Is ALLIED VICTORY GOLD & SILVER INVESTMENT LIMITED safe?

Business

License

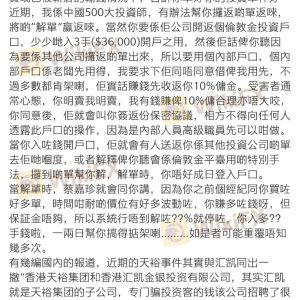

Is AVG SIL A Scam?

Introduction

AVG SIL is a forex brokerage firm that has emerged in the competitive landscape of the foreign exchange market. Established in Hong Kong, it offers a range of trading services to investors looking to engage in forex, commodities, and CFDs. However, with the proliferation of online trading platforms, it has become increasingly crucial for traders to carefully evaluate the legitimacy and safety of these brokers. This article aims to provide a comprehensive analysis of AVG SIL, examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk assessment. The evaluation is based on a thorough review of available information, including user feedback, regulatory data, and industry standards.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a fundamental aspect of its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices. In the case of AVG SIL, the broker currently operates without any recognized regulatory oversight, which raises significant concerns regarding its credibility.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Unregulated |

The absence of regulation implies that AVG SIL is not subject to the same level of scrutiny and accountability as regulated brokers. This lack of oversight can lead to potential risks for traders, including the possibility of fraud or the mishandling of client funds. Furthermore, the company's history of compliance is questionable, as it has not established a track record of operating within a regulated framework. Therefore, potential clients should exercise caution and consider the implications of trading with an unregulated broker like AVG SIL.

Company Background Investigation

AVG SIL, officially known as Allied Victory Gold & Silver Investment Limited, has been operating since 2009. However, the company lacks a transparent history and has not provided substantial information about its ownership structure or management team. This opacity raises concerns about the broker's accountability and trustworthiness.

The management teams background is a critical factor in assessing a broker's reliability. Unfortunately, AVG SIL does not offer detailed insights into the experience and qualifications of its leadership, which is often a red flag in the industry. A transparent company typically shares information about its executives and their professional history to instill confidence among potential clients. The lack of such information from AVG SIL further complicates the assessment of its legitimacy.

Moreover, the company's transparency regarding its operations and business practices is minimal. This lack of information can leave potential traders in the dark about the broker's true intentions and operational integrity. As a result, traders should be wary of engaging with AVG SIL, given the insufficient information available about its background and management.

Trading Conditions Analysis

The trading conditions offered by a broker are vital in determining its attractiveness to potential clients. In the case of AVG SIL, the brokers fee structure appears to be less competitive compared to industry standards, which could impact traders' profitability.

| Fee Type | AVG SIL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of clear information regarding spreads, commissions, and overnight interest rates raises concerns about potential hidden fees that could affect trading costs. Additionally, if AVG SIL employs an unusual fee structure, it could lead to unexpected expenses for traders. Without a transparent breakdown of these costs, traders may find themselves at a disadvantage, making it difficult to assess the true cost of trading with AVG SIL.

Furthermore, the lack of competitive trading conditions can be a significant deterrent for traders who seek to maximize their returns. A broker's inability to provide favorable conditions may indicate its lack of commitment to trader success. Therefore, potential clients should carefully consider these factors before deciding to trade with AVG SIL.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. Brokers must implement robust measures to protect traders' investments and ensure that funds are managed securely. In the case of AVG SIL, there is no substantial information available regarding the safety measures in place.

AVG SIL does not appear to offer client fund segregation, which is a standard practice among regulated brokers. Segregation ensures that client funds are kept separate from the broker's operational funds, providing an additional layer of protection in case of insolvency. Furthermore, the absence of investor protection schemes raises concerns about the security of traders' investments.

Historically, AVG SIL has not faced any significant controversies regarding fund safety, but the lack of transparency and regulatory oversight leaves potential clients vulnerable to risks. Traders should be aware that without proper safeguards, their funds may be at risk. Therefore, it is essential for potential clients to scrutinize AVG SILs fund safety measures before proceeding with any investments.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability and service quality. In the case of AVG SIL, the available reviews highlight mixed experiences among clients. While some traders report satisfactory experiences, others express concerns regarding the broker's responsiveness and support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Poor Customer Support | Medium | Inconsistent |

| Unclear Fee Structures | High | Lacking |

Common complaints include withdrawal delays, which can significantly impact traders' ability to access their funds. Additionally, clients have reported difficulties in reaching customer support, leading to frustration and dissatisfaction. The inconsistency in responses from the company further exacerbates the issue, as traders may feel unsupported during critical situations.

One notable case involved a client who experienced significant delays in processing a withdrawal request, leading to frustration and a loss of trust in the broker. This incident underscores the importance of reliable customer support and efficient withdrawal processes in maintaining client satisfaction. Therefore, potential clients should consider these factors when evaluating AVG SIL.

Platform and Trade Execution

The performance and reliability of a trading platform are vital for traders seeking to execute their strategies effectively. In the case of AVG SIL, there is limited information available regarding the platform's performance and user experience.

Traders have reported mixed experiences with order execution quality, with some experiencing slippage and order rejections during high volatility periods. Such issues can hinder a trader's ability to capitalize on market opportunities, leading to potential losses. Additionally, signs of platform manipulation or unfair practices can further erode trust in the broker.

Given the lack of transparency regarding the platform's performance, potential clients should approach AVG SIL with caution. A broker that does not provide clear information about its trading infrastructure may not be committed to ensuring a fair trading environment.

Risk Assessment

Engaging with a broker like AVG SIL carries inherent risks that traders must consider. The lack of regulation, transparency, and reliable customer support raises significant concerns regarding the overall safety of trading with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Fund Safety Risk | High | Lack of fund segregation and protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Support Risk | High | Inconsistent support can lead to unresolved issues. |

To mitigate these risks, traders should consider conducting thorough research and exploring alternative brokers that offer better regulatory oversight and customer support. Additionally, maintaining a diversified trading strategy can help protect against potential losses associated with trading with AVG SIL.

Conclusion and Recommendations

In conclusion, the evaluation of AVG SIL raises significant concerns regarding its legitimacy and safety for traders. The broker's lack of regulatory oversight, transparency, and reliable customer support suggests that potential clients should exercise caution when considering this platform.

Is AVG SIL safe? Given the available evidence, it appears that traders may be at risk by engaging with this broker. For those seeking a trustworthy trading experience, it is advisable to explore alternative brokers that are properly regulated and have a proven track record of client satisfaction.

Some reputable alternatives include brokers like OANDA and Saxo Bank, which offer robust regulatory frameworks and transparent trading conditions. Ultimately, traders should prioritize their safety and ensure that they are trading with a broker that aligns with their needs and expectations.

Is ALLIED VICTORY GOLD & SILVER INVESTMENT LIMITED a scam, or is it legit?

The latest exposure and evaluation content of ALLIED VICTORY GOLD & SILVER INVESTMENT LIMITED brokers.

ALLIED VICTORY GOLD & SILVER INVESTMENT LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ALLIED VICTORY GOLD & SILVER INVESTMENT LIMITED latest industry rating score is 1.73, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.73 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.