WZG Review 32

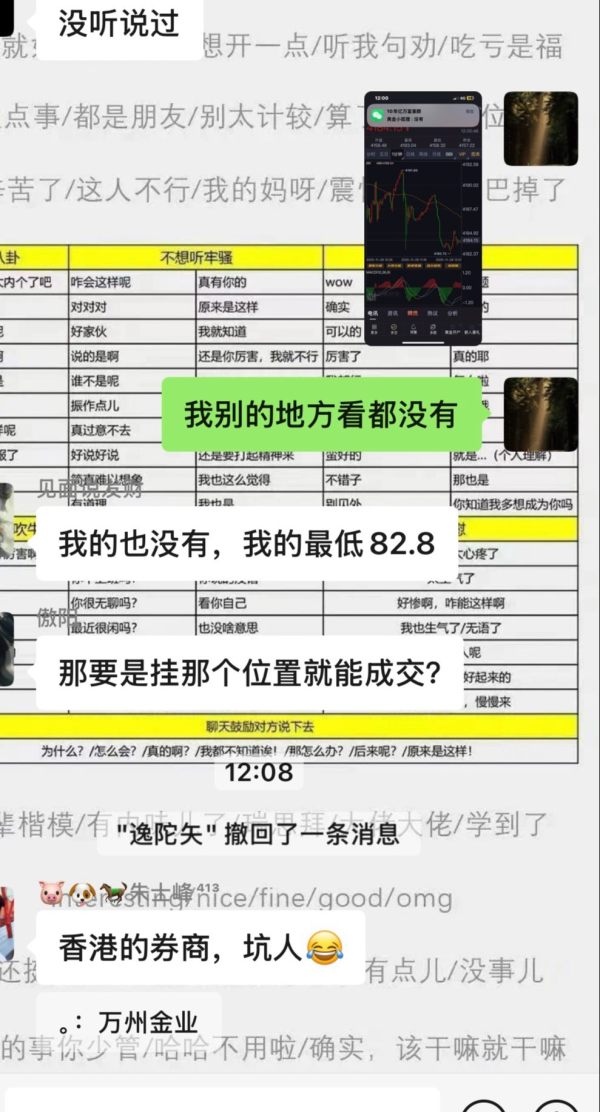

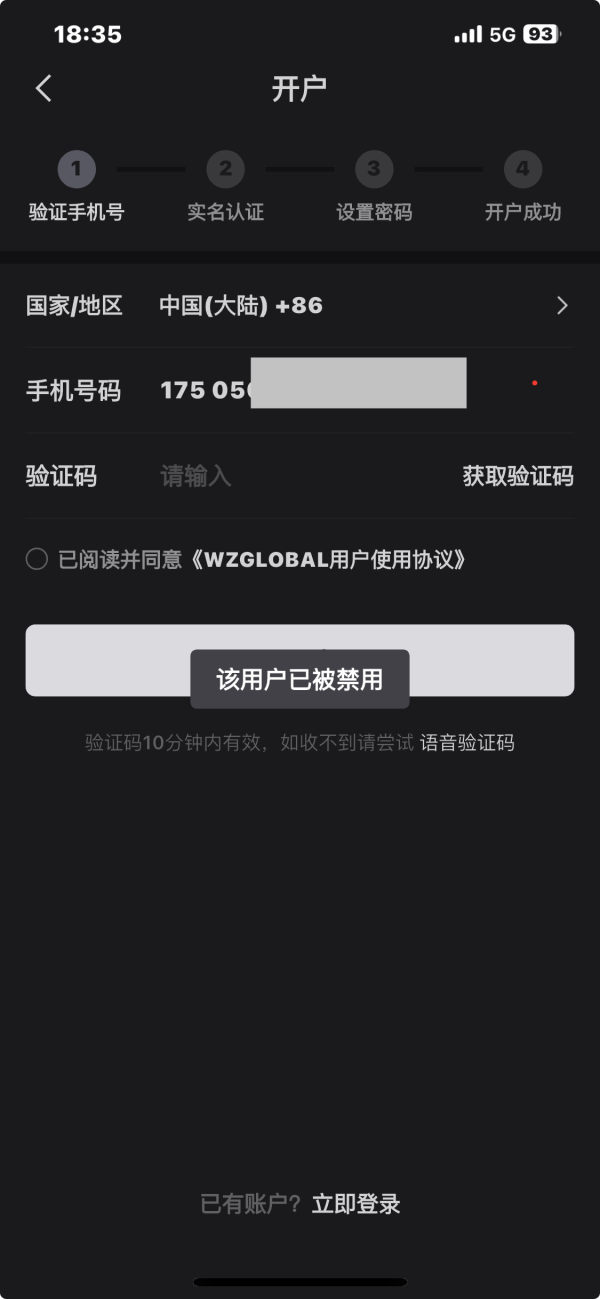

Internal manipulation of candlestick patterns Random spikes appear, yet no spikes show on other platforms or spot gold charts. Customer service claims we shouldn't compare with spot gold or other platforms. I'm not trading spot gold. They keep using official jargon: “legitimate,” “compliant.” “If you disagree, file a complaint in Hong Kong.” When issues surfaced, I lost 160,000 yuan in two months. After reporting to police, they immediately froze my account—now I can't log in. #MyFirstTrade #ScamPlatform #PonziScheme #BeginnersTechnicalGuidance

Internal manipulation of candlestick patterns with arbitrary spikes—no such spikes appear on other platforms or spot gold charts. Customer service claims we shouldn't reference spot gold or other platforms. I'm not trading spot gold. They consistently use official jargon about “legitimacy,” threatening to send complaints to Hong Kong. After discovering issues, I lost 160,000 yuan over two months. When I reported it to the police, they immediately locked my account, preventing login.

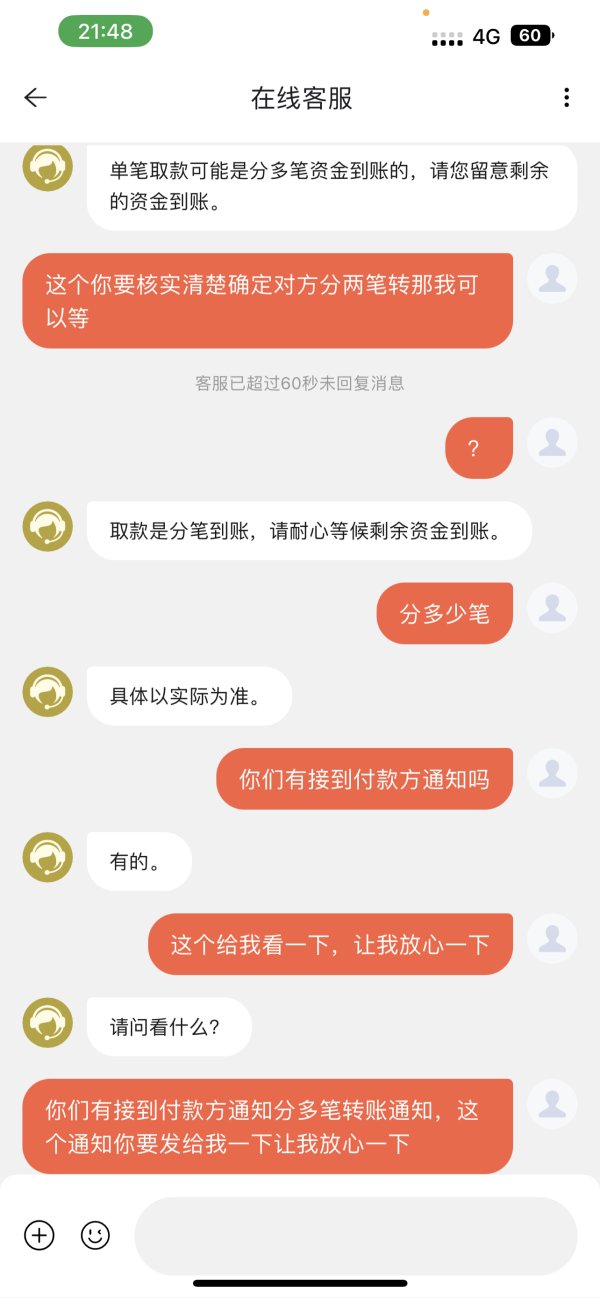

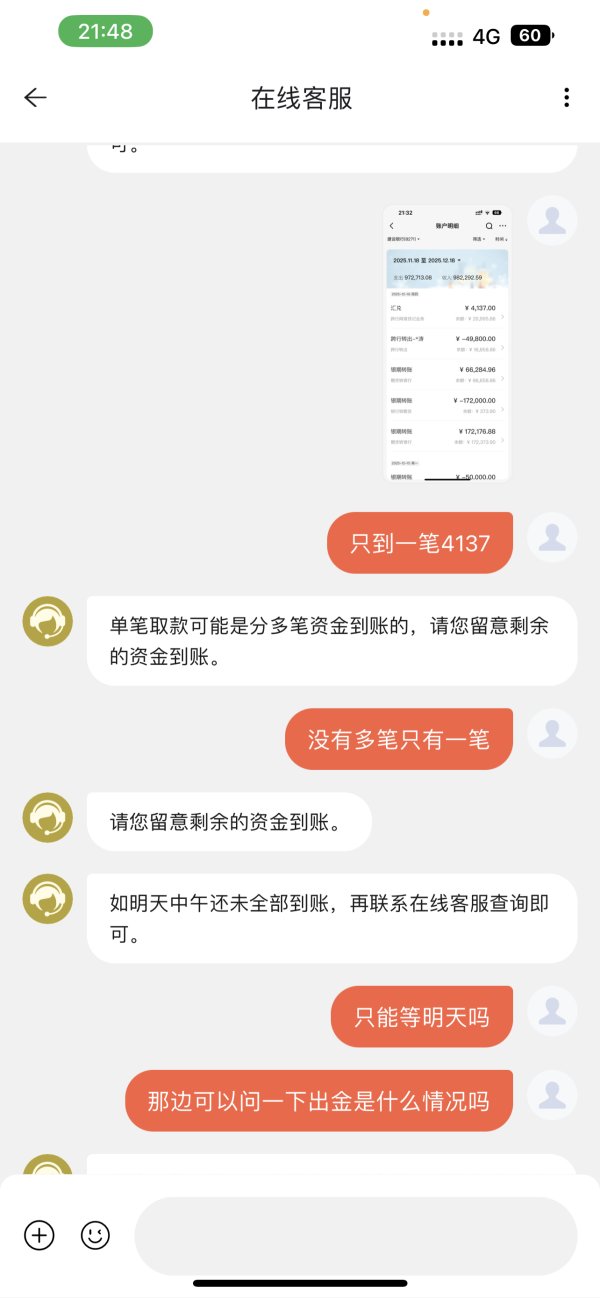

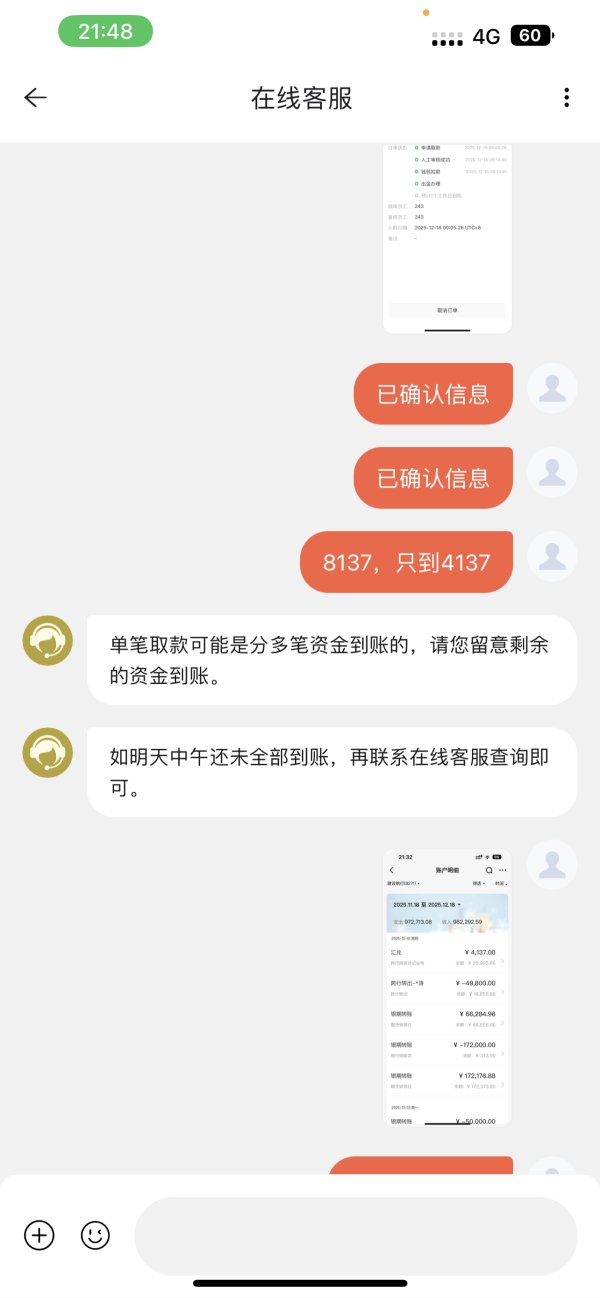

Even with barely enough left for a pair of underwear, he still only withdrew half the funds and made me wait for the other half. What a platform with no sense of scale.

Tested, withdrawals are functioning normally, and funds will arrive on the same day.

Seeing others expose you for not processing withdrawals despite making profits!! Is this how you play at the Hong Kong International Financial Centre? Watch out for triad members knocking on your door.

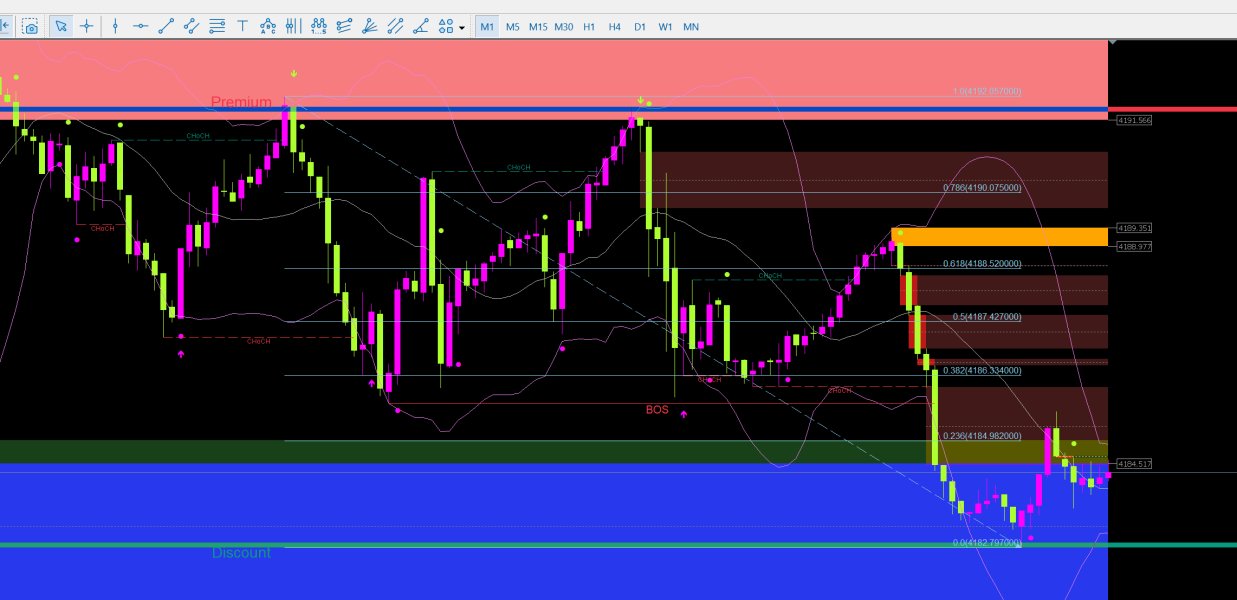

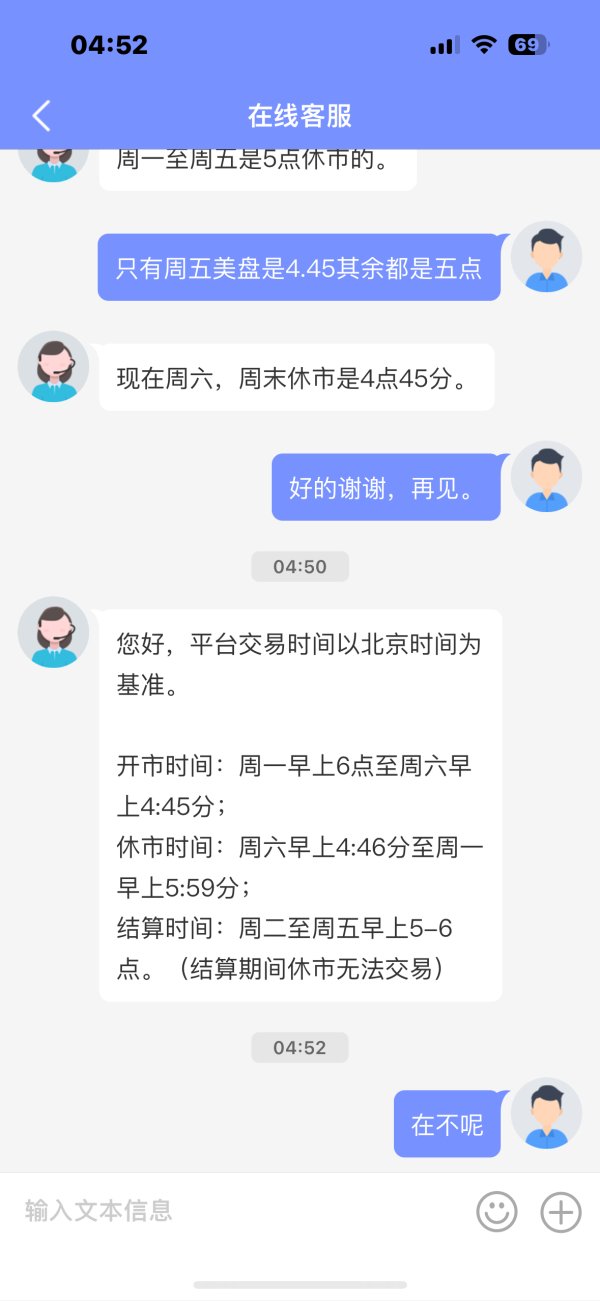

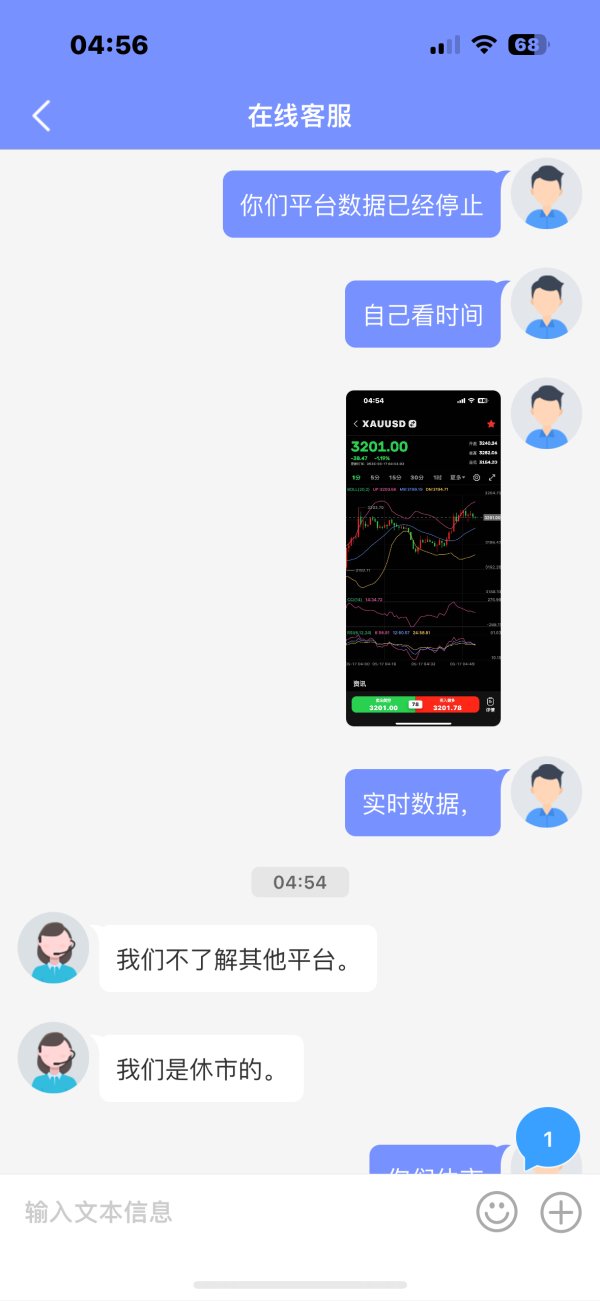

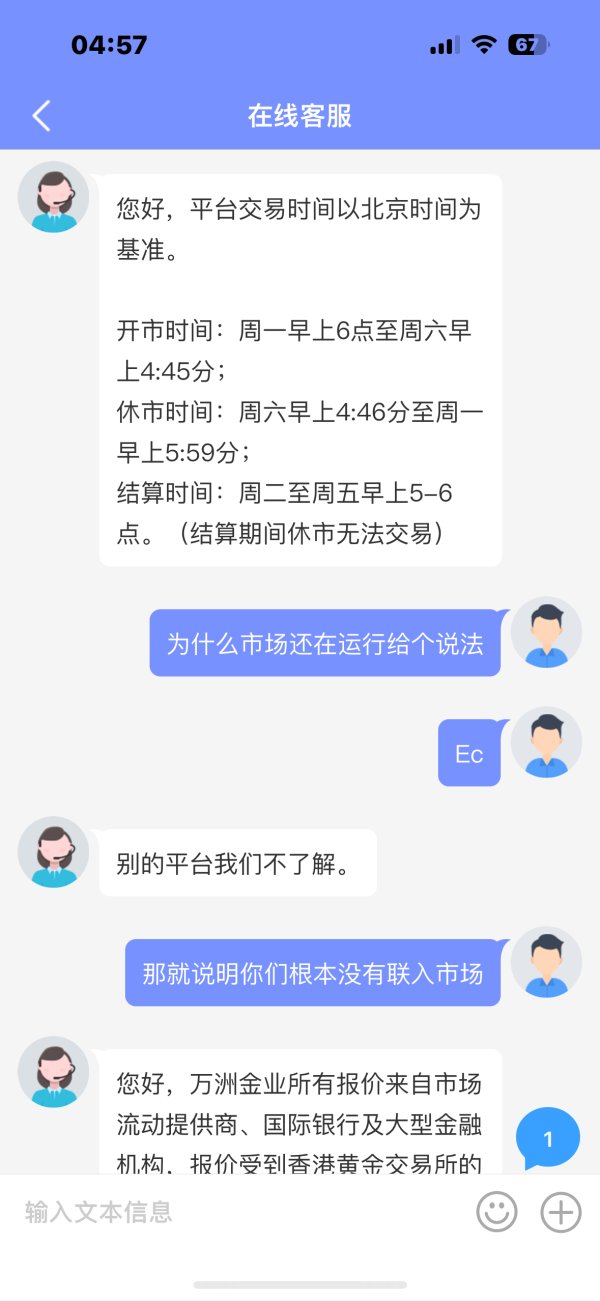

Hello everyone! Today is May 17, 2025. I've been trading Forex and Gold on the WZG platform in Hong Kong. If going long, the price drops instantly, if shorting, it immediately starts moving in the long direction. If hedging, it sweeps within both ranges. WZG is now closed, with data frozen (see the white image). The customer service has shown chats suggesting the market closure. Yet, the ec Markets platform (see the black image), regulated in the UK, is still operational. Their customer service is vague about the situation. It seems the market wasn't closed, but the platform was shut down prematurely. Who covers the losses from those data fluctuations? Their customer service reiterated their legality and regulation by the Hong Kong Gold Business Association, highlighting the importance of understanding a platform thoroughly before choosing.

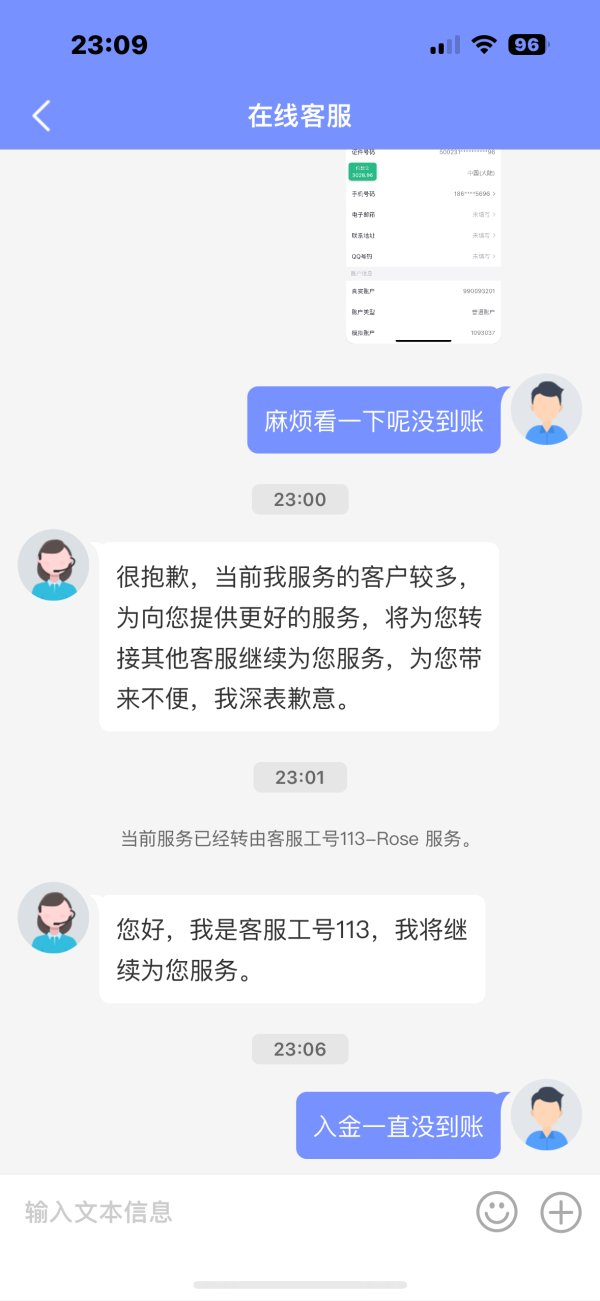

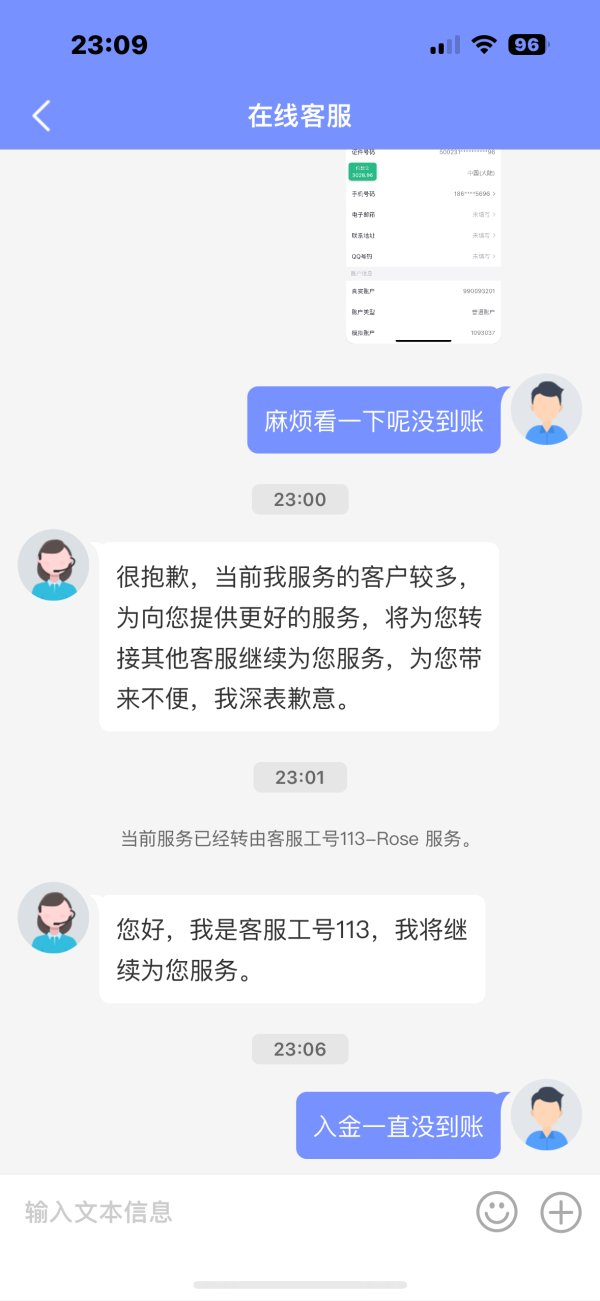

Deposit processing is slow, customer service keeps saying it's being handled, the platform is deliberately stalling for time,

The official website states one business day for withdrawals, but in reality, it usually takes more than one business day. Contacting customer service shows they are online, but in practice, they are often offline for long periods.