BullFX 2025 Review: Everything You Need to Know

Executive Summary

BullFX positions itself as a regulated STP forex broker. It serves both individual and corporate clients in international markets through Straight Through Processing technology. This bullfx review reveals a broker that operates under international compliance frameworks including the international company act, dealer in securities act, and AML/CTF regulations. The broker's business model centers around providing forex trading services with a focus on regulatory compliance and multi-account offerings.

The main highlights of BullFX include its claimed regulatory compliance and provision of multiple account types for different trader segments. The broker appears to target individual investors and small to medium enterprises seeking forex trading opportunities. However, detailed information about specific trading conditions, platform features, and comprehensive user feedback remains limited in publicly available sources.

User reviews on platforms like Trustpilot show mixed feedback. Some clients express concerns about various aspects of the service. The broker's overall market presence suggests moderate recognition within the forex trading community, though comprehensive performance data and detailed operational metrics are not extensively documented in current market analysis reports.

Important Disclaimers

This evaluation is based on publicly available information and user feedback collected from various sources as of 2025. Regulatory requirements and compliance standards may vary significantly across different jurisdictions. Potential users should verify the broker's licensing status in their specific region before engaging in any trading activities.

The information presented in this review may experience delays in updates. Trading conditions, fees, or service offerings might have changed since the last available data. Prospective clients are strongly advised to conduct their own due diligence and consult with the broker directly for the most current terms and conditions before making any financial commitments.

Rating Framework

Broker Overview

BullFX presents itself as an established STP forex broker operating under international regulatory frameworks. The company complies with the international company act, dealer in securities act, and Anti-Money Laundering/Counter-Terrorism Financing regulations according to sources. The broker's primary business model involves serving both individual and corporate clients through forex trading services, generating revenue through client trading activities.

The broker appears to focus on providing direct market access through its STP model. This theoretically allows for more transparent pricing and execution. However, specific details about the company's founding date, headquarters location, and key management personnel are not clearly documented in available public information. This lack of transparency regarding corporate structure and leadership may be a consideration for potential clients seeking comprehensive background information.

Regarding trading infrastructure and available instruments, bullfx review sources indicate that the broker offers forex trading services with potential CFD offerings. Specific asset classes and the total number of available instruments are not definitively confirmed though. The platform selection, technological capabilities, and execution speeds remain unclear based on current publicly available documentation, which may require direct inquiry with the broker for detailed specifications.

Regulatory Compliance: BullFX claims adherence to international company law, securities trading regulations, and anti-money laundering frameworks. Specific licensing authorities, registration numbers, and jurisdictional details are not clearly specified in available documentation however.

Deposit and Withdrawal Methods: Current sources do not provide comprehensive information about supported payment methods. Processing times and associated fees for funding and withdrawal operations are also unclear.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not detailed in publicly available information. This requires direct contact with the broker for accurate figures.

Promotions and Bonuses: Available sources do not mention any current promotional offers. Welcome bonuses and ongoing incentive programs for new or existing clients are not documented.

Trading Instruments: The broker appears to offer forex trading with possible CFD instruments. The complete range of available currency pairs, commodities, indices, or other assets is not comprehensively documented though.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs is not readily available. Current market analysis reports lack this essential pricing data.

Leverage Ratios: Specific leverage offerings for different account types and instruments are not clearly stated. Accessible documentation does not provide these details.

Platform Options: Information about supported trading platforms is not specified in current sources. Whether the broker uses proprietary or third-party solutions like MetaTrader remains unclear.

Geographic Restrictions: Details about restricted countries or regional limitations are not outlined. Available materials do not address geographic service boundaries.

Customer Support Languages: The range of supported languages for customer service is not documented. Accessible sources do not provide multilingual support information.

Comprehensive Rating Analysis

Account Conditions Analysis

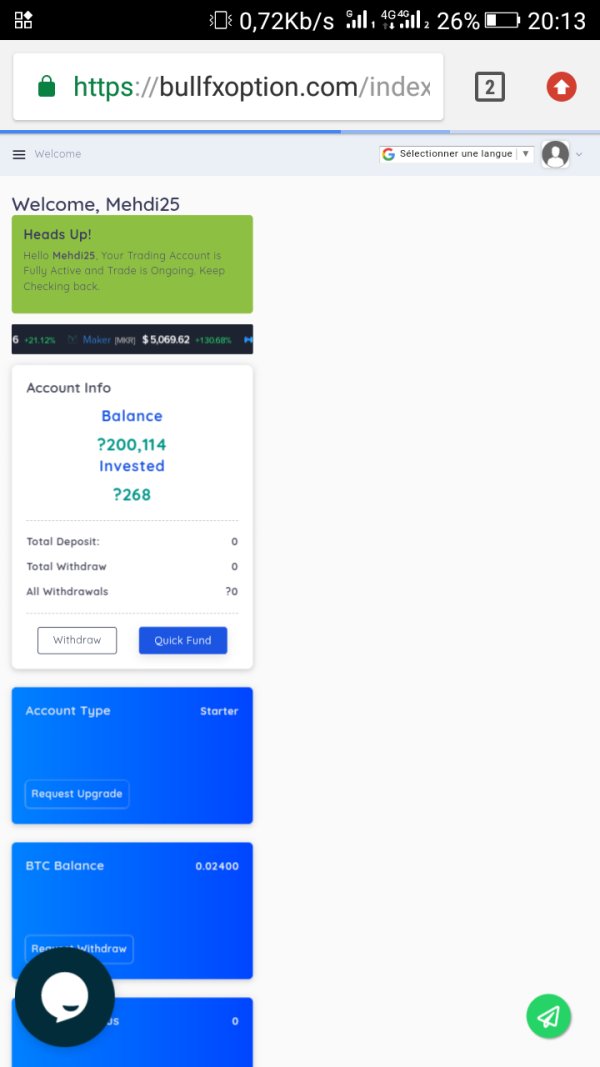

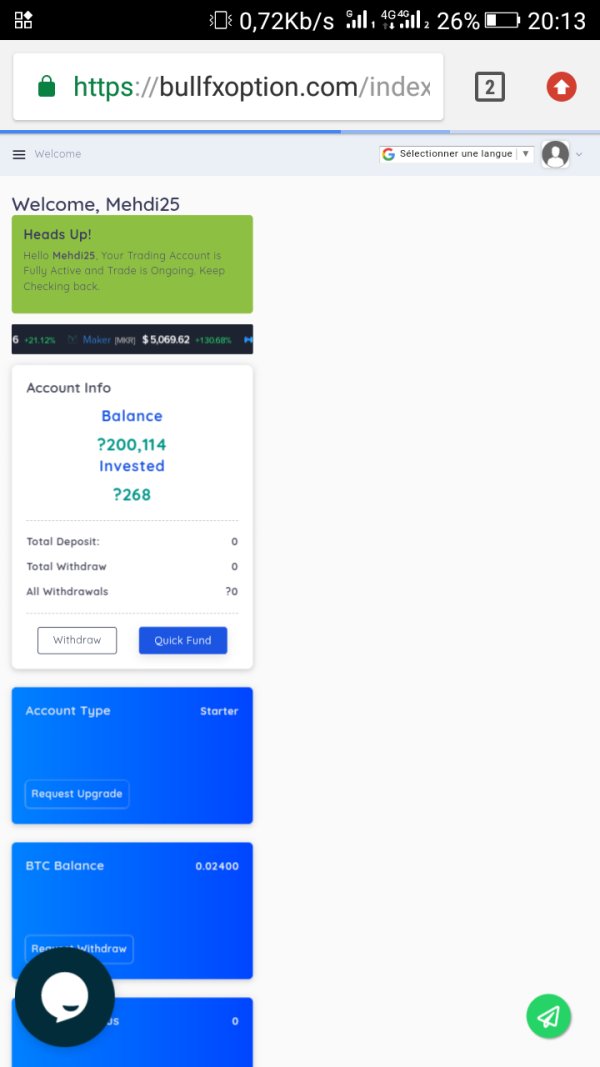

The account structure at BullFX appears to include multiple account types designed to serve different client segments. It serves individual traders to corporate entities through various account options. However, this bullfx review reveals significant gaps in publicly available information regarding specific account features, minimum deposit requirements, and tier-based benefits. The lack of transparent pricing information makes it difficult for potential clients to compare offerings with other market participants.

Account opening procedures and verification requirements are not clearly outlined in current documentation. Essential details such as required documentation, processing timeframes, and approval criteria remain unclear. The absence of information about specialized account features, such as Islamic accounts for Shariah-compliant trading or managed account options, suggests either limited offerings or inadequate disclosure of available services.

The broker's STP model theoretically provides direct market access. This could benefit account holders through potentially tighter spreads and reduced conflicts of interest. However, without specific details about liquidity providers, execution policies, or order handling procedures, it's challenging to assess the practical advantages of the account structure for different trading strategies and client needs.

Available information suggests limited transparency regarding BullFX's trading tools and analytical resources. The absence of detailed platform specifications, charting capabilities, and technical analysis tools in public documentation raises questions about the comprehensiveness of the trading environment. Modern forex traders typically expect robust analytical capabilities, real-time market data, and sophisticated order management systems.

Educational resources are increasingly important for broker differentiation but are not prominently featured in available materials. The lack of information about webinars, trading guides, market analysis, or educational content suggests either minimal investment in trader development or poor communication of available resources.

Research and analysis support, including daily market commentary, economic calendar integration, and expert insights, are not documented in current sources. For active traders, the availability of comprehensive market intelligence and analytical support often influences broker selection decisions significantly.

Automated trading support is not addressed in accessible documentation. This includes Expert Advisor compatibility, signal services, and algorithmic trading capabilities, potentially limiting appeal to technically sophisticated traders.

Customer Service and Support Analysis

User feedback available on review platforms indicates mixed experiences with BullFX customer support services. Some clients appear satisfied with response times and issue resolution while others have expressed concerns about service quality and communication effectiveness. The variability in customer experiences suggests inconsistent service delivery standards.

Support channel availability is not clearly documented in current sources. This includes live chat, telephone support, email assistance, and ticket systems. Response time commitments, service level agreements, and escalation procedures for complex issues are not publicly outlined, making it difficult to assess support quality expectations.

Multilingual support capabilities are crucial for international brokers serving diverse client bases but are not specified in available documentation. The absence of clear information about supported languages and regional support teams may indicate limitations in global service delivery capabilities.

Operating hours for customer support are not documented in accessible sources. This includes weekend and holiday availability information. For active traders operating across different time zones, 24/7 support availability often represents a critical service consideration.

Trading Experience Analysis

The trading experience evaluation for BullFX is complicated by limited publicly available performance data and user experience documentation. Platform stability, execution speeds, and order processing quality are fundamental aspects that require comprehensive assessment but lack detailed public reporting. This bullfx review finds insufficient data to make definitive conclusions about trading environment quality.

Order execution policies are not clearly documented in current sources. This includes slippage management, requote handling, and price improvement practices. These factors significantly impact trading outcomes, particularly for scalping strategies and high-frequency trading approaches that require precise execution conditions.

Mobile trading capabilities are increasingly important for modern traders but are not adequately described in available materials. The functionality, reliability, and feature completeness of mobile applications or web-based platforms remain unclear based on current documentation.

Market access and trading hours information is not comprehensively provided. This makes it difficult to assess whether the broker offers extended trading sessions or weekend trading opportunities that some traders require for their strategies.

Trust and Reliability Analysis

BullFX's regulatory compliance claims include adherence to international company law, securities regulations, and anti-money laundering frameworks. The absence of specific regulatory body names, license numbers, and verification details creates uncertainty about the actual scope and enforceability of regulatory oversight however.

Client fund protection measures are not clearly outlined in available documentation. This includes segregated account policies, deposit insurance coverage, and compensation schemes. These protections represent critical safety considerations for traders evaluating broker reliability and financial security.

Corporate transparency appears limited in publicly accessible sources. This includes company ownership structure, financial reporting, and management team information. The lack of comprehensive corporate disclosure may concern traders seeking detailed background information about their chosen broker.

Industry recognition, awards, or third-party certifications are not prominently featured in current documentation. These might validate the broker's market standing and operational quality but are absent, limiting external validation of service claims.

User Experience Analysis

Overall user satisfaction indicators from review platforms suggest mixed experiences among BullFX clients. The variability in user feedback points to inconsistent service delivery and potentially different experiences across various client segments or account types.

Platform usability and interface design feedback is not comprehensively available in current user reviews. This makes it difficult to assess the quality of the trading environment from an end-user perspective. Navigation ease, feature accessibility, and overall user interface quality remain unclear based on accessible feedback.

Account opening and verification processes have not been extensively documented in user reviews. Some clients have noted experiences with customer service during onboarding though. The efficiency and user-friendliness of initial account setup procedures appear to vary among different client experiences.

Deposit and withdrawal experiences are not consistently documented in available user feedback. This includes processing times, fee transparency, and transaction reliability. These operational aspects significantly impact overall user satisfaction but lack comprehensive reporting in current review sources.

Conclusion

This bullfx review presents a neutral assessment of a broker that claims regulatory compliance and STP operations but lacks comprehensive public documentation of key service details. BullFX appears suitable for individual investors and small businesses seeking basic forex trading services. The limited transparency regarding trading conditions, costs, and platform capabilities may concern traders requiring detailed operational information though.

The broker's main advantages include its claimed regulatory compliance and multi-account structure serving different client types. However, significant disadvantages include insufficient public disclosure of trading conditions, platform specifications, and comprehensive user experience data. Potential clients should conduct thorough due diligence and direct communication with the broker to obtain essential information not readily available in public sources.