ZAG Review 1

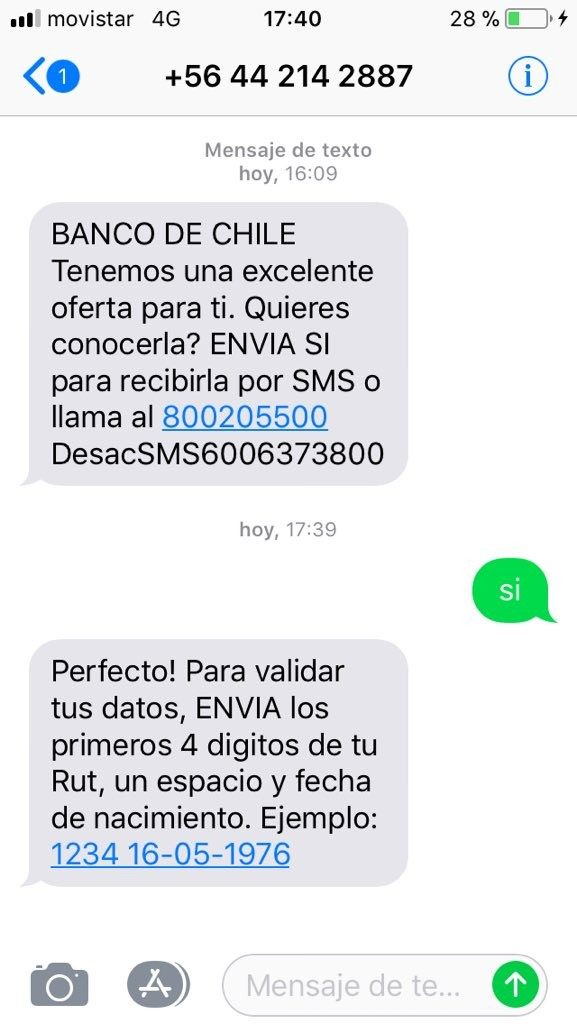

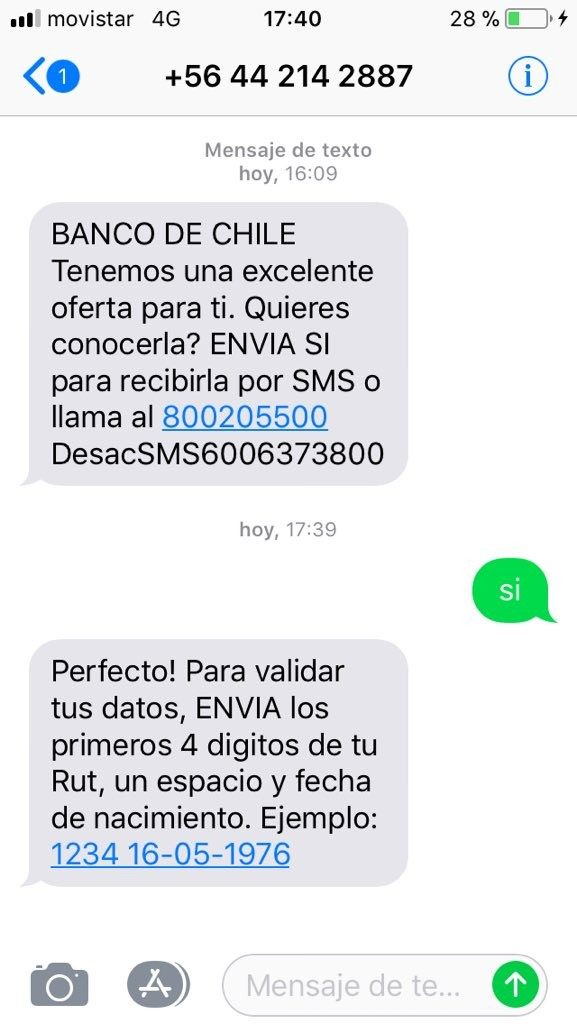

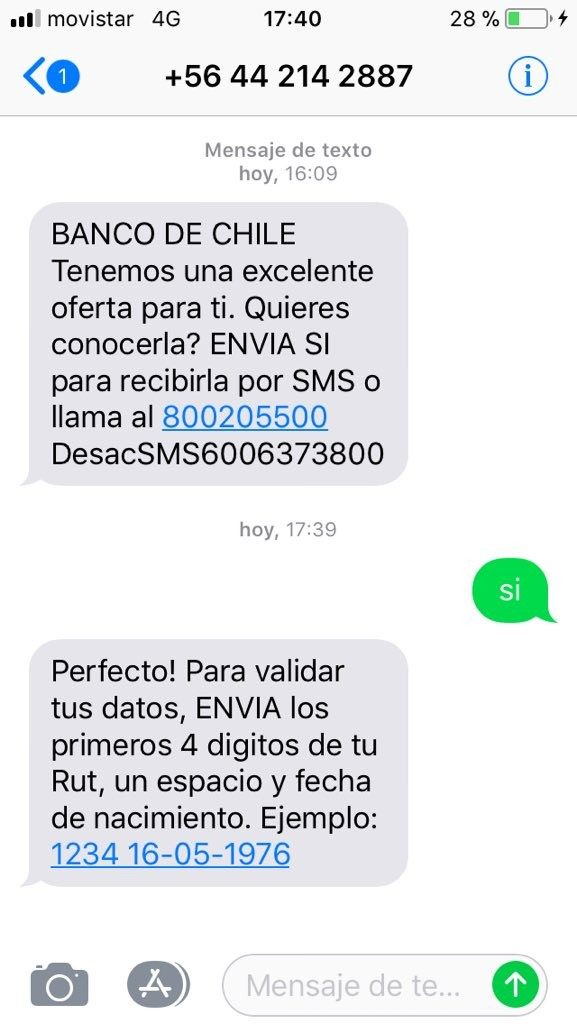

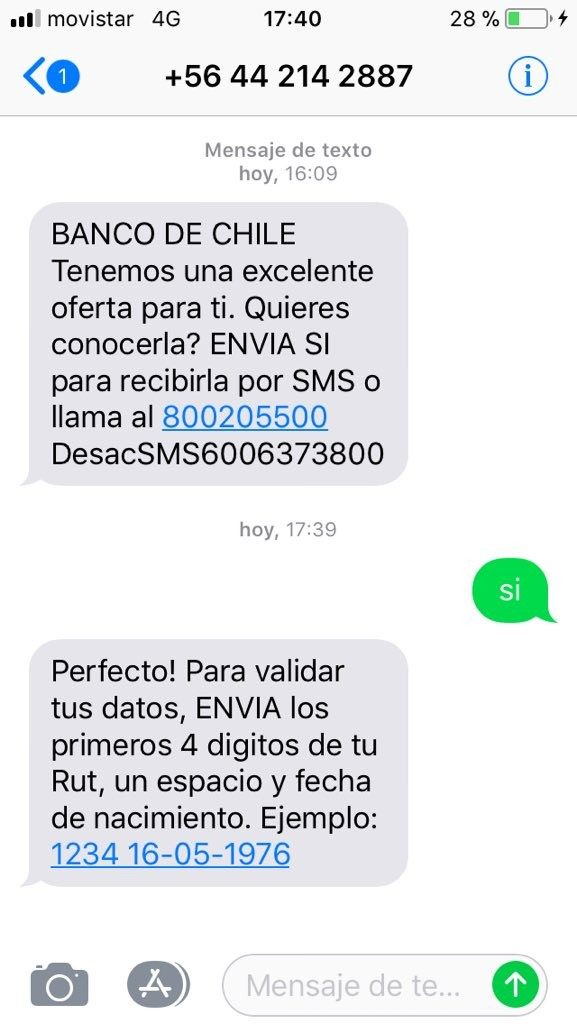

They asked me to deposit. They were scammers. Their platform was of no license. Please help.

ZAG Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They asked me to deposit. They were scammers. Their platform was of no license. Please help.

ZagTrader positions itself as a leading global technology company specializing in trading and investment solutions for the financial industry. This zag review examines a platform that offers multi-asset trading and investment capabilities, targeting institutional clients including banks, brokers, and asset managers. The company provides comprehensive solutions that cover front-office, middle-office, and back-office operations. They also offer online and mobile trading platforms.

Based on available information, ZagTrader serves over 100 institutions globally and operates with a team of 51-200 employees from their Dubai headquarters. The platform integrates trading, order management, digital asset management, and global market access through routing networks. However, specific regulatory details, trading conditions, and comprehensive user feedback remain limited in publicly available sources.

This evaluation reveals a platform primarily designed for institutional use rather than individual retail traders. The company emphasizes technological infrastructure and comprehensive financial solutions. ZagTrader maintains a presence on professional platforms like LinkedIn and has some user feedback available through Trustpilot. However, detailed performance metrics and regulatory transparency require further investigation.

Regional Entity Differences: Due to limited regulatory information available in public sources, users must independently verify legal and compliance requirements in their respective jurisdictions. ZagTrader's services may vary significantly across different regions. Potential clients should directly contact the company for jurisdiction-specific information.

Review Methodology: This assessment is based on publicly available information, company communications, and limited user feedback. Given the institutional focus of ZagTrader's services, comprehensive retail trader experiences may not be fully represented in this analysis.

| Criterion | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Specific account conditions not detailed in available information |

| Tools and Resources | 7/10 | Comprehensive multi-asset platform with front-to-back office solutions |

| Customer Service | 6/10 | Trustpilot presence indicates user engagement, but detailed feedback limited |

| Trading Experience | N/A | Insufficient specific trading experience details in public sources |

| Trust and Regulation | N/A | Regulatory information not specified in available materials |

| User Experience | 6/10 | Professional platform design, but primarily institutional focus |

ZagTrader operates as a specialized Financial Technology Company serving the institutional financial sector. According to company information, they provide sophisticated solutions that enable brokerage, investment banking, capital markets, and asset management firms to operate effectively. The company has established itself as a technology provider rather than a traditional retail broker. They focus on comprehensive platform solutions.

The company's business model centers on delivering fully integrated platforms that span the entire trading ecosystem. Their solutions include trading systems, order management, digital asset management, global data feeds, and market access through extensive routing networks. This comprehensive approach positions ZagTrader as an infrastructure provider for financial institutions rather than a direct-to-consumer trading platform.

Based on available information, ZagTrader's platform supports multi-asset trading capabilities, though specific asset classes and trading instruments are not detailed in public sources. The company emphasizes its global reach, serving over 100 institutions worldwide, and maintains its headquarters in Dubai with a workforce ranging from 51-200 employees.

Regulatory Status: Specific regulatory information is not detailed in available public sources. Potential clients should directly verify regulatory compliance and licensing in their respective jurisdictions.

Deposit and Withdrawal Methods: Payment methods and funding options are not specified in publicly available information.

Minimum Deposit Requirements: Minimum deposit thresholds are not mentioned in available sources.

Bonuses and Promotions: No promotional offers or bonus structures are referenced in current public information.

Tradeable Assets: The platform supports multi-asset trading capabilities, though specific instruments, currencies, and asset classes require direct inquiry with the company.

Cost Structure: Specific information regarding spreads, commissions, and fee structures is not detailed in available public sources.

Leverage Ratios: Leverage options and maximum ratios are not specified in current public information.

Platform Options: The company provides online and mobile trading solutions as part of their comprehensive platform offering.

Geographic Restrictions: Specific regional limitations or service availability by country is not detailed in available information.

Customer Support Languages: Supported languages for customer service are not specified in public sources.

This zag review highlights the need for direct communication with ZagTrader to obtain specific trading conditions and service details.

The specific account conditions offered by ZagTrader remain largely undisclosed in publicly available information. As an institutional-focused technology provider, the company likely offers customized account structures tailored to the needs of banks, brokers, and asset management firms rather than standardized retail trading accounts.

Given ZagTrader's positioning as a B2B financial technology company, account offerings presumably involve enterprise-level agreements with institutional clients. This approach differs significantly from traditional retail brokers who offer standardized account types with published terms and conditions. The lack of publicly available account condition details suggests that ZagTrader operates on a consultative basis. They design solutions specific to each institutional client's requirements.

For potential institutional clients, account setup likely involves comprehensive onboarding processes that include due diligence, compliance verification, and technical integration requirements. The company's emphasis on providing front-office, middle-office, and back-office solutions indicates that account structures may be more complex than typical retail trading arrangements.

The absence of detailed account condition information in this zag review reflects the company's institutional focus and the customized nature of their service offerings. Prospective clients would need to engage directly with ZagTrader's sales team to understand specific account structures, minimum commitments, and service level agreements.

ZagTrader demonstrates strong capabilities in the tools and resources category, earning a 7/10 rating based on their comprehensive platform offerings. The company provides an integrated solution that spans front-office, middle-office, and back-office operations, indicating sophisticated technological infrastructure designed for institutional use.

The platform's multi-asset trading capabilities suggest robust tools for handling diverse financial instruments and markets. ZagTrader's emphasis on providing global market access through routing networks indicates advanced connectivity and execution capabilities that would be essential for institutional trading operations.

Their offering includes digital asset management functionality, positioning the platform to handle both traditional and cryptocurrency assets. This diversification in asset support demonstrates the company's adaptation to evolving market demands and technological trends in the financial services sector.

The availability of both online and mobile trading solutions shows ZagTrader's commitment to providing flexible access options. For institutional clients, this flexibility is crucial for maintaining operations across different environments and ensuring continuous market access for their end users.

However, specific details about analytical tools, research resources, charting capabilities, and automated trading features are not detailed in available public information, limiting a more comprehensive assessment of the platform's tool suite.

ZagTrader's customer service capabilities receive a 6/10 rating based on limited available information. The company maintains a presence on Trustpilot, indicating some level of user engagement and feedback collection, though detailed user experiences are not extensively documented in public sources.

As an institutional service provider, ZagTrader likely offers dedicated account management and technical support tailored to enterprise clients. This approach typically involves assigned relationship managers and specialized technical support teams rather than traditional retail customer service models.

The company's LinkedIn presence and professional networking suggest they maintain industry connections and provide support through business development channels. For institutional clients, this type of relationship-based support often proves more valuable than traditional customer service channels.

However, the lack of detailed information about support channels, response times, availability hours, and service quality metrics limits the ability to provide a comprehensive assessment. The company's focus on institutional clients may mean that support quality is high but not publicly documented in the same way as retail-focused brokers.

Given ZagTrader's B2B model, customer support likely involves technical integration assistance, platform training, and ongoing relationship management rather than the transaction-based support typical of retail trading platforms.

The trading experience offered by ZagTrader cannot be comprehensively evaluated based on available public information, as specific details about platform performance, execution quality, and user interface design are not documented in accessible sources.

As a technology provider for institutional clients, ZagTrader's trading experience likely focuses on reliability, scalability, and integration capabilities rather than the user-friendly interfaces typically emphasized in retail trading platforms. The company's emphasis on providing comprehensive front-to-back office solutions suggests a focus on workflow efficiency and operational integration.

The platform's multi-asset capabilities indicate support for diverse trading strategies and instruments, which would be essential for institutional clients serving varied customer bases. The availability of mobile trading solutions suggests attention to accessibility and real-time market engagement.

However, critical trading experience factors such as order execution speed, platform stability during high-volume periods, latency performance, and system uptime statistics are not available in public sources. These metrics would be crucial for institutional clients evaluating the platform's suitability for their operations.

The absence of detailed trading experience information in this zag review reflects the company's institutional focus, where performance metrics and user experiences are typically shared through private communications rather than public documentation.

The trust and regulation assessment for ZagTrader is limited by the absence of specific regulatory information in publicly available sources. This lack of regulatory transparency presents challenges for evaluating the company's compliance framework and oversight mechanisms.

For institutional clients, regulatory compliance is typically a primary concern, and the absence of clearly stated regulatory affiliations may require direct verification with the company. Different jurisdictions have varying requirements for financial technology providers, and ZagTrader's global operations likely involve multiple regulatory considerations.

The company's presence in Dubai and service to over 100 institutions globally suggests some level of regulatory compliance, though specific licensing details are not publicly documented. Dubai's financial services sector operates under established regulatory frameworks, which may provide some indication of compliance standards.

The lack of transparency regarding regulatory status, client fund protection measures, and compliance certifications limits the ability to assess trust factors comprehensively. Institutional clients typically require detailed regulatory documentation before engaging with technology providers, suggesting this information may be available through direct inquiry.

For potential clients evaluating ZagTrader's services, independent verification of regulatory status, compliance certifications, and client protection measures would be essential components of due diligence processes.

ZagTrader's user experience receives a 6/10 rating, reflecting its institutional focus and the limited publicly available feedback from end users. The company's emphasis on serving banks, brokers, and asset managers suggests that user experience design prioritizes operational efficiency and integration capabilities over consumer-friendly interfaces.

The platform's comprehensive approach, covering front-office through back-office operations, indicates a focus on workflow optimization for professional users. This institutional orientation typically results in more complex but powerful interfaces designed for experienced financial professionals rather than retail traders.

The availability of both online and mobile trading solutions demonstrates attention to accessibility across different devices and environments. For institutional clients, this flexibility is crucial for maintaining operations and providing services to their own customer bases.

However, specific user interface design elements, ease of navigation, onboarding processes, and user satisfaction metrics are not detailed in available public sources. The company's Trustpilot presence suggests some level of user engagement, though comprehensive feedback analysis is not accessible.

The institutional focus means that user experience optimization likely emphasizes reliability, functionality, and integration capabilities rather than the simplified interfaces and educational resources typically found in retail trading platforms. This approach aligns with the sophisticated requirements of professional financial services organizations.

This zag review reveals ZagTrader as a specialized financial technology company focused on institutional clients rather than retail traders. The platform demonstrates strengths in providing comprehensive multi-asset trading and investment solutions, with particular emphasis on integrated front-to-back office capabilities.

ZagTrader appears most suitable for banks, brokers, and asset management firms seeking comprehensive technology infrastructure rather than individual traders looking for retail trading platforms. The company's global reach, serving over 100 institutions, suggests established credibility within the institutional market segment.

The primary limitations identified include limited regulatory transparency, absence of detailed trading conditions, and insufficient publicly available user feedback. These factors reflect the company's B2B focus but may require additional due diligence for potential clients seeking comprehensive service evaluation.

FX Broker Capital Trading Markets Review