Is BBT safe?

Pros

Cons

Is BBT Safe or Scam?

Introduction

BBT Financial Limited, commonly referred to as BBT, positions itself as a forex broker offering a range of trading instruments, including currencies, indices, and commodities. In a market filled with both reputable and dubious players, it is crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen brokers. The risks associated with trading forex can be significant, particularly when dealing with unregulated entities that may not prioritize client protection. This article aims to provide an objective assessment of BBT, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on a comprehensive review of multiple online sources and expert analyses.

Regulation and Legitimacy

BBTs regulatory status is a critical factor in determining whether it is a safe broker to trade with. A broker's regulation ensures that it adheres to certain standards, providing a layer of protection for traders. Unfortunately, BBT is not licensed by any recognized financial authority, which raises significant concerns regarding its legitimacy and operational practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight means that BBT operates outside the purview of any governing body, making it vulnerable to potential malpractice. Many reputable jurisdictions, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), have strict requirements for brokers to ensure client safety. Without such regulation, BBT cannot guarantee the protection of client funds or the integrity of its trading practices. This lack of oversight is a significant red flag, leading to the conclusion that BBT is not safe for traders.

Company Background Investigation

BBT Financial Limited lacks transparency regarding its history and ownership structure, further complicating the assessment of its safety. The company does not provide clear information about its founding date, management team, or operational history. This ambiguity raises concerns about the brokers credibility and reliability.

The management team's background is essential in evaluating a broker's trustworthiness. However, BBT does not disclose information about its executives or their professional qualifications, which is another significant drawback. Transparency in a brokers operations is paramount; without it, potential clients may find themselves at risk of engaging with an entity that lacks proper governance and accountability.

Moreover, the absence of a physical address or contact information, aside from a generic email, contributes to the perception that BBT may not operate in good faith. This lack of transparency is a strong indicator that BBT is not safe for traders looking for a reliable forex broker.

Trading Conditions Analysis

Understanding the trading conditions offered by BBT is crucial for evaluating its viability as a trading platform. The broker claims to offer competitive spreads and leverage, but specific details are often vague or undisclosed.

| Fee Type | BBT | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Structure | Not Disclosed | Varies (0 - 10 USD per lot) |

| Overnight Interest Range | Not Disclosed | Varies |

The lack of clarity regarding spreads and commissions is concerning. Typically, reputable brokers provide detailed information on their fee structures to help clients make informed decisions. BBTs failure to disclose such information raises questions about hidden fees or unfavorable trading conditions that could negatively impact traders' profitability. Additionally, the high leverage ratios advertised (up to 1:1000) are often associated with increased risk, particularly for inexperienced traders. This suggests that trading with BBT could expose clients to significant financial losses, confirming that BBT is not safe for those who may not fully understand the implications of trading with high leverage.

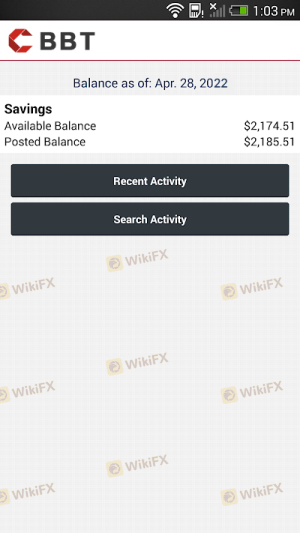

Client Fund Safety

The safety of client funds is a primary concern for any trader. BBT has not provided adequate information regarding its fund security measures. There are no indications that client funds are kept in segregated accounts, a standard practice among regulated brokers to ensure that client money is protected in the event of the broker's insolvency.

Moreover, there is no mention of investor protection schemes, which are critical in safeguarding client investments. The absence of such measures implies that traders using BBT may be at risk of losing their deposits without any recourse. This lack of protection is alarming and reinforces the conclusion that BBT is not safe for trading.

Customer Experience and Complaints

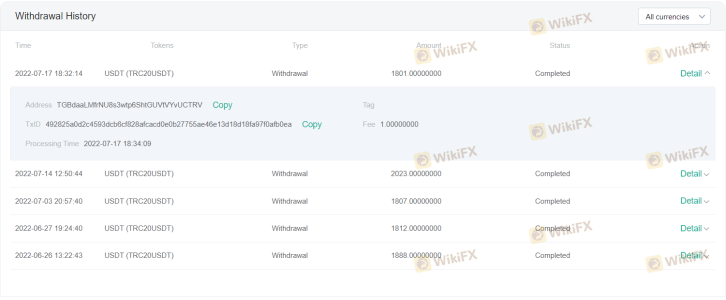

Analyzing customer feedback is essential to understanding the overall experience with BBT. Numerous complaints have surfaced regarding withdrawal issues, where clients report being unable to access their funds after requesting withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | High | Poor |

| Hidden Fees | Medium | Unresponsive |

Many users have reported that once they deposit funds, the broker becomes unresponsive, making it difficult to resolve issues or retrieve their investments. This pattern of behavior is characteristic of scam brokers, where clients are lured in with promises of high returns but then find themselves unable to withdraw their funds. Such experiences further support the assertion that BBT is not safe for traders.

Platform and Trade Execution

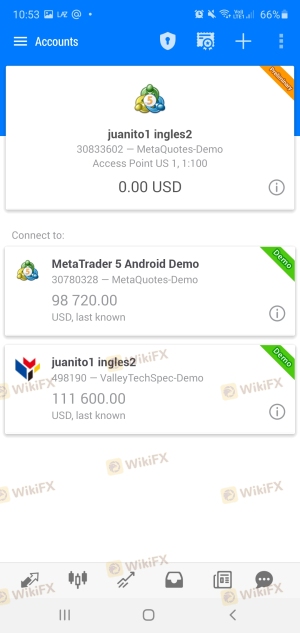

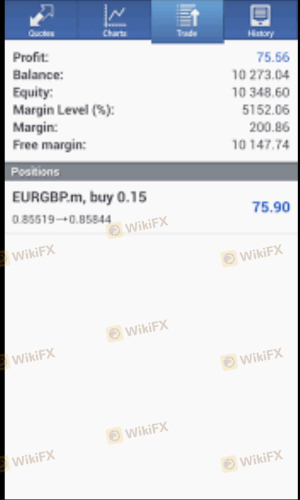

The performance of a trading platform is critical for a satisfactory trading experience. BBT claims to offer access to the MetaTrader 5 platform, which is known for its advanced features. However, many users have reported issues with platform stability and order execution.

Traders have noted instances of slippage and rejected orders, which can severely impact trading outcomes. If a broker manipulates platform performance, it can lead to significant financial losses for traders. The lack of transparency regarding order execution policies and any signs of potential manipulation raises further concerns about BBT's reliability.

Risk Assessment

Trading with BBT presents several risks that potential clients should consider. The absence of regulation, unclear trading conditions, and poor customer feedback indicate a high-risk environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities |

| Financial Risk | High | Potential loss of funds without protection |

| Operational Risk | Medium | Issues with platform stability and execution |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers that provide clear information about their operations, fees, and security measures.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that BBT is not safe for trading. The lack of regulation, transparency, and poor customer experiences are significant red flags that should not be ignored. Traders seeking a reliable forex broker should avoid BBT and consider reputable alternatives that offer regulatory oversight, transparent trading conditions, and strong customer support.

For those looking for trustworthy options, brokers regulated by authorities like the FCA or ASIC are recommended, as they provide the necessary protections and assurances that BBT lacks. Always prioritize safety and due diligence when selecting a trading partner in the forex market.

Is BBT a scam, or is it legit?

The latest exposure and evaluation content of BBT brokers.

BBT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BBT latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.