Is Wintersnow safe?

Pros

Cons

Is Wintersnow Safe or a Scam?

Introduction

Wintersnow is a forex broker that has emerged in the online trading landscape, claiming to offer a range of trading services to its clients. Positioned as a platform for both novice and experienced traders, Wintersnow aims to provide a user-friendly trading environment. However, the forex market is notorious for its potential risks, and traders must exercise caution when evaluating brokers. The significance of thorough due diligence cannot be overstated, as the wrong choice can lead to financial losses. This article aims to investigate Wintersnow's legitimacy by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulatory and Legality

A crucial aspect of assessing any forex broker's credibility is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect client funds. In the case of Wintersnow, the broker operates without any valid regulatory oversight, as confirmed by multiple sources. Below is a summary of the regulatory status of Wintersnow:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation raises significant concerns about the safety of funds and the potential for fraudulent activities. Legitimate brokers typically display their regulatory information prominently, providing clients with a sense of security. In contrast, Wintersnow's lack of regulatory affiliation is a major red flag. The Hong Kong Securities and Futures Commission (SFC) does not recognize Wintersnow as a licensed broker, further emphasizing its unregulated status. This lack of oversight means that investors' funds are not protected by any governing body, making it imperative for potential clients to reconsider their decision to trade with Wintersnow.

Company Background Investigation

Understanding a broker's history and ownership structure is essential in evaluating its trustworthiness. Wintersnow claims to be based in Hong Kong, but there is little information available about its founding, management team, or operational history. The company appears relatively new, having been established in 2021, which raises concerns about its experience and stability in the market.

Moreover, the lack of transparency regarding the management team and their qualifications is alarming. A credible broker typically provides information about its executives and their professional backgrounds. In Wintersnow's case, such details are conspicuously absent, which further diminishes its credibility. Additionally, the company's website has been reported as inaccessible at times, indicating potential operational issues. The opacity surrounding Wintersnow's ownership and management is a significant concern, as it suggests a lack of accountability and transparency that traders should be wary of.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. In the case of Wintersnow, the broker's overall fee structure and trading conditions are not clearly defined, which is a common tactic used by unregulated brokers to obscure hidden fees. Traders often encounter unexpected charges that can erode their profits. Below is a comparison of Wintersnow's trading costs against industry averages:

| Fee Type | Wintersnow | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies (typically $5 per lot) |

| Overnight Interest Range | N/A | Varies (typically 0.5% - 2%) |

The lack of transparency regarding spreads, commissions, and overnight interest rates is concerning. Typically, legitimate brokers provide detailed information about their fee structures, allowing traders to make informed decisions. Wintersnow's vague policies raise questions about potential hidden fees that could impact profitability.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Wintersnow's lack of regulatory oversight means that it is not required to implement standard safety measures, such as segregating client funds or offering negative balance protection. The absence of these safety nets puts traders at significant risk.

Moreover, there have been allegations of fund mismanagement and withdrawal issues from users who claim they faced difficulties accessing their money. Such complaints are common among unregulated brokers, where clients often find themselves unable to withdraw their funds after depositing. The lack of adequate investor protection measures is a significant concern, making it crucial for potential clients to consider the risks associated with trading on this platform.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's performance. Reviews and comments about Wintersnow suggest a pattern of dissatisfaction among users, particularly regarding withdrawal issues and unresponsive customer service. Below is a summary of the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Promotions | High | Poor |

Many users report being unable to withdraw their funds, often citing vague excuses from the broker. Some have described their experiences as akin to a scam, with promises of high returns that never materialize. The frequency of these complaints raises significant concerns about the broker's reliability and commitment to customer service.

For instance, one user detailed a scenario where they were unable to access their funds after multiple requests, leading them to believe they had been scammed. Such experiences highlight the importance of choosing a broker with a proven track record of positive customer interactions and transparent practices.

Platform and Trade Execution

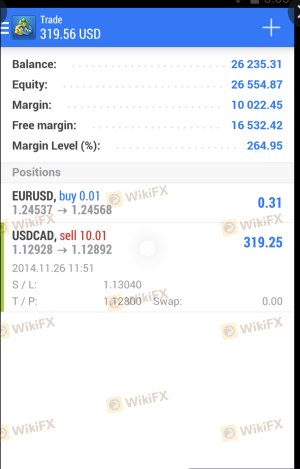

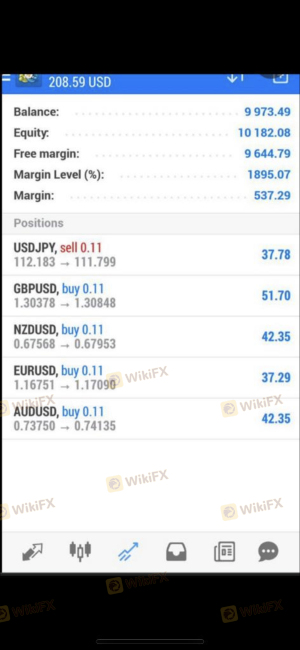

The performance of a broker's trading platform is critical for traders. Wintersnow claims to offer the popular MetaTrader 5 (MT5) platform, known for its advanced features and user-friendly interface. However, user reviews indicate concerns about platform stability and execution quality. Issues such as slippage and order rejections have been reported, which can significantly affect trading outcomes.

Furthermore, there are indications that the platform may be manipulated to create the illusion of trading activity, a common tactic used by fraudulent brokers. This raises alarm bells for potential clients who rely on accurate and fair trading conditions to execute their strategies.

Risk Assessment

Engaging with an unregulated broker like Wintersnow presents numerous risks. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for clients |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues |

| Transparency Risk | Medium | Lack of clear information on fees and terms |

| Platform Manipulation Risk | High | Potential for unfair trading conditions |

To mitigate these risks, traders should thoroughly research and consider alternative brokers that are regulated and offer transparent trading conditions. It is advisable to avoid brokers that lack proper oversight and have a history of customer complaints.

Conclusion and Recommendations

In conclusion, the evidence suggests that Wintersnow is not a safe trading option. The broker's lack of regulation, transparency issues, and numerous customer complaints indicate a high level of risk associated with trading on this platform. Potential investors should exercise extreme caution and consider the significant red flags presented in this analysis.

For traders seeking reliable alternatives, it is recommended to choose brokers with established regulatory oversight, transparent fee structures, and positive customer feedback. Brokers regulated by reputable authorities such as the FCA or ASIC are typically safer options for trading. Always prioritize safety and due diligence when selecting a forex broker to protect your investments.

Is Wintersnow a scam, or is it legit?

The latest exposure and evaluation content of Wintersnow brokers.

Wintersnow Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Wintersnow latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.