Is Athenaplace Finance Ltd safe?

Business

License

Is Athenaplace Finance Ltd Safe or Scam?

Introduction

Athenaplace Finance Ltd is a forex broker that has gained attention in the trading community, but its legitimacy is under scrutiny. As the forex market continues to expand, traders must exercise caution when selecting brokers, as the risks of scams and fraudulent activities are prevalent. With numerous reports of unregulated brokers engaging in unethical practices, it is crucial for traders to assess the safety and reliability of their chosen platforms. This article will investigate whether Athenaplace Finance Ltd is a safe trading option or a potential scam. The analysis is based on multiple sources, including regulatory records, customer reviews, and expert assessments.

Regulation and Legitimacy

Athenaplace Finance Ltd operates without any valid regulatory oversight, which is a significant red flag for potential investors. The lack of regulation means that the broker is not held accountable by any financial authority, raising concerns about the safety of client funds. Here's a summary of the regulatory status of Athenaplace Finance Ltd:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a license from recognized bodies such as the Financial Conduct Authority (FCA) in the UK or the Securities and Futures Commission (SFC) in Hong Kong indicates that Athenaplace Finance Ltd does not adhere to the necessary compliance standards. This lack of oversight can lead to potential risks for traders, as unregulated brokers are not bound by strict operational guidelines. Additionally, traders have reported difficulties in withdrawing funds, further suggesting that the broker may not prioritize client interests.

Company Background Investigation

Athenaplace Finance Ltd claims to offer a range of trading services, yet the company's history and ownership structure remain opaque. Established reportedly in Hong Kong, the company lacks transparency regarding its management team and their qualifications. This lack of information can be concerning for traders looking to invest their capital. A thorough investigation reveals that the broker has been associated with numerous complaints and negative reviews, indicating a troubling operational history.

The absence of a clearly defined ownership structure raises questions about accountability and the broker's commitment to ethical practices. A transparent company typically provides details about its founders and management, but Athenaplace Finance Ltd does not disclose such information. This lack of transparency is a crucial factor for traders to consider when evaluating whether Athenaplace Finance Ltd is safe or a scam.

Trading Conditions Analysis

When assessing Athenaplace Finance Ltd's trading conditions, it is essential to analyze the fee structure and any potential hidden costs. Reports indicate that the broker's trading fees may not be competitive compared to industry standards. Here is a comparison of core trading costs:

| Fee Type | Athenaplace Finance Ltd | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High (exact figures unavailable) | Low to Moderate |

| Commission Structure | Unclear | Varies by broker |

| Overnight Interest Range | Unclear | Varies by broker |

The high spreads reported by users suggest that trading costs may be significantly higher than those offered by regulated competitors. Additionally, the ambiguity surrounding commission structures raises concerns about potential hidden fees, which could further erode traders' profits. Such factors contribute to the overall risk of trading with Athenaplace Finance Ltd, leading to the question: Is Athenaplace Finance Ltd safe for traders?

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Athenaplace Finance Ltd has been criticized for its lack of robust safety measures. Reports indicate that the broker does not implement fund segregation practices, which means that client funds may not be kept separate from the company's operational funds. This poses a risk in the event of insolvency or financial mismanagement.

Furthermore, the absence of investor protection schemes means that traders have no recourse in case of disputes or financial loss. The lack of negative balance protection is another alarming aspect, as traders could potentially lose more than their initial investment. Historical complaints regarding fund withdrawal issues further exacerbate concerns about the safety of funds held with Athenaplace Finance Ltd.

Customer Experience and Complaints

Customer feedback is a vital component in evaluating the trustworthiness of a broker. Athenaplace Finance Ltd has garnered numerous complaints from users who have reported challenges in executing trades and withdrawing funds. Common complaint types include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Platform Stability | Medium | Poor |

| Customer Support Issues | High | Poor |

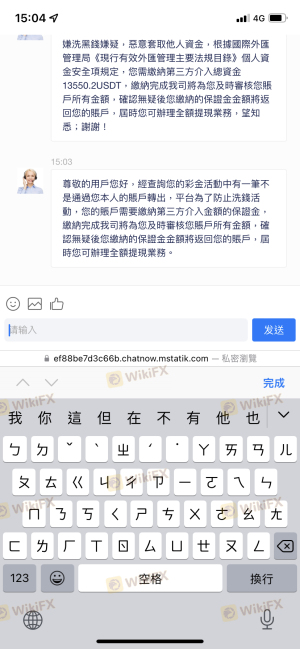

Many users have expressed frustration over the unresponsive customer service, making it difficult to address their concerns. Notable cases include traders who claimed they were unable to withdraw their funds after meeting specific trading requirements, leading to suspicions of a scam. Such patterns of complaints raise serious concerns about whether Athenaplace Finance Ltd is safe for traders.

Platform and Execution

The performance of Athenaplace Finance Ltd's trading platform has also been a point of contention. Users have reported issues with platform stability, including crashes during critical trading periods. These technical difficulties can hinder traders' ability to execute orders promptly, leading to potential financial losses. Additionally, reports of slippage and order rejections further complicate the trading experience, raising suspicions of possible platform manipulation.

Risk Assessment

Trading with Athenaplace Finance Ltd comes with inherent risks, primarily due to its unregulated status and negative customer feedback. Here is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation and protection |

| Customer Service Risk | High | Poor response to complaints |

Given the high-risk levels associated with Athenaplace Finance Ltd, traders should exercise extreme caution. It is advisable to consider alternatives with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In summary, the evidence suggests that Athenaplace Finance Ltd poses significant risks for traders. The absence of regulation, poor customer feedback, and troubling operational practices indicate that this broker may not be safe. Traders should be wary of engaging with Athenaplace Finance Ltd and consider reputable alternatives that prioritize client safety and transparency.

For those seeking reliable trading options, it is recommended to explore brokers that are regulated by recognized financial authorities, offer competitive trading conditions, and maintain a transparent operational history. Always conduct thorough research and due diligence before investing your capital in any forex broker, as the risks associated with unregulated platforms can lead to substantial financial losses.

Is Athenaplace Finance Ltd a scam, or is it legit?

The latest exposure and evaluation content of Athenaplace Finance Ltd brokers.

Athenaplace Finance Ltd Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Athenaplace Finance Ltd latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.