FTB Review 1

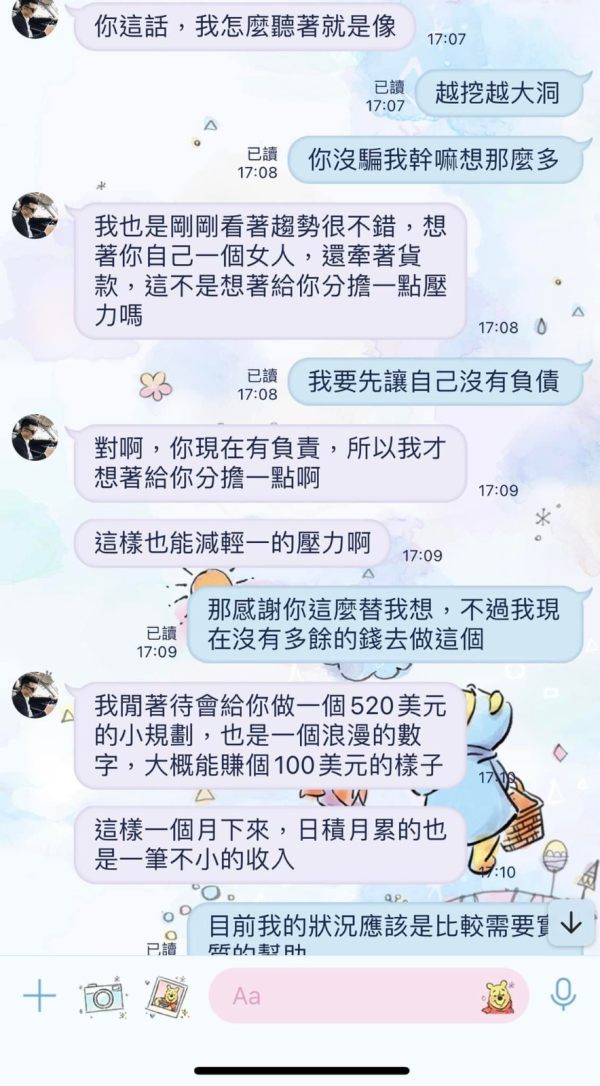

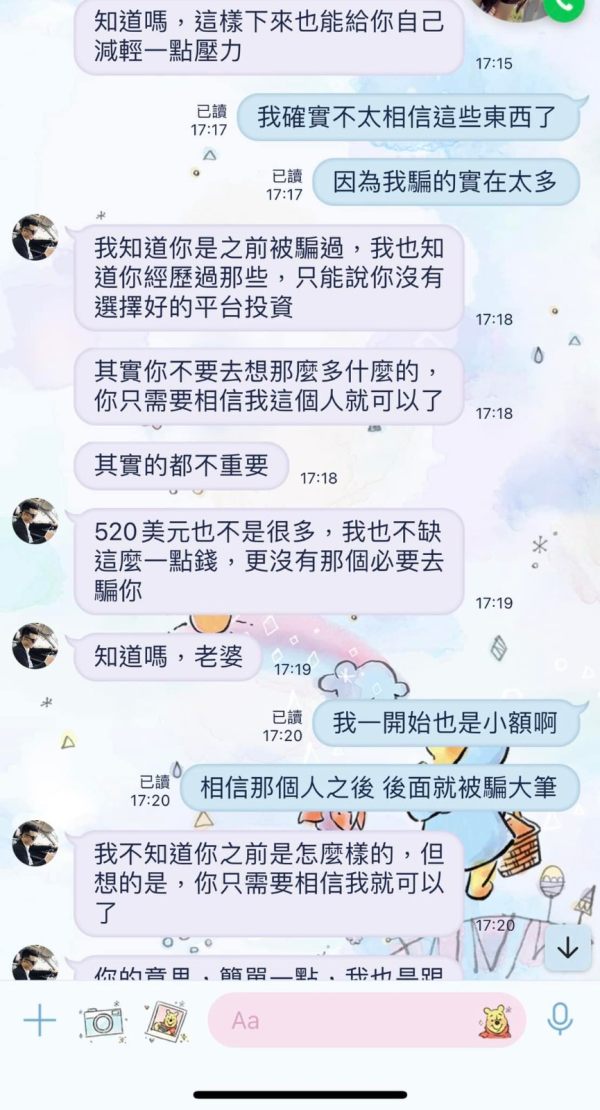

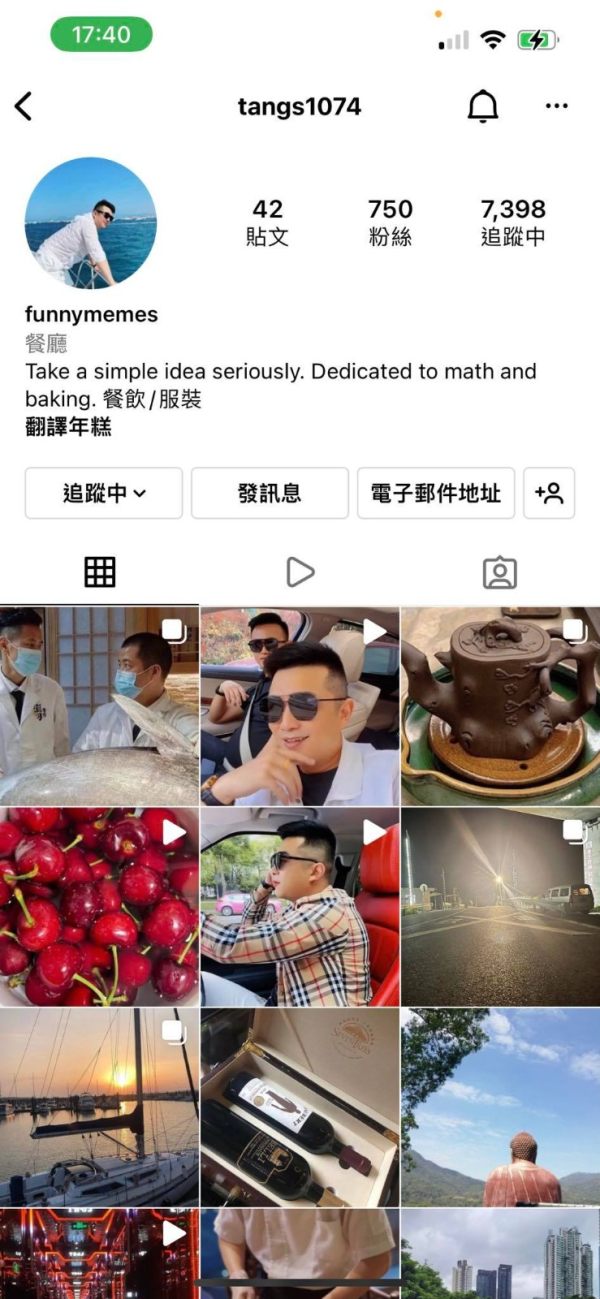

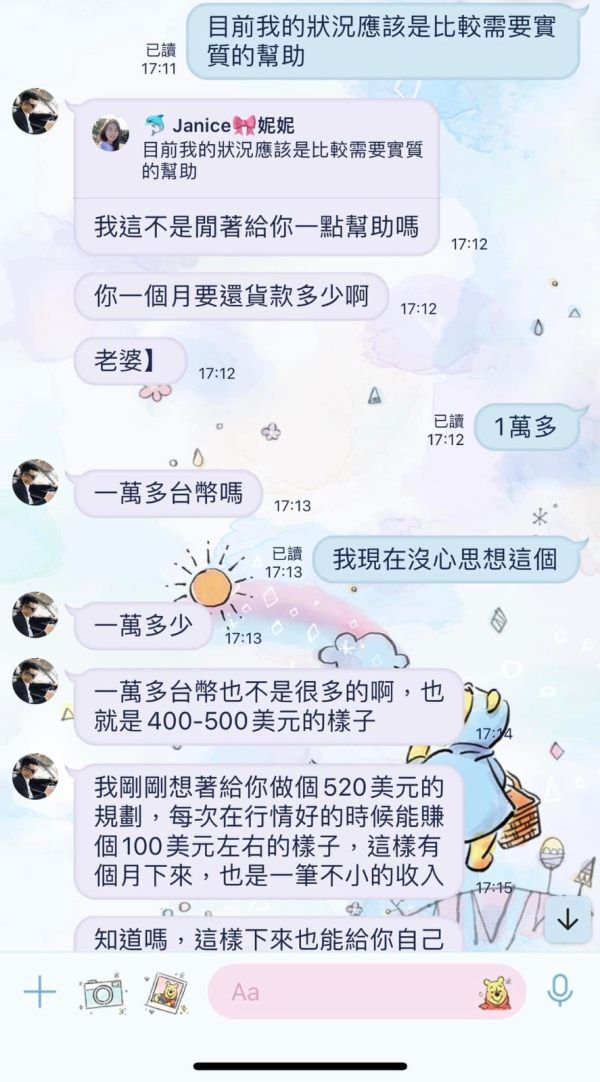

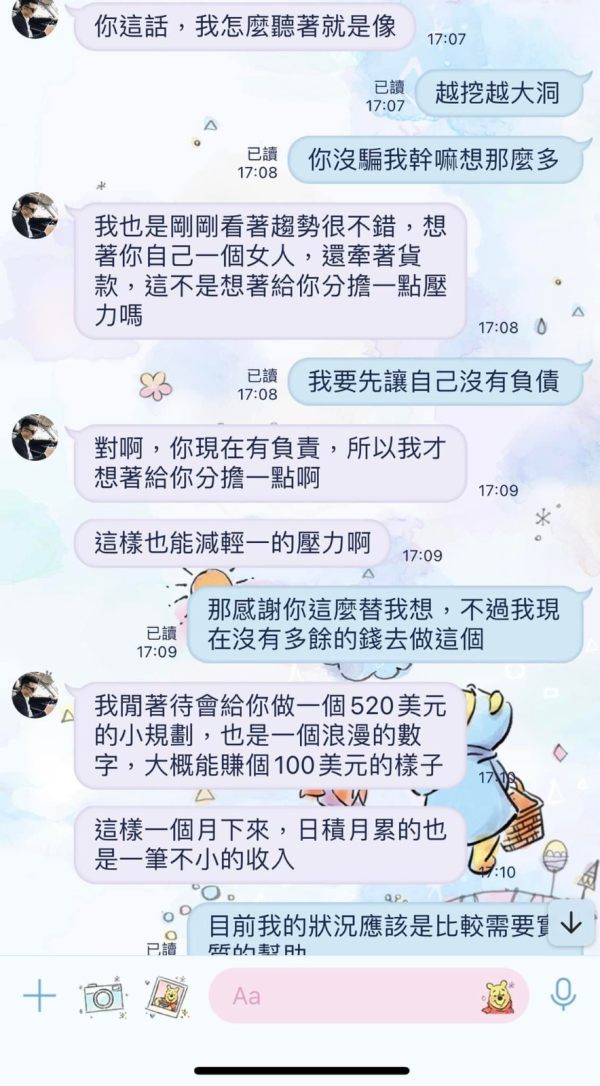

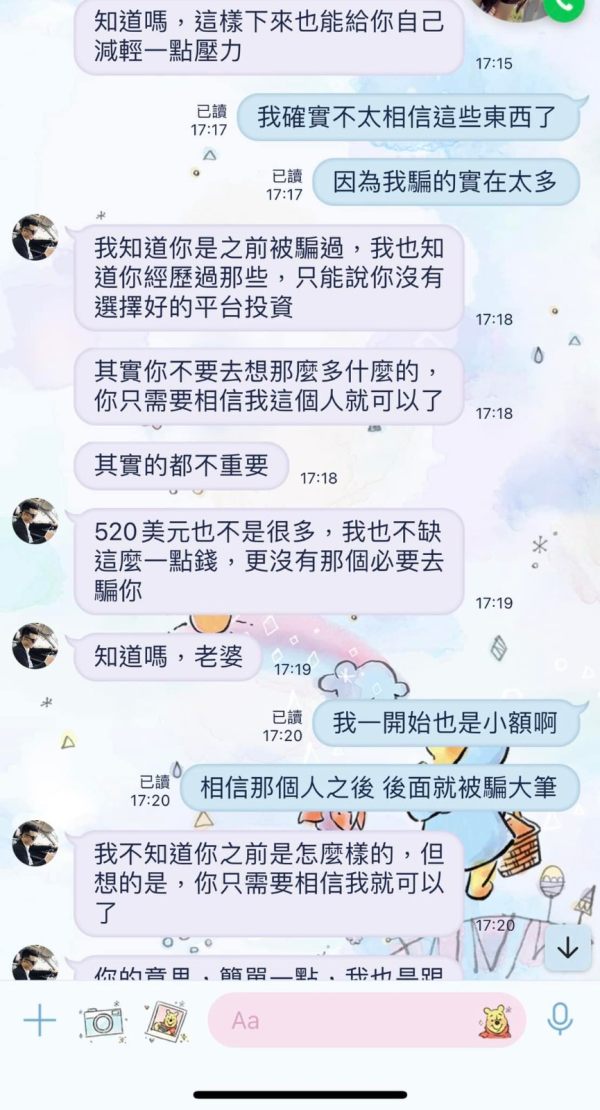

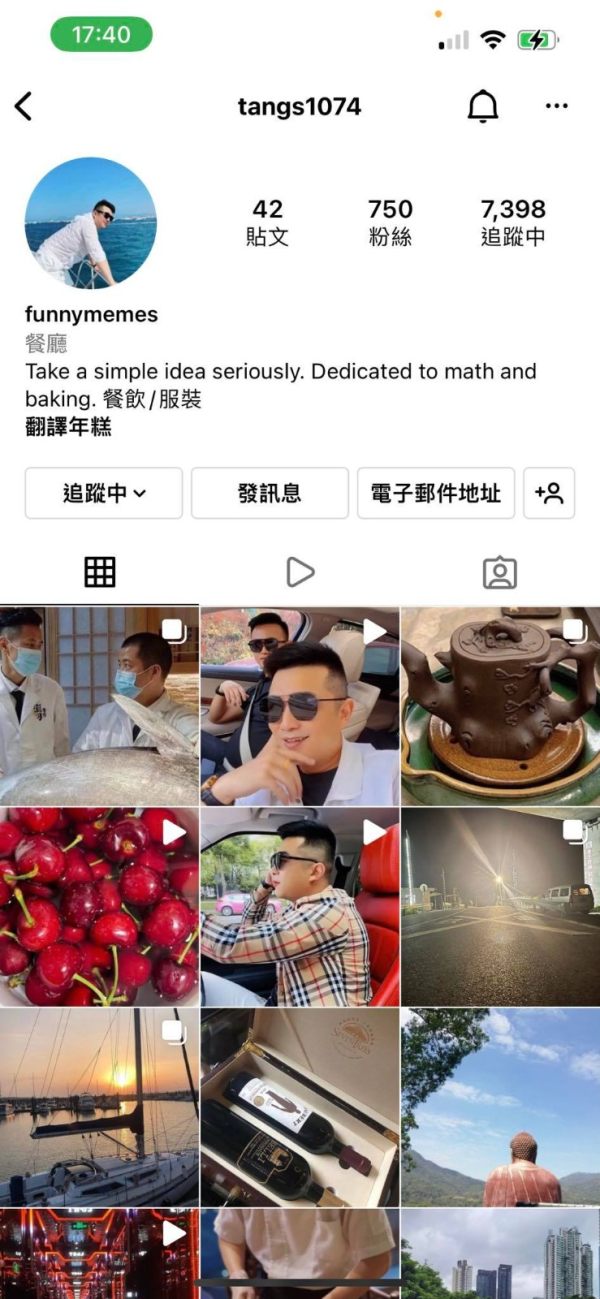

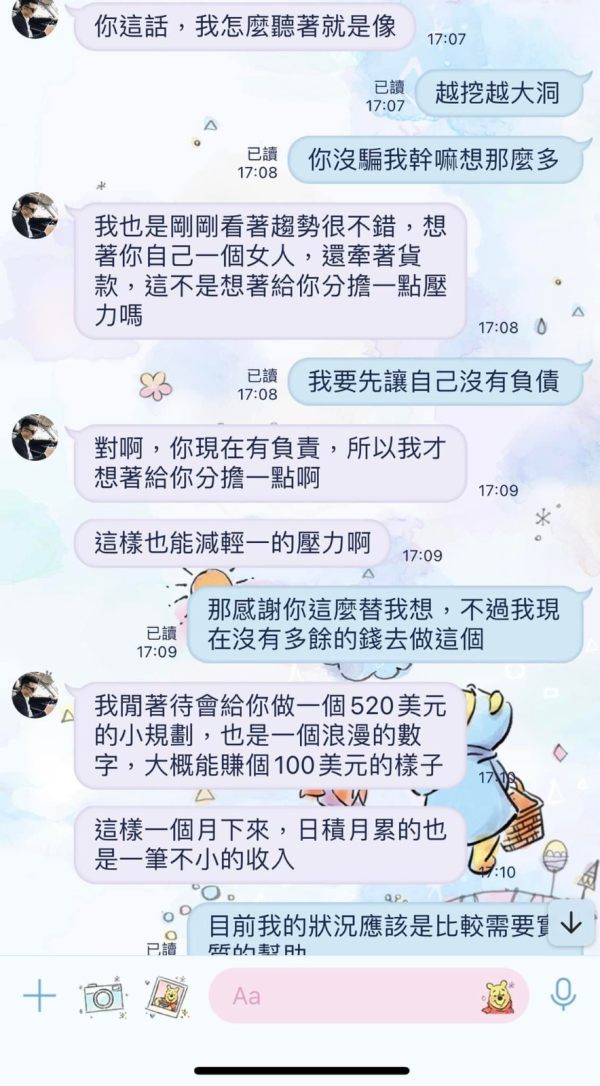

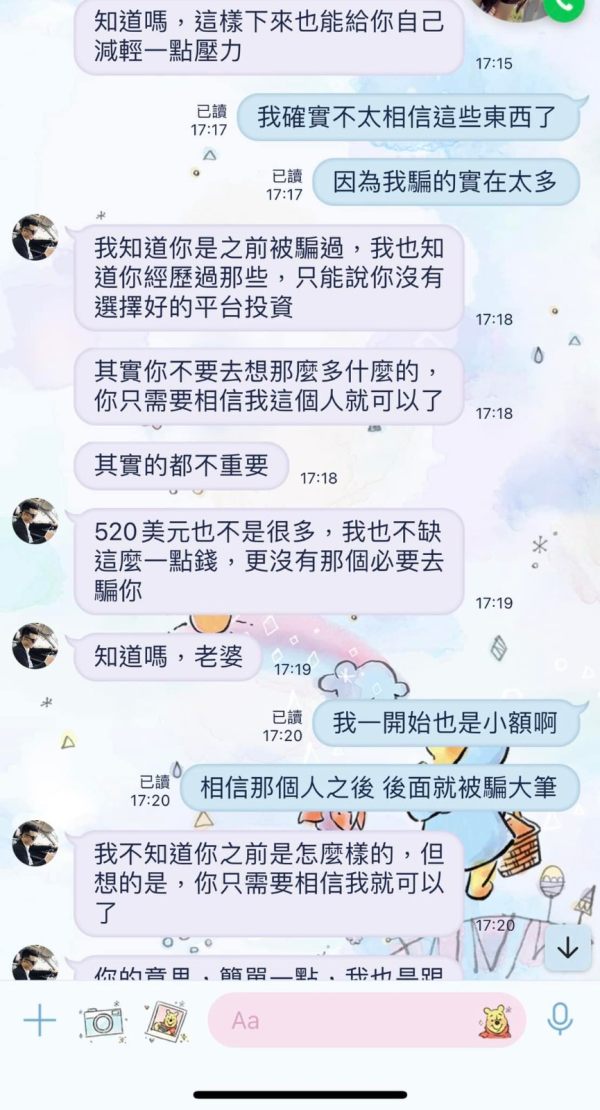

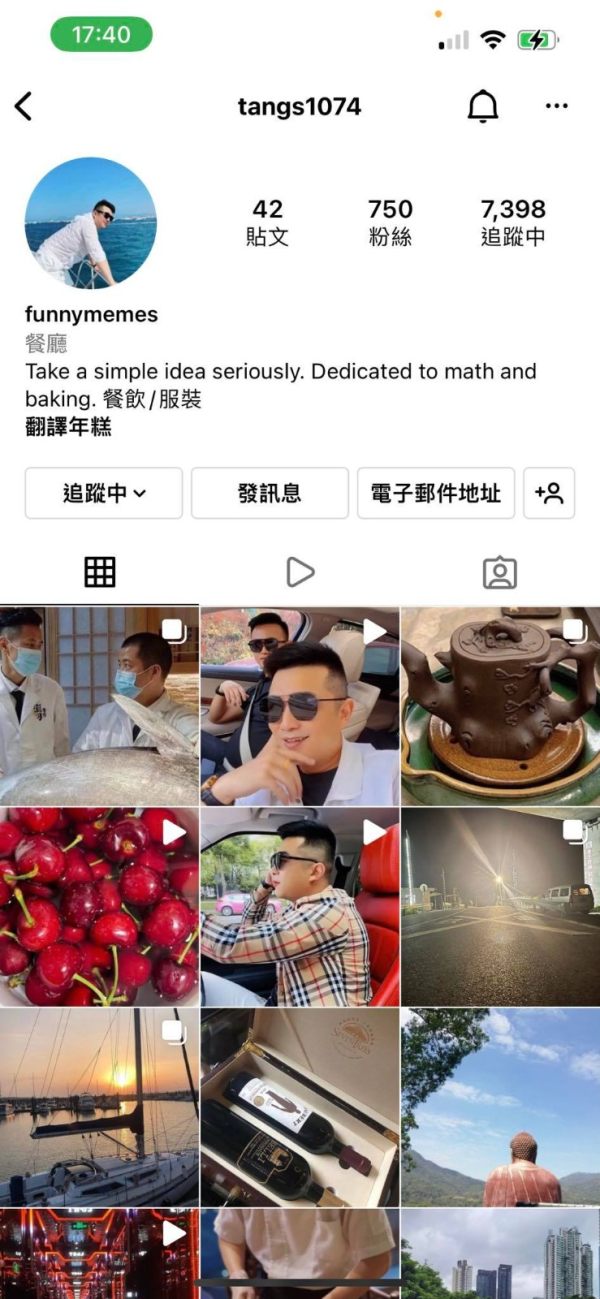

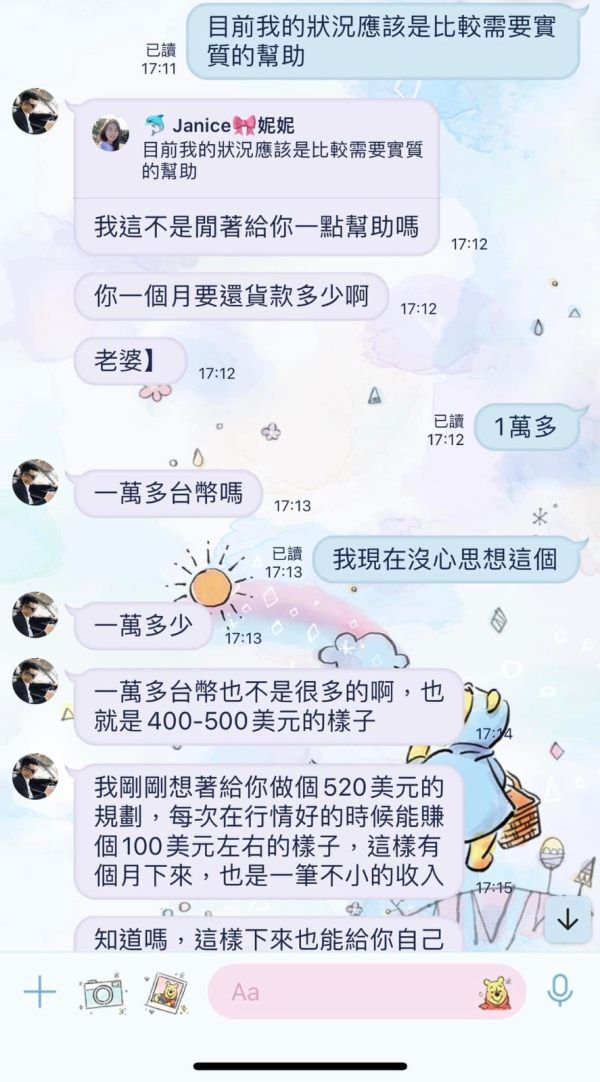

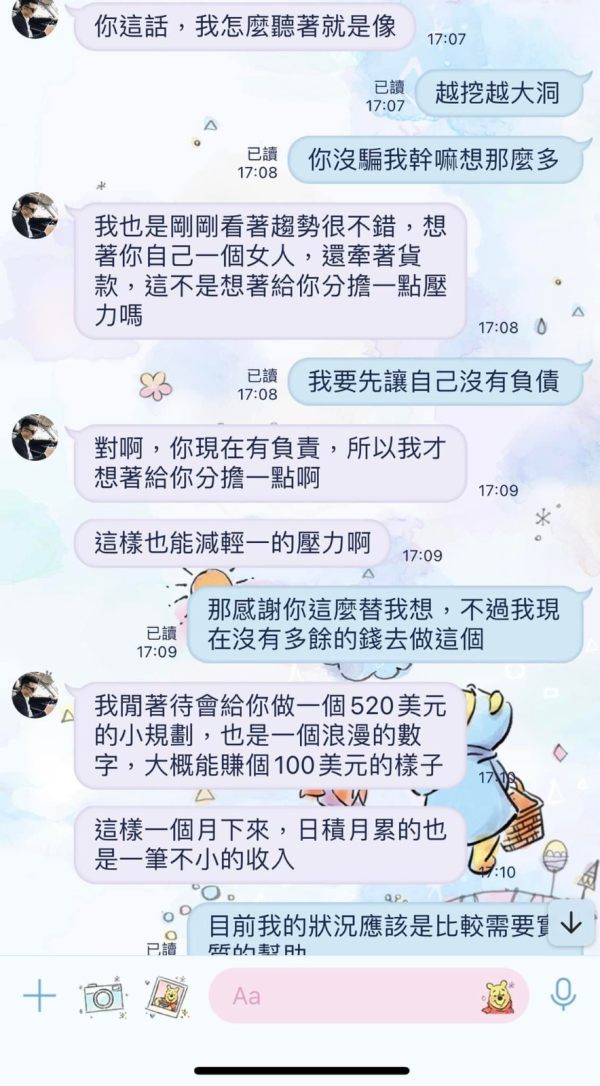

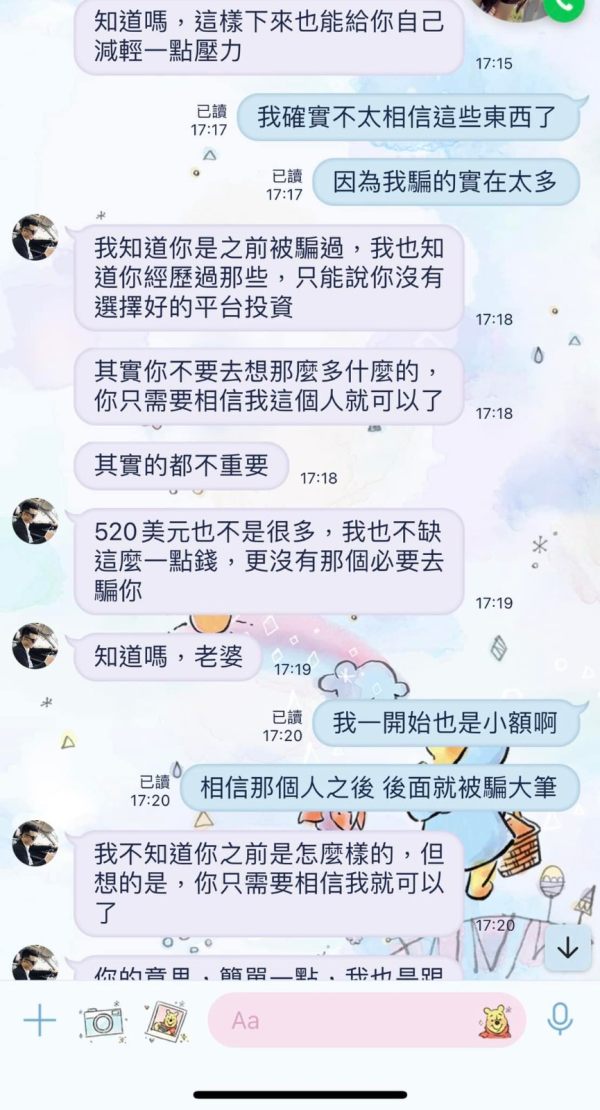

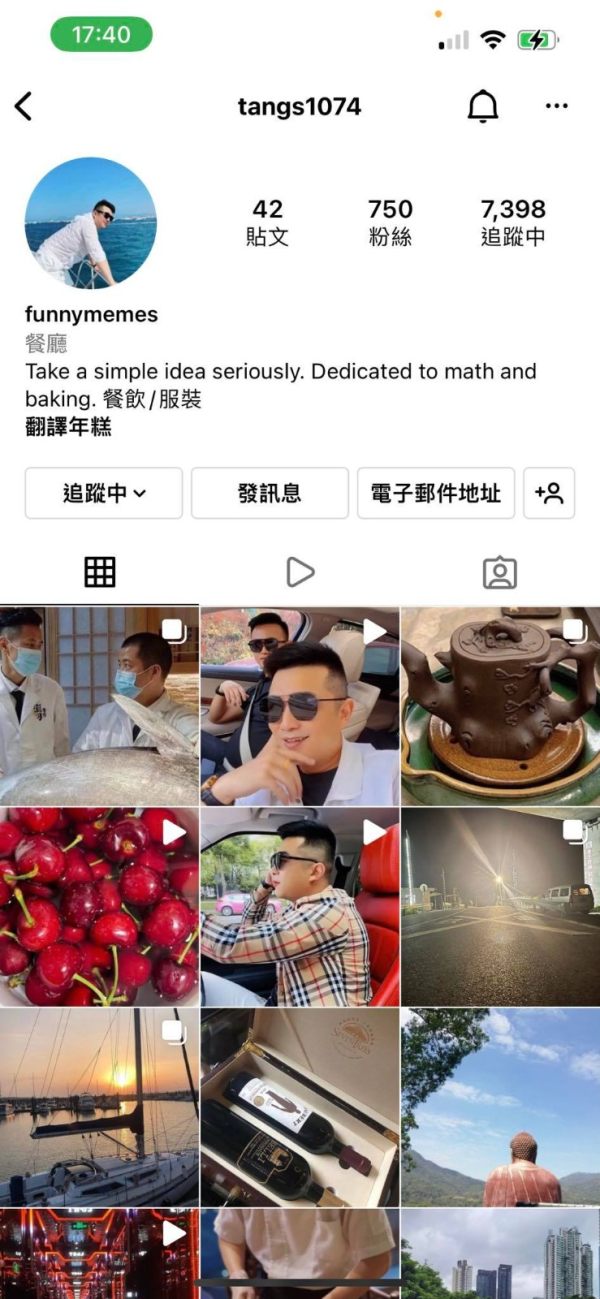

I lost my mind a while ago and was fascinated by a man. He cheated my savings with just a small amount of money. Now I can't get the money. The police only told me to be mentally prepared. I don't know what to do in rest of my life

FTB Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

I lost my mind a while ago and was fascinated by a man. He cheated my savings with just a small amount of money. Now I can't get the money. The police only told me to be mentally prepared. I don't know what to do in rest of my life

FTB presents itself as a forex-focused brokerage platform offering multiple account types designed to serve both individual and corporate clients. Based on available information from WikiBit and other sources, this ftb review reveals a broker that positions itself in the competitive forex trading landscape with emphasis on mobile trading accessibility, though specific details about trading conditions remain limited in publicly available documentation. The broker operates through its FTB Mobile trading app. This provides clients with on-the-go access to foreign exchange markets and essential trading tools.

The platform appears to cater primarily to traders seeking straightforward forex trading solutions. FTB's approach seems centered on providing essential forex trading services rather than comprehensive multi-asset trading solutions, which may appeal to dedicated currency traders. However, the lack of detailed information about regulatory compliance, fee structures, and customer support quality presents challenges for potential clients seeking thorough due diligence. This evaluation aims to provide traders with a balanced assessment based on available information. It also highlights areas where additional transparency would benefit prospective clients.

This ftb review is based on publicly available information and may not reflect the complete current state of FTB's services. Potential differences may exist between regional entities or service offerings in different jurisdictions, making comprehensive evaluation challenging. The evaluation methodology employed here relies on accessible documentation, platform information, and market feedback where available.

Traders should conduct independent verification of all trading conditions, regulatory status, and service terms before making investment decisions. Information presented reflects the state of available data as of the review date. It may be subject to changes in the broker's offerings or regulatory environment.

| Evaluation Category | Score | Key Assessment Factors |

|---|---|---|

| Account Conditions | 6/10 | Multiple account types offered but limited condition details |

| Tools and Resources | 7/10 | FTB Mobile app available, forex-focused platform |

| Customer Service | 5/10 | Limited information on support channels and quality |

| Trading Experience | 6/10 | Mobile trading platform, unclear execution quality |

| Trust and Safety | 4/10 | Limited regulatory information available |

| User Experience | 5/10 | Insufficient user feedback and interface details |

FTB operates as a forex-specialized brokerage service. It positions itself to serve both individual traders and corporate clients through multiple account configurations. According to information from WikiBit, the broker maintains a focus on foreign exchange trading rather than diversifying into broader financial instruments, which may appeal to traders seeking specialized currency market access. The company's business model appears centered on providing accessible forex trading solutions through digital platforms. It particularly emphasizes mobile trading capabilities for modern traders.

The broker's operational structure suggests a targeted approach to forex markets. It offers various account types to accommodate different client needs and trading volumes. However, specific details about the company's founding date, headquarters location, and corporate history remain unclear in available documentation, which may concern traders who prioritize comprehensive due diligence in broker selection.

FTB's platform ecosystem revolves around its mobile trading application. This indicates a strategy focused on modern, accessible trading solutions that align with current market trends. The emphasis on mobile trading aligns with current market trends toward on-demand trading access. However, the absence of detailed information about desktop platforms or web-based trading interfaces represents a notable gap in the service offering overview. This ftb review finds that while the broker's forex specialization may appeal to dedicated currency traders, the limited available information about company structure and comprehensive service details may require additional investigation by prospective clients.

Regulatory Status: Available documentation does not specify particular regulatory authorities overseeing FTB's operations. This represents a significant information gap for traders prioritizing regulatory compliance verification.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in accessible sources.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in available documentation.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not detailed in accessible information.

Tradeable Assets: The platform focuses primarily on forex trading. However, the complete range of available currency pairs and any additional instruments remain unspecified.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in available sources. This limits cost comparison capabilities for potential clients.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible documentation.

Platform Options: FTB Mobile trading app serves as the primary trading interface. Information about additional platform options remains limited in available sources.

Geographic Restrictions: Specific jurisdictions where services are restricted or unavailable are not detailed in available sources.

Customer Support Languages: Supported languages for customer service communications are not specified in accessible documentation.

This ftb review notes that the limited availability of detailed operational information presents challenges for comprehensive broker evaluation and comparison.

FTB's account structure reportedly includes multiple account types designed to serve diverse client needs. These range from individual retail traders to corporate entities. However, the specific characteristics, benefits, and requirements for each account category remain unclear in available documentation, which makes it difficult for potential clients to assess which account type might best suit their trading objectives and capital requirements.

The absence of clear minimum deposit information across different account tiers represents a significant gap in available data. Most established brokers provide transparent deposit requirements to help traders select appropriate account levels. However, this information is not readily accessible for FTB. Similarly, account-specific features such as spread reductions, commission structures, or premium services are not detailed in available sources, limiting informed decision-making capabilities.

Account opening procedures, required documentation, and verification processes are not specified in accessible information. This lack of transparency regarding onboarding requirements may concern traders who prefer understanding the complete account establishment process before committing to a broker. Additionally, information about account maintenance fees, inactivity charges, or minimum trading requirements is not provided in available documentation.

The platform's focus on serving both individual and corporate clients suggests some level of account customization. However, specific details about corporate account features, institutional services, or high-volume trader accommodations are not available. This ftb review finds that while the broker advertises multiple account options, the lack of detailed conditions and requirements makes informed account selection challenging for prospective clients.

FTB's primary technological offering centers on its mobile trading application. This provides forex trading capabilities for users seeking portable market access. The FTB Mobile app represents the broker's main platform for client trading activities, though detailed information about the application's features, analytical tools, and technical capabilities is not comprehensively available in accessible sources.

The mobile-first approach aligns with contemporary trading preferences. Many traders value the ability to monitor positions and execute trades from mobile devices. However, the apparent absence of detailed information about desktop trading platforms or web-based interfaces may limit appeal for traders who prefer comprehensive analytical tools typically associated with full-featured desktop applications.

Research and analytical resources, market commentary, economic calendars, and educational materials are not detailed in available documentation. Most competitive brokers provide substantial research support and market analysis to assist trader decision-making. However, FTB's offerings in this area remain unclear. The absence of information about third-party research partnerships or proprietary analytical content represents a notable gap in service transparency.

Automated trading support, algorithmic trading capabilities, and API access for systematic traders are not addressed in accessible information. Additionally, details about charting packages, technical indicators, and analytical tools within the mobile platform are not specified in available sources. Risk management tools, position sizing calculators, and other trader-assistance features also lack detailed documentation.

This evaluation notes that while the mobile trading platform provides basic market access, the limited information about comprehensive trading tools and analytical resources may concern traders who rely heavily on research and analytical support for their trading decisions.

Information regarding FTB's customer support infrastructure, service quality, and client assistance capabilities is notably limited in available documentation. The absence of detailed customer service information represents a significant transparency gap. This may concern traders who prioritize responsive support when evaluating brokers.

Support channel availability, including phone, email, live chat, or ticket-based systems, is not specified in accessible sources. Response time commitments, service level agreements, and support hour coverage also lack clear documentation in available materials. These details are typically important factors for traders, particularly those operating in different time zones or requiring urgent assistance during volatile market conditions.

Multilingual support capabilities, which are increasingly important for international brokers, are not detailed in available information. The geographic scope of FTB's operations suggests potential international clientele. However, specific language support offerings remain unclear. Additionally, specialized support for different account types or trading issues is not addressed in accessible documentation.

Training resources, onboarding assistance, and educational support services are not detailed in available sources. Many brokers provide comprehensive client education and platform training. However, FTB's offerings in this area cannot be assessed based on current information availability. Technical support for platform issues, trading problems, or account management difficulties also lacks detailed documentation.

The limited information about customer service quality, satisfaction levels, and problem resolution effectiveness makes it difficult to assess FTB's commitment to client support. This ftb review notes that the absence of detailed customer service information may require direct inquiry with the broker to understand available support options and service quality expectations.

FTB's trading environment centers on its mobile application platform. This provides forex market access for clients seeking portable trading solutions. However, detailed information about platform performance, execution quality, and overall trading experience remains limited in available documentation, making comprehensive assessment challenging for potential clients.

Platform stability, order execution speed, and system reliability are critical factors for trading success. Specific performance metrics or user experience data are not provided in accessible sources. The mobile-focused approach may appeal to traders prioritizing convenience and accessibility, though the absence of detailed platform specifications limits evaluation of technical capabilities.

Order execution quality, including fill rates, slippage characteristics, and execution speed during volatile market conditions, is not detailed in available information. These factors significantly impact trading outcomes, particularly for active traders or those employing specific trading strategies that require precise execution. Additionally, available order types, position management tools, and risk control features within the mobile platform are not comprehensively documented.

Market access quality, including available currency pairs, trading hours, and market depth information, lacks detailed specification. The scope of forex offerings, exotic pair availability, and spread characteristics during different market conditions are not clearly outlined in accessible documentation, which limits trader ability to assess market access quality.

Integration capabilities with third-party tools, data export options, and compatibility with external analytical software are not addressed in available information. Advanced trading features such as one-click trading, preset position sizes, or customizable interface options also lack detailed documentation in accessible sources. This ftb review finds that while the mobile platform provides basic market access, the limited information about comprehensive trading features and execution quality makes thorough evaluation difficult for prospective clients.

The regulatory oversight and safety framework surrounding FTB's operations present significant transparency challenges based on available documentation. Clear regulatory authorization, licensing information, and supervisory authority details are not readily accessible. This represents a fundamental concern for traders prioritizing regulatory compliance and investor protection.

Client fund protection measures, segregated account policies, and deposit insurance coverage are not detailed in available sources. These safety mechanisms are crucial for trader confidence and financial security. However, specific information about fund segregation, custodial arrangements, or compensation scheme participation is not provided in accessible documentation. The absence of clear safety protocol documentation may concern risk-conscious traders.

Corporate transparency, including detailed company information, ownership structure, and financial reporting, is limited in accessible documentation. Established regulatory frameworks typically require comprehensive disclosure of corporate details. However, such information is not readily available for FTB. This lack of corporate transparency may impact trader confidence in the broker's stability and accountability.

Industry reputation, regulatory compliance history, and any significant operational incidents are not documented in available sources. Third-party verification of the broker's standing, regulatory relationships, or industry recognition is also not accessible through standard channels. The absence of verifiable regulatory information makes independent confirmation of the broker's authorized status challenging.

Risk disclosure adequacy, terms of service transparency, and client agreement clarity are not assessed due to limited access to comprehensive legal documentation. Dispute resolution mechanisms, complaint handling procedures, and regulatory reporting obligations also lack detailed specification in available sources. This evaluation notes that the limited regulatory and safety information available represents a significant consideration for traders prioritizing comprehensive due diligence and regulatory protection.

Assessment of FTB's overall user experience faces limitations due to insufficient available feedback and detailed interface information. User satisfaction levels, platform usability ratings, and comprehensive client testimonials are not readily accessible in available documentation. This makes thorough user experience evaluation challenging.

Interface design quality, navigation efficiency, and mobile app usability within the FTB Mobile platform lack detailed description in accessible sources. Modern trading platforms typically emphasize intuitive design and user-friendly interfaces. However, specific information about FTB's approach to user experience design is not available. The mobile-first strategy suggests attention to contemporary user preferences, though detailed interface assessments are not possible based on current information.

Registration and account verification processes, including required documentation, processing times, and user onboarding experience, are not detailed in available sources. Streamlined account opening procedures often contribute significantly to positive user experiences. However, FTB's specific approach to client onboarding remains unclear. Additionally, information about user guidance during the registration process is not documented.

Funding and withdrawal experiences, including process efficiency, transaction transparency, and user satisfaction with financial operations, are not documented in accessible information. These operational aspects significantly impact overall user satisfaction, particularly regarding convenience and reliability of financial transactions that affect daily trading activities.

Common user complaints, frequently reported issues, or areas of client dissatisfaction are not identified in available documentation. Similarly, positive user feedback, platform strengths, or particularly appreciated features lack detailed documentation in accessible sources. The absence of comprehensive user feedback makes it difficult to identify the broker's strengths and areas requiring improvement.

Platform customization options, personal preference settings, and user interface adaptability are not detailed in available sources. Additionally, mobile app store ratings, user reviews, and third-party platform assessments are not accessible for evaluation purposes, limiting comprehensive user experience assessment.

This ftb review reveals a forex-focused brokerage that offers multiple account types and mobile trading accessibility through its FTB Mobile application. While the broker positions itself to serve both individual and corporate clients, significant information gaps regarding regulatory oversight, detailed trading conditions, and comprehensive service offerings limit the ability to provide a complete assessment of the platform's capabilities.

FTB may appeal to traders seeking straightforward forex trading solutions with mobile platform access. This particularly benefits those prioritizing convenience and accessibility over comprehensive analytical tools. However, the limited transparency regarding regulatory compliance, cost structures, and detailed service specifications presents notable concerns for traders who prioritize thorough due diligence before selecting a broker.

The broker's strengths appear to include mobile trading convenience and multiple account type availability for different trader needs. Key weaknesses include insufficient regulatory information transparency and limited detailed service documentation. Prospective clients should consider conducting direct inquiry with FTB to obtain comprehensive information about trading conditions, regulatory status, and service terms before making investment decisions.

FX Broker Capital Trading Markets Review