Xone Review 1

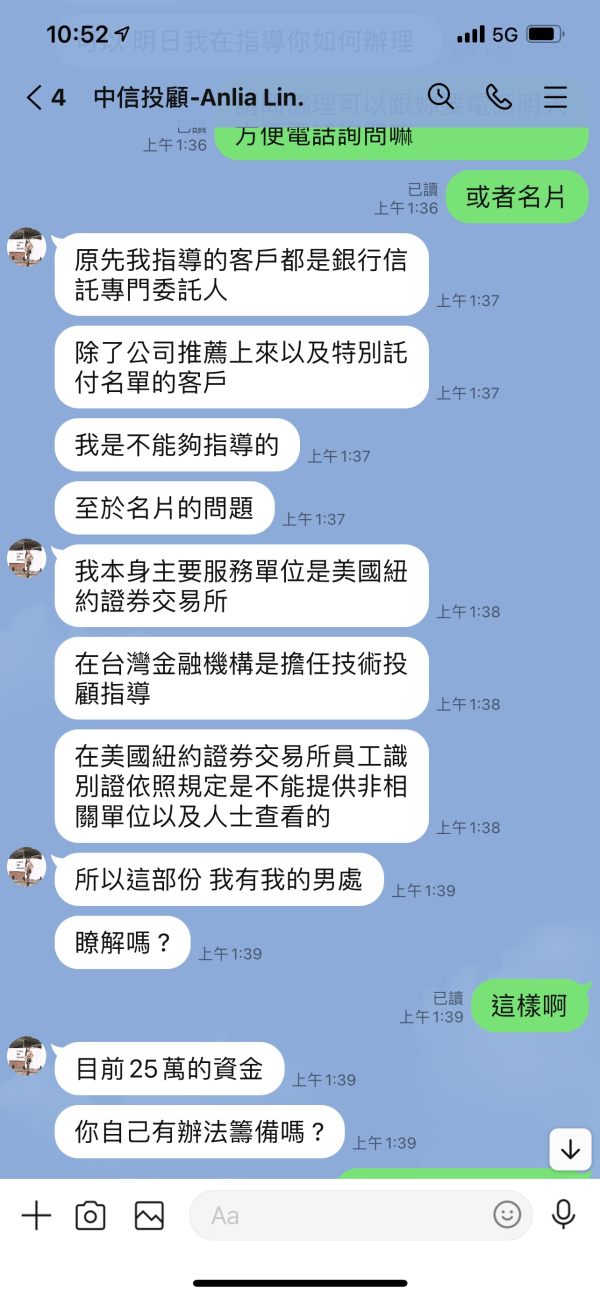

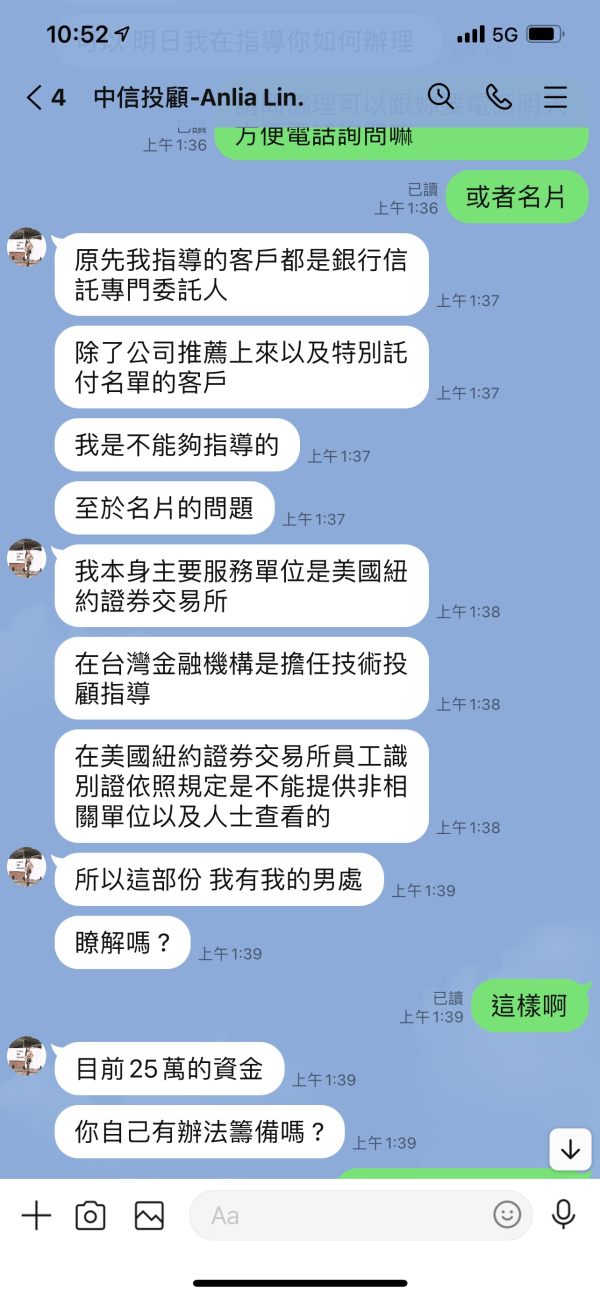

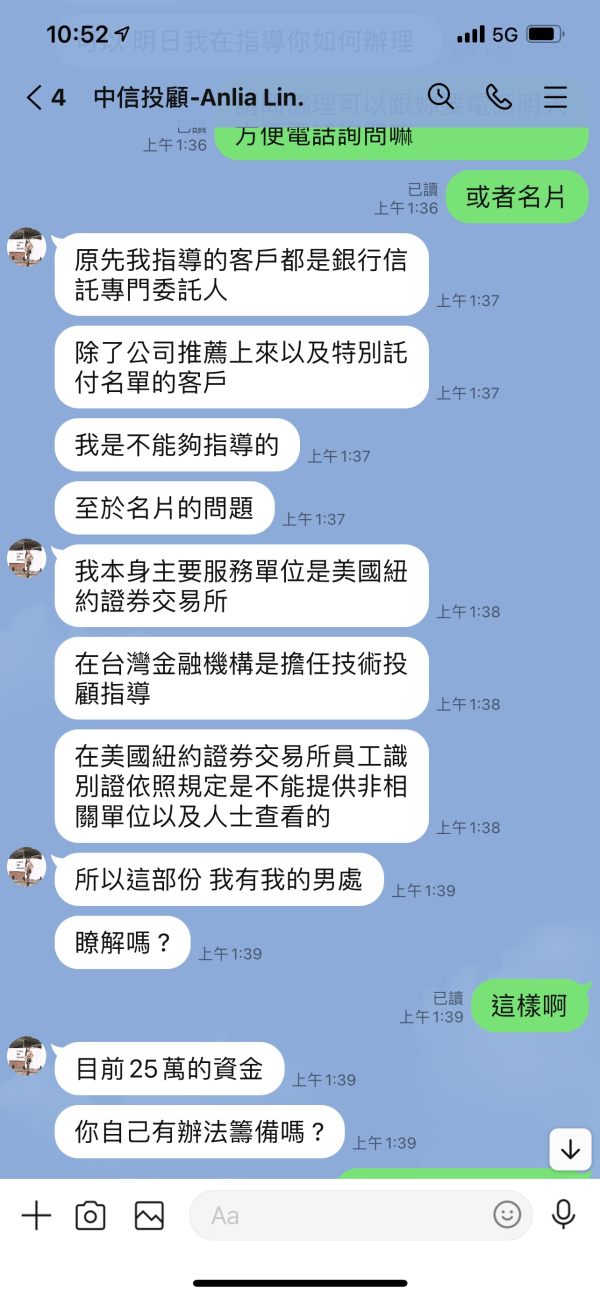

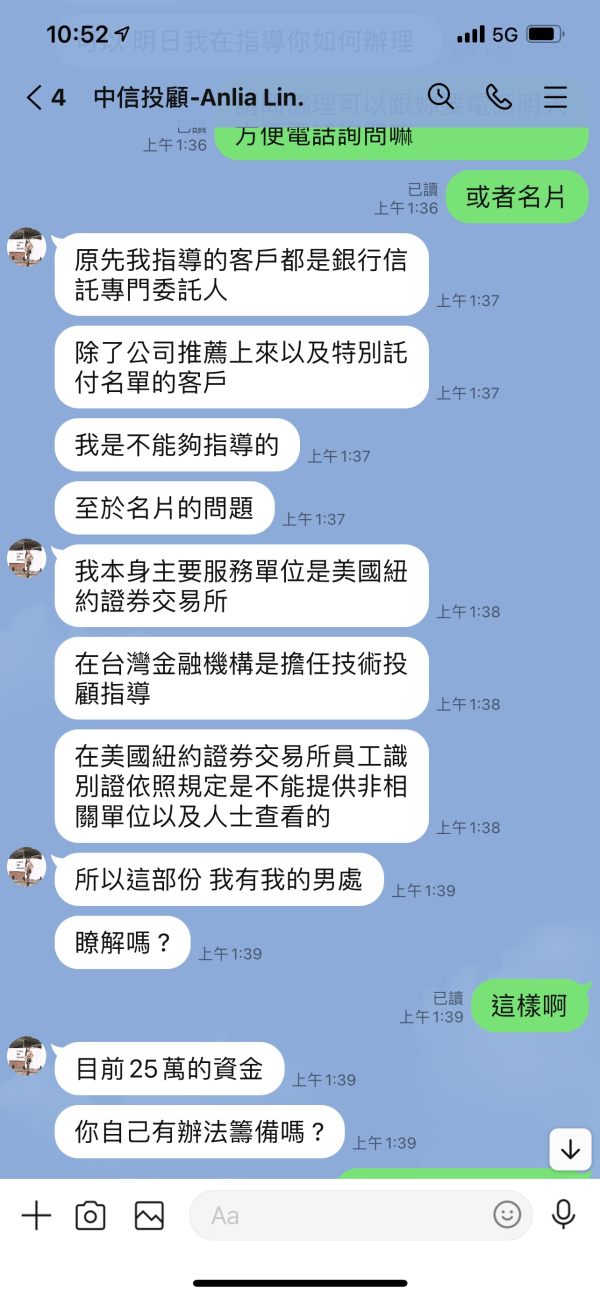

Internet fraud. This website is already removed. Inducing fraud.

Xone Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Internet fraud. This website is already removed. Inducing fraud.

This comprehensive xone review examines the offerings of Xone Brokerage. It's a US-based foreign exchange trading software company headquartered in Wilmington. Overall, Xone positions itself as a provider of flexible STP-compliant clearing and settlement systems. The company targets traders who prioritize efficient trading solutions.

The platform's standout features include highly configurable modular solutions and support for rapid implementation and deployment. These characteristics make Xone particularly appealing to professional traders and institutional clients seeking streamlined operations. The company primarily serves users interested in leveraging forex and commodity trading opportunities. They do this through their specialized software solutions.

According to available information, Xone operates with a focus on maximizing operational efficiency through its modular approach. This allows clients to customize their trading infrastructure according to specific needs. The platform supports forex and commodities trading. However, detailed specifications about trading conditions and regulatory oversight remain limited in publicly available materials.

Due to limited regulatory information in available sources, users should carefully evaluate different regional legal frameworks and potential risks before engaging with Xone's services. The regulatory landscape for forex trading varies significantly across jurisdictions. Traders must ensure compliance with their local regulations.

This review is based on publicly available information and known market data. Specific details about account conditions, trading costs, and regulatory status were not comprehensively detailed in accessible materials. Prospective users are advised to conduct thorough due diligence and seek updated information directly from the company.

| Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account condition details not mentioned in available information |

| Tools and Resources | N/A | Specific tools and resources content not detailed in source materials |

| Customer Service and Support | N/A | Customer service information not specified in available sources |

| Trading Experience | N/A | Trading experience specifics not detailed in accessible materials |

| Trust and Reliability | N/A | Trust-related information not comprehensively covered in sources |

| User Experience | N/A | User experience details not specified in available information |

Xone Brokerage operates as a foreign exchange trading software company based in Wilmington, United States. It focuses on delivering efficient clearing and settlement systems to the trading community. The company has positioned itself as a technology-driven solution provider. It emphasizes STP-compliant operations that aim to enhance trading efficiency for its user base.

The company's business model centers around providing STP-compliant clearing and settlement systems designed to optimize user trading efficiency. This approach suggests a focus on direct market access and transparent order processing. Such features typically appeal to more sophisticated trading operations. The modular nature of their solutions indicates flexibility in implementation. This allows different types of trading organizations to adapt the system to their specific operational requirements.

The trading platform offered is Xone Trader. However, detailed platform functionality specifications are not extensively documented in available materials. The platform supports trading in forex and commodities markets. It caters to traders interested in these asset classes. However, specific regulatory oversight details are not mentioned in accessible sources. This represents an important information gap for potential users conducting due diligence.

Regulatory Regions: Specific regulatory regions and oversight authorities are not detailed in available source materials. This represents a significant information gap for compliance assessment.

Deposit and Withdrawal Methods: Available sources do not specify the deposit and withdrawal methods supported by the platform.

Minimum Deposit Requirements: Minimum deposit requirements are not mentioned in accessible information sources.

Bonuses and Promotions: No information about bonuses or promotional offers is available in the reviewed materials.

Tradeable Assets: The platform supports trading in forex and commodities markets. It provides access to these two major asset classes for interested traders.

Cost Structure: Specific cost structure details, including spreads, commissions, and fees, are not detailed in available information sources.

Leverage Ratios: Leverage ratio information is not specified in accessible materials.

Platform Options: The primary platform is Xone Trader. No additional platform options are mentioned in available sources.

Regional Restrictions: Specific regional restrictions are not detailed in available information.

Customer Service Languages: Customer service language support is not specified in accessible sources.

This xone review highlights the limited publicly available detailed information about many standard broker features that traders typically evaluate.

The evaluation of Xone's account conditions faces significant limitations due to insufficient information in available sources. Specific account type varieties and their characteristics are not detailed in accessible materials. This makes it challenging to assess the diversity of options available to different trader segments.

Minimum deposit requirements, which represent a crucial factor for many traders in broker selection, are not specified in the reviewed sources. This information gap extends to account opening procedures. These typically involve verification processes, documentation requirements, and timeline expectations that prospective users would need to understand.

Special account features that might differentiate Xone from competitors are not detailed in available materials. These could include features such as Islamic accounts, managed accounts, or specialized institutional offerings. Such features might be relevant to specific trader demographics.

The absence of detailed account condition information in this xone review reflects the limited publicly available documentation about these fundamental aspects of the trading service. Prospective users would need to contact the company directly to obtain comprehensive account condition details.

The assessment of Xone's tools and resources encounters substantial information limitations in available sources. Trading tool varieties and quality metrics are not specifically detailed. This prevents a comprehensive evaluation of the platform's analytical and execution capabilities.

Research and analysis resources, which many traders consider essential for informed decision-making, are not described in accessible materials. These typically include market analysis, economic calendars, news feeds, and technical analysis tools that support trading strategies.

Educational resources, increasingly important for trader development and platform adoption, are not mentioned in available sources. Such resources often include webinars, tutorials, market education materials, and trading guides. These help users maximize platform capabilities.

Automated trading support capabilities are not specified in reviewed materials. This represents a significant information gap. Automated trading functionality has become increasingly important for many trading strategies and operational efficiency.

The limited information available for tools and resources analysis in this review reflects the need for more comprehensive public documentation of platform capabilities.

Customer service and support evaluation faces considerable challenges due to limited information in available sources. Customer service channels and availability are not specified. This prevents assessment of how users can access support when needed.

Response time metrics, which significantly impact user satisfaction and problem resolution efficiency, are not detailed in accessible materials. These metrics typically include initial response times, resolution timeframes, and escalation procedures for complex issues.

Service quality indicators are not mentioned in available sources. Quality assessment usually involves factors such as staff expertise, problem resolution effectiveness, and overall user satisfaction with support interactions.

Multilingual support capabilities are not specified in reviewed materials. This feature often proves crucial for international trading platforms serving diverse user bases across different regions and language preferences.

Customer service hours and availability schedules are not detailed in accessible sources. This information typically helps users understand when they can expect support access and response times across different time zones.

The trading experience evaluation encounters significant information limitations in available sources. Platform stability and speed metrics are not specified. These factors critically impact trading effectiveness and user satisfaction.

Order execution quality details are not provided in accessible materials. Execution quality typically involves factors such as slippage rates, rejection rates, and fill quality. These directly affect trading outcomes and costs.

Platform functionality completeness is not comprehensively detailed in available sources. This assessment would typically cover charting capabilities, order types, risk management tools, and other features. Such features support various trading strategies.

Mobile trading experience details are not specified in reviewed materials. Mobile functionality has become increasingly important as traders seek flexibility in market access and position management across different devices and locations.

Trading environment characteristics are not detailed in accessible sources. This xone review reflects the limited public information available about the actual trading experience users can expect.

Trust and reliability assessment faces substantial challenges due to limited regulatory and transparency information in available sources. Regulatory credentials are not specified. This represents a critical information gap for users evaluating platform legitimacy and oversight.

Fund security measures are not detailed in accessible materials. These typically include segregated account policies, insurance coverage, and other protections. Such measures safeguard user funds and provide recourse in adverse situations.

Company transparency levels are not comprehensively documented in available sources. Transparency usually involves factors such as financial reporting, ownership disclosure, and operational transparency. These help users assess company stability and reliability.

Industry reputation indicators are not mentioned in reviewed materials. Reputation assessment typically involves industry awards, peer recognition, and standing within the professional trading community.

Negative event handling procedures and historical incident management are not detailed in accessible sources. Such information helps users understand how the company manages challenges and maintains operational integrity.

User experience evaluation encounters significant information limitations in available sources. Overall user satisfaction metrics are not specified. This prevents assessment of how well the platform meets user expectations and needs.

Interface design and usability characteristics are not detailed in accessible materials. User interface quality significantly impacts trading efficiency and user adoption. This is particularly true for traders managing multiple positions or complex strategies.

Registration and verification process details are not specified in reviewed materials. These processes typically involve account opening procedures, document verification requirements, and timeline expectations. Such factors affect initial user experience.

Fund operation experience, including deposit and withdrawal processes, processing times, and associated procedures, are not detailed in available sources. These operational aspects significantly impact overall user satisfaction and platform usability.

Common user complaints or concerns are not documented in accessible materials. Such feedback typically provides valuable insights into platform strengths and areas needing improvement.

This xone review reveals that Xone operates as a foreign exchange trading software company offering modular solutions for clearing and settlement operations. However, it faces significant limitations in publicly available detailed information. While the company provides flexible trading systems with STP-compliant operations, the lack of transparent regulatory information and detailed account conditions represents notable concerns for prospective users.

The platform appears suitable for users seeking efficient trading solutions and modular system flexibility. This is particularly true for those with institutional or professional trading requirements. However, the absence of comprehensive public information about regulatory oversight, trading conditions, costs, and user support creates challenges for thorough evaluation.

The main advantages include the provision of flexible, modular trading systems and focus on operational efficiency. Key disadvantages involve limited transparency regarding regulatory compliance, account conditions, and detailed service specifications. These are details that traders typically require for informed broker selection.

FX Broker Capital Trading Markets Review