ADI Markets Review 1

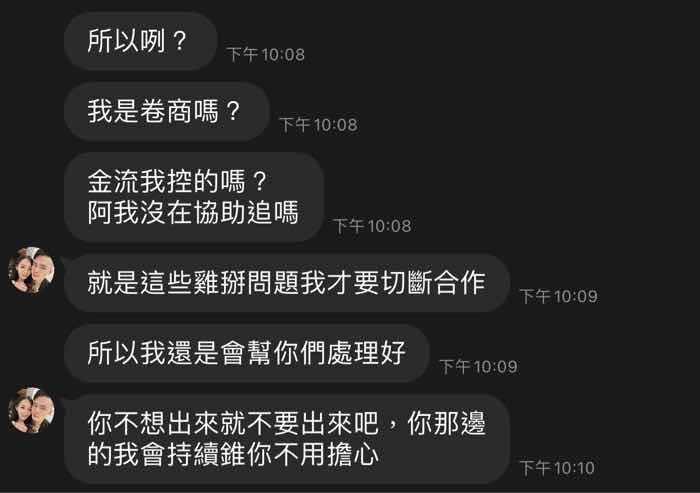

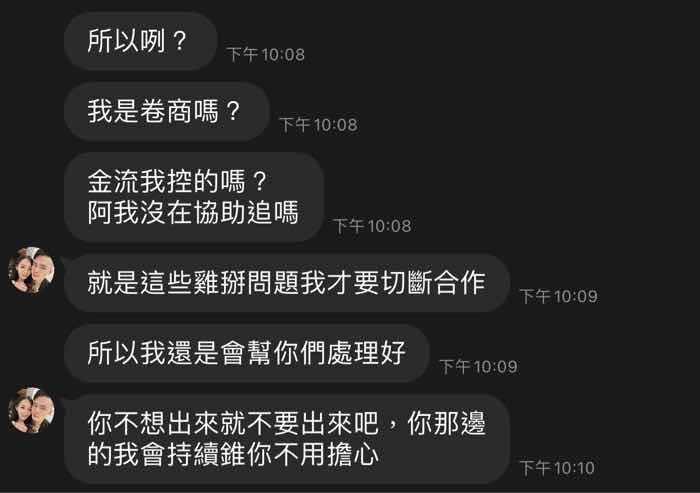

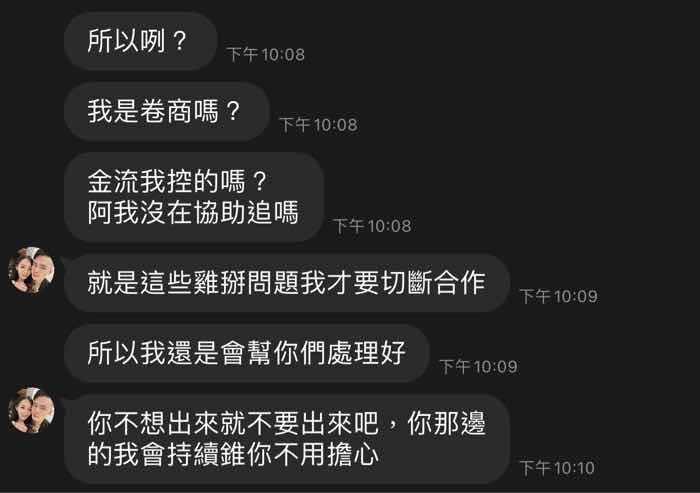

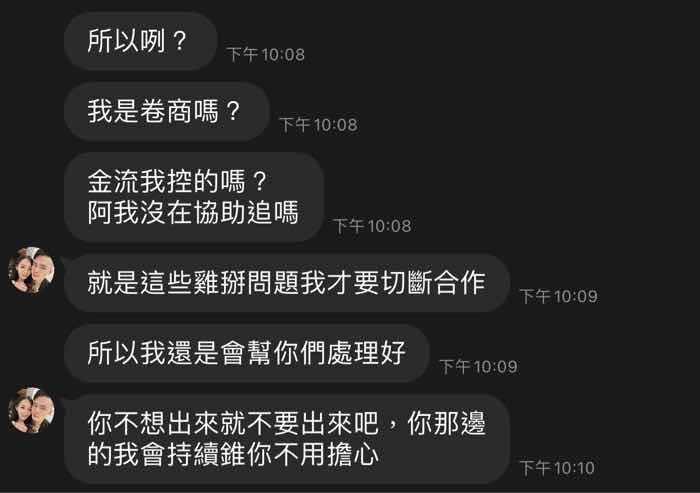

I'm an agent of the broker. It's easy to deposit but once my customer was unable to withdraw his money. So I went to ask for my commission. But I failed. It's no wonder that the score of it is very low

ADI Markets Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I'm an agent of the broker. It's easy to deposit but once my customer was unable to withdraw his money. So I went to ask for my commission. But I failed. It's no wonder that the score of it is very low

ADI Markets has positioned itself as a low-cost trading platform, targeting primarily the Chinese forex and CFD trading market. The appeal of lower trading costs attracts a significant number of retail traders who are eager to maximize their investment potential. However, this advantageous cost structure is overshadowed by considerable concerns regarding the safety of funds and withdrawal processes, stemming from a lack of valid regulatory oversight. As ADI Markets operates within an unregulated environment, retail traders must weigh the benefits of low transaction costs against the heightened risks associated with such platforms. Hence, while ADI Markets may present opportunities for savvy traders familiar with the challenges of unregulated trading, it is essential for potential clients to proceed with caution.

Risk Statement: Investing with ADI Markets poses significant risks due to unregulated operations and serious concerns about fund safety.

Potential Harms:

Steps for Self-Verification:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | Lack of valid regulatory cover raises concerns about fund safety and the overall integrity of operations. |

| Trading Costs | 4 | ADI Markets offers competitive spreads and low commission rates, appealing to cost-sensitive traders. |

| Platforms & Tools | 3 | Provides popular platforms (MT4, MT5), but lacks sufficient proprietary tools that may enhance user experience. |

| User Experience | 2 | User feedback points to frustrating withdrawal issues, impacting overall satisfaction. |

| Customer Support | 2 | Limited available support channels have resulted in negative experiences shared by users. |

| Account Conditions | 2 | High withdrawal fees and untransparent account management practices contribute negatively to user feedback. |

ADI Markets is a relatively new forex and CFD broker that emerged to offer low-cost trading options primarily targeting the Chinese market. Operating without any valid regulatory oversight, the broker has raised numerous red flags, leading to skepticism about its legitimacy and security. The company has positioned itself with a low-fee model aimed at attracting retail traders looking to minimize costs.

Despite its appealing offerings, the absence of regulatory protection requires that potential traders exercise extreme caution and perform in-depth due diligence before engaging with the platform.

ADI Markets primarily focuses on forex trading and contracts for difference (CFDs), catering to a market increasingly interested in these financial products. The broker claims to provide access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). However, it has no valid regulatory licenses to reassure potential clients about the safety of their investments. This lack of regulatory information raises questions about the overall trustworthiness and operational integrity of ADI Markets, particularly in light of complaints regarding fund safety and withdrawal difficulties.

| Details | Information |

|---|---|

| Regulation | None available |

| Minimum Deposit | $100 |

| Leverage | Up to 1:500 |

| Major Fees | Withdrawal fees reported high |

The primary concern for potential clients considering ADI Markets revolves around its trustworthiness, which is severely compromised due to its lack of valid regulatory information. Traders regularly encounter conflicting reports about the level of oversight, which poses a significant risk to investor funds.

Analysis of Regulatory Information Conflicts: Lack of transparent information relating to the broker's regulatory status raises substantial questions about its commitment to safeguarding investor interests. Without an established regulatory authority to enforce compliance, investors may be left vulnerable to potential fund mismanagement and withdrawal issues.

User Self-Verification Guide:

"Withdrawing my funds was a nightmare; I haven't seen my money in over a month!"

Given these sentiments, self-verification remains the most crucial step for prospective clients considering trading with ADI Markets.

The trading costs at ADI Markets reflect a "double-edged sword" effect, where incredibly low commission rates entice traders but can also mask hidden fees.

Advantages in Commissions: ADI Markets proudly advertises its low commissions, claiming competitive trading costs that may save savvy traders substantial capital compared to traditional brokers.

The "Traps" of Non-Trading Fees: Numerous user complaints spotlight high withdrawal fees, with reports detailing charges of up to $30 per withdrawal, which can significantly erode trading profits, especially for traders who frequently withdraw funds.

"I couldn't believe they were charging me $30 every time I tried to cash out; it's outrageous!" — Said one frustrated user.

Understanding the available platforms and tools is essential for traders looking to engage efficiently with ADI Markets.

Platform Diversity: ADI Markets offers popular trading platforms, including MT4 and MT5, both known for their robust functionalities and tools that serve serious traders well. These platforms facilitate access to market analytics, various chart types, and a range of asset classes.

Quality of Tools and Resources: Despite offering standard tools like charts and technical analysis indicators, users have expressed a desire for more advanced proprietary tools that could enhance trading efficiency. This limitation might deter users looking for a comprehensive trading solution.

Platform Experience Summary: User experiences highlight the limitations of platform functionality. One user commented:

"The MT4 platform is fine, but there's nothing unique here that stands out from other brokers."

This reinforces the idea that while the platforms are competent, a lack of innovation or tailored tools could hinder user satisfaction.

User experience has largely been marred by issues relating to fund accessibility and account management.

Onboarding and Account Management: Initial account setup is straightforward; however, numerous reports indicate that managing accounts post-sign-up leads to frustration, particularly around withdrawal processes.

User Feedback: Several customer feedback sources indicate a common narrative concerning withdrawal delays and blocked accounts, calling into question the overall user experience offered by ADI Markets.

Potential traders need responsive customer support to navigate challenges that may arise while trading.

Availability of Support: ADI Markets reportedly has limited support hours, with some users noting difficulty in reaching help when it is needed most, particularly regarding account withdrawal issues.

User Testimonials: User experiences often highlight frustration surrounding unresponsive customer service, which poses a potential barrier for traders needing timely resolutions.

Understanding the account conditions is vital to assess compatibility with individual trading styles.

Account Types and Conditions: ADI Markets provides a few basic account types; however, some critical limitations in terms of withdrawal policies and applicable fees can lead traders to reconsider their options.

Summary of Issues: High withdrawal fees and the absence of comprehensive account features are significant drawbacks, potentially leading users to explore alternatives that meet their trading needs better.

In summary, while ADI Markets offers low-cost trading options appealing to a specific segment of retail traders primarily targeting the Chinese market, the operational risks associated with its lack of regulation and numerous user complaints cannot be overlooked. The absence of valid oversight challenges the brokers credibility, warranting cautious deliberation from potential clients. Savvy traders familiar with self-verification practices and risk assessment may navigate this platform, but newer traders are advised to thoroughly investigate and consider alternative, regulated options for their trading activities.

In light of these factors, ADI Markets could well be considered an opportunity, but it would be prudent to approach this broker with a healthy degree of skepticism, as the potential pitfalls may be substantial.

FX Broker Capital Trading Markets Review