Is Meta-Traders safe?

Pros

Cons

Is Meta-Traders A Scam?

Introduction

Meta-Traders is a relatively new player in the forex market, having been established in 2021. Positioned as an online trading platform, it claims to offer a variety of trading instruments, including forex pairs, commodities, and indices. However, in an industry rife with scams and unregulated brokers, it is crucial for traders to meticulously evaluate the legitimacy and safety of any trading platform before committing their funds. This article aims to investigate whether Meta-Traders is a scam or a legitimate broker by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our analysis is based on a comprehensive review of available information from reputable financial sources, user feedback, and regulatory databases.

Regulation and Legitimacy

When assessing the safety of any trading platform, regulatory oversight is a critical factor. A well-regulated broker is more likely to adhere to industry standards and protect traders' interests. Unfortunately, Meta-Traders does not hold any licenses from recognized financial authorities, which raises significant concerns about its legitimacy. Below is a summary of the regulatory status of Meta-Traders:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders are not afforded the protections typically provided by regulatory bodies, such as compensation schemes and strict operational guidelines. Furthermore, the lack of regulatory oversight indicates a higher risk of fraudulent activities, making it essential for traders to be cautious. The company's claims of operating within the UK market are particularly troubling, as the UK's Financial Conduct Authority (FCA) is known for its stringent regulations, and Meta-Traders does not appear to be listed among its licensed entities. This unregulated status is a significant red flag, suggesting that Meta-Traders is not safe for trading.

Company Background Investigation

Understanding the background of a broker can provide insights into its reliability. Meta-Traders was established in 2021, which is relatively new compared to many established brokers in the industry. The company's ownership structure and management team are not publicly disclosed, which is concerning for potential investors. Transparency is a vital aspect of trust in the financial services sector, and the lack of available information raises questions about the company's intentions and operational integrity.

The absence of a clear ownership structure and detailed information about the management team further complicates the evaluation. A reputable broker typically provides comprehensive information about its founders and key executives, including their qualifications and experience in the financial markets. However, this is not the case with Meta-Traders, making it difficult to assess the credibility of the individuals behind the platform. This lack of transparency is another reason to be skeptical about whether Meta-Traders is safe for trading.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, are crucial for traders to understand the cost of trading. Meta-Traders claims to offer competitive spreads and various account types. However, the absence of detailed information about its fee structure is concerning. Below is a comparison of core trading costs:

| Fee Type | Meta-Traders | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding fees and spreads could indicate hidden costs that may affect a trader's profitability. Moreover, the absence of a clearly defined commission structure raises concerns about potential unexpected charges. In the forex trading industry, brokers are expected to disclose all costs associated with trading, and the failure of Meta-Traders to do so suggests that it may not be operating in good faith. Given these factors, traders should exercise caution, as Meta-Traders may not be safe for those looking for a reliable trading environment.

Customer Funds Security

The security of customer funds is paramount when choosing a trading platform. A reputable broker should implement robust measures to protect client funds, such as segregated accounts and negative balance protection. Unfortunately, Meta-Traders does not provide any information regarding its security measures. This lack of detail is alarming, particularly in light of the numerous scams that plague the forex industry.

Without proper safeguards in place, traders risk losing their funds without any recourse. The absence of segregated accounts means that client funds may not be protected from the broker's operational risks. Furthermore, there are no indications that Meta-Traders offers negative balance protection, which could leave traders liable for losses exceeding their account balance. Given these shortcomings, it is reasonable to conclude that Meta-Traders is not safe when it comes to the security of customer funds.

Customer Experience and Complaints

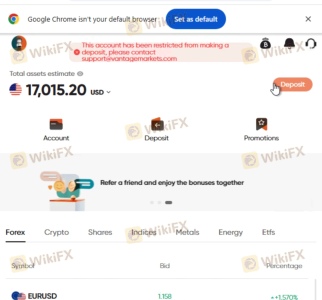

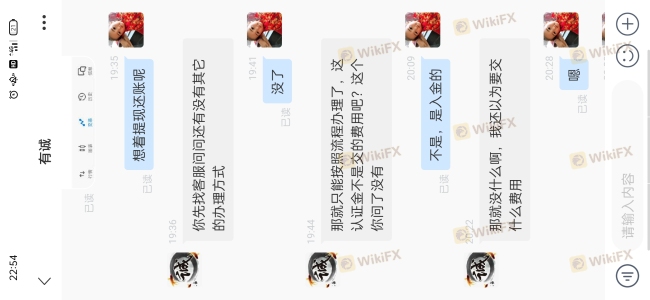

Customer feedback is a valuable resource for assessing the reliability of a broker. Unfortunately, Meta-Traders has received numerous complaints from users, primarily concerning withdrawal issues and claims of being scammed. Below is an overview of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Scam Allegations | High | Poor |

The prevalence of withdrawal issues is particularly concerning, as it suggests that traders may struggle to access their funds when needed. Furthermore, the company's poor response to complaints raises questions about its commitment to customer service and support. In one notable case, a user reported being unable to withdraw funds after making a deposit, leading to frustration and financial loss. This pattern of complaints indicates that Meta-Traders may not be safe for traders, especially those who prioritize timely access to their funds.

Platform and Execution

The performance and reliability of a trading platform are crucial for a trader's success. While Meta-Traders claims to provide a web-based trading platform, there is limited information available regarding its performance, stability, and user experience. The absence of detailed reviews and user feedback on the platform raises concerns about its execution quality and potential issues such as slippage and order rejections.

Without concrete evidence of the platform's reliability, traders may face significant risks when executing trades. Additionally, any indications of platform manipulation could further undermine trust in the broker. Given these factors, it is prudent for traders to be cautious, as Meta-Traders is likely not safe for those seeking a dependable trading environment.

Risk Assessment

When evaluating the overall risk profile of Meta-Traders, several factors come into play. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Security Risk | High | Lack of safeguards for client funds. |

| Customer Service Risk | High | Poor response to complaints. |

| Platform Reliability Risk | High | Limited information on execution quality. |

The cumulative risks associated with trading through Meta-Traders indicate a high likelihood of negative experiences for traders. To mitigate these risks, it is advisable for potential clients to consider alternative brokers with established reputations and robust regulatory oversight.

Conclusion and Recommendations

In conclusion, the investigation into Meta-Traders reveals significant red flags that suggest it may not be a safe trading platform. The absence of regulation, lack of transparency regarding company ownership, and numerous customer complaints raise serious concerns about its legitimacy. Based on the evidence presented, it is reasonable to conclude that Meta-Traders is likely a scam and poses substantial risks to traders.

Traders seeking a reliable and safe trading experience should consider alternative brokers with strong regulatory frameworks, transparent operations, and positive customer feedback. Some reputable alternatives include established brokers like OANDA, Forex.com, and IC Markets, which offer robust trading conditions and a commitment to customer security. Always conduct thorough research and due diligence before committing funds to any trading platform.

Is Meta-Traders a scam, or is it legit?

The latest exposure and evaluation content of Meta-Traders brokers.

Meta-Traders Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Meta-Traders latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.