. Such experiences are indicative of potential operational inefficiencies and raise questions about the broker's commitment to client satisfaction.

Platform and Trade Execution

The trading platform's performance, stability, and user experience are vital components of a broker's offering. BV Trading utilizes the widely recognized MetaTrader 4 and MetaTrader 5 platforms, which are favored by many traders for their functionality and features. However, concerns have been raised regarding the platform's reliability, particularly in terms of order execution quality, slippage, and potential rejections of orders.

Reports of slippage during high volatility periods have been noted, which can adversely affect traders positions and profitability. Additionally, the absence of proprietary trading tools or innovative features may limit the overall trading experience for clients. Traders should be cautious and consider their trading needs when choosing a broker, as platform performance can significantly impact their trading outcomes.

Risk Assessment

Using BV Trading poses several risks that potential clients should carefully consider. The absence of regulatory oversight is a significant risk factor, as it increases the likelihood of encountering fraudulent activities or unfair practices. Below is a summary of the key risk areas associated with BV Trading:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Limited support and withdrawal issues |

To mitigate these risks, traders are advised to conduct thorough research before engaging with BV Trading. Seeking out regulated and reputable alternatives can provide a safer trading environment and greater peace of mind.

Conclusion and Recommendations

In conclusion, the evidence suggests that BV Trading raises several red flags that warrant caution. The lack of regulatory oversight, combined with limited transparency, operational inefficiencies, and customer complaints, indicates that traders should be wary of potential scams. While BV Trading offers a range of trading instruments and high leverage, the associated risks may outweigh the benefits for many traders.

For those considering entering the forex market, it is advisable to prioritize regulated brokers with established reputations and robust customer support systems. Alternatives such as brokers regulated by top-tier authorities like the FCA, ASIC, or FINMA should be considered to ensure a safer trading experience. Ultimately, thorough research and due diligence are essential in navigating the complexities of the forex market and safeguarding ones investments.

Is BV Trading a scam, or is it legit?

The latest exposure and evaluation content of BV Trading brokers.

BV Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BV Trading latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.