Is CPIH safe?

Pros

Cons

Is Cpih Safe or Scam?

Introduction

Cpih, a forex broker operating primarily in the Chinese market, has gained attention for its trading services since its establishment in 2021. As the forex market continues to attract a growing number of traders, it becomes increasingly important for individuals to carefully evaluate the credibility of brokers like Cpih. The potential for scams in this sector is significant, making due diligence essential for protecting ones investments. This article aims to provide a comprehensive analysis of whether Cpih is a safe trading option or a potential scam. Our investigation is based on a thorough review of online sources, regulatory information, and user experiences, providing a balanced view of the broker's legitimacy.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of a forex broker. A well-regulated broker is more likely to adhere to industry standards and protect its clients interests. In the case of Cpih, it is important to note that it operates without oversight from a recognized regulatory body. This lack of regulation raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | United States | Not Verified |

The absence of a license from a reputable authority like the National Futures Association (NFA) indicates that Cpih is not subject to the same level of scrutiny as regulated brokers. This lack of oversight can lead to potential risks for traders, as they may have limited recourse in the event of disputes or financial mismanagement. Furthermore, the brokers operations are primarily focused on the Chinese market, which may limit its accountability to international regulatory standards. Overall, the regulatory status of Cpih raises a red flag, leading to questions about whether Cpih is safe for trading.

Company Background Investigation

Understanding the background of a broker is crucial for assessing its reliability. Cpih, officially known as Creative Process Investments Holding LLC, was founded in 2021. However, detailed information about its ownership structure and management team is scarce. This lack of transparency can be concerning for potential clients, as it may indicate a reluctance to disclose critical information.

The management team‘s background is another vital aspect to consider. A broker led by experienced professionals with a proven track record in the financial industry is generally more trustworthy. Unfortunately, there is limited public information available regarding the qualifications and expertise of Cpih’s management. The opacity surrounding the companys leadership may further contribute to doubts about its safety and reliability.

Moreover, the overall transparency of Cpihs operations, including its financial health and business practices, remains questionable. A broker that is unwilling to provide clear information about its operations may not be acting in the best interests of its clients. This lack of transparency is a significant factor when evaluating whether Cpih is safe for traders.

Trading Conditions Analysis

Examining the trading conditions offered by a broker is essential for understanding its cost structure and the potential impact on traders profitability. Cpih claims to provide competitive trading conditions, but a closer analysis reveals some concerning aspects. The overall fee structure, including spreads and commissions, is a critical factor in determining the cost-effectiveness of trading with Cpih.

| Fee Type | Cpih | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | Varies | Standard |

The spread for major currency pairs on Cpih appears to be higher than the industry average, which could significantly impact traders overall costs. Additionally, the commission model is not clearly defined, leaving traders uncertain about potential hidden fees. Such discrepancies in trading conditions can raise concerns about the broker's transparency and fairness, contributing to the question of whether Cpih is safe for trading.

Client Fund Security

The security of client funds is paramount when evaluating a forex broker. Traders need assurance that their deposits are protected and that the broker employs robust security measures. Unfortunately, Cpih's policies regarding fund security are not well-documented, leading to uncertainty.

Traders should look for brokers that offer segregated accounts, investor protection schemes, and negative balance protection. However, there is little evidence that Cpih provides these essential safeguards. The absence of such measures could expose traders to significant risks, particularly in volatile market conditions.

Furthermore, any historical issues related to fund security or disputes involving Cpih can further exacerbate concerns. Without a clear track record of safeguarding client assets, potential traders may question whether Cpih is safe for their investments.

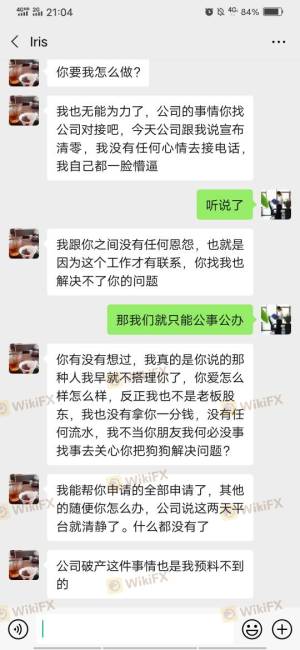

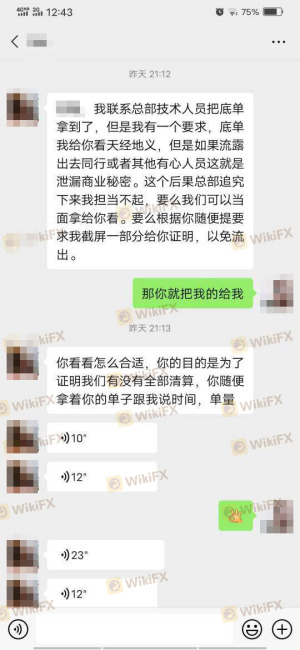

Customer Experience and Complaints

Customer feedback is an essential component of assessing a broker's reliability. Reviews and testimonials can provide insight into the experiences of other traders with Cpih. However, a review of available sources reveals a mixed bag of customer experiences, with several complaints surfacing regarding withdrawal issues and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inadequate |

Common complaints include difficulties in withdrawing funds and slow responses from the support team. Such issues can be indicative of deeper problems within the broker's operations. For instance, one trader reported being unable to withdraw their funds after multiple attempts, leading to frustration and distrust. These patterns of complaints raise significant concerns about whether Cpih is safe for potential clients.

Platform and Execution

The performance of a trading platform is vital for traders, as it directly affects order execution and overall trading experience. A thorough evaluation of Cpihs trading platform reveals varying degrees of performance and reliability. Users have reported issues with slippage and order rejections, which can be detrimental to trading outcomes.

Moreover, signs of potential platform manipulation, such as irregular pricing or sudden spikes in spreads, can be alarming for traders. A broker that engages in such practices may not be acting in the best interests of its clients. Therefore, the execution quality on Cpih's platform is a crucial factor in determining its safety for traders.

Risk Assessment

When considering whether to trade with Cpih, it is essential to evaluate the overall risk associated with the broker. Various factors contribute to this risk, including regulatory status, trading conditions, and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation |

| Trading Cost Risk | Medium | High spreads |

| Customer Service Risk | High | Poor response |

The lack of regulation and transparency, coupled with high trading costs and customer complaints, paints a concerning picture regarding the safety of trading with Cpih. Traders should be aware of these risks and consider them before making any financial commitments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Cpih raises several red flags regarding its safety and legitimacy. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, leads to the conclusion that traders should exercise extreme caution.

Potential clients should consider alternative brokers that are well-regulated and have a proven track record of protecting client funds and providing excellent customer service. Some recommended alternatives include brokers with strong regulatory backing and positive customer feedback, ensuring a safer trading environment.

Ultimately, the question remains: Is Cpih safe? Based on the current evidence, it seems prudent for traders to look elsewhere for their forex trading needs.

Is CPIH a scam, or is it legit?

The latest exposure and evaluation content of CPIH brokers.

CPIH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CPIH latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.