Is BESTSAFECRYPTOFX safe?

Business

License

Is BestSafeCryptoFX Safe or Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, brokers play a pivotal role in facilitating trades for both novice and seasoned traders. BestSafeCryptoFX, a relatively new entrant in this space, claims to offer a secure and user-friendly trading environment. However, the increasing prevalence of scams in the forex industry necessitates a cautious approach when evaluating such platforms. Traders must rigorously assess the legitimacy and safety of brokers like BestSafeCryptoFX to protect their investments. This article employs a comprehensive investigative approach to assess the safety and reliability of BestSafeCryptoFX, focusing on key aspects such as regulatory compliance, company background, trading conditions, customer experience, and risk factors.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors to consider when evaluating its safety. Regulation serves as a safeguard for investors, ensuring that the broker adheres to strict operational standards. Unfortunately, BestSafeCryptoFX operates as an unregulated broker, which raises significant concerns regarding the protection of client funds and the overall integrity of the trading platform.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that BestSafeCryptoFX is not subject to any oversight by a recognized financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. This lack of oversight is alarming, as it exposes traders to potential fraud and mismanagement of their funds. Furthermore, the historical compliance record of BestSafeCryptoFX is non-existent due to its unregulated status, which means there are no past records to assess its adherence to industry standards.

Company Background Investigation

BestSafeCryptoFX was established with the intention of providing a reliable trading platform; however, its background raises several red flags. The company appears to lack transparency regarding its ownership structure and management team. The absence of publicly available information about the company's founders and executives is concerning, as it limits the ability of potential clients to evaluate the experience and qualifications of those running the platform.

Moreover, the company's website provides minimal information about its operational history, which is typically a standard practice among reputable brokers. A lack of transparency in this area significantly undermines the credibility of BestSafeCryptoFX, making it difficult for traders to trust that their investments will be handled responsibly.

Trading Conditions Analysis

When evaluating the trading conditions offered by BestSafeCryptoFX, it is essential to consider the fee structure and any unusual policies that could impact traders. The broker advertises competitive spreads and various account types, but the absence of clear information regarding commissions and other fees is concerning.

| Fee Type | BestSafeCryptoFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

The lack of transparency regarding trading costs can lead to unexpected expenses for traders, which is a common tactic employed by potentially fraudulent brokers. Furthermore, the absence of detailed information about any hidden fees or conditions may indicate a lack of commitment to fair trading practices.

Client Fund Safety

The safety of client funds is paramount when assessing the reliability of a forex broker. BestSafeCryptoFX's lack of regulation raises significant concerns regarding its fund protection measures. The broker does not provide clear information about whether client funds are kept in segregated accounts or if there are any investor protection policies in place.

Without such measures, traders face a heightened risk of losing their investments in the event of the broker's insolvency or fraudulent activities. Additionally, there have been no documented incidents of fund security breaches or disputes, but the absence of a regulatory framework makes it challenging to ascertain the overall safety of client funds.

Customer Experience and Complaints

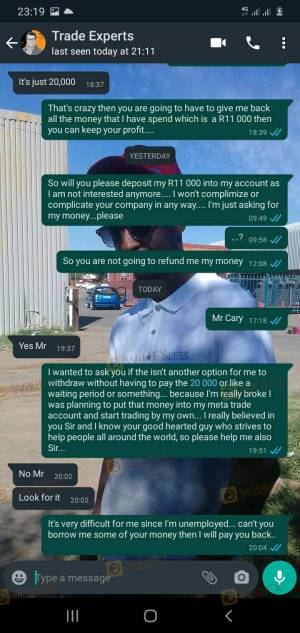

Customer feedback is a valuable resource for evaluating the effectiveness and reliability of a forex broker. Reviews of BestSafeCryptoFX reveal a mix of experiences, with several users expressing concerns about the platform's transparency and customer service responsiveness. Common complaints include difficulties in withdrawing funds and a lack of support from the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Customer Service Issues | Medium | Average |

| Transparency Concerns | High | Poor |

For instance, some traders reported being unable to withdraw their funds after making deposits, which is a significant red flag and indicative of potential fraudulent behavior. The company's slow response to these complaints further exacerbates concerns regarding its legitimacy and reliability.

Platform and Trade Execution

The performance of a trading platform can significantly affect a trader's experience. BestSafeCryptoFX claims to offer a user-friendly interface and efficient trade execution; however, user experiences vary widely. Some traders have reported issues with order execution quality, including slippage and delayed order fulfillment.

The absence of concrete data on the platform's performance makes it difficult to draw definitive conclusions about its reliability. Moreover, any signs of platform manipulation, such as sudden price changes or frequent disconnections, could indicate a lack of integrity in BestSafeCryptoFX's operations.

Risk Assessment

Engaging with BestSafeCryptoFX carries inherent risks, primarily due to its unregulated status and lack of transparency. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation in place. |

| Fund Safety Risk | High | Lack of clear fund protection measures. |

| Transparency Risk | High | Limited information about company operations. |

| Customer Service Risk | Medium | Mixed feedback on responsiveness. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with BestSafeCryptoFX. It may be prudent to consider alternative, well-regulated brokers that offer more transparency and investor protection.

Conclusion and Recommendations

In conclusion, the evidence suggests that BestSafeCryptoFX poses significant risks to potential investors. The broker's unregulated status, lack of transparency, and mixed customer feedback indicate that it may not be a safe option for trading. While it is not definitively labeled as a scam, the numerous warning signs warrant caution.

Traders seeking a reliable forex trading experience should consider reputable alternatives that are regulated by recognized authorities. Brokers that provide clear information about their operations, fees, and fund protection measures are generally safer options. Ultimately, due diligence is essential for ensuring that investments are secure and managed responsibly.

Is BESTSAFECRYPTOFX a scam, or is it legit?

The latest exposure and evaluation content of BESTSAFECRYPTOFX brokers.

BESTSAFECRYPTOFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BESTSAFECRYPTOFX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.