Is ADI Markets safe?

Pros

Cons

Is ADI Markets Safe or a Scam?

Introduction

ADI Markets is a forex broker that primarily targets the Chinese market, offering trading services in various financial instruments. As the forex market continues to grow, traders must exercise caution when selecting brokers, as the risk of encountering scams is prevalent. The importance of evaluating a broker's legitimacy cannot be overstated, as it directly impacts the safety of traders' funds and the quality of their trading experience. This article investigates whether ADI Markets is a scam or a safe trading option by analyzing its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy. Regulation provides oversight, ensuring that brokers adhere to specific standards designed to protect traders. In the case of ADI Markets, it lacks any valid regulatory licenses, raising significant concerns about its safety and compliance.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that ADI Markets is not subject to the scrutiny of a governing body, which is essential for safeguarding traders' investments. Without a regulatory framework, there are no guarantees regarding the broker's financial practices, transparency, or operational integrity. Historical compliance issues are also absent, as the broker has not been evaluated by any regulatory authority. This lack of oversight poses a substantial risk to traders, making it crucial to question: Is ADI Markets safe?

Company Background Investigation

Understanding the company behind a broker is vital for assessing its reliability. ADI Markets appears to be a relatively new entity in the forex trading landscape, with insufficient information available about its history, ownership structure, or management team. This lack of transparency raises red flags regarding the broker's credibility.

The management team's background and professional experience are essential components in evaluating a broker's trustworthiness. Unfortunately, details about the individuals behind ADI Markets are scarce, leaving traders with little insight into their qualifications or expertise. Furthermore, the broker's website does not provide adequate information regarding its operational practices or client support mechanisms.

Given these factors, the question remains: Is ADI Markets safe? The lack of transparency and information about the company's history and management creates an environment of uncertainty, making it difficult for potential clients to feel confident in their decision to trade with ADI Markets.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence a trader's experience and profitability. In the case of ADI Markets, the overall fee structure appears to be opaque, with limited information available regarding spreads, commissions, and other associated costs.

| Fee Type | ADI Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2.0% - 5.0% |

The absence of clear information regarding trading fees is concerning, as it may lead to unexpected costs that could impact traders' profitability. Moreover, any unusual or problematic fee policies could indicate a lack of transparency and fairness in the broker's operations.

As traders consider their options, they must ask themselves: Is ADI Markets safe? The uncertainty surrounding trading costs and the potential for hidden fees create a risk-laden environment, further complicating the decision-making process for prospective clients.

Customer Funds Security

The security of customer funds is a primary concern for traders when selecting a broker. ADI Markets' lack of regulation raises serious questions about its ability to protect clients' investments.

A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection to safeguard clients' funds. However, without any regulatory oversight, it is unclear what security measures ADI Markets has in place.

Historical incidents of fund security issues or disputes are also absent, but the lack of transparency and regulatory compliance increases the risk of potential problems in the future.

In light of these factors, traders must seriously consider whether ADI Markets is safe for their investments. The absence of robust security measures and regulatory oversight poses a significant risk to clients, making it imperative to approach this broker with caution.

Customer Experience and Complaints

Customer feedback is invaluable in assessing a broker's reliability and service quality. Unfortunately, reviews and testimonials regarding ADI Markets are limited, making it challenging to gauge the overall customer experience.

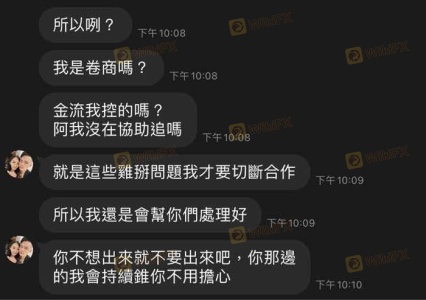

Common complaints associated with unregulated brokers include withdrawal issues, poor customer service, and lack of responsiveness. Without established channels for addressing such complaints, traders may find themselves at a disadvantage when dealing with ADI Markets.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | N/A |

| Poor Customer Support | Medium | N/A |

The absence of documented complaints or case studies makes it difficult to provide concrete examples of customer experiences. However, the potential for issues to arise in the absence of regulatory oversight and transparency cannot be ignored.

As traders weigh their options, they must ask themselves: Is ADI Markets safe? The lack of customer feedback and the potential for unresolved complaints create an environment of uncertainty that may deter prospective clients.

Platform and Trade Execution

The performance and reliability of a trading platform significantly impact a trader's experience. Unfortunately, information about the platform used by ADI Markets is limited, making it difficult to assess its performance, stability, and user experience.

Key factors such as order execution quality, slippage, and rejection rates are critical for traders. A lack of transparency regarding these metrics raises concerns about the broker's operational integrity.

Given these uncertainties, traders must consider the following question: Is ADI Markets safe? The absence of reliable information regarding platform performance creates a risk-laden environment, making it essential for traders to exercise caution.

Risk Assessment

Using ADI Markets carries a range of risks that potential clients must carefully evaluate.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulation, increasing risk of fraud. |

| Fund Security | High | Lack of transparency regarding fund protection measures. |

| Trading Costs | Medium | Opaque fee structure may lead to unexpected costs. |

| Customer Support | High | Limited feedback and potential withdrawal issues. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers that offer robust regulatory oversight and transparent trading conditions.

Conclusion and Recommendations

In conclusion, the investigation into ADI Markets raises significant concerns regarding its safety and legitimacy. The absence of regulatory oversight, coupled with limited transparency and customer feedback, strongly suggests that potential clients should exercise extreme caution.

For traders seeking a reliable and safe trading environment, it is advisable to explore alternatives that are well-regulated and offer transparent trading conditions. Brokers with established reputations and verifiable regulatory licenses can provide the peace of mind that ADI Markets currently lacks.

Ultimately, the question remains: Is ADI Markets safe? The evidence suggests that traders should be wary and consider other options to protect their investments and ensure a positive trading experience.

Is ADI Markets a scam, or is it legit?

The latest exposure and evaluation content of ADI Markets brokers.

ADI Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ADI Markets latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.