Regarding the legitimacy of AFMFX forex brokers, it provides ASIC and WikiBit, .

Is AFMFX safe?

Pros

Cons

Is AFMFX markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ARCADIA FUNDS MANAGEMENT LIMITED

Effective Date:

2003-08-13Email Address of Licensed Institution:

hamish_flett@arcadiafm.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SuiTe 1 Level 11, 9-13 CasTlereaGh STreeT, SYDNEY NSW 2000Phone Number of Licensed Institution:

(02) 8243 6969Licensed Institution Certified Documents:

Is AFMFX Safe or Scam?

Introduction

AFMFX is an online forex broker that has emerged in the competitive landscape of foreign exchange trading. Established in 2018, this broker claims to offer a range of trading services, primarily targeting traders interested in forex markets. However, the importance of conducting thorough due diligence when selecting a forex broker cannot be overstated. The forex market is rife with both legitimate opportunities and potential scams, making it crucial for traders to carefully evaluate the credibility and safety of their chosen broker. This article aims to investigate whether AFMFX is a safe trading platform or a potential scam. Our evaluation is based on a comprehensive analysis of regulatory status, company background, trading conditions, customer experiences, and security measures.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors to consider when assessing its safety. Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and practices. In the case of AFMFX, it claims to be regulated by the Australian Securities and Investments Commission (ASIC) under license number 225417. However, there are significant concerns regarding the legitimacy of this claim, as multiple sources indicate that AFMFX may be operating as a clone of a legitimate ASIC-registered entity. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 225417 | Australia | Suspicious Clone |

The quality of regulation is paramount; brokers regulated by reputable authorities like ASIC are expected to maintain high standards of transparency and client protection. In this case, the suspicion surrounding AFMFX's ASIC license raises red flags. Furthermore, the broker's official website is currently inaccessible, suggesting possible operational issues or even potential closure. The lack of a verifiable regulatory framework makes it challenging for traders to trust AFMFX, leading to the conclusion that AFMFX is not safe based on its regulatory status.

Company Background Investigation

AFMFX operates under the name Arcadia Funds Management Limited, and it is registered in Australia. However, the company's history is relatively short, having been founded just a few years ago. The limited operational history raises questions about its stability and reliability. The management team behind AFMFX has not been extensively documented, making it difficult to assess their professional qualifications and experience in the financial sector. A transparent broker typically provides detailed information about its management team, including their backgrounds and industry experience, which is lacking in this case.

Moreover, the level of transparency regarding the company's ownership structure is also concerning. A reputable broker should disclose its ownership details to instill confidence among traders. The absence of such information suggests that AFMFX may not be committed to maintaining transparency, further contributing to the perception that AFMFX is not safe for traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is essential. AFMFX claims to offer competitive trading fees, but there are discrepancies that warrant scrutiny. The fee structure and trading conditions should be clearly outlined for potential clients, and any unusual or hidden fees should be flagged as potential red flags. Below is a summary of the core trading costs associated with AFMFX:

| Fee Type | AFMFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low to Moderate |

The spread on major currency pairs is reported to be variable, which could lead to unexpected costs for traders. Additionally, the absence of a clear commission model raises concerns about potential hidden fees that could impact trading profitability. The elevated overnight interest rates also suggest that traders may incur significant costs when holding positions overnight, which is not ideal for those employing swing trading strategies. These factors collectively indicate that AFMFX may not provide a competitive trading environment, further questioning its safety for traders.

Client Fund Safety

The safety of client funds is a paramount concern for any forex trader. AFMFX claims to implement measures to protect clients' funds, but specific details about these measures are scarce. It is crucial for brokers to segregate client funds from their operational funds, ensuring that trader capital is not misused or at risk in the event of financial difficulties. Furthermore, the availability of investor protection schemes and negative balance protection policies is vital for safeguarding trader interests.

However, there is a lack of information regarding AFMFX's fund safety measures. The absence of documented policies raises concerns about the broker's commitment to protecting client assets. Additionally, the historical context of any past fund safety issues or disputes is essential for understanding the risk profile of the broker. Given the current lack of transparency and clarity regarding fund safety measures, it can be concluded that AFMFX does not prioritize client fund security, making it a risky choice for traders.

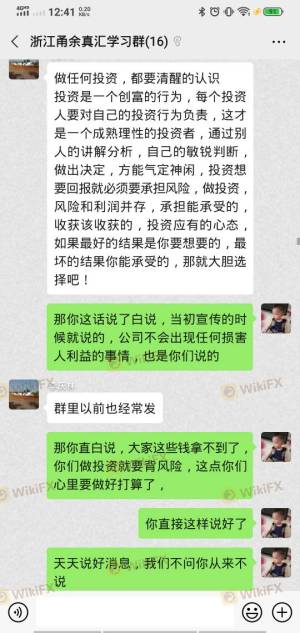

Customer Experience and Complaints

Customer feedback is a critical aspect of assessing a broker's reliability. Reports indicate that AFMFX has received multiple complaints from users, with common issues including withdrawal difficulties and poor customer service. Such patterns of complaints can be indicative of underlying operational problems within the broker. Below is a summary of the major complaint types associated with AFMFX:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Inadequate |

The severity of withdrawal issues is particularly alarming, as this is a fundamental aspect of trading that directly impacts user trust. Complaints of delayed or denied withdrawals suggest that AFMFX may be experiencing liquidity problems or operational inefficiencies. Furthermore, the lack of adequate responses from the company indicates a disregard for customer concerns, which can exacerbate frustrations among traders. These factors collectively reinforce the notion that AFMFX is not a safe trading option, as the user experience is fraught with significant challenges.

Platform and Execution

The trading platform's performance is another critical factor in evaluating a forex broker's reliability. AFMFX utilizes the widely known MetaTrader 4 (MT4) platform, which is generally regarded as user-friendly and reliable. However, there are concerns regarding the platform's execution quality, including potential slippage and order rejection rates. Traders expect efficient order execution, especially in a fast-paced market like forex.

Reports suggest that users have experienced issues with order execution, including delays and slippage, which can significantly impact trading outcomes. Furthermore, any signs of platform manipulation or irregularities in trade execution should raise immediate concerns for traders. Given the existing feedback regarding execution quality, it can be argued that AFMFX may not provide a reliable trading environment, leading to further skepticism about its safety.

Risk Assessment

Using AFMFX as a trading platform presents a variety of risks that potential traders should carefully consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of legitimate regulation raises concerns. |

| Fund Safety Risk | High | Insufficient transparency regarding fund protection measures. |

| Operational Risk | Medium | Complaints indicate potential operational inefficiencies. |

| Execution Risk | Medium | Reports of slippage and order rejection may affect trading outcomes. |

To mitigate these risks, traders are advised to conduct thorough research, consider alternative brokers with better regulatory standing, and maintain a cautious approach when engaging with AFMFX.

Conclusion and Recommendations

In conclusion, the investigation into AFMFX reveals a broker that raises numerous red flags in terms of regulatory compliance, company transparency, trading conditions, and customer experiences. The lack of verifiable regulation, combined with a history of complaints and operational issues, strongly suggests that AFMFX is not safe for traders.

For those considering trading in the forex market, it is advisable to explore alternative options that prioritize regulatory compliance, transparency, and customer support. Brokers such as Pepperstone, IC Markets, and FXTM offer robust regulatory frameworks and positive user feedback, making them more reliable choices for traders seeking a safe trading environment. Always prioritize your investment's safety and conduct thorough research before committing to any broker.

Is AFMFX a scam, or is it legit?

The latest exposure and evaluation content of AFMFX brokers.

AFMFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AFMFX latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.