Is Atwell safe?

Pros

Cons

Is Atwell Safe or Scam?

Introduction

Atwell is a relatively new player in the forex market, claiming to provide a range of trading services across various financial instruments. As with any online broker, it is crucial for traders to exercise caution and conduct thorough due diligence before engaging with Atwell. The forex market is notorious for its volatility and the potential for scams, making it essential for investors to assess the legitimacy of brokers they consider. This article will investigate whether Atwell is safe or a scam by evaluating its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety. A regulated broker is subject to oversight by relevant financial authorities, which helps protect investors from fraud and malpractice. Unfortunately, Atwell does not appear to be regulated by any reputable authority, raising significant concerns about its legitimacy. Below is a summary of Atwell's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation is alarming, as it indicates that Atwell may not adhere to the stringent standards required for the protection of traders' funds. Furthermore, the lack of a valid license suggests that Atwell may be operating outside the legal framework, which can expose traders to various risks. The quality of regulation is paramount; brokers regulated by top-tier authorities such as the FCA (UK) or ASIC (Australia) offer better investor protection compared to those under low-tier or no regulation. In summary, the lack of regulatory oversight raises serious questions about whether Atwell is safe or a scam.

Company Background Investigation

Atwell's corporate history is another area of concern. The broker claims to have a global presence, yet there is little verifiable information regarding its ownership structure or management team. The company's website lacks transparency, failing to provide details about its founders or key personnel. This anonymity is a red flag, as it makes it challenging for investors to hold anyone accountable in case of disputes or issues with the broker.

Additionally, Atwell's domain was registered only recently, which raises suspicions about its credibility. A domain registration date of June 2022 suggests that the broker is relatively new and may lack the experience and stability that more established firms possess. The lack of a clear corporate structure and the absence of publicly available information about its management team further contribute to the uncertainty surrounding Atwell's legitimacy. Therefore, traders should be cautious and consider the potential implications of engaging with a broker that lacks a solid corporate foundation.

Trading Conditions Analysis

When evaluating whether Atwell is safe or a scam, it is essential to analyze its trading conditions. The broker offers a variety of trading instruments, including forex pairs, stocks, and cryptocurrencies. However, the overall fee structure and trading conditions leave much to be desired. Below is a comparison of Atwell's core trading costs:

| Fee Type | Atwell | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | High | Low to None |

| Overnight Interest Range | High | Moderate |

Atwell's commission structure appears to be problematic, as it charges higher fees than the industry average. This can significantly impact a trader's profitability and raises concerns about the broker's intentions. Traders should be wary of brokers that impose excessive fees, as this can be a tactic to siphon off profits. Furthermore, if the spreads offered are not competitive, it may indicate that Atwell is not committed to providing favorable trading conditions.

Customer Fund Security

The safety of customer funds is paramount when assessing whether Atwell is safe or a scam. According to the information available, Atwell claims to implement certain security measures, such as segregating client funds from operational funds. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

Traders should inquire about the specifics of Atwell's fund security protocols, including whether they provide negative balance protection or investor compensation schemes. The absence of such protections can leave traders vulnerable to significant losses, especially in the highly volatile forex market. Moreover, there have been reports of difficulties in withdrawing funds from Atwell, which is a common complaint associated with fraudulent brokers. This history of withdrawal issues further underscores the importance of evaluating the safety of customer funds with this broker.

Customer Experience and Complaints

Customer feedback is a valuable source of information when determining whether Atwell is safe or a scam. Numerous reviews and complaints highlight a range of issues associated with the broker. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Inadequate |

| Poor Customer Support | High | Slow |

Common complaints include difficulties in withdrawing funds, high fees, and inadequate customer support. Many users have reported that Atwell's response to complaints is slow and unhelpful, which is concerning for potential clients. This pattern of negative feedback raises significant red flags about the broker's reliability and commitment to customer satisfaction.

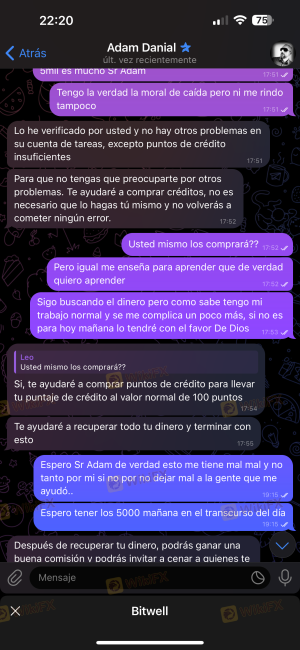

For instance, one user reported being unable to withdraw their funds for weeks, only to receive vague responses from customer support. Such experiences are indicative of potential scam operations, where brokers exploit clients and make it difficult to recover funds. Therefore, prospective traders should be cautious and consider these user experiences before engaging with Atwell.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Atwell claims to offer a robust trading platform, but user reviews suggest otherwise. Many traders have reported issues with platform stability, including frequent outages and slow execution speeds. These problems can significantly hinder trading performance and lead to missed opportunities.

Moreover, concerns about order execution quality have been raised, with some users reporting instances of slippage and rejected orders. Such issues can indicate potential manipulation by the broker, raising further questions about whether Atwell is safe or a scam. A reliable broker should provide a stable trading environment with transparent execution policies, which does not seem to be the case with Atwell.

Risk Assessment

Assessing the risks associated with using Atwell is essential for prospective traders. The following risk summary highlights key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Financial Risk | High | High fees and poor fund security. |

| Operational Risk | Medium | Platform instability and execution issues. |

The overall risk level of trading with Atwell is high, primarily due to its lack of regulation, high fees, and numerous complaints about fund security and customer service. Traders should consider these risks and weigh them against their own risk tolerance before deciding to engage with this broker. To mitigate these risks, it is advisable to conduct thorough research and consider alternative, more reputable brokers that offer better protection and trading conditions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Atwell raises significant red flags regarding its legitimacy and safety. The lack of regulatory oversight, combined with numerous customer complaints and issues with fund security, indicates that Atwell may not be a trustworthy broker. Therefore, traders should exercise extreme caution and consider avoiding this broker to protect their investments.

For those seeking reliable alternatives, it is recommended to explore brokers that are regulated by top-tier authorities and have a proven track record of transparency and customer satisfaction. Ultimately, the key takeaway is that while Atwell may present itself as a legitimate broker, the risks associated with trading with it far outweigh any potential benefits.

Is Atwell a scam, or is it legit?

The latest exposure and evaluation content of Atwell brokers.

Atwell Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Atwell latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.