Aichi 2025 Review: Everything You Need to Know

Executive Summary

This aichi review examines a forex broker that operates under the name AICHI Forex Broker/FX/Capital. Based on available public information, Aichi appears to position itself as a forex trading service provider, though comprehensive details about their operations remain limited in current market documentation. The broker's name suggests a connection to Japan's Aichi Prefecture. This potentially indicates Japanese market focus or regional operations.

Our analysis reveals that while Aichi presents itself as a forex broker, specific information regarding trading conditions, regulatory oversight, and operational details is not extensively documented in readily available sources. This lack of comprehensive public information presents challenges for traders seeking detailed operational insights. The broker appears to target forex traders. However, without detailed service specifications, determining the exact user demographic proves difficult.

Given the limited available information, this aichi review maintains a neutral stance, emphasizing the importance of thorough due diligence before engaging with any broker where operational transparency may be limited.

Important Notice

This evaluation is based on publicly available information and market analysis conducted in 2025. Due to the limited specific details available about Aichi's operations, regulatory status, and trading conditions, potential clients should conduct additional independent research before making any trading decisions.

The forex industry operates under varying regulatory frameworks across different jurisdictions. Broker services may differ significantly between regions. This review cannot account for potential variations in service offerings or regulatory compliance across different operational territories due to insufficient publicly available data about Aichi's specific regulatory jurisdictions.

Rating Framework

Note: Ratings marked as N/A indicate insufficient publicly available information to provide accurate scoring.

Broker Overview

Aichi operates under the designation "AICHI Forex Broker/FX/Capital," suggesting its primary focus lies within foreign exchange trading services. The broker's name indicates potential Japanese market connections, with Aichi being a prominent prefecture in Japan known for its industrial and economic significance. However, the specific founding date, operational history, and detailed company background remain unclear in current public documentation.

The broker appears to position itself within the competitive forex market. Without detailed information about their business model, client base, or operational scale, determining their exact market position proves challenging. Available information suggests they operate as a forex broker. Specifics regarding whether they function as market makers, ECN providers, or through other execution models are not clearly documented.

This aichi review notes that while the broker presents itself in the forex trading space, the lack of comprehensive operational details in public sources makes thorough evaluation difficult. Potential clients should seek additional information directly from the broker regarding their specific services, trading conditions, and operational framework before making any commitment to their platform.

Regulatory Jurisdiction: Available information does not specify which regulatory authorities oversee Aichi's operations. This makes it difficult to assess compliance standards or client protection measures.

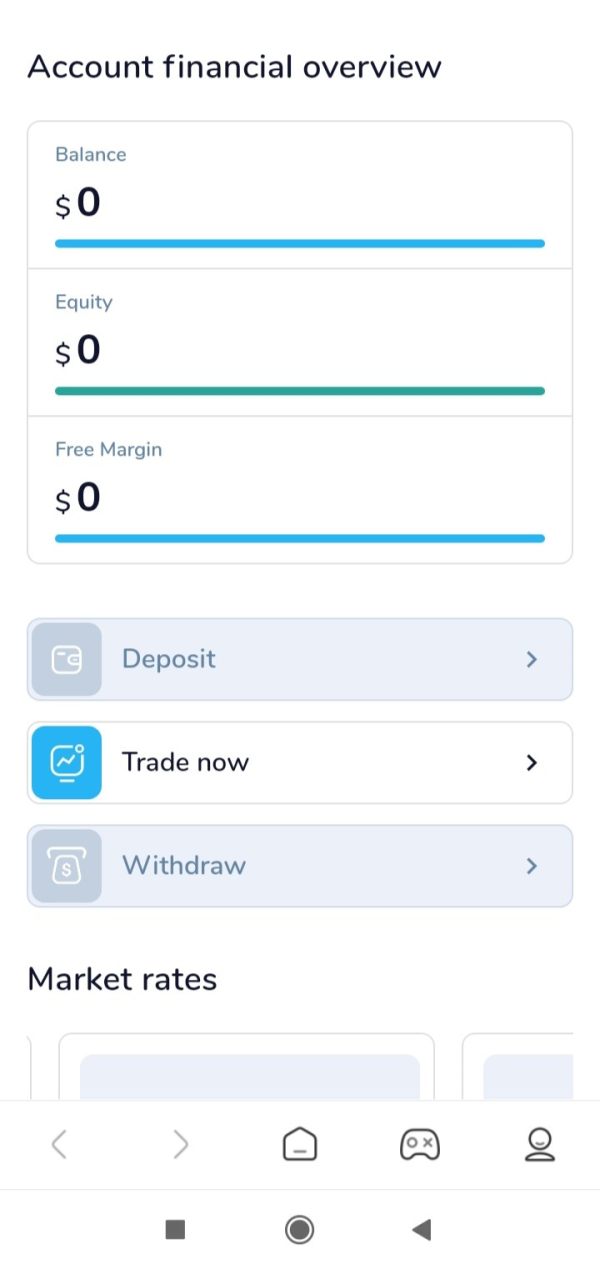

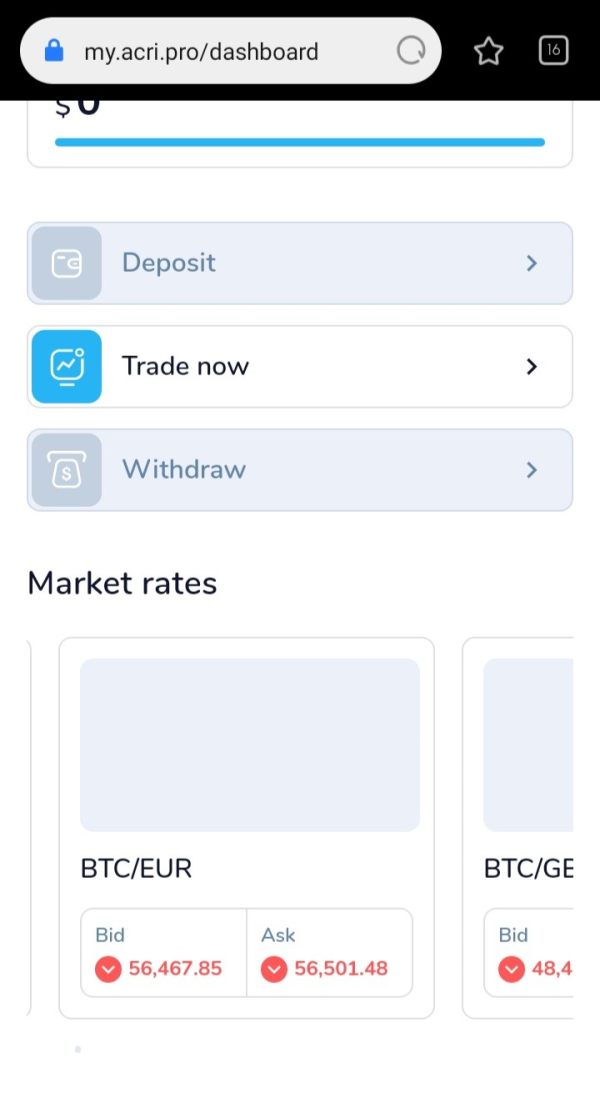

Deposit and Withdrawal Methods: Specific payment processing options, supported currencies, and transaction procedures are not detailed in current public documentation.

Minimum Deposit Requirements: The broker's entry-level investment requirements are not specified in available sources. This prevents assessment of accessibility for different trader categories.

Promotions and Bonuses: Current promotional offerings, welcome bonuses, or ongoing incentive programs are not documented in accessible information sources.

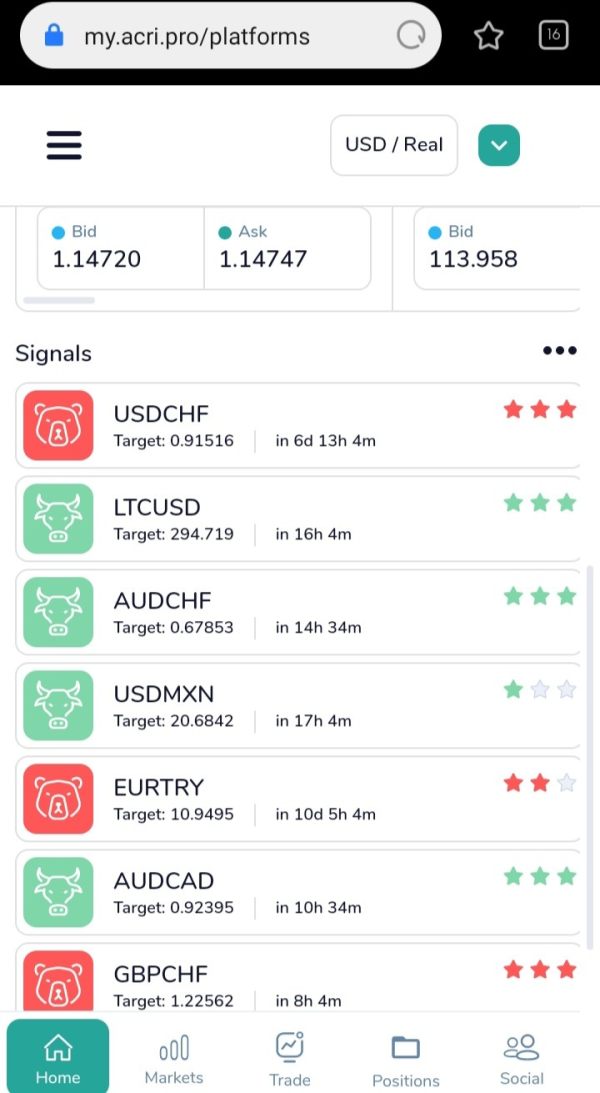

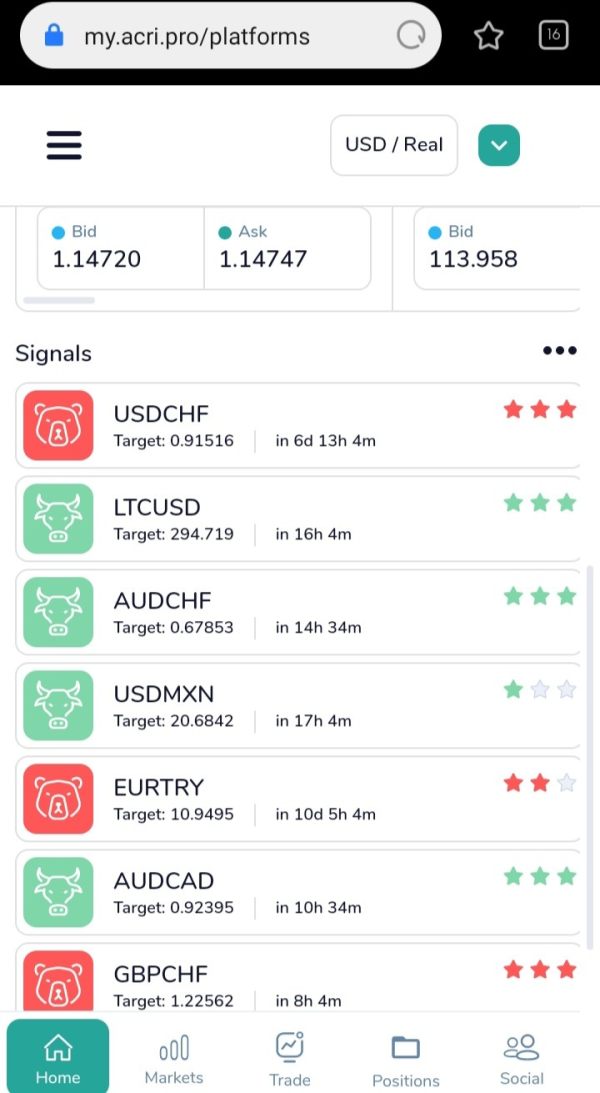

Tradeable Assets: While the broker name suggests forex focus, the complete range of available trading instruments remains unspecified. This includes currency pairs, commodities, indices, or other assets.

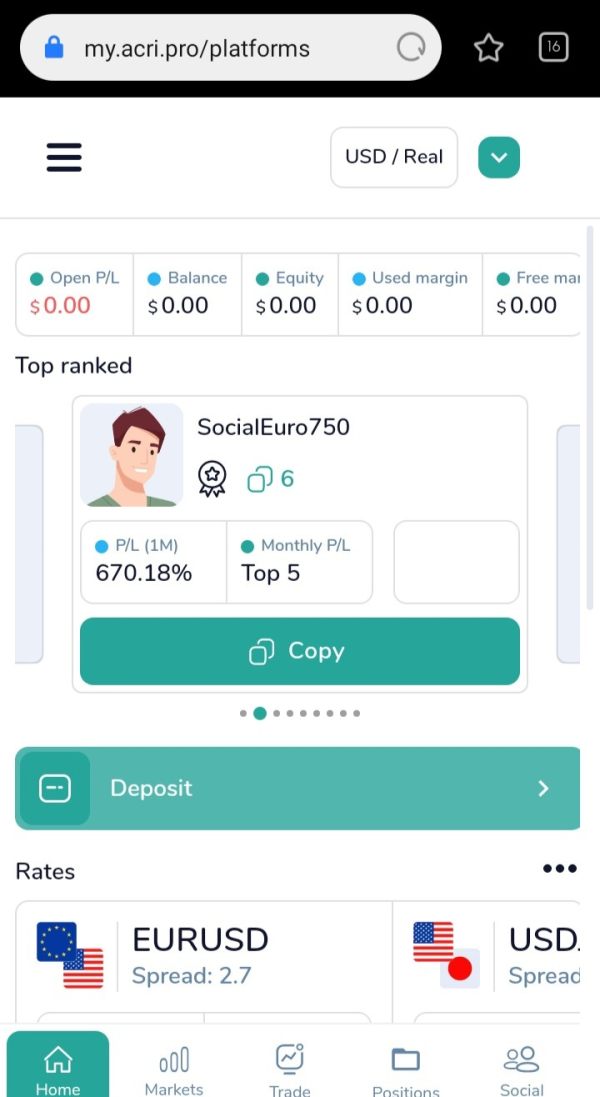

Cost Structure: Critical trading costs including spreads, commissions, overnight fees, and other charges are not detailed in available public information. This makes cost comparison impossible.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in current documentation.

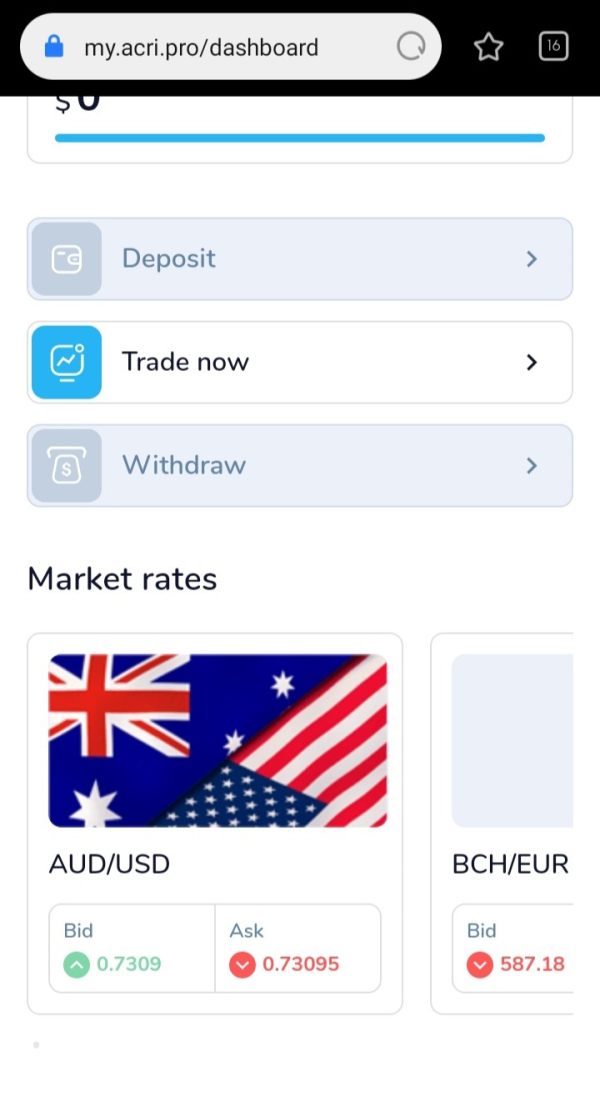

Platform Options: Trading platform availability is not clearly indicated. This includes whether they support MetaTrader 4, MetaTrader 5, proprietary platforms, or other trading software.

Geographic Restrictions: Service availability across different countries and any regional limitations are not documented in accessible sources.

Customer Support Languages: Available communication languages and international support capabilities remain unspecified.

This aichi review emphasizes that the limited availability of detailed operational information presents challenges for comprehensive evaluation and comparison with other market participants.

Account Conditions Analysis

The assessment of Aichi's account conditions proves challenging due to the absence of specific information regarding account types, structures, and associated terms. Without detailed documentation of their account offerings, it becomes impossible to evaluate the diversity of options available to different trader categories or assess the competitiveness of their account structures within the current market landscape.

Standard industry practice typically includes multiple account tiers designed to accommodate varying trader needs. These range from beginner-friendly options to professional-grade accounts with enhanced features. However, specific information about Aichi's account hierarchy, minimum deposit requirements for different tiers, or special features associated with various account types is not available in current public sources.

The absence of clear information regarding account opening procedures, verification requirements, and onboarding processes makes it difficult to assess the user experience from initial registration through account activation. Additionally, without documented details about account maintenance fees, inactivity charges, or other ongoing costs, potential clients cannot accurately budget for their trading activities.

This aichi review notes that prospective clients should seek comprehensive account information directly from the broker. This includes detailed terms and conditions, fee structures, and any restrictions or limitations that may apply to different account categories before proceeding with account opening procedures.

Evaluating Aichi's trading tools and educational resources presents significant challenges due to the limited information available in public sources. Modern forex brokers typically provide comprehensive suites of analytical tools, market research, and educational materials to support trader decision-making and skill development. However, specific details about Aichi's offerings in these areas are not documented.

Professional trading environments usually include advanced charting capabilities, technical analysis tools, economic calendars, market news feeds, and research reports. Without specific information about Aichi's platform features or third-party integrations, it's impossible to assess the quality and comprehensiveness of their analytical resources.

Educational support represents a crucial differentiator in the competitive forex market. Leading brokers offer webinars, tutorials, market analysis, and trading guides. The absence of documented information about Aichi's educational initiatives makes it difficult to evaluate their commitment to trader development and ongoing support.

Automated trading capabilities have become increasingly important for modern traders. These include expert advisor support, copy trading features, and algorithmic trading tools. However, specific information about Aichi's support for these advanced trading methodologies is not available in current public documentation, limiting assessment of their technological capabilities and innovation in trading solutions.

Customer Service and Support Analysis

Assessment of Aichi's customer service capabilities faces limitations due to insufficient publicly available information about their support infrastructure, response protocols, and service quality standards. Effective customer support represents a critical component of forex broker operations. This is particularly true given the time-sensitive nature of trading activities and the need for reliable technical assistance.

Industry-leading brokers typically provide multiple communication channels including live chat, email support, telephone assistance, and sometimes social media engagement. However, specific details about Aichi's available support channels, operational hours, and geographic coverage are not documented in accessible sources.

Response time performance cannot be assessed without access to service level agreements, user feedback, or documented performance standards. This represents a crucial metric for evaluating customer service effectiveness. Additionally, the availability of multilingual support, which is essential for international operations, remains unspecified.

The quality of customer service often reflects in user testimonials, complaint resolution procedures, and overall client satisfaction metrics. However, without access to user reviews, feedback systems, or documented service protocols, evaluating Aichi's customer service performance becomes impossible. Professional support capabilities cannot be properly assessed without more detailed information about their support team qualifications and service procedures. This includes assistance with trading platform issues, account management, and technical troubleshooting.

Trading Experience Analysis

Analyzing the trading experience offered by Aichi encounters significant obstacles due to the absence of detailed information about platform performance, execution quality, and user interface design. The trading experience encompasses multiple critical factors including platform stability, order execution speed, price accuracy, and overall system reliability during various market conditions.

Platform performance metrics such as uptime statistics, execution speeds, and system latency are not documented in available sources. This makes it impossible to assess the technical quality of their trading infrastructure. These factors directly impact trading outcomes and user satisfaction, particularly during high-volatility market periods when reliable execution becomes crucial.

Order execution quality represents another vital component of the trading experience. This includes fill rates, slippage statistics, and rejection rates. However, without documented performance data or user feedback regarding execution quality, evaluating Aichi's operational efficiency in trade processing proves impossible.

Mobile trading capabilities have become increasingly important as traders demand flexible access to markets. Information about mobile applications, cross-platform synchronization, and mobile-specific features is not available in current documentation. The user interface design, navigation efficiency, and overall platform usability cannot be assessed without detailed platform information or user experience reports.

This aichi review emphasizes that the trading experience evaluation requires comprehensive platform testing and user feedback analysis. This cannot be conducted without access to detailed operational information and actual user testimonials about their trading environment.

Trust Factor Analysis

Evaluating Aichi's trustworthiness presents considerable challenges due to the absence of clear regulatory information and transparency details in publicly available sources. Trust in forex brokers fundamentally depends on regulatory oversight, financial transparency, and demonstrated commitment to client protection measures.

Regulatory compliance serves as the primary foundation for broker trustworthiness. Reputable brokers operate under recognized financial authorities that enforce strict operational standards. However, specific information about Aichi's regulatory status, licensing jurisdictions, and compliance frameworks is not documented in accessible sources, making trust assessment extremely difficult.

Client fund protection measures are not detailed in available information. These include segregated account policies, insurance coverage, and dispute resolution mechanisms. These protections represent crucial safeguards for trader investments and are typically prominently disclosed by reputable brokers.

Company transparency contributes significantly to trust evaluation. This includes ownership information, financial reporting, and operational history. Without access to detailed company background, operational track record, or third-party verification of their business practices, assessing Aichi's reliability and stability becomes problematic.

Industry recognition, awards, and third-party ratings often provide additional trust indicators, but such information is not available in current public documentation. The absence of verifiable trust indicators emphasizes the importance of conducting thorough independent research before engaging with any broker where transparency may be limited.

User Experience Analysis

Assessing user experience with Aichi faces significant limitations due to the absence of documented user feedback, interface descriptions, and operational process details. User experience encompasses the entire client journey from initial registration through ongoing trading activities and support interactions.

Overall user satisfaction typically manifests through review platforms, testimonials, and feedback systems. However, specific user opinions about Aichi's services are not available in current public sources. This absence of user voice makes it impossible to gauge real-world satisfaction levels or identify common user concerns.

Interface design and platform usability significantly impact daily trading activities. Without detailed platform information or user interface descriptions, evaluating the ease of use and navigation efficiency becomes impossible. Modern traders expect intuitive designs that facilitate quick decision-making and efficient trade management.

Registration and verification processes affect the initial user experience, but specific information about account opening procedures, document requirements, and verification timelines is not documented. Similarly, funding and withdrawal experiences cannot be assessed without detailed information about payment processing and transaction procedures. These often determine user satisfaction.

Common user complaints and areas for improvement typically emerge through feedback analysis and support ticket patterns. However, without access to such data, identifying potential user experience challenges becomes impossible. This limitation emphasizes the importance of seeking direct user testimonials and conducting personal due diligence when evaluating any broker with limited public feedback.

Conclusion

This aichi review reveals significant limitations in publicly available information about the broker's operations, services, and performance metrics. While Aichi presents itself as a forex broker, the absence of detailed information regarding trading conditions, regulatory status, platform features, and user feedback makes comprehensive evaluation challenging.

The lack of transparent operational details, regulatory information, and user testimonials suggests that potential clients should exercise considerable caution. They should conduct extensive independent research before considering Aichi's services. In the competitive forex market, established brokers typically provide comprehensive public information about their services, regulatory compliance, and operational standards.

For forex traders seeking reliable broker partnerships, the limited transparency observed in this evaluation may indicate the need to consider alternative options. These alternatives should have more comprehensive public documentation and established market presence. Successful forex trading requires trusted broker relationships built on transparency, regulatory compliance, and demonstrated operational excellence. These are factors that cannot be adequately assessed based on currently available information about Aichi.