Blue Whale Markets is presented as an online trading platform operating since 2023, purportedly headquartered in locations like San Francisco, USA, and Costa Rica. However, investigations have revealed a lack of matching records with regulatory bodies such as the National Futures Association (NFA), suggesting that the entity may not exist in any official capacity. This raises serious concerns regarding the brokers authenticity and commitment to safeguarding investor funds.

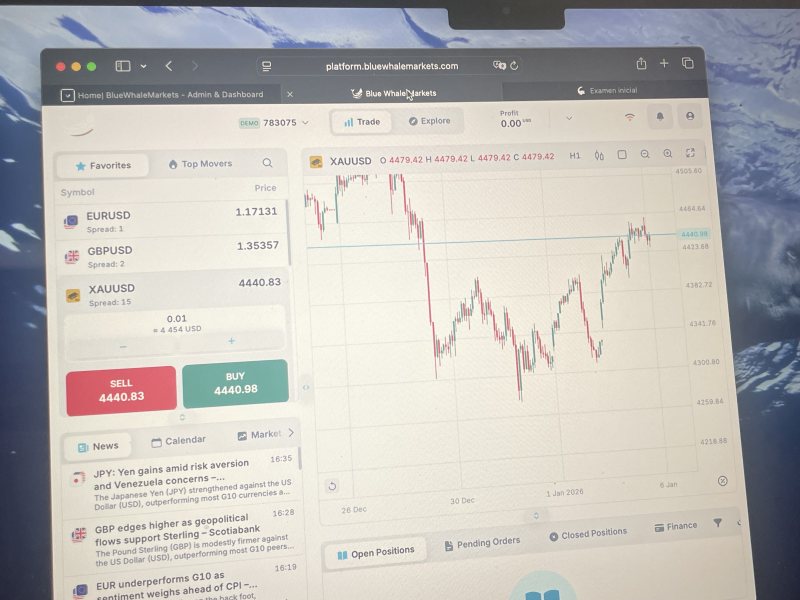

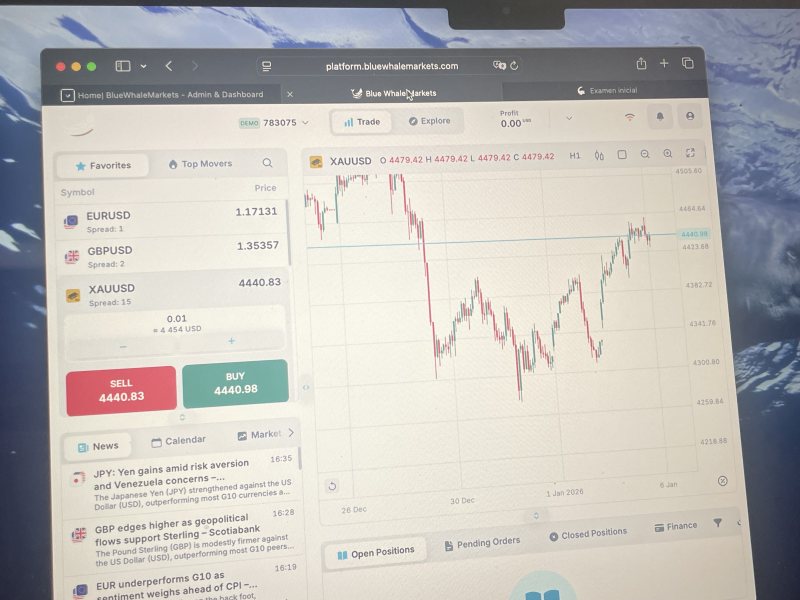

The broker claims to provide services related to forex trading and CFDs across various asset classes with features like the MetaTrader 5 platform. Despite these assertions, the reality reflected in user reviews indicates a considerable gap between promise and performance, particularly regarding the speed of withdrawals and customer support. The lack of visible regulatory affiliation further compounds risks, as new traders could find themselves without any channels for complaint or redress.

Examining Blue Whale Markets reveals significant discrepancies regarding its regulatory claims. Despite advertising a presence in regulated jurisdictions, thorough checks with the NFA and FCA reveal no recorded compliance, indicating potential risks for investors.

To ensure safety, users can verify the broker‘s status through official regulatory databases. Here’s how:

- Access the regulatory agency's website.

- Search for the brokers name in their registered entities list.

- Confirm if they possess an active license number.

User feedback emphasized concerns regarding the safety of funds. One review states:

“I was promised that my funds were safe, yet I faced delays in withdrawals that left me questioning their integrity.”

Investors should prioritize brokers with verifiable regulatory oversight and a proven track record of financial practices.

Trading Costs Analysis

Decoding Blue Whale's cost structure reveals a blend of attractive commission rates juxtaposed with potential hidden fees. The platform claims low trading commissions, appealing to novice traders aiming to maximize their profit margins.

However, user experiences recount the reality of high hidden fees, particularly during withdrawals. One user lamented:

“They offered low spreads, but my withdrawals were met with unexpected charges that drained my profits.”

Thus, while the advertised cost may seem beneficial, one must proceed with caution as the true cost landscape may lead to unintended expenses.

Blue Whale Markets touts the use of the MetaTrader 5 platform, which is known for its robust features. Unfortunately, critical information about platform accessibility or specific tools available is lacking, diminishing trader capability.

Feedback suggests significant usability challenges, with reports of technical glitches and sluggish performance. One trader noted:

“I experienced frequent lags while trading, making it almost impossible to execute timely trades.”

This indicates that although the platform may appear user-friendly, the reality could hinder an effective trading experience.

User Experience Analysis

User feedback about Blue Whale Markets reveals a considerable disparity between expectation and reality. Many novice traders, drawn by the promise of low entry costs, later reported frustrations with supportiveness.

The absence of direct customer service contact methods like phone support leaves clients feeling abandoned, particularly during crises. A disgruntled user remarked:

“Emailing was fruitless; I felt ignored as I sought resolutions to issues with my account.”

Such experiences are counterintuitive to the broker's claims of excellent customer service, creating a gap that potentially impacts user retention.

Customer Support Analysis

The broker primarily relies on email as its communication method, which raises concerns regarding accessibility and response time. Reports indicate users struggle to obtain timely assistance, heightening anxiety in tumultuous trading moments.

A recurring theme in reviews indicates dissatisfaction with the slow response, emphasizing that immediate support channels such as live chat would significantly enhance the user experience.

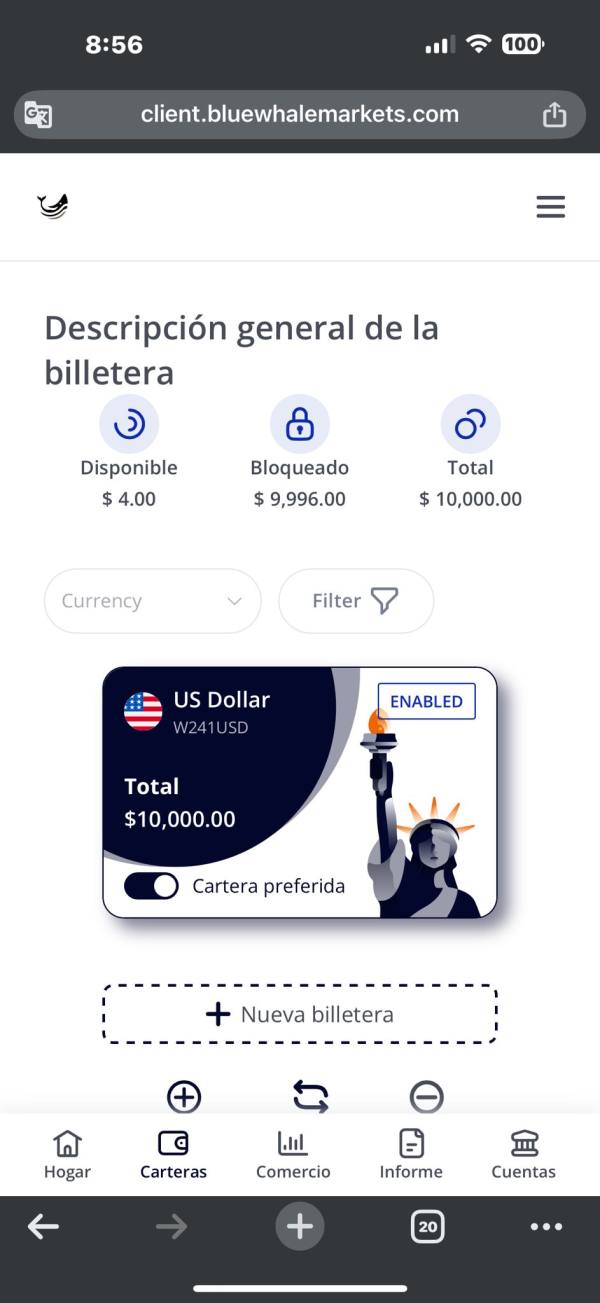

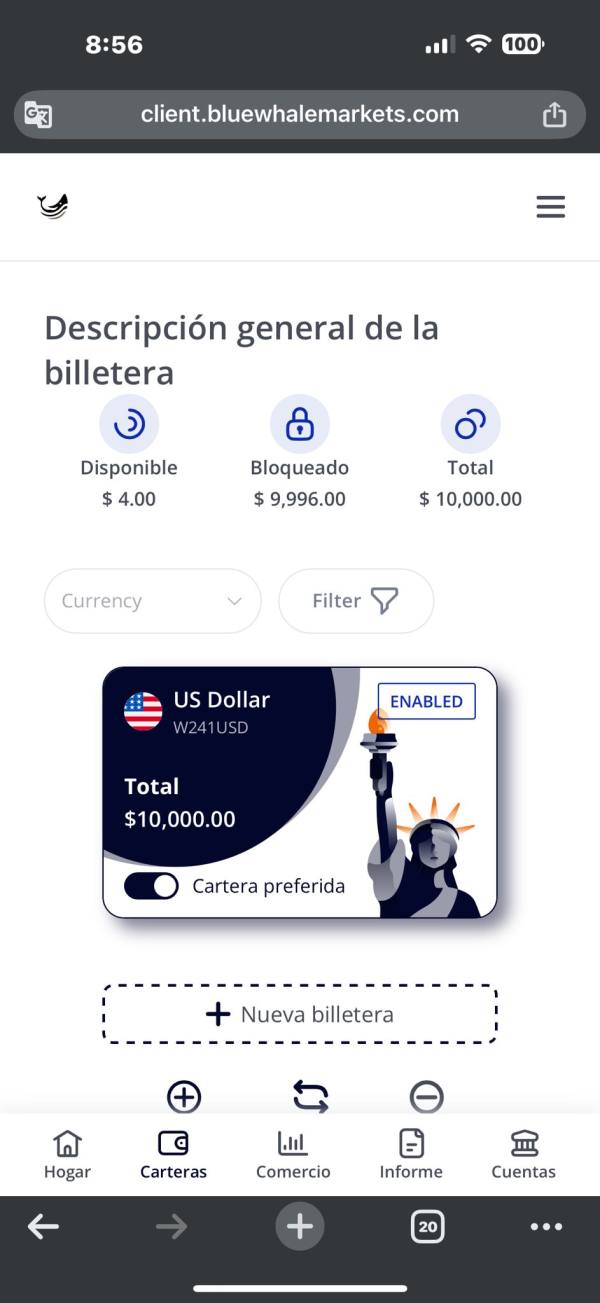

Account Conditions Analysis

Users frequently express frustrations due to the lack of clarity surrounding account types and conditions. This ambiguity can deter novice traders from entering the market with confidence, as they might feel uncertain about the environment theyre getting into.

Insufficient information regarding leverage, spreads, and withdrawal processes prevents traders from making informed choices. Without comprehensive details, many may feel ill-prepared for the risks associated with forex trading.

Conclusion

In conclusion, while Blue Whale Markets positions itself as an ideal trading platform for novice investors, its lack of regulatory oversight, coupled with significant user complaints, paints a grim picture. Investors are left to weigh potential trading opportunities against heightened risks associated with unregulated environments. For those looking for stability and assurance in their trading experience, seeking regulated alternatives may prove to be a more prudent approach. The gaps and inconsistencies surrounding this broker warrant careful consideration and thorough research before any financial commitment.