Is YAMATO GLOBAL safe?

Pros

Cons

Is Yamato Global Safe or Scam?

Introduction

Yamato Global is a forex brokerage that has gained attention in the trading community, particularly among investors looking for trading opportunities in various financial instruments. As the forex market continues to grow, the importance of evaluating the credibility and safety of brokers like Yamato Global cannot be overstated. Traders need to ensure that their chosen broker operates transparently, adheres to regulatory standards, and provides a secure trading environment. This article investigates the safety and legitimacy of Yamato Global by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of any forex broker. Regulatory bodies enforce rules and standards that protect traders and ensure fair practices. In the case of Yamato Global, concerns have been raised regarding its regulatory compliance and legitimacy. Currently, Yamato Global operates without a valid license from recognized regulatory authorities, which is a significant red flag for potential investors.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation raises questions about the broker's operational practices and accountability. A lack of oversight can lead to potential risks for traders, including the possibility of fraud or mismanagement of funds. Furthermore, historical compliance issues have been reported, with multiple complaints about withdrawal problems and unexpected fees. Without a solid regulatory framework, it is challenging for traders to feel secure in their investments with Yamato Global.

Company Background Investigation

Yamato Global was established relatively recently, with limited historical data available regarding its operations. The company's ownership structure is opaque, with little information about key stakeholders and their backgrounds. This lack of transparency can be concerning for potential clients, as it hinders the ability to assess the broker's trustworthiness and reliability.

The management team behind Yamato Global has not been widely publicized, raising further concerns about their experience and qualifications in the forex industry. The absence of clear information about the company's leadership can lead to skepticism regarding its commitment to ethical practices and customer service. Overall, the limited transparency surrounding Yamato Global's operations contributes to the uncertainty about whether Yamato Global is safe or a scam.

Trading Conditions Analysis

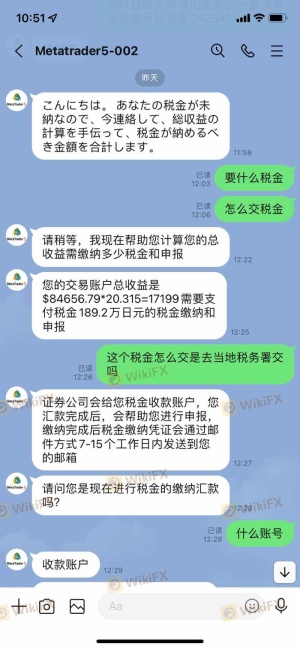

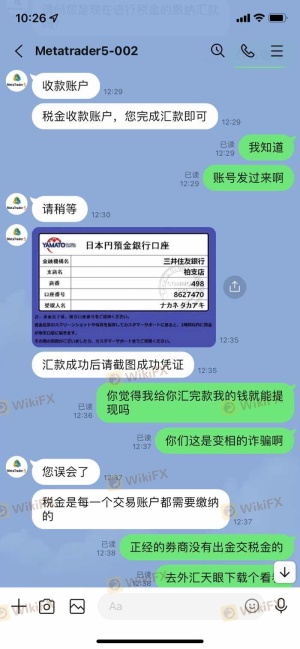

An essential aspect of evaluating a forex broker's safety is understanding its trading conditions. Yamato Global's fee structure has raised eyebrows among traders, particularly concerning its withdrawal policies and associated costs. Reports from users indicate that the broker imposes unexpected fees, including mandatory tax payments before allowing withdrawals, which is not standard practice in the industry.

| Fee Type | Yamato Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | High | Low to Moderate |

| Overnight Interest Range | High | Low to Medium |

These fees can significantly impact a trader's profitability and raise concerns about the broker's intentions. The imposition of such fees, particularly when they deviate from industry norms, suggests that traders should approach Yamato Global with caution. Understanding these trading conditions is vital for assessing whether Yamato Global is safe or potentially a scam.

Client Funds Security

When it comes to the safety of client funds, Yamato Global has faced scrutiny over its security measures. The broker's policies regarding fund segregation, investor protection, and negative balance protection are unclear. Traders must ensure that their funds are held securely and that they are protected from potential losses beyond their initial investments.

Reports of past funding issues and disputes have emerged, indicating that some clients have faced difficulties in retrieving their funds. This history raises significant concerns about the safety of investing with Yamato Global. A broker that does not prioritize client fund security may pose an elevated risk to traders, further fueling the debate over whether Yamato Global is safe or a scam.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. In the case of Yamato Global, numerous complaints have surfaced regarding withdrawal issues, unexpected fees, and poor customer service. Many users have reported being unable to withdraw their funds without facing additional charges, which is a common complaint among those who suspect fraudulent practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Delayed/Unresponsive |

| Unexpected Fees | Medium | Inconsistent |

| Customer Service Quality | High | Poor |

Several case studies illustrate these complaints, with clients expressing frustration over the inability to access their funds after meeting withdrawal requirements. Such patterns of behavior can indicate a lack of integrity on the part of the broker, leading to further skepticism about whether Yamato Global is safe for investors.

Platform and Trade Execution

The performance of a trading platform is essential for a smooth trading experience. Yamato Global offers a trading platform that has been reported to have stability issues, including delays and execution problems. Traders have noted instances of slippage and rejected orders, which can significantly affect trading outcomes.

The quality of order execution can be a determining factor in a trader's success, and any signs of manipulation or unfair practices can raise serious concerns. If traders experience repeated issues with order execution, it may suggest that Yamato Global is not operating in their best interests, further complicating the question of whether Yamato Global is safe or a scam.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Yamato Global is no exception. The combination of regulatory uncertainty, customer complaints, and operational transparency issues contributes to an elevated risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid licenses, potential for fraud |

| Financial Risk | Medium | Unclear fund security measures |

| Operational Risk | High | Frequent complaints about service and execution |

To mitigate these risks, potential clients should conduct thorough research and consider alternative brokers with a more established reputation and regulatory backing. It is essential to prioritize safety over potential returns when choosing a forex broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that Yamato Global raises multiple red flags regarding its legitimacy and safety. The lack of regulatory oversight, transparency issues, and numerous customer complaints indicate that traders should exercise caution. While not every user may have a negative experience, the patterns observed in customer feedback and operational practices warrant a careful approach.

For traders considering engaging with Yamato Global, it is advisable to explore alternative brokers with robust regulatory frameworks and proven track records. Brokers that prioritize client safety, transparent fee structures, and reliable customer service are more likely to provide a secure trading environment. Ultimately, the question remains: Is Yamato Global safe? The prevailing evidence suggests that it may be prudent to seek safer alternatives in the forex market.

Is YAMATO GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of YAMATO GLOBAL brokers.

YAMATO GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YAMATO GLOBAL latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.