Is Legit Crypto safe?

Pros

Cons

Is Legit Crypto Safe or a Scam?

Introduction

Legit Crypto is an emerging player in the forex and cryptocurrency trading landscape, positioning itself as a broker that caters to both novice and experienced traders. With the rapid growth of the cryptocurrency market and increasing interest from retail investors, brokers like Legit Crypto are attracting attention. However, with the rise of such platforms comes the necessity for traders to exercise caution and conduct thorough evaluations before committing their funds. This article aims to investigate the legitimacy of Legit Crypto by assessing its regulatory status, company background, trading conditions, client safety measures, user experiences, and overall risk profile. The analysis is based on a review of various online sources, regulatory databases, and customer feedback to provide a comprehensive overview of whether Legit Crypto is safe or a potential scam.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is crucial for assessing its safety and reliability. Legit Crypto claims to operate within the cryptocurrency and forex trading sectors; however, it lacks clear regulatory oversight from recognized financial authorities. This absence of regulation raises red flags for potential investors, as the lack of oversight can lead to unregulated practices and increased risks for traders.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Not Verified |

The importance of regulation cannot be overstated. Brokers regulated by top-tier authorities, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the USA, are subject to strict compliance standards and regular audits. This oversight helps ensure that client funds are protected and that the broker adheres to fair trading practices. Unfortunately, Legit Crypto is safe does not hold a license from any reputable regulatory body, which significantly undermines its credibility.

Moreover, the history of compliance and regulatory actions against the broker is a critical factor to consider. Reports indicate that Legit Crypto has faced scrutiny and negative feedback from users regarding its operations, which further complicates the assessment of its legitimacy. The absence of a regulatory framework and the associated risks make it imperative for prospective clients to approach Legit Crypto with caution.

Company Background Investigation

A thorough examination of a broker's background can provide valuable insights into its reliability and operational integrity. Legit Crypto's history is somewhat opaque, with limited information available regarding its founding, ownership structure, and developmental milestones. This lack of transparency raises concerns about the broker's legitimacy and accountability.

The company's management team is another critical aspect to consider. An experienced and reputable management team can enhance a broker's credibility. However, details about the individuals behind Legit Crypto remain scarce, with no publicly available information about their qualifications or professional backgrounds. This lack of information contributes to a perception of untrustworthiness, as potential clients cannot ascertain the expertise or integrity of the management team.

Furthermore, the level of information disclosure by Legit Crypto is inadequate. A reputable broker typically provides comprehensive details about its operations, including its physical address, ownership structure, and regulatory compliance. In contrast, Legit Crypto is safe appears to operate with minimal transparency, which is a significant red flag for investors seeking to protect their funds.

Trading Conditions Analysis

The trading conditions offered by a broker are vital in determining its overall appeal to clients. Legit Crypto presents a range of trading options, but the specifics of its fee structure and trading conditions warrant closer examination. Understanding the costs associated with trading can significantly impact a trader's profitability.

The overall fees associated with Legit Crypto include spreads, commissions, and overnight interest rates. However, the broker's fee structure lacks clarity, and potential clients often report unexpected charges. This lack of transparency regarding fees can lead to confusion and dissatisfaction among traders.

| Fee Type | Legit Crypto | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (0.1% - 0.5%) |

| Commission Model | N/A | Varies (0% - 0.5%) |

| Overnight Interest Range | N/A | Varies (0.5% - 3%) |

The absence of detailed information about the trading costs associated with Legit Crypto is concerning. Traders should be aware of any potential hidden fees that could erode their profits. Additionally, the broker's commission model, if not competitive, could further deter potential clients. Overall, the lack of transparency in trading conditions raises questions about whether Legit Crypto is safe for traders who expect clarity and fairness in their trading experience.

Client Funds Security

Ensuring the safety of client funds is a paramount concern for any trading platform. Legit Crypto claims to implement various security measures to protect client assets; however, the effectiveness of these measures remains uncertain. A detailed analysis of the broker's security protocols is essential to assess the safety of client investments.

One key aspect of client funds security is the segregation of client accounts. Legit Crypto's policies regarding fund segregation and investor protection are not clearly outlined, which raises concerns about the safety of clients' investments. In the event of the broker facing financial difficulties, the lack of proper fund segregation could jeopardize client assets.

Moreover, the absence of negative balance protection policies is another area of concern. Traders should be protected from losing more than their invested capital, but without clear policies in place, there is a risk that clients could incur significant losses. The lack of transparency regarding these critical security measures raises doubts about whether Legit Crypto is safe for traders looking to protect their investments.

Customer Experience and Complaints

Customer feedback is a valuable source of information when evaluating a broker's reliability. Legit Crypto has received mixed reviews from users, with numerous complaints highlighting issues related to withdrawals, customer support, and overall trading experience.

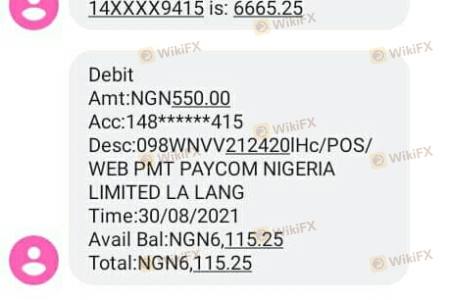

Common complaints include difficulties in withdrawing funds, slow response times from customer support, and a lack of transparency regarding fees and trading conditions. These issues can significantly impact a trader's experience and raise concerns about the broker's integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Inconsistent |

| Fee Transparency | High | Unresolved |

Two notable cases involve clients who experienced significant delays in withdrawing their funds, leading to frustration and distrust. These incidents highlight the potential risks associated with trading through Legit Crypto, as unresolved complaints can indicate deeper systemic issues within the broker's operations.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a successful trading experience. Legit Crypto's trading platform has been described as user-friendly, but its stability and execution quality require further scrutiny.

Traders have reported mixed experiences regarding order execution, with some experiencing slippage and rejected orders during high volatility periods. These issues can hinder a trader's ability to capitalize on market opportunities and raise concerns about the broker's operational integrity.

Risk Assessment

Engaging with any broker comes with inherent risks, and Legit Crypto is no exception. A comprehensive risk assessment can help traders understand the potential pitfalls associated with using this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns about oversight. |

| Financial Risk | Medium | Unclear fee structure may lead to unexpected costs. |

| Operational Risk | High | Reports of withdrawal issues and execution problems. |

To mitigate these risks, traders should consider conducting thorough research before engaging with Legit Crypto. Diversifying investments and using risk management strategies can also help protect against potential losses when trading with this broker.

Conclusion and Recommendations

In conclusion, the investigation into Legit Crypto raises several concerns regarding its legitimacy and safety. The absence of regulatory oversight, combined with a lack of transparency in its operations and a history of customer complaints, points to significant risks for potential traders.

While Legit Crypto may offer attractive trading conditions, the overall assessment suggests that traders should approach this broker with caution. For those seeking a safer trading environment, it is advisable to consider alternative brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction.

In summary, Legit Crypto is not safe and presents multiple red flags that warrant careful consideration before investing.

Is Legit Crypto a scam, or is it legit?

The latest exposure and evaluation content of Legit Crypto brokers.

Legit Crypto Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Legit Crypto latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.