Capital Peak 2025 Review: Everything You Need to Know

Executive Summary

Capital Peak Advisors presents itself as a CFD trading broker offering access to various asset classes. However, this Capital Peak review reveals significant concerns regarding transparency and user trust. The broker operates with limited public disclosure about its regulatory status, which raises immediate red flags for potential clients. The most alarming aspect is the reported TrustScore of 0/5. This indicates severe user dissatisfaction or lack of verified user feedback.

Capital Peak claims to provide CFD trading services across multiple asset categories including major crypto pairs. The absence of clear regulatory information significantly impacts its credibility. The broker appears to target traders seeking diversified CFD products, but users who prioritize security and regulatory compliance should exercise extreme caution. Limited available information about account conditions, trading platforms, and customer support makes it challenging to recommend this broker to serious traders. This comprehensive evaluation will examine all available aspects of Capital Peak's services. Information gaps remain a persistent concern throughout our analysis.

Important Notice

Trading experiences may vary significantly across different regions due to the limited regulatory information available about Capital Peak Advisors. The broker's operational structure and compliance standards are not clearly documented. This could result in inconsistent service delivery depending on your geographical location. This evaluation is based on publicly available information, user feedback where available, and industry standard assessment criteria. Given the lack of transparent regulatory oversight, potential clients should conduct additional due diligence before engaging with this broker. The information presented in this review reflects the current state of publicly available data. It should not be considered as investment advice or a recommendation to trade with Capital Peak.

Rating Framework

Broker Overview

Capital Peak Advisors operates as a multi-licensed CFD broker. However, the specific details of these licenses remain unclear from available documentation. The company positions itself in the competitive CFD trading market, claiming to offer access to various financial instruments including cryptocurrency pairs and other popular trading assets. The establishment date, company history, and founding background are not readily available in public records. This is unusual for legitimate financial services providers.

The broker's business model centers around CFD trading. This allows clients to speculate on price movements without owning the underlying assets. Capital Peak promotes trading opportunities across different market segments, though specific asset categories beyond crypto pairs are not clearly enumerated. The absence of detailed company background information raises questions about transparency. This includes founding dates, key personnel, and corporate structure. Most established brokers readily provide such fundamental information as part of their commitment to client transparency and regulatory compliance requirements.

Regulatory Jurisdictions: Specific regulatory information is not mentioned in available materials. This represents a significant concern for potential clients seeking licensed and supervised trading environments.

Deposit and Withdrawal Methods: Available materials do not specify the payment methods supported by Capital Peak. Processing times, fees, and minimum transaction amounts are also not disclosed.

Minimum Deposit Requirements: No information about minimum deposit thresholds is available in the current documentation. This makes it impossible to assess accessibility for different trader segments.

Bonus and Promotions: Details about welcome bonuses, trading incentives, or promotional offers are not disclosed in available materials.

Available Trading Assets: The broker offers CFD trading with specific mention of major crypto pairs. However, the complete range of available instruments remains unspecified.

Cost Structure: Critical information about spreads, commissions, overnight financing charges, and other trading costs is not available in current materials. This makes cost comparison impossible.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in available documentation.

Platform Options: Specific trading platforms such as MetaTrader 4/5, proprietary platforms, or web-based solutions are not mentioned in current materials.

Geographic Restrictions: Information about restricted countries or regional limitations is not available.

Customer Support Languages: Supported languages for customer service are not specified in available materials.

This Capital Peak review highlights the concerning lack of essential information. Traders typically require this information when evaluating potential brokers.

Account Conditions Analysis

The account structure and conditions offered by Capital Peak remain largely undisclosed in available materials. This presents significant challenges for potential clients attempting to evaluate the broker's suitability. Without clear information about account types, minimum deposit requirements, or special account features, traders cannot make informed decisions about whether Capital Peak meets their specific needs. Most reputable brokers provide detailed account specifications including various tiers designed for different trading styles and experience levels.

The absence of information about Islamic accounts, VIP services, or professional trader accommodations suggests either limited service offerings or poor transparency practices. Account opening procedures, verification requirements, and approval timeframes are also not documented. This leaves potential clients uncertain about the onboarding process. The lack of transparency regarding basic account conditions is particularly concerning given that account terms directly impact trading costs, available features, and overall trading experience.

Without access to specific account documentation or terms of service, this Capital Peak review cannot provide meaningful analysis. We cannot determine whether the broker's account conditions are competitive or suitable for different trader segments. The information gap represents a significant red flag that potential clients should consider carefully.

Capital Peak's trading tools and resources remain largely undocumented in available materials. This makes it impossible to assess the broker's commitment to supporting trader success. Most established brokers provide comprehensive suites of analytical tools, market research, economic calendars, and educational resources to help clients make informed trading decisions. The absence of information about technical analysis tools, charting capabilities, or market insights suggests either limited offerings or inadequate marketing transparency.

Educational resources are particularly important for newer traders. The lack of information about webinars, tutorials, trading guides, or market analysis indicates potential deficiencies in client support. Advanced features such as automated trading support, API access, or algorithmic trading capabilities are also not mentioned in available materials. Without clear documentation of available tools and resources, traders cannot evaluate whether Capital Peak provides the analytical and educational support necessary for successful trading.

The information gap regarding trading tools and educational resources further reinforces concerns about Capital Peak's transparency. It also raises questions about their commitment to client success. This makes it difficult to recommend the broker to traders who value comprehensive support and analytical capabilities.

Customer Service and Support Analysis

Customer service information for Capital Peak is notably absent from available materials. This represents a critical gap in evaluating the broker's client support capabilities. Essential details such as available contact methods, support hours, response times, and service quality metrics are not documented. These include phone, email, and live chat options. Most reputable brokers prioritize transparent communication about their customer support services, including multilingual capabilities and regional support availability.

The lack of information about customer service channels raises concerns about accessibility when clients encounter issues or require assistance. Without documented support procedures, escalation processes, or service level commitments, potential clients cannot assess whether Capital Peak provides adequate support for their trading activities. Emergency contact procedures, weekend support availability, and technical assistance protocols are also undocumented.

This absence of customer service information is particularly concerning given the importance of reliable support in financial services. Traders need confidence that they can reach qualified assistance when dealing with account issues, technical problems, or trading disputes. The information gap regarding customer support represents another significant concern in this Capital Peak review.

Trading Experience Analysis

The trading experience offered by Capital Peak cannot be adequately assessed due to insufficient information about platform performance, execution quality, and user interface design. Critical factors such as order execution speed, slippage rates, platform stability, and mobile trading capabilities are not documented in available materials. These elements are fundamental to evaluating any broker's trading environment and directly impact client profitability and satisfaction.

Platform functionality details remain unspecified, including available order types, risk management tools, and real-time data quality. Mobile trading capabilities, which are essential for modern traders, are not mentioned in current documentation. Without information about platform reliability, server uptime, or technical performance metrics, potential clients cannot evaluate whether Capital Peak provides a competitive trading environment.

The absence of user testimonials or independent platform reviews further complicates assessment of the actual trading experience. Most established brokers readily provide platform demonstrations, performance statistics, and user feedback to showcase their trading environment. This Capital Peak review cannot provide meaningful analysis of trading experience quality due to the significant information gaps in available materials.

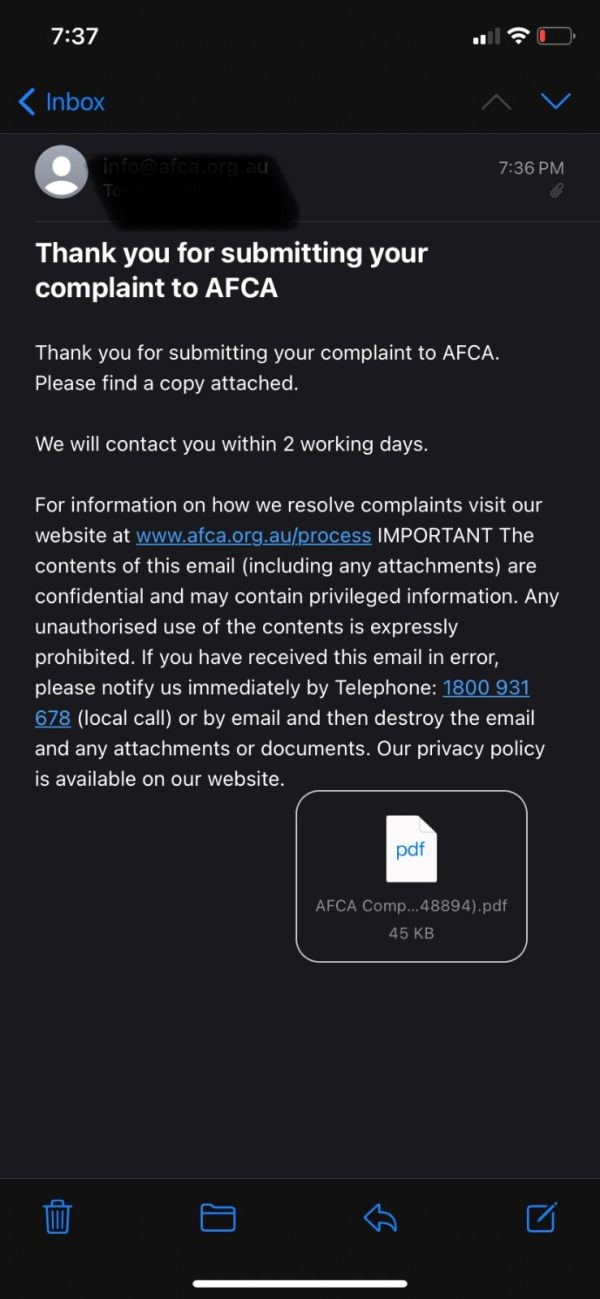

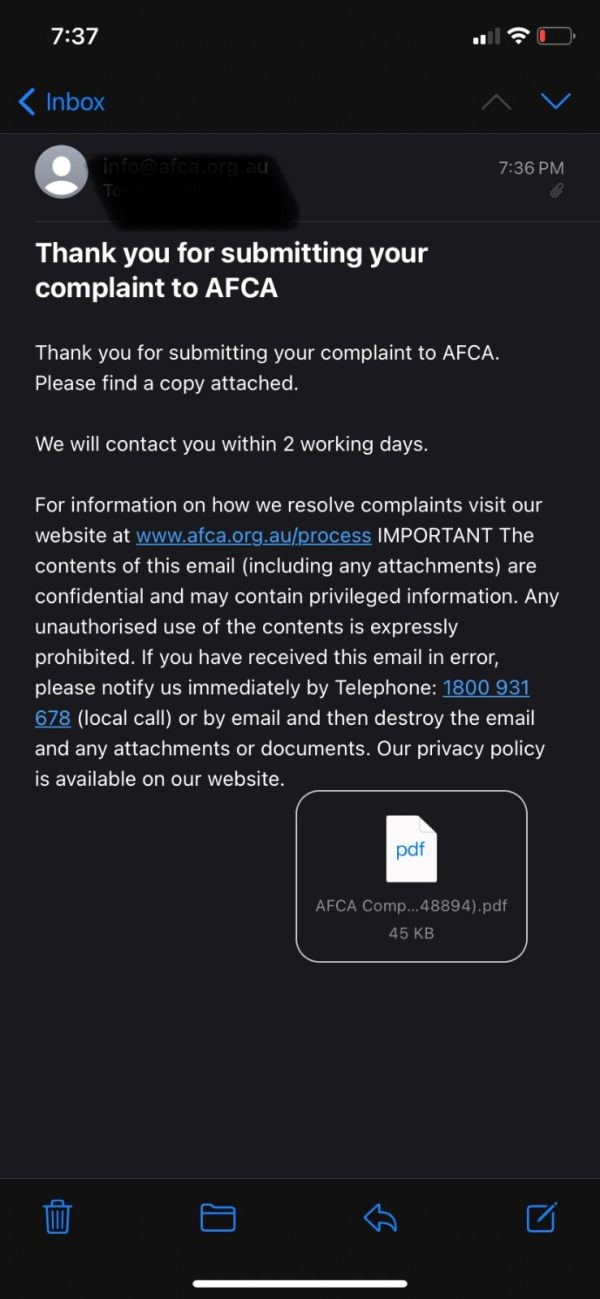

Trust and Safety Analysis

Trust and safety represent the most concerning aspects of Capital Peak's profile. The reported TrustScore of 0/5 indicates severe issues with user confidence or lack of verified user engagement. The absence of clear regulatory information compounds these concerns, as regulatory oversight provides essential client protections including segregated client funds, compensation schemes, and dispute resolution mechanisms. Without transparent regulatory status, clients cannot verify whether their funds receive appropriate protection.

The lack of information about client fund segregation, insurance coverage, or regulatory compliance measures raises significant red flags about Capital Peak's safety profile. Most legitimate brokers prominently display their regulatory credentials and explain client protection measures as part of their commitment to transparency and safety. The absence of such information suggests either regulatory non-compliance or inadequate transparency practices.

Industry reputation indicators are also absent from available materials. These include awards, recognition from financial publications, or positive third-party evaluations. The combination of poor user ratings and lack of regulatory transparency creates a highly concerning trust profile that potential clients should carefully consider before engaging with Capital Peak.

User Experience Analysis

User experience evaluation for Capital Peak is severely limited by the lack of available user feedback and interface information. The reported TrustScore of 0/5 suggests significant user dissatisfaction or absence of verified user engagement. Both of these raise serious concerns about the overall user experience. Without access to user testimonials, interface screenshots, or usability assessments, it's impossible to evaluate whether Capital Peak provides an intuitive and efficient trading environment.

Key user experience factors remain undocumented, such as registration simplicity, account verification processes, deposit and withdrawal efficiency, and platform navigation. Most successful brokers invest heavily in user experience design and readily showcase their platform interfaces and user journey optimizations. The absence of such information suggests either poor user experience design or inadequate marketing transparency.

Common user complaints, satisfaction surveys, or user retention metrics are not available for analysis. This makes it impossible to identify potential pain points or areas of user satisfaction. The comprehensive lack of user experience information represents another significant concern for potential clients considering Capital Peak as their trading partner.

Conclusion

This Capital Peak review reveals significant concerns about the broker's transparency, regulatory status, and user satisfaction. The combination of limited available information, poor user ratings, and absent regulatory disclosure creates a highly concerning profile for potential clients. The TrustScore of 0/5 is particularly alarming. While Capital Peak claims to offer CFD trading services including crypto pairs, the lack of essential information about account conditions, trading costs, platform features, and customer support makes it impossible to recommend this broker to serious traders.

The broker may appeal to traders specifically seeking CFD trading opportunities. However, the significant transparency and trust issues make it unsuitable for users who prioritize security, regulatory compliance, and reliable customer support. The numerous information gaps identified throughout this evaluation suggest that potential clients should exercise extreme caution and consider well-established, transparently regulated alternatives. Until Capital Peak addresses these fundamental transparency and trust issues, traders would be better served by choosing brokers with clear regulatory status and positive user feedback.