Is 2BFX safe?

Business

License

Is 2BFX Trading A Scam?

Introduction

2BFX Trading, operating under the domain 2bfx.eu, positions itself as a global trading platform offering access to various financial markets, including forex, commodities, and cryptocurrencies. As the forex market continues to expand, the necessity for traders to evaluate the legitimacy and reliability of brokers like 2BFX Trading becomes paramount. In a landscape rife with potential scams, traders must exercise caution to protect their investments. This article aims to provide a comprehensive analysis of 2BFX Trading's legitimacy through a structured investigation that encompasses regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its trustworthiness. A regulated broker is subject to oversight by recognized financial authorities, which helps ensure compliance with industry standards and provides a level of protection for investors. Unfortunately, 2BFX Trading operates without any valid licenses from major regulatory bodies, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that 2BFX Trading is not held accountable to any standards of transparency or ethical conduct. This lack of oversight increases the risk for traders, as unregulated brokers can engage in fraudulent practices without fear of repercussions. Furthermore, the lack of a physical office address further complicates the broker's credibility, as it is a common tactic employed by scam brokers to avoid accountability.

Company Background Investigation

2BFX Trading's company history is sparse, with limited information available regarding its ownership structure and development timeline. The lack of transparency surrounding the management team is concerning, as a reputable broker typically provides detailed information about its leadership and their professional backgrounds. Without this information, it becomes challenging to assess the broker's commitment to ethical trading practices and customer service.

Moreover, the company's website lacks comprehensive details about its operational history, which raises red flags for potential investors. A trustworthy broker should provide clear information about its founding, mission, and the expertise of its team. The absence of such information further undermines the credibility of 2BFX Trading.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its fairness and transparency. 2BFX Trading's fee structure appears opaque, with several reports highlighting hidden fees and unfavorable trading conditions.

| Fee Type | 2BFX Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies (Often high) | 1.0 - 1.5 pips |

| Commission Model | None (Hidden fees likely) | Varies (typically lower) |

| Overnight Interest Range | Unclear | 0.5% - 1.5% |

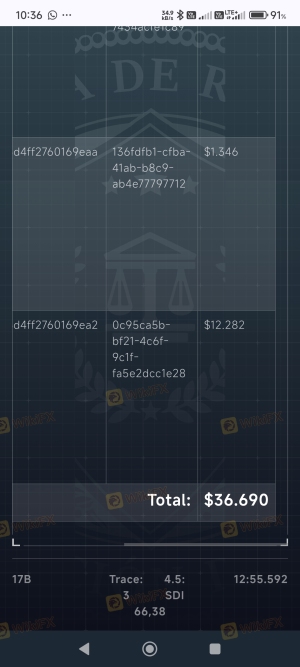

The lack of clarity regarding spreads and commissions is alarming, as traders expect transparent fee structures when engaging with a broker. Reports from users suggest that 2BFX Trading may impose excessive charges when withdrawing funds, which is a common tactic used by fraudulent brokers to retain client money.

Client Funds Security

The security of client funds is a crucial aspect of any trading platform. In the case of 2BFX Trading, the absence of regulatory oversight raises significant concerns regarding the safety of investor funds. The broker does not appear to implement any measures for fund segregation, which is critical for protecting client assets in the event of bankruptcy or operational failure.

Furthermore, the lack of investor protection schemes means that traders have little recourse if the broker misappropriates their funds. Historical reports of fund security issues associated with 2BFX Trading further emphasize the risks involved, as many users have reported difficulties in withdrawing their money.

Customer Experience and Complaints

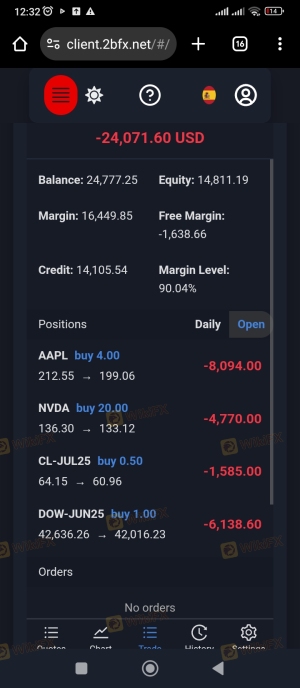

Customer feedback plays a vital role in assessing the reliability of a broker. A review of user experiences with 2BFX Trading reveals a pattern of negative feedback, with many clients expressing frustration over withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | High | Poor |

Typical complaints include delayed withdrawals, aggressive sales tactics, and lack of communication from the broker. For instance, one user reported losing significant funds after being pressured to invest more, only to find their account blocked when they attempted to withdraw. Such experiences highlight the potential risks associated with using 2BFX Trading, raising the question: Is 2BFX Trading safe?

Platform and Trade Execution

The trading platform's performance is crucial for a positive trading experience. Users have reported that 2BFX Trading's platform suffers from slow execution speeds and frequent outages, which can severely impact trading effectiveness. Additionally, complaints about slippage and rejected orders further exacerbate concerns about the broker's reliability.

The overall user experience appears subpar, with many traders expressing dissatisfaction with the platform's functionality and support. These issues raise further questions regarding the integrity of 2BFX Trading's operations.

Risk Assessment

Using 2BFX Trading presents several risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of fund segregation and protection. |

| Customer Support Risk | Medium | Poor response to client inquiries and issues. |

Given these risks, traders should exercise extreme caution when considering 2BFX Trading as a trading partner. It is advisable to seek alternative brokers with established regulatory oversight and positive user feedback.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that 2BFX Trading is not a safe option for traders. The lack of regulatory oversight, poor customer feedback, and concerning trading conditions all point to the possibility that 2BFX Trading may operate as a scam. Traders should be particularly wary of investing their funds with this broker and should consider alternative, regulated options that offer greater transparency and security.

For those looking to trade safely, it is recommended to choose brokers with solid regulatory frameworks, positive user experiences, and transparent fee structures. Some reliable alternatives may include brokers regulated by the FCA or ASIC, which adhere to strict industry standards. Always prioritize safety and due diligence when selecting a trading partner in the forex market.

Is 2BFX a scam, or is it legit?

The latest exposure and evaluation content of 2BFX brokers.

2BFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

2BFX latest industry rating score is 1.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.